FlashNotes

-

AAPL tallied its 5th consecutive session in the red, making it the worst stretch for the stock this year. Closing ~$178, the stock has entered a range where technical analysis indicates strong support exists between $176 and $180. The ~$177.5 intraday low for AAPL corresponds with a 38.2% Fibonacci retracement of the current rally (purple).…

-

While I would have expected more discomfort over monthly average hourly wages coming in 0.1% higher than expected, albeit flat month-over-month, the miss on headline job creation – 187k actual vs. 200k estimated – was enough to cool hawkish sentiment in the bond market. With inflation concerns now on the backburner, the market has been…

-

📈📉 Apple (#AAPL) and Amazon (#AMZN) investors, take note! As these tech giants prepare to report their earnings on the eve of July #Payrolls, a highly influential macroeconomic report, it’s crucial to be aware that Apple and Amazon may see their stocks fall, despite even phenomenal quarters, if July Payrolls is too strong. An inflationary payrolls…

-

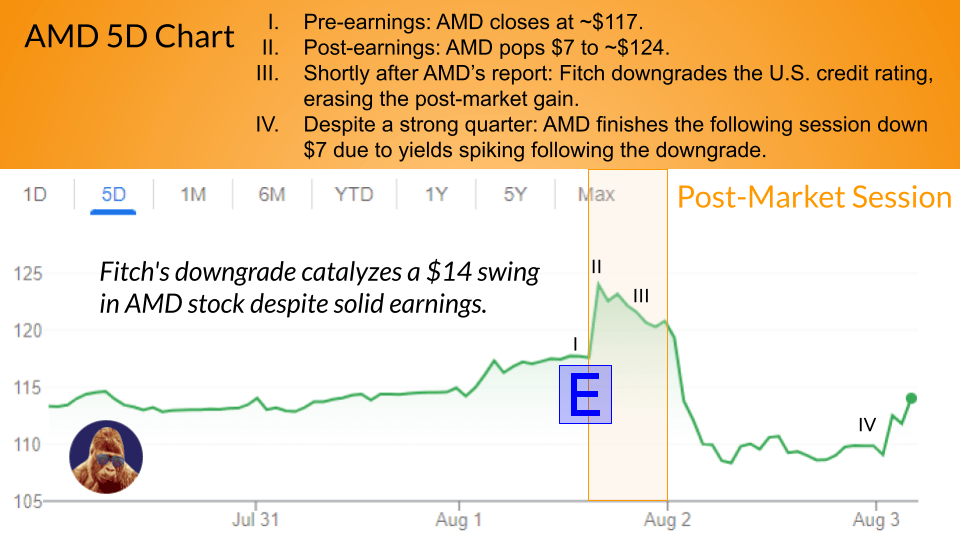

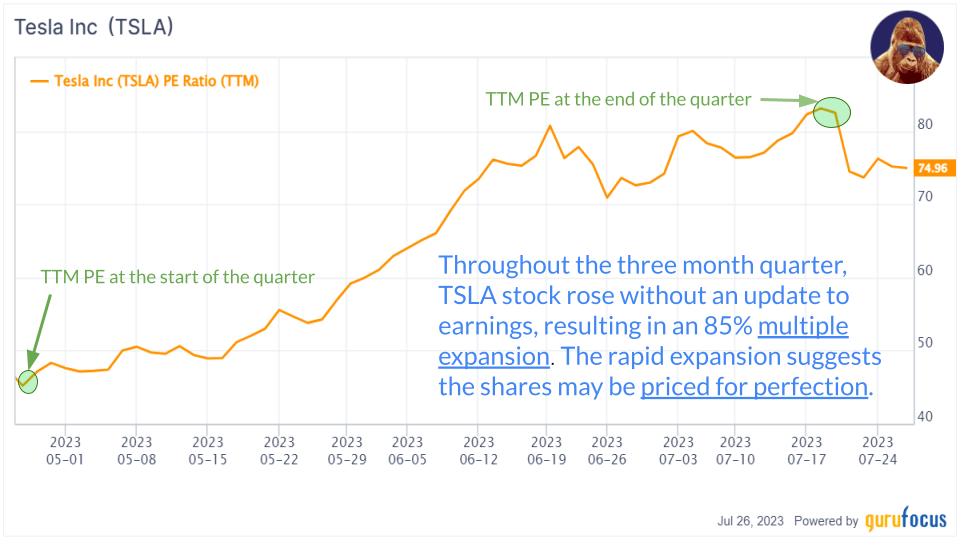

Valuation and Expectation Valuation plays a significant role in shaping expectations for each company’s quarter. There is a direct correlation between relative valuation and expectation: The higher the relative valuation; the higher the expectation. The lower the relative valuation; the lower the expectation. Priced for Perfection When a stock experiences rapid price increases before its…

-

Nonfarm Payrolls, which is the most influential job report of each month, will be released on Friday morning. Historically, Payrolls has had an impact on market expectations regarding the Fed and interest rates. A little less than 48 hours out, it is the opportune time to review current expectations and assess risks attached to the…

-

Markets look a little sluggish today as Powell meets with the House for the first day of the two-day Biannual Report on U.S. Monetary Policy. Tomorrow, Powell will conclude the biannual event with a meeting with the Senate. While some attribute today’s weakness to related headlines, I disagree. In my opinion, Powell’s prepared remarks and…

-

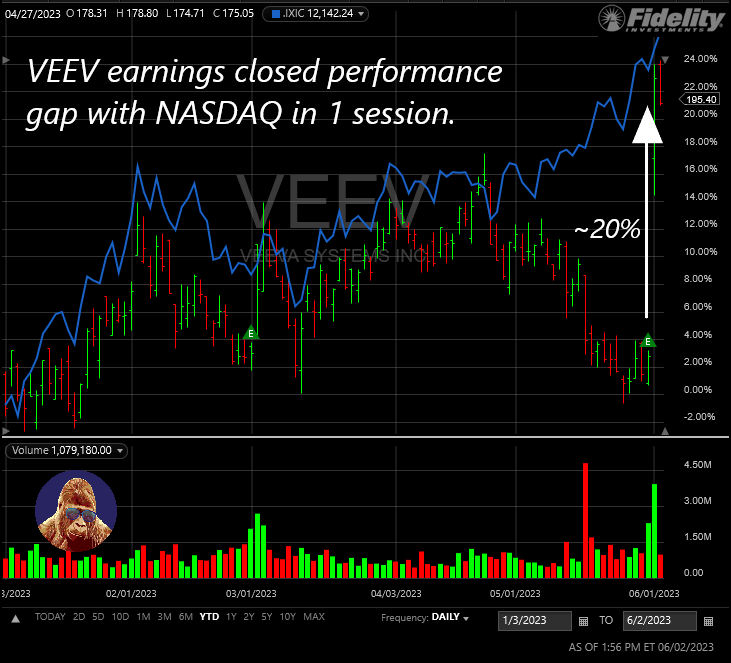

Veeva Systems (VEEV) didn’t disappoint investors with its latest quarterly report, which was released last Wednesday. If you read the 9:25, then this one would have been on your radar. On Monday, I wrote… VEEV offers industry cloud solutions for life sciences companies. Although it hasn’t participated to the same extent as other cloud companies…

-

At the start of the year, I selected four ETFs that I believed would offer a positive return irrespective of the macroeconomic environment. We’re a quarter in, so it’s time to check in. To do so, we will compare the year-to-date (YTD) performance of each pick against the SPY (S&P 500 ETF) and update the…

-

Friday morning, the financial sector kicked off earnings with reports from J.P. Morgan (JPM), BlackRock (BLK), Wells Fargo (WFC), Citi Group (C), and PNC Financial (PNC). Although many other banks, including the regionals, have yet to report, three significant stories caught my attention. 1) The Net Interest Margin (NIM) Narrative Is Not Over As earnings…