Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

Weekly Performance S&P 500 1.11% Equal Weight S&P 500 (RSP) 1.15% NASDAQ 1.13% DOW 1.21% Russell 2000 (VTWO) 0.98% Talk of the Tape Although CPI was a touch warm, it wasn’t disastrous. The bullish trade following Friday’s earnings, headlined by JPM, is an additional indication of the market’s willingness to prioritize earnings and place inflation…

-

Weekly Performance S&P 500 0.62% Equal Weight S&P 500 (RSP) 0.95% NASDAQ 0.95% DOW 0.59% Russell 2000 (VTWO) -0.14% Talk of the Tape Despite both GDP and PCE supporting the bullish soft-to-no landing narrative, the market reaction was relatively muted. The subdued response was largely attributed to anticipation for this week’s Payrolls report, which is…

-

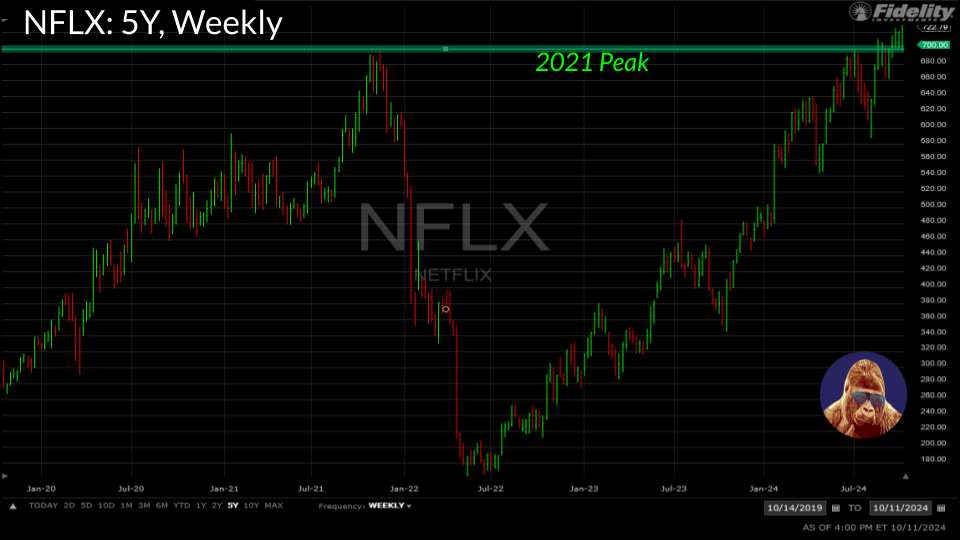

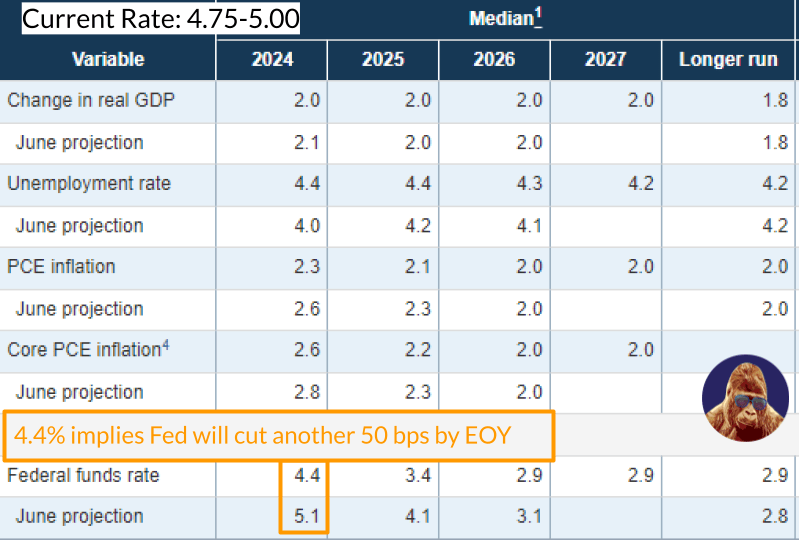

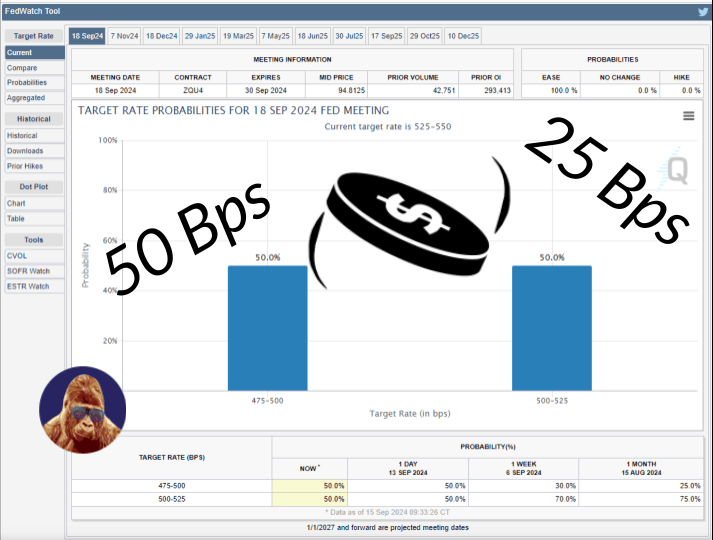

Weekly Performance S&P 500 1.36% Equal Weight S&P 500 (RSP) 1.03% NASDAQ 1.49% DOW 2.62% Russell 2000 (VTWO) 2.08% Talk of the Tape Retail sales showcased resilience, and the Fed delivered a 50 bps cut. Despite some initial uncertainty, stocks ultimately embraced the decision as the US10Y yield firmed, signaling an incrementally positive economic outlook…

-

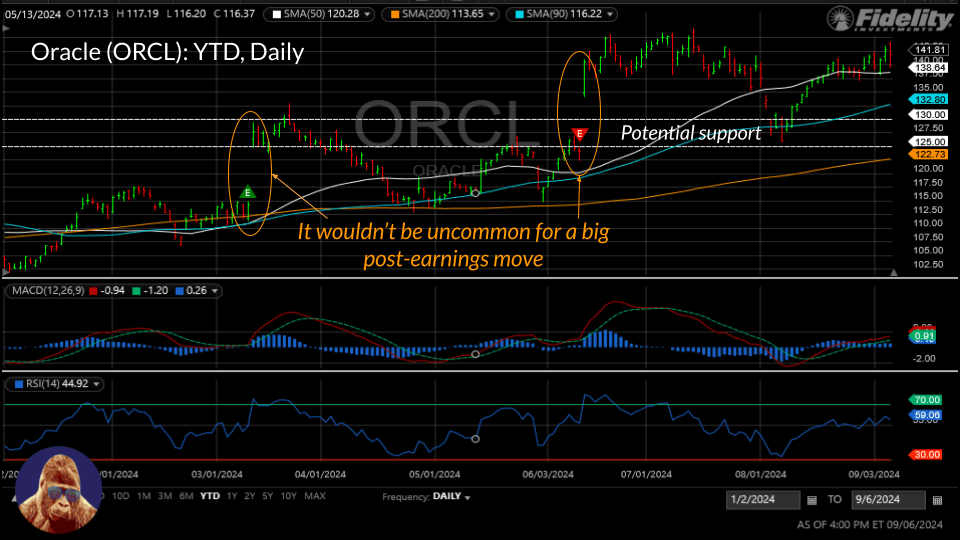

Weekly Performance S&P 500 4.02% Equal Weight S&P 500 (RSP) 2.19% NASDAQ 5.95% DOW 2.60% Russell 2000 (VTWO) 4.36% Talk of the Tape Confidence in AI ROI recovered, driven by Oracle’s earnings, and financials stabilized after JPM rattled the sector with NII concerns. The in-line CPI report did nothing to challenge the case for normalization…

-

Weekly Performance S&P 500 -4.25% Equal Weight S&P 500 (RSP) -2.64% NASDAQ -5.77% DOW -2.93% Russell 2000 (VTWO) -5.69% Talk of the Tape Although many attribute the prior week’s decline to a more balanced economic debate pressuring multiples, I believe the pullback is more about timing: the data being used as cover to sell ahead…

-

Tough start to the trading week, no doubt. It’s hard to miss this morning’s weakness in semiconductors, particularly with Nvidia down 8%. For those who believe the market can only move higher with Nvidia leading the way, it’s time to reconsider. Last week, despite Nvidia dropping 5%, the S&P 500 finished flat. With that in…

-

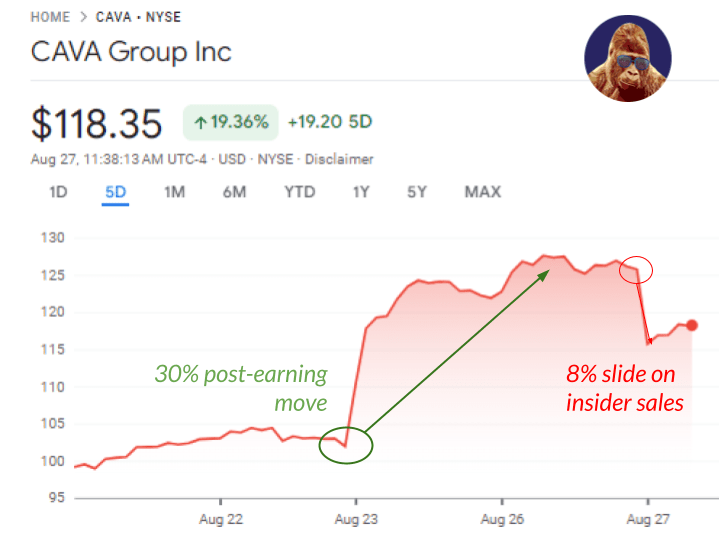

Cava (CAVA) was down as bad as 8% on news that insiders and major shareholders are taking substantial profits after the blockbuster quarter: 💲Artal International is looking to offload 6 million shares.💲The CEO sold 210,000 shares.💲The Chief Concept Officer and Co-Founder sold 5,000 shares. For reference, the 90-day average trading volume is 3 million shares.…

-

Weekly Performance S&P 500 1.45% Equal Weight S&P 500 (RSP) 1.97% NASDAQ 1.40% DOW 1.27% Russell 2000 (VTWO) 3.58% Talk of the Tape Powell’s Jackson Hole address was a masterclass in subtlety. Without providing new insights to move markets, the tone and intent projected a genuine confidence in the soft landing. Unlike in 2022, where…

-

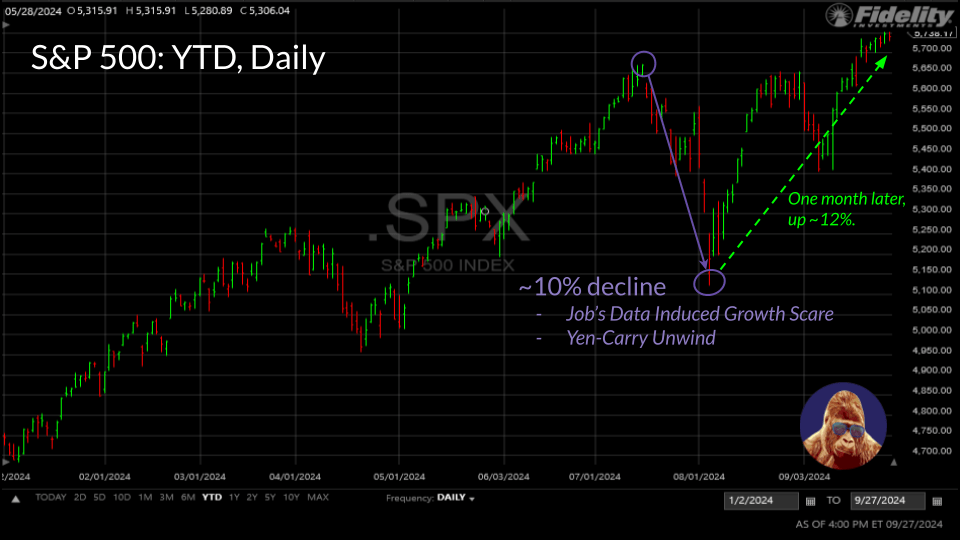

Weekly Performance S&P 500 3.93% Equal Weight S&P 500 (RSP) 2.42% NASDAQ 5.29% DOW 2.94% Russell 2000 (VTWO) 2.93% Talk of the Tape Soft landing sentiment has made a strong comeback. Dovish CPI report and unexpectedly robust retail sales data have dispelled fears of sticky inflation and an imminent recession. The result? A broad stock…

-

Recap In a word: mixed. For their fiscal fourth quarter, the parent company of Chili’s and Maggiano’s reported mixed results, beating revenue expectations but missing on EPS. Guidance for fiscal year 2025 mirrored the quarter as revenue beat and EPS fell short. In Between the Top and Bottom While expenses at Chili’s have increased compared…