Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

Surprise! A soft pivot from Powell at Jackson. I break down how this changes the state of play for stocks and set the table for the most important earnings report of the season: Nvidia (NVDA). Finally, we wrap up with a fun game of “buy, sell, or hold” featuring AMD, OXY, FTNT, WMT, UNH, LLY,…

-

Subscribers eat first. We’re going to be talking about the fallout from the worst PPI inflation reading since June 2022, what to expect on Friday at Jackson Hole, preview corporate earnings that punch well above their market cap weight, and reveal another name that’s been the beneficiary of my regret minimization cash pile. Don’t miss…

-

Payrolls made the Fed look offside but earnings bolstered the market for a feel-good, bounce back week following Friday’s sell-off. This week I get you prepared for fresh inflation data and quarterly reports from some of the hottest names in tech that you may not be as familiar with as you should be.

-

This week on The 9:25, I talk about the sudden dislocation between financial markets and the Fed and what that means for Q3. I dive into Powell’s surprising hawkish posture, the ramification of a soft Payrolls report, and share my regret minimization playbook. Finally, we wrap up by previewing earnings from Palantir, Lilly, and Uber.…

-

Appreciate the patience. This will be the worst edition of the 9:25 you ever watch… because it is the first 9:25 in a video format. Earnings previews, my thoughts on AI, and a little macro for the rest of your week. Hope you all enjoy.

-

💼Business is about to Pick-Up☎️ Tuesday brings the start of earnings season and a fresh look at inflation for the month of June. Investors across disciplines have something at stake. There’s a little something for everybody. Also, it’s hard to blame investors for feeling a little invincible. I’ll share my take on stock market stupidity.

-

🏖️ It appears we’ve officially entered the summer slowdown 🐌 Not much in the way of earnings or eco data to move money. With many institutions — or their clients — on vacation, there isn’t much volume either. That leaves the market especially vulnerable to headline-driven moves that may not stick once full participation returns.…

-

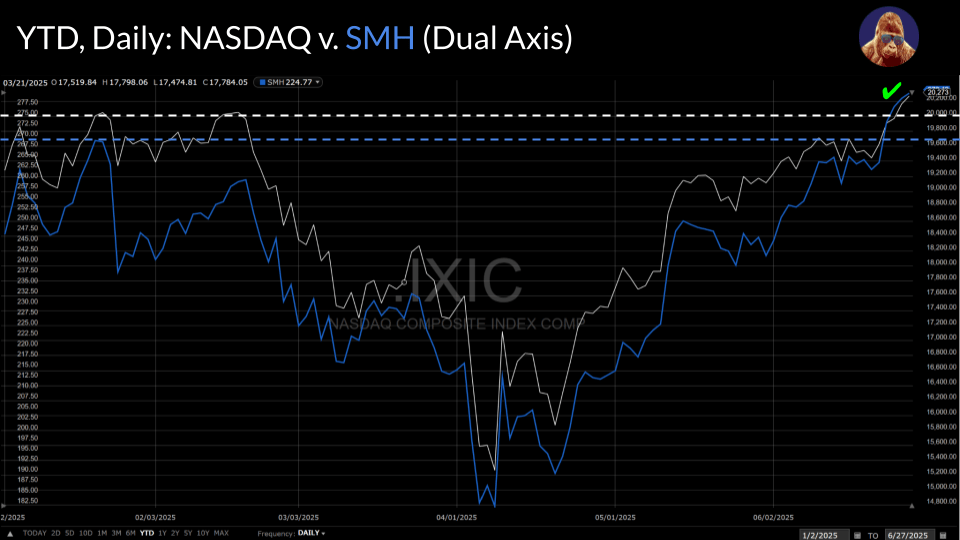

🍾Happy New All-Time Highs 🥂 Stocks did it. They climbed the wall of worry and did not succumb to it. If you stuck around, then you managed the same feat. Congratulations. It got scary there for a moment. Now, we play the confirmation game. Can the new highs be trusted? If we get confirmation from…

-

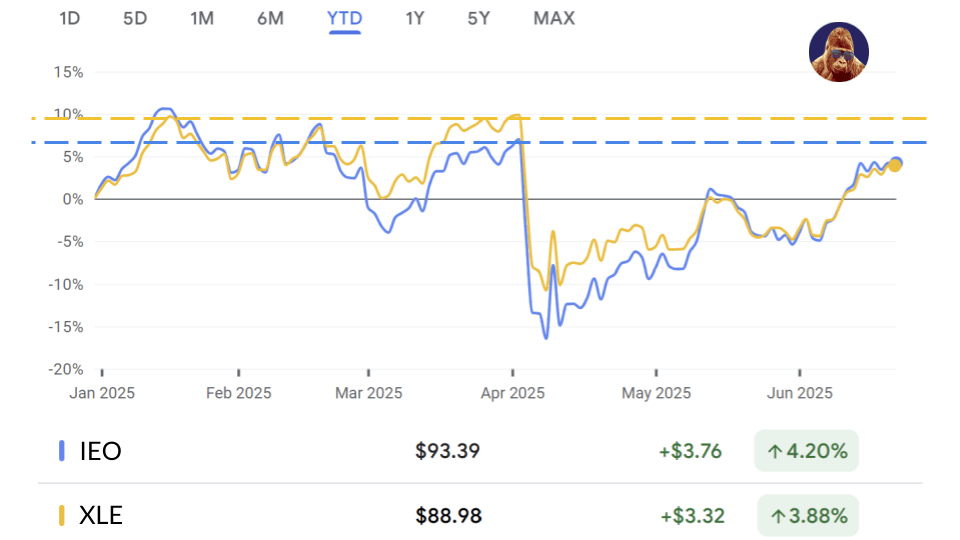

There are a number of factors working for a sector-wide breakout: 📈Momentum Energy components in the S&P 500 feature the highest median RSI at ~61. 🏃Catch-Up Trade Unlike the broader S&P 500, the IEO and XLE have both yet to reclaim the April levels. The current backdrop suggests a catch-up bid is appropriate. 💸Under-Owned Due…