Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

👀Everyone’s watching oil as the situation in the Middle East escalates🛢️ In this edition of the 9:25, I spotlight a few charts that may lead you to opportunity in the market right now. I also share my thoughts on last week’s FOMC, preview this week’s economic releases, and let you in on what I’m listening…

-

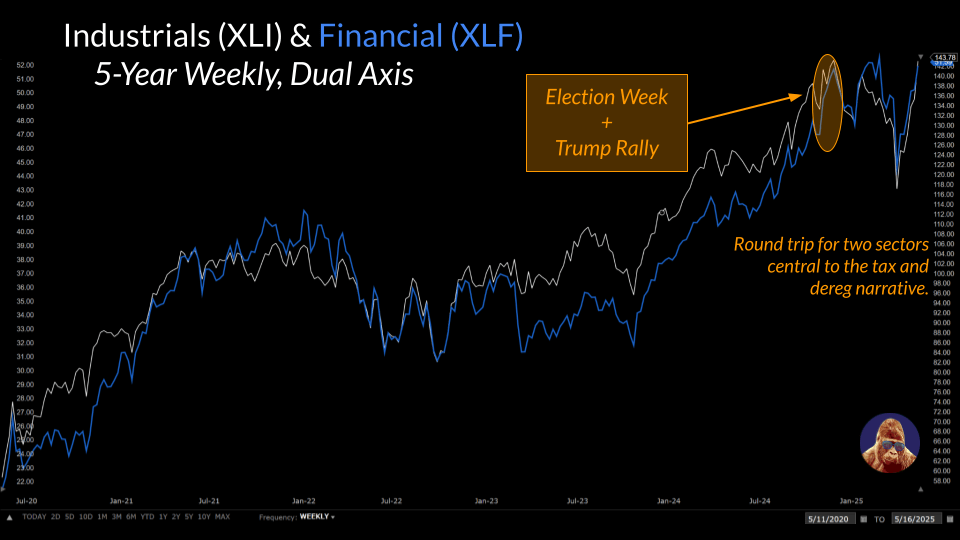

💸While the easy money has been made, I believe there are still clear opportunities in stocks to outperform an S&P 500 that I expect needs to consolidate before its next move🏁 The animal spirits that first accompanied Trump’s election victory appear to be waking up. In this edition of the 9:25, I share why I…

-

![9:25 on 5/05/25 – Data [Distortion] Dependent](https://gorillawglasses.com/wp-content/uploads/2025/05/9.25-on-5.05.25-thumbnail.png?w=960)

🌐The global economy is massive, and shocks take time to work through. It’s not unreasonable to expect a long duration for data distortion📊 The data points are not only contradictory, but some seem to be distorted by tariff-related activity. How is a data dependent body such as the Fed supposed to act under these circumstances?…

-

With tariffs in excess of 100%, there’s now a de facto trade embargo between two countries that make up ~44% of global GDP. While we’re seeing progress in the headlines and on social media, until we see that progress in signed agreements, we can’t let one good week of price action lead us to conclude…

-

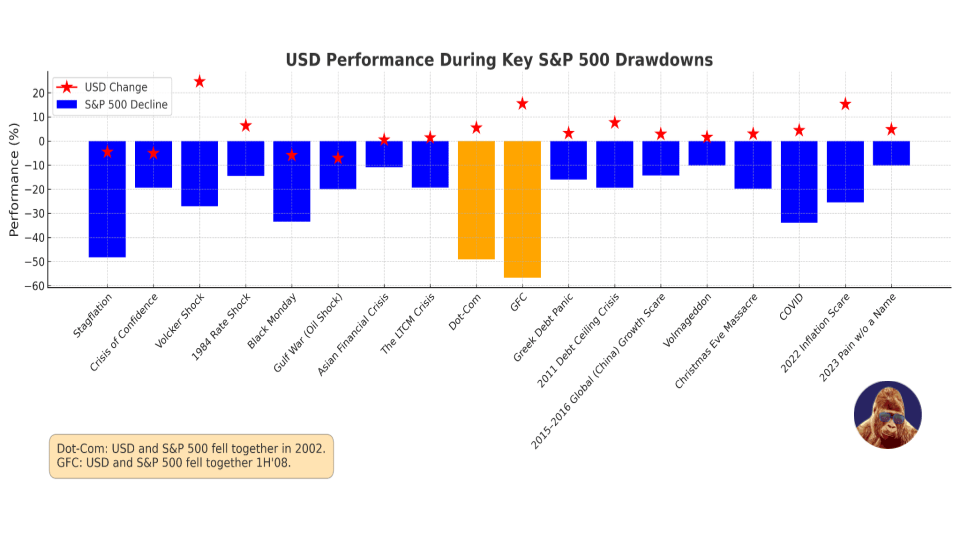

💵 The USD is typically seen as a safe-haven asset 🦺 But during this event-driven selloff, it hasn’t attracted the usual bid—down ~7% while the S&P 500 is off ~15%. This isn’t your typical sell-off, and parts of the usual risk-off playbook aren’t working. A classic defensive sector may have just lost its safe-haven bid.…

-

📈Let’s not confuse a rally with resolution⚠️ Markets rallied hard, and it felt good—but we need to talk about what has changed and what hasn’t. This edition of the 9:25 does exactly that. It also takes time to unpack the role fixed income played in last week’s events, why staying invested matters, and what to…