A massive outage sent cybersecurity leader CrowdStrike (CRWD) back six months in just a few days. The multi-day disruption erased $29.5 billion in market cap as the stock dropped more than 30% following the disaster.

Is it warranted? Depends on your time horizon.

Fair or not, this outage has eroded years of credibility and momentum that CRWD had built with customers and prospects. Closing new and extending current deals just got a lot more challenging. Furthermore, you can already see the tsunami of lawsuits from the shore. High-valuation stocks like CRWD have little margin for error. While the damage here is hard to calculate quantitatively, it clearly surpasses that margin. A 30% drop seems appropriate for a screw-up of this magnitude. In fact, this falling knife may still have further to drop.

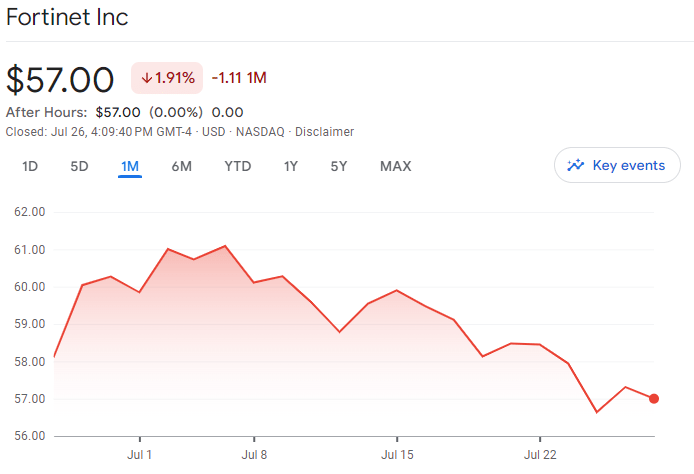

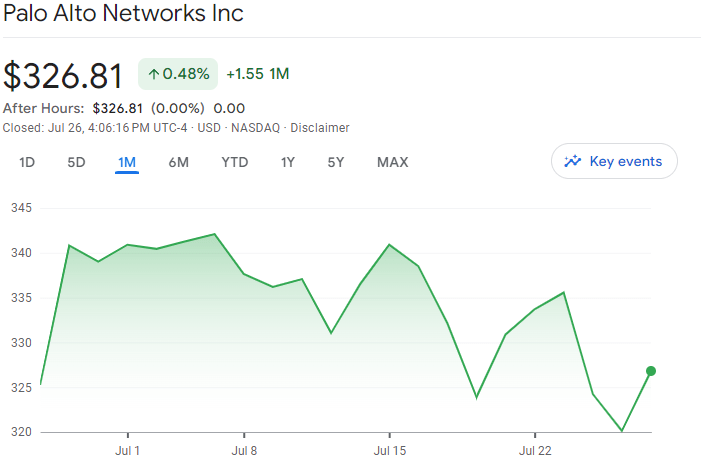

That said, this is not an existential threat. Cybersecurity is a sticky business. Changing providers is a hassle. I don’t believe CWRD customers will be switching. Disagree with me if you like, but I’m just listening to the market. If CRWD were expected to lose customers and market share, we would see money flowing into their competitors. Check the performance of Palo Alto (PANW) and Fortinet (FTNT). Do you see any of the ~$29.5 billion that left CRWD in July finding a new home in PANW or FTNT?

Should you pick up some CRWD shares today? No. As mentioned, CRWD looks like a falling knife. However, I am optimistic that CEO George Kurtz will get CRWD back on track in a quarter or two. In the meantime, keep an eye on this stock and wait for the news flow to change. The time to start buying will come once the stock stops falling and starts rising.

Leave a Reply