Weekly Performance

| S&P 500 | 4.59% |

| Equal Weight S&P 500 (RSP) | 3.75% |

| NASDAQ | 6.73% |

| DOW | 2.48% |

| Russell 2000 | 4.09% |

Talk of the Tape

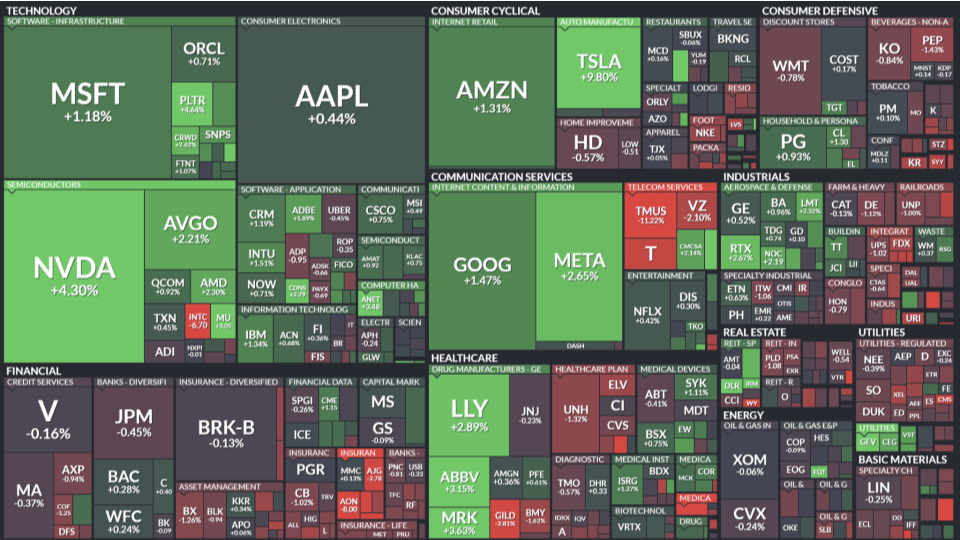

Stocks across the board tallied an impressive week as Trump reversed rhetoric on Powell, sentiment surrounding trade talks improved, and Q1 earnings didn’t spark growth concerns.

The Week Ahead

Monday

- Waste Management (WM)

Tuesday

- JOLTs

- Spotify (SPOT)

- Coca-Cola (KO)

- Altria (MO)

Wednesday

- ADP Employment

- 25Q1 GDP

- March PCE

- Microsoft (MSFT)

- Meta (META)

- Robinhood (HOOD)

Thursday

- Eli Lilly (LLY)

- Apple (AAPL)

- Reddit (RDDT)

Friday

- April Payrolls

Macro Movers

Headline-Driven Market

The news cycle was positive last week. Trump materially softened his tone on Powell, and JD Vance’s trip to India appeared to generate significant progress toward a trade deal. These headlines helped the USD and Treasuries (yields declined) rally, notably stabilizing sentiment, which set the stage for stocks to respond positively to Q1 earnings and company-specific stories.

As I’m writing this, more positive headlines are flashing across the WSJ: Trump’s trip to the Vatican to pay respects to the late Pope Francis included an “incredibly productive” one-on-one with Zelenskyy. Perhaps the President will have other productive meetings with other world leaders also in attendance. As such, this week is shaping up to be another where optimistic headlines create a more supportive backdrop for markets to interpret economic data and quarterly earnings.

But while I hate to throw cold water on what feels like progress, it’s important to acknowledge: had the news cycle stayed negative, last week likely would’ve brought more carnage than a reprieve. The “sell America” trade took a week off, but that doesn’t mean it is over. .

This remains an extremely headline-driven market:

- Headlines good, stocks good, trade war over.

- Headlines bad, stocks bad, trade war back on.

Until we see concrete deals, signed agreements in concept, or a true removal of “reciprocal tariff” plans beyond the current 90-day reprieve, any progress made one day can just as easily be reversed the next. So long as the situation remains this liquid, expect headlines to have the ultimate say over the direction of your money. That is the current state of play.

I don’t say that to scare anyone. I say that to share the mindset I’m using to make sure I don’t get too upset when the market is down or too excited when the market is up.

Hard Data

New month, new batch of labor market data. The question now is whether hard data will finally catch down to match sentiment. So far, we haven’t seen it. Unfortunately, until there’s clarity on trade, these reports can only ratify the fear already in the air.

To understand that fear, let’s be explicit about its source:

With tariffs in excess of 100%, there’s now a de facto trade embargo between two countries that make up ~44% of global GDP (the U.S. and China). Even if resolved tomorrow, the multi-month economic freeze will almost certainly materialize as a slowdown or shallow recession.

So, until trade resumes, investors will have to live with good economic data being interpreted through the skeptical lens of “this doesn’t reflect a trade shock.”

It’s worth noting that this isn’t so different from 2022. Markets spent months pricing in a Fed-induced recession that never came. Stocks traded poorly until it was clear the Fed could back off with inflation cooling and the economy hadn’t cracked.

Heading into this week, my guess is that this week’s data will be reassuring. However, I’m not sure how much markets will reward it in this backdrop. And if good data is rewarded, there is still headline risk to contend with.

JOLTs (Job Openings)

- Forecast is set at 7.4M vs last month’s 7.6M.

ADP Employment

- Headline job creation: 110k estimate vs. 155k prior

- Prior Wage Change for Job Stayers: 4.6%

- Prior Wage Change for Job Changers: 6.5%

25Q1 GDP (Preliminary)

- Consensus is 0.4% vs. prior 2.4% (final, 24Q4)

Personal Consumption Expenditures Index (PCE, March)

- Core PCE MoM: 0.1% estimate vs. 0.4% prior

- Core PCE YoY: 2.5% estimate vs. 2.8% prior

- Headline PCE MoM: 0.0% estimate vs. 0.3% prior

- Headline PCE YoY: 2.2% estimate vs. 2.5% prior

Payrolls (April)

- Headline job creation: 130k estimate vs. 228k prior

- Unemployment: 4.2% estimate vs. 4.2% prior

- Hourly Wages MoM: 0.3% estimate. vs. 0.3% prior

Micro Movers

Worth mentioning, Alphabet (GOOG) put together a nice quarter. Although Tesla (TSLA) wasn’t quite as robust—in fact, it may belong in the “so bad it’s good” bucket—both featured an important commonality: no slowdown in AI spending. While neither reported, Amazon and Nvidia made a joint announcement reaffirming the same. One of the bear theses centers on hyperscalers cutting data center capex. Maybe the bears will eventually be proven right, but for this quarter, not so.

With that, let’s hit this week’s reports.

Mega Caps: Microsoft (MSFT), Meta (META), Apple (AAPL)

Microsoft (MSFT) faces questions around the health of enterprise demand, given the disruption tariffs have caused to international trade. Google Cloud numbers were strong, but MSFT has had a harder time monetizing CoPilot and Azure. My guess is these numbers—more than anything else—will determine the stock’s direction, holding trade headlines equal.

Meta (META) could face pressure if advertisers start pulling budgets in anticipation of a recession, but I doubt we’ll see that show up in this quarter’s results or guide. Meta has used AI to separate itself meaningfully in the ad space. In the event advertising budgets shrink, their leadership makes Meta the last place to get cut.

Capex will be in the headlines for both MSFT and META. MSFT shareholders may be less receptive to increased spending unless CoPilot and Azure show clear evidence of meaningful ROI. The stakes aren’t as high for Meta, which has already demonstrated ROI on its AI investments. Still, capex figures will matter for semiconductor sentiment, which improved notably last week with Alphabet’s quarter and the Amazon-Nvidia release.

While an AI strategy update will get attention, tariff management is the primary concern for Apple (AAPL). iPhones are already expensive. Price increases will exacerbate upgrade cycle concerns. As for tariff navigation, Apple has already made a few notable moves:

- Apple airlifted 600 tons of iPhones out of India to beat tariff deadlines—a clever move, but a lever that can only be pulled once.

- Apple plans to shift all U.S. iPhone production to India by 2026, a good move considering a U.S.-India trade deal appears close.

Traditional Safe Havens: Waste Management (WM), Coca-Cola (KO), Altria (MO)

What do waste collection, non-alcoholic beverages, and tobacco have in common? No matter how bad things get, people and businesses need their garbage collected, won’t say no to a Coke (or Pepsi), and—sad as it may be—find themselves wanting to smoke more. They’re recession-resistant.

On Friday, we saw a little money rotate into quality-defensive growth at the expense of traditional safe-haven sectors: primarily telecoms, utilities, and staples. While I’m not particularly interested in what these companies have to say, I am interested in how the market treats these safe-haven names.

If earnings can’t justify the crowding that has pushed up multiples, it could be a tailwind for a rotation to growth names that are both high quality and defensively positioned: select names across tech, industrials, and healthcare.

Defensive-Growth Safe Haven: Spotify (SPOT)

Speaking of select names, Spotify certainly comes to mind. While I’m not long the name, I wish I were. I own Netflix and could make a similar investment case for Spotify as the winner in their category. Netflix is the king of video streaming. I see Spotify as the king of audio streaming.

Now, the elevated stock price may already reflect that thesis, even if people don’t talk about Spotify with the same bass. Sure, you can make the case that Netflix subscribers are more entrenched than those of Spotify. But I’d disagree.

As such, buying up here feels too much like chasing to me. So, I won’t be doing anything ahead of the print. However, if the market gives me a discount on a decent quarter, I may need to take a flyer.

Best of the Rest: Robinhood (HOOD), Eli Lilly (LLI), Reddit (RDDT)

Robinhood (HOOD) has the trifecta: a profitable business, a clear runway, and growing Street acceptance. It can move higher. I sold my SoFi (SOFI) to fund the HOOD purchase, swapping one fintech for another. I still like SOFI and think both can work, but I prefer the future opportunity HOOD offers.

Lilly (LLY) has its mojo back now that its weight loss pill is gaining traction with the FDA. Put it the “select healthcare” bucket I mentioned earlier. Lately, bears have taken aim by arguing injectables can’t create the recurring revenue to meet analyst projections. A pill clears that concern. While I still like the name and remain constructive on their impressive progress with Alzheimer’s treatment, it’s clear the GLP-1 business is all that matters to the stock right now. I’m not sure if that’s bullish or bearish—I just want to point out that a part of the company I view as valuable doesn’t appear to be getting any credit, for good or bad.

Reddit (RDDT) may have finally put in a bottom after getting washed away in the broader tech-wreck. I maintain my view that Jevon’s paradox only increases the value of the unique data Reddit houses. I got stopped out of my position and am looking to get back in. However, the stock is now 40% off its April low, gaining 25% just last week. I’ll wait for the quarter. If it gets away from me, so be it.