FlashNotes

-

A massive outage sent cybersecurity leader CrowdStrike (CRWD) back six months in just a few days. The multi-day disruption erased $29.5 billion in market cap as the stock dropped more than 30% following the disaster. Is it warranted? Depends on your time horizon. Fair or not, this outage has eroded years of credibility and momentum…

-

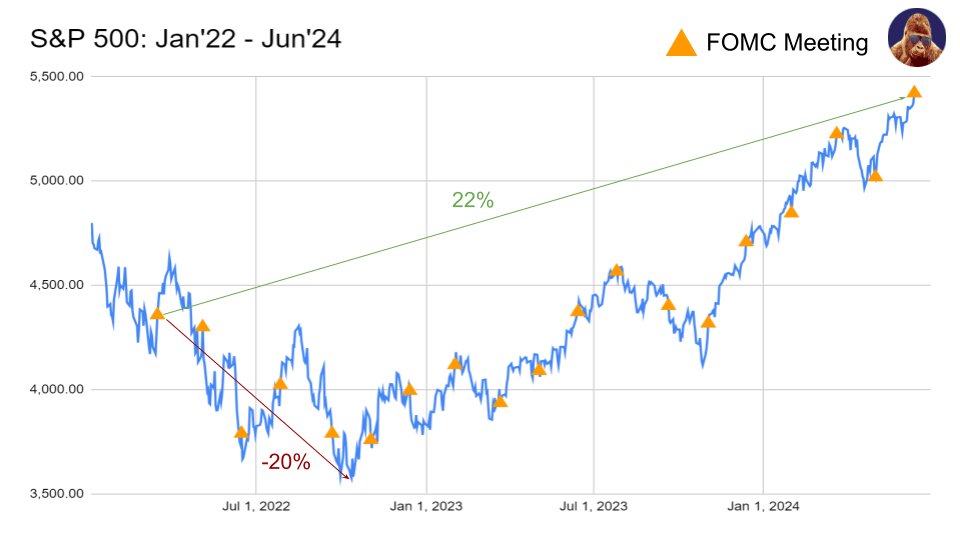

June’s FOMC Meeting was a non-event. The data suggests the FOMC Meeting hasn’t been an event for a while. This is bullish. Some Statistical Context In 2022, the FOMC Meeting held the market hostage. Without accounting for the absolute intraday insanity during Powell’s conference, in the two sessions following the meeting, the S&P 500 moved…

-

Retail sales for May appear to have validated the popular idea that consumers are getting more selective. 📍 Retail Sales: 0.1% actual vs. 0.2% estimated.📍 Retail Sales Minus Autos: -0.1% actual vs. 0.2% estimated.📍 Revisions lower to prior months. The report indicates consumers aren’t spending as much, implying that inflation (and growth) will continue to…

-

A Bit of Background For years, I had been happily married to my Samsung devices. But earlier this year, in a moment of weakness fueled by Vision Pro hype, I converted to Apple via the iPhone 15 Max Pro. My brother, the family’s resident Apple aficionado, rolled out the red carpet for my transition. My…

-

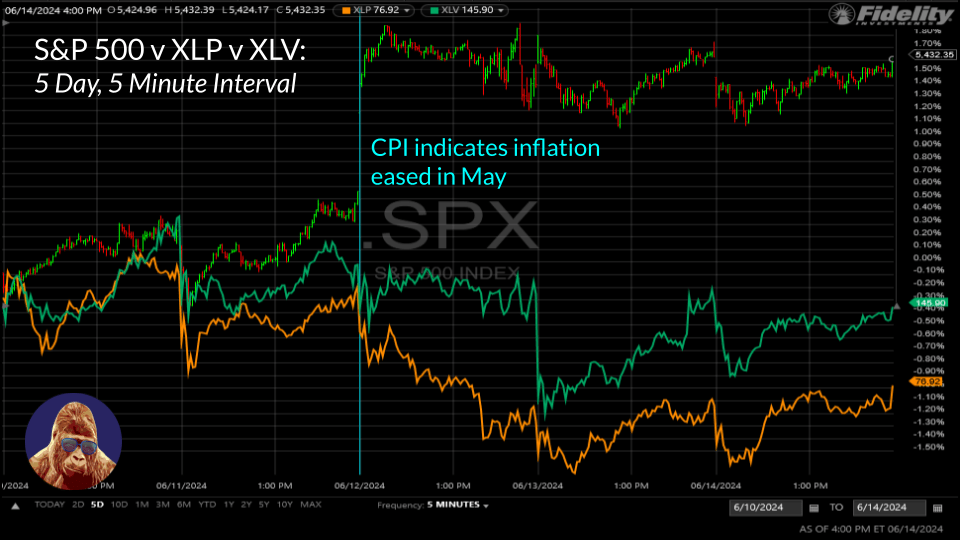

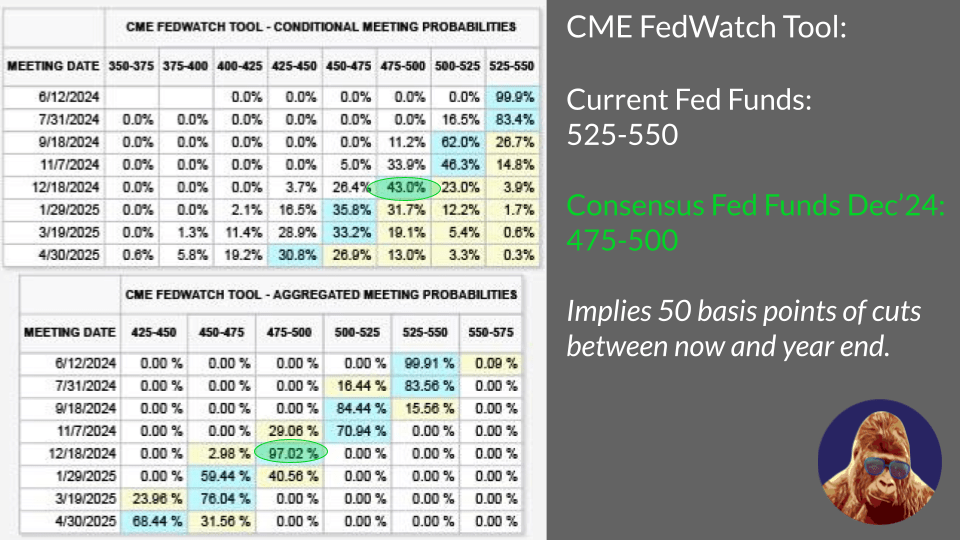

May CPI came in softer-than-anticipated this morning: Relief on inflation has mitigated the impact of last Friday’s hawkish Payrolls on interest rate expectations. According to the CME FedWatch Tool, two interest rate cuts this year remains consensus: the first in September and the second in December. The market is up nicely on the news. For…

-

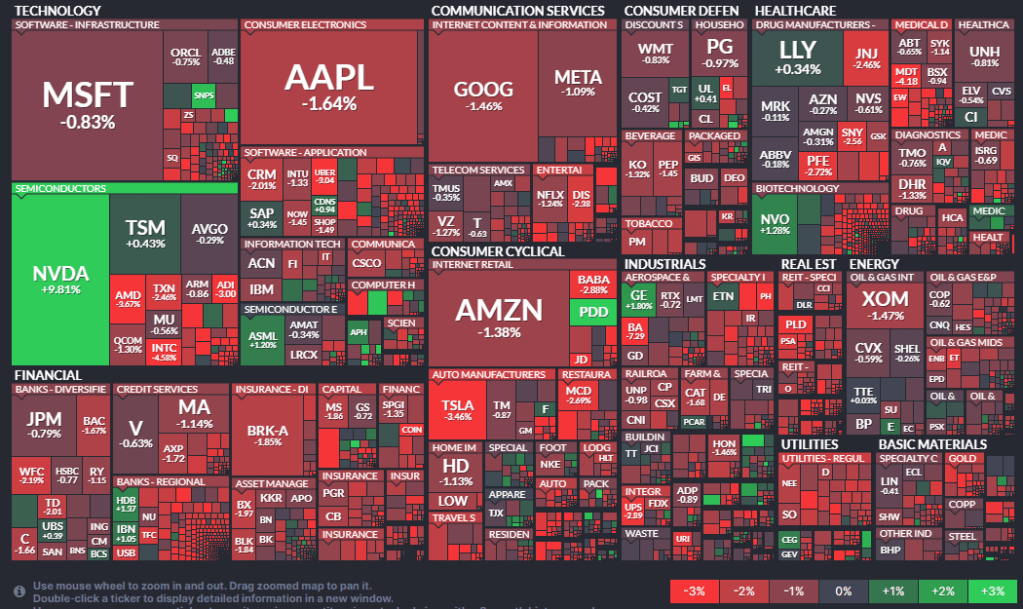

Around the time Nvidia (NVDA) first cracked $800 and Apple (AAPL) was teetering in the $160s, I joked that the time to trim Nvidia would come when it surpassed Apple in market cap. The joke being this milestone would trigger algorithms and/or hedge funds to go short-NVDA and long-AAPL in a predictable attempt to showcase…

-

Hershey (HSY) Under Pressure For about a year, Hershey has been a tragedy of a stock. Since topping in April 2023 around $275, HSY has fallen a little more than 30%. Why has America’s well-known chocolate-dealer fallen from Wall Street grace? Have you seen cocoa prices? Meteoric rise. High cocoa prices adversely affect HSY’s profitability,…

-

Jobs data for February is in! Although job creation was stronger than expected, unemployment and hourly wages, which I believe hold greater predictive value, printed dovish outcomes. 🦅 Job Creation: 275k act v 198k est.🕊 Unemployment: 3.9% act v 3.7% est.🕊 Monthly Hourly Wages: 0.1% act v 0.2% est.🕊 Annual Hourly Wages: 4.3% act v…