FlashNotes

-

A forgotten gem in the AI-story. The story and the trade. Nothing more; nothing less in less than 60s.

-

Two stocks are minting new, golden all-time highs. I’m putting some money to work in one of them at today’s close in 20 minutes. For the trade, the names, and catalysts click the link.

-

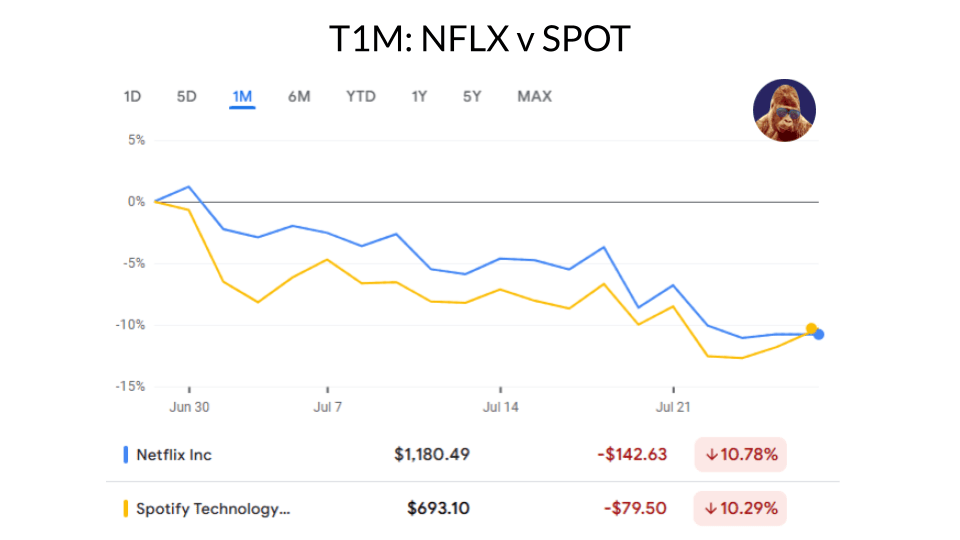

I said I’d buy more Spotify if they put up a Netflix-esque quarter and sold off anyway… Got the sell-off, but not exactly the quarter. So, what not? Click around and find out.

-

⚖️ While most brace for higher yields to weigh on equities, this morning’s move looks different🔍 Read my contrarian take on today’s rise in yields. Spoiler: It has nothing to do with CPI inflation.

-

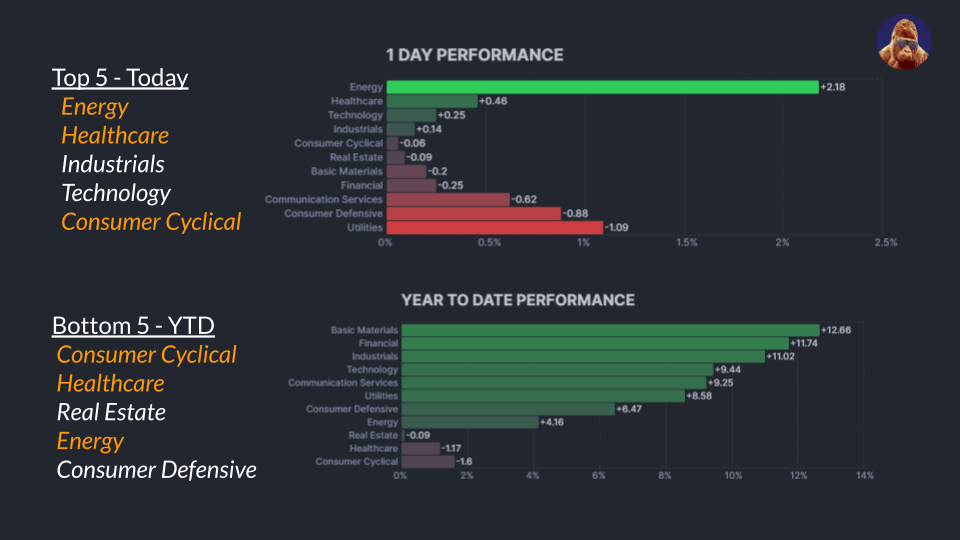

Two Thoughts on Today’s Trade 7.8.25 Rotation from Leaders to Laggards Three of the worst-performing sectors YTD are showing strength today. The rotation from leader to laggard doesn’t often have legs. However, if it persists, then we’ll inevitably start talking about a broader rotation. That said, I view days like these as investors taking profits…

-

The dots, or Summary of Economic Projections (SEPs), are still hot out of the oven. Smells of Stagflation.

-

Happy Tuesday! Due to travel and Father’s Day, there wasn’t much time to write. However, with retail sales fresh in our minds and the FOMC tomorrow, I figured I’d add my 6 cents on 3 matters (2 cents per matter) that would’ve made the 9:25: Oil, the Fed, and Retail Sales.