economy

-

Appreciate the patience. This will be the worst edition of the 9:25 you ever watch… because it is the first 9:25 in a video format. Earnings previews, my thoughts on AI, and a little macro for the rest of your week. Hope you all enjoy.

-

⚖️ While most brace for higher yields to weigh on equities, this morning’s move looks different🔍 Read my contrarian take on today’s rise in yields. Spoiler: It has nothing to do with CPI inflation.

-

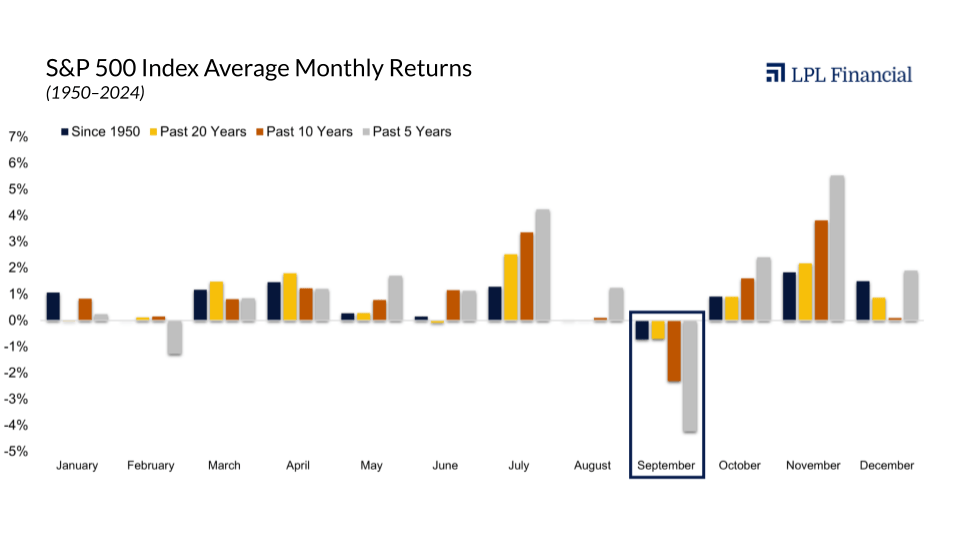

💼Business is about to Pick-Up☎️ Tuesday brings the start of earnings season and a fresh look at inflation for the month of June. Investors across disciplines have something at stake. There’s a little something for everybody. Also, it’s hard to blame investors for feeling a little invincible. I’ll share my take on stock market stupidity.

-

🏖️ It appears we’ve officially entered the summer slowdown 🐌 Not much in the way of earnings or eco data to move money. With many institutions — or their clients — on vacation, there isn’t much volume either. That leaves the market especially vulnerable to headline-driven moves that may not stick once full participation returns.…

-

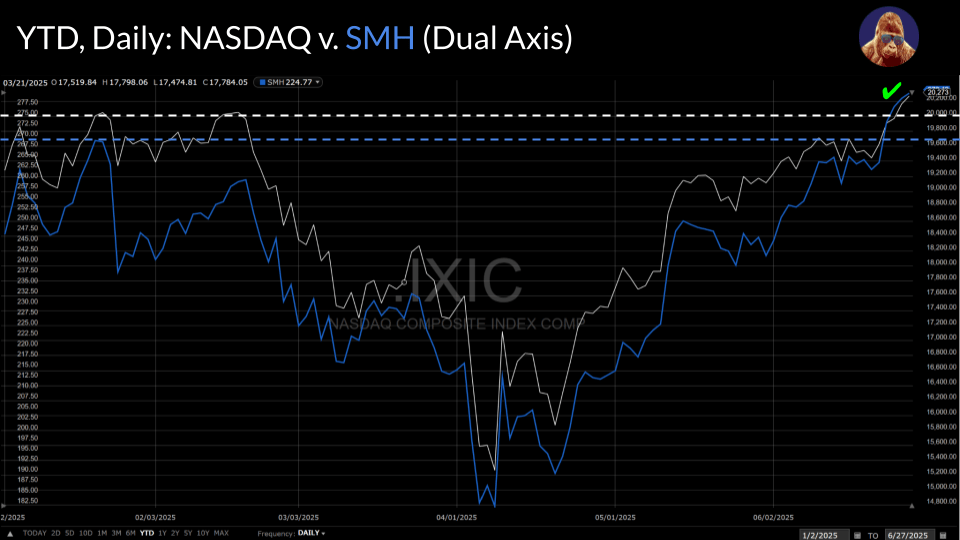

🍾Happy New All-Time Highs 🥂 Stocks did it. They climbed the wall of worry and did not succumb to it. If you stuck around, then you managed the same feat. Congratulations. It got scary there for a moment. Now, we play the confirmation game. Can the new highs be trusted? If we get confirmation from…

-

The dots, or Summary of Economic Projections (SEPs), are still hot out of the oven. Smells of Stagflation.

-

Happy Tuesday! Due to travel and Father’s Day, there wasn’t much time to write. However, with retail sales fresh in our minds and the FOMC tomorrow, I figured I’d add my 6 cents on 3 matters (2 cents per matter) that would’ve made the 9:25: Oil, the Fed, and Retail Sales.