FlashNotes

-

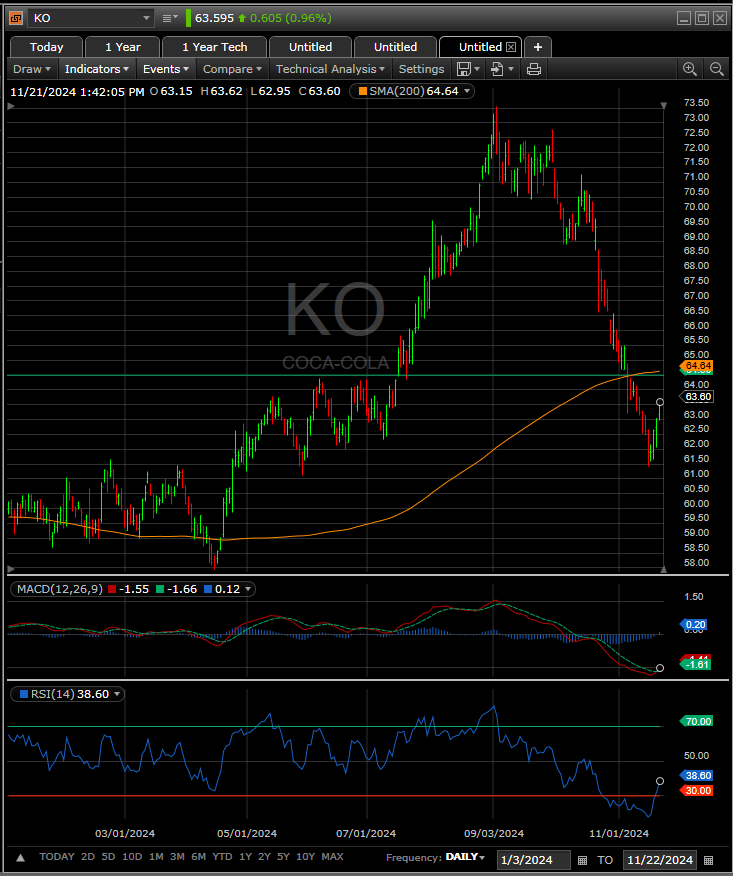

Who doesn’t like Coca-Cola? I tend to prefer the beverage, but the stock (KO) looks tempting. The 16% slide KO finds itself in began in September, marking its worst drawdown since GLP-1 concerns catalyzed a 20% sell-off last year. After nearly three straight months of decline, KO is showing signs of life: MACD, which has…

-

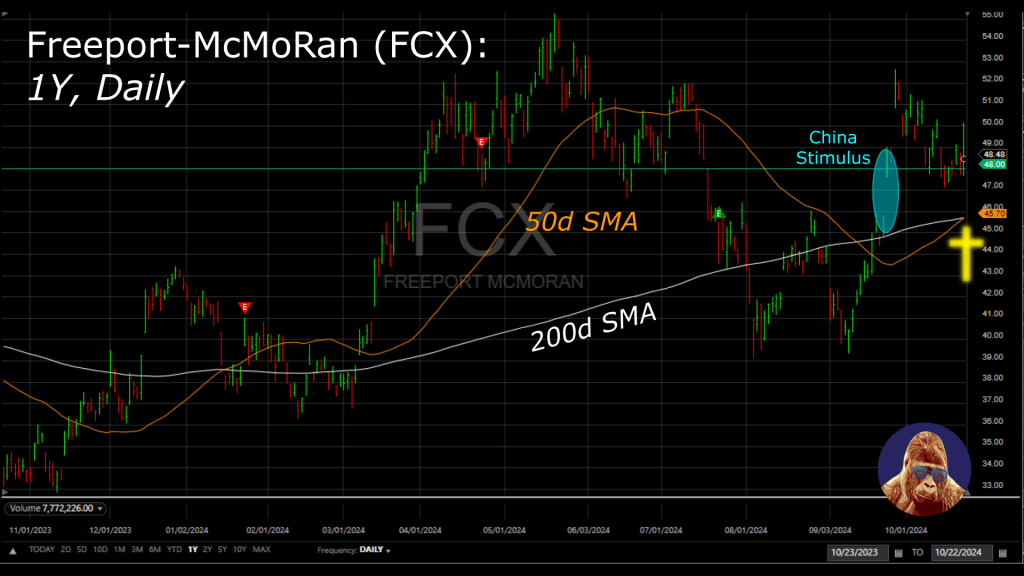

Freeport-McMoRan (FCX) delivered a strong quarter this morning. The headline everyone expected but needed to see: copper demand will increase as data center construction continues to rise. The stock is holding at $48, the same level it jumped to on the China-stimulus news. For those unfamiliar, copper and China’s economy are closely correlated I stand…

-

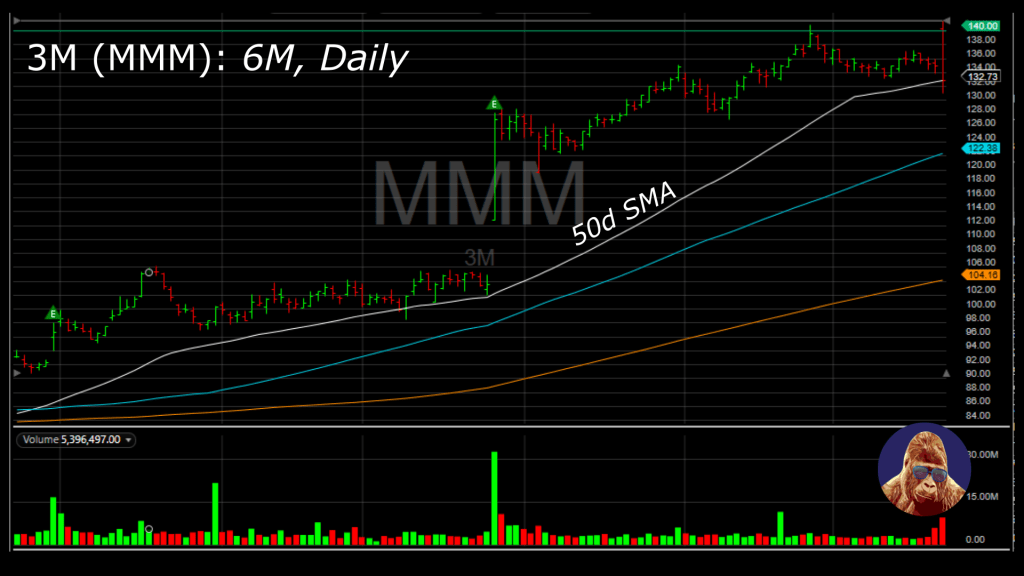

In premarket trading, 3M (MMM) shares rose as much as 5% after beating on the top- and bottom-line. After briefly surpassing $140, MMM reversed before stabilizing around the 50-day SMA. Back to the quarter: management offered more details on the restructuring. While a few business units are being considered for sale, none are significant enough…

-

As semiconductor demand continues to rise, the importance of copper – an integral component – has never been clearer. From Nvidia’s Blackwell to my Oral-B Toothbrush, semiconductors are impossible to escape. They’re in everything. While copper prices remain heavily influenced by China’s economy, the growing global demand for the metal makes it an essential part…

-

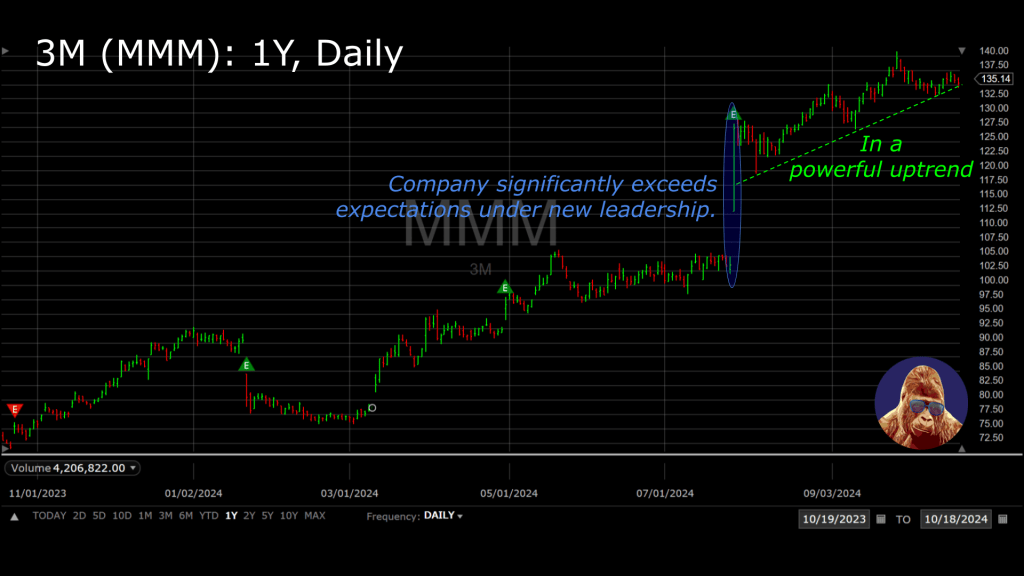

3M (MMM) struggled for years with lawsuits and managerial missteps. In May 2024, their board brought in William Brown as the new CEO to lead a turnaround. Last quarter, new management delivered faster-than-expected progress, triggering a significant gap higher. I entered the position a few weeks later (~$130), once it was clear the gap wasn’t…

-

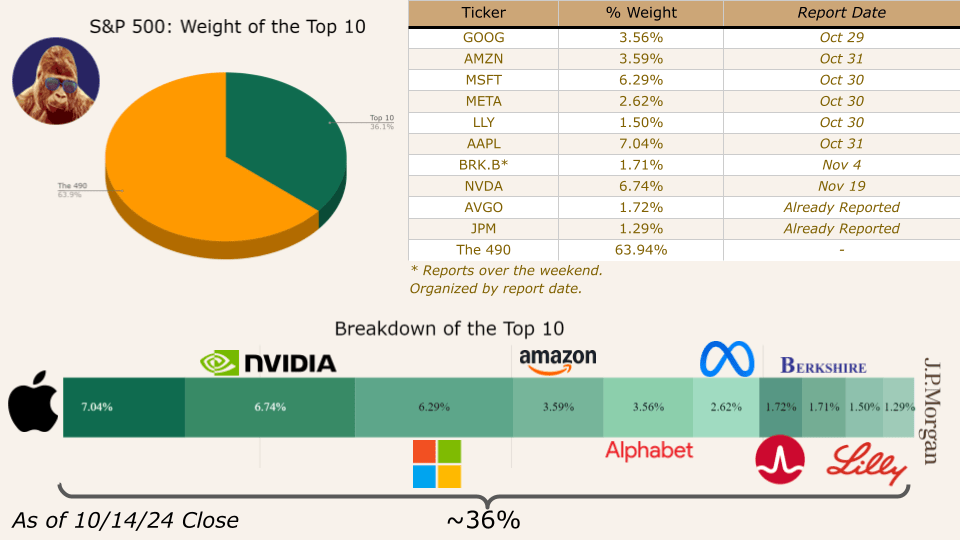

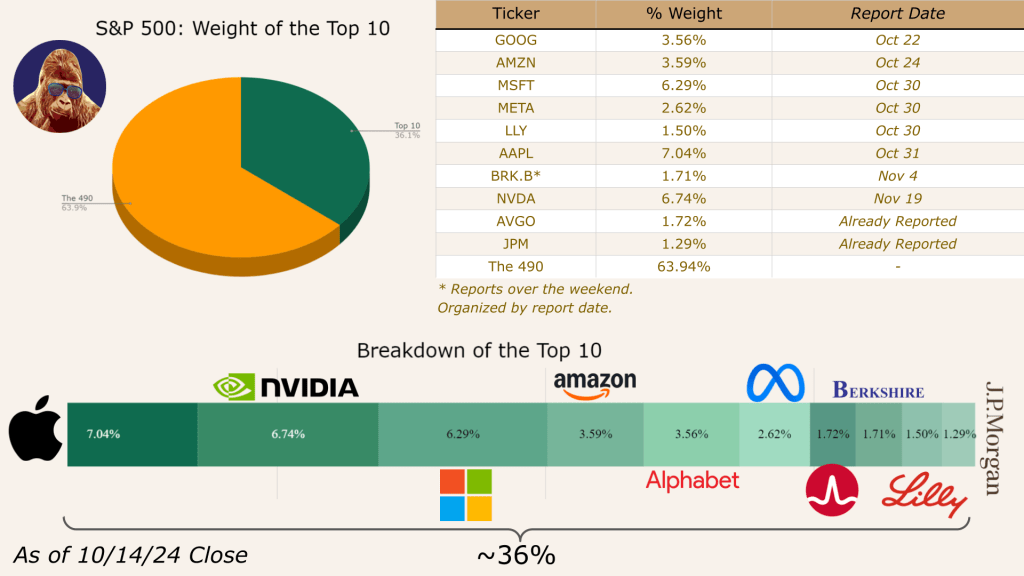

I’ve put together some visuals to help navigate the whirlwind that is earnings season. Here are a few standout insights: 1) Mark Your Calendar for October 28th: Due to some shuffling of the corporate calendar in the last few days, the week of October 28th will now feature all the mega-caps, making it THE week…

-

During last night’s earnings call, Netflix (NFLX) highlighted the growing momentum of its advertising business. With a captive audience and a deep data pool, advertisers are willing to pay up for access to the platform. Management is tracking toward the “critical ad subscriber scale” that will be essential for creating the reliable cash-flow stream long-term…

-

I’ve put together some visuals to help navigate the whirlwind that is earnings season. Here are a few standout insights: 1) Mark Your Calendar for October 28th: 119 constituents making up a 38.5% weight of the index report, making it the most consequential week of earnings season. 2) The Lull Two weeks of relative calm…

-

Normally, I don’t talk Delta (DAL, because it doesn’t interest me), but their earnings touched on several relevant topics as well as a few I’ve commented on in the past. So, I’ll add my two cents. I’ll leave a link to the CNBC interview that references these points: 1) Hurricanes Helene and Milton dampened both…

-

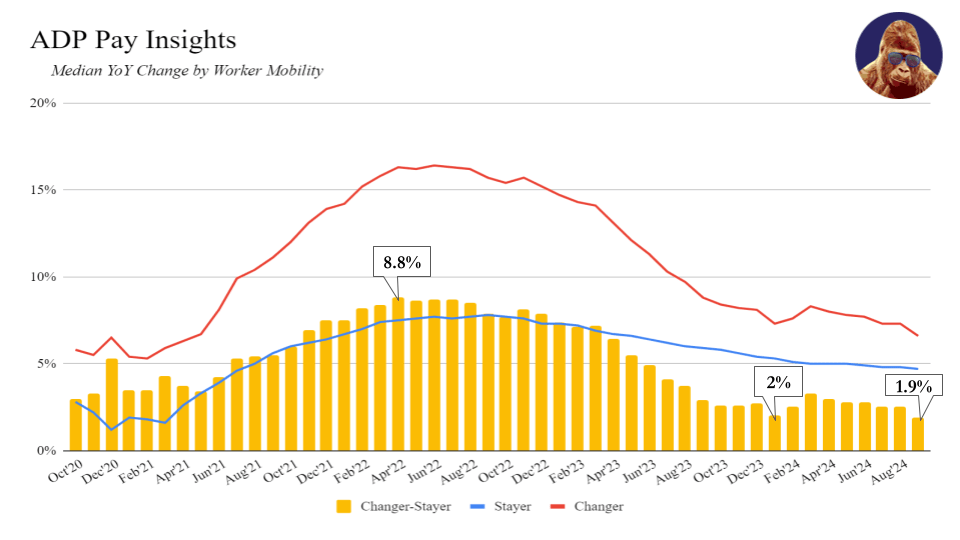

✔ Headline job creation of 143k beat the 128k estimate. ✔ Wage growth continues to decline: ⬇ Job stayers: 4.7%, compared to 4.7% YoY ⬇ ⬇ Job changers: 6.6%, compared to 7.3% YoY ⬇ In a sentence, the U.S. economy again experienced improved hiring without accelerated wage growth, reinforcing the Fed’s view that the labor…