September 2024

-

Weekly Performance S&P 500 0.62% Equal Weight S&P 500 (RSP) 0.95% NASDAQ 0.95% DOW 0.59% Russell 2000 (VTWO) -0.14% Talk of the Tape Despite both GDP and PCE supporting the bullish soft-to-no landing narrative, the market reaction was relatively muted. The subdued response was largely attributed to anticipation for this week’s Payrolls report, which is…

-

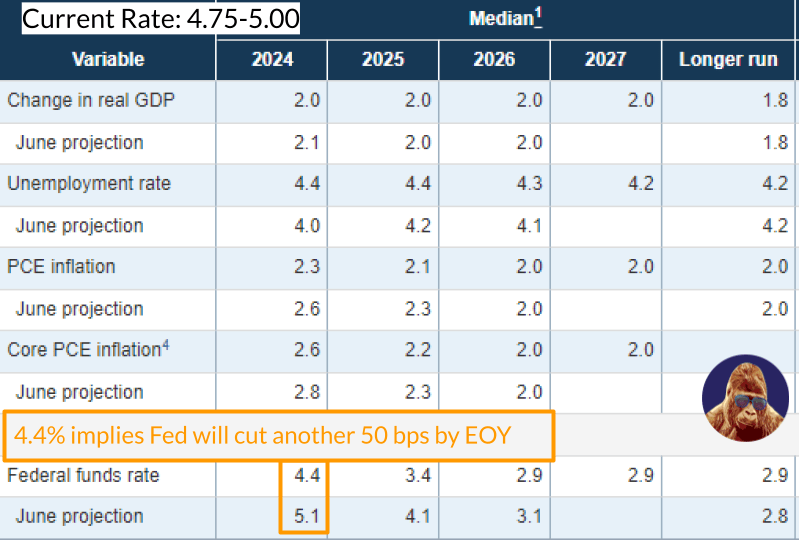

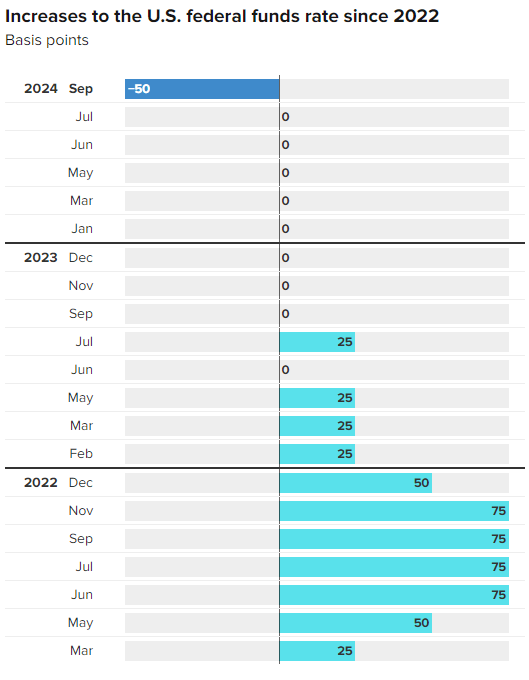

Weekly Performance S&P 500 1.36% Equal Weight S&P 500 (RSP) 1.03% NASDAQ 1.49% DOW 2.62% Russell 2000 (VTWO) 2.08% Talk of the Tape Retail sales showcased resilience, and the Fed delivered a 50 bps cut. Despite some initial uncertainty, stocks ultimately embraced the decision as the US10Y yield firmed, signaling an incrementally positive economic outlook…

-

Yesterday, the S&P 500 and Dow Jones Industrials closed at new all-time highs. 🍾🍾🍾🍾🍾 The Next Hurdle In my view, it’s the search for confirmation: looking for signs that this new high is sustainable and not just a false positive. Dow Theory would have us watch for similar action in another index or average before…

-

A Proactive Approach The Fed is often – and rightly – criticized for being too late. Relying on backward-looking data will do that to you. This iteration of the Fed, however, appears to be taking a more proactive stance. During the Q&A, Powell remarked, “The U.S. economy is in a good place. Our decision today…

-

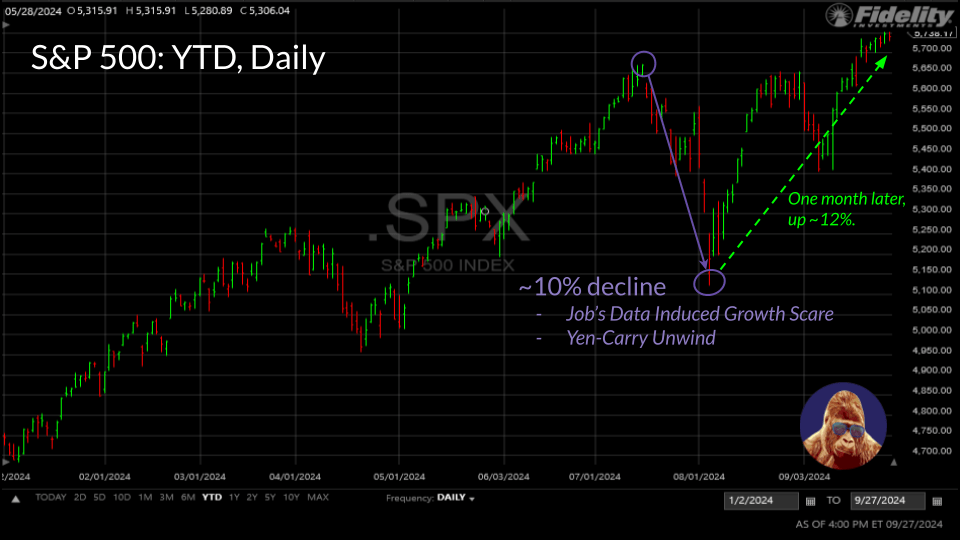

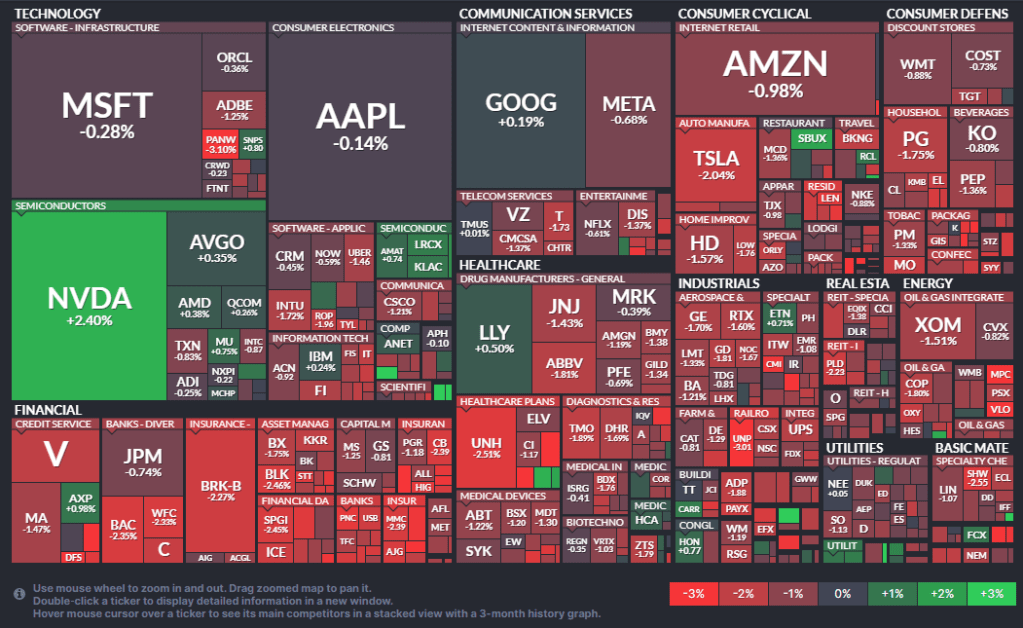

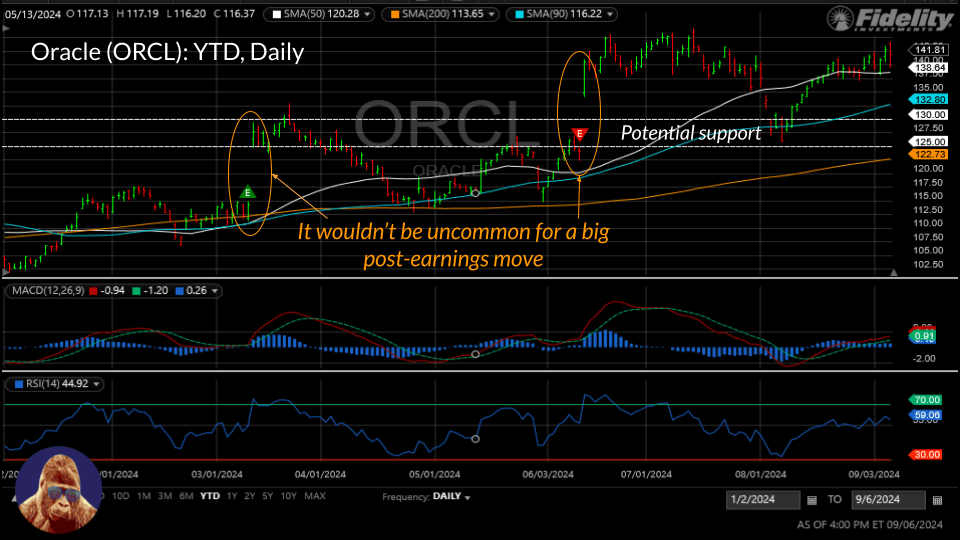

Weekly Performance S&P 500 4.02% Equal Weight S&P 500 (RSP) 2.19% NASDAQ 5.95% DOW 2.60% Russell 2000 (VTWO) 4.36% Talk of the Tape Confidence in AI ROI recovered, driven by Oracle’s earnings, and financials stabilized after JPM rattled the sector with NII concerns. The in-line CPI report did nothing to challenge the case for normalization…

-

Remember the yen-splosion in early August? Of course, you do. Just over a month later, the Japanese Yen is now stronger than it was back then. Given the context— the Fed’s first rate cut scheduled for next week, weakening the USD, and the BoJ raising Japanese rates, strengthening the Yen— the steady rise in the…

-

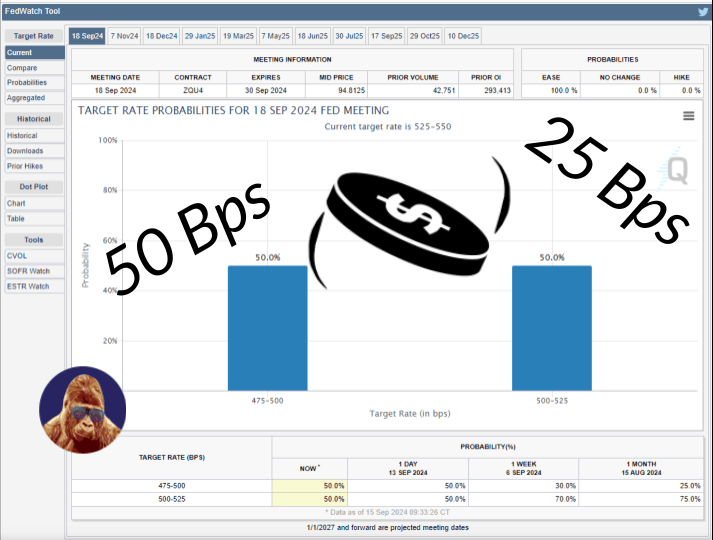

The market responded to this morning’s largely in-line CPI with a sell-off. It seems the market is unhappy with the reduced likelihood of a 50 bps cut, which dropped to 17% after starting the month as a slight 51% favorite. Personally, I find the 25 vs. 50 debate myopic. Focus on the idea the Fed is…

-

Weekly Performance S&P 500 -4.25% Equal Weight S&P 500 (RSP) -2.64% NASDAQ -5.77% DOW -2.93% Russell 2000 (VTWO) -5.69% Talk of the Tape Although many attribute the prior week’s decline to a more balanced economic debate pressuring multiples, I believe the pullback is more about timing: the data being used as cover to sell ahead…

-

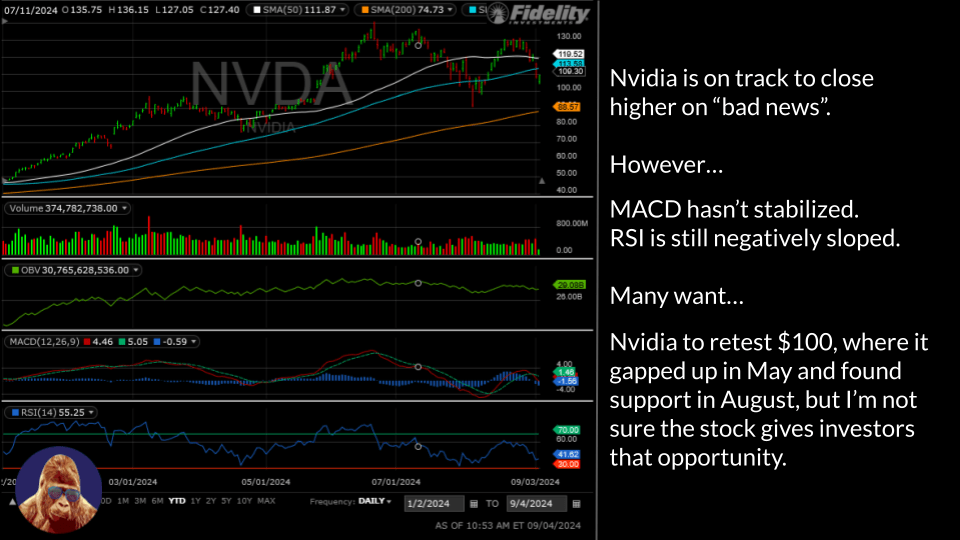

Nvidia opened lower as the DOJ issued subpoenas. The market seems to have forgotten that this is standard procedure for the DOJ. Mr. DOJ doesn’t just casually call Mr. Nvidia to ask for information. In my view, if Nvidia manages to close in the green after a red open, it would check the “stock rising…

-

Tough start to the trading week, no doubt. It’s hard to miss this morning’s weakness in semiconductors, particularly with Nvidia down 8%. For those who believe the market can only move higher with Nvidia leading the way, it’s time to reconsider. Last week, despite Nvidia dropping 5%, the S&P 500 finished flat. With that in…