Weekly Performance

| S&P 500 | -0.08% |

| Equal Weight S&P 500 (RSP) | -0.56% |

| NASDAQ | 0.24% |

| DOW | -0.08% |

| Russell 2000 (VTWO) | 1.27% |

Talk of the Tape

It was a great week for the soft landing camp. Doves sang as PCE and GDP data came in supportive of a victory cut this year. Bulls charged as an upside surprise on revenue from FedEx (FDX) suggested the economy remains steady.

The Week Ahead

| Monday | Tuesday | Wednesday | Thursday | Friday |

|---|---|---|---|---|

| – | Powell at ECB Forum Job Openings | ADP Employment | Market Holiday: July 4th | Payrolls |

Macro Movers

Again, the market finds itself without any fresh fuel to further develop micro-stories. As a result, the macro maintains the focus with special emphasis on a new round of labor data: Job Openings (JOLTs), ADP Employment, and Nonfarm Payrolls.

JOLTs: Expectations are for 7.9 million, down from the prior month’s 8.1 million. An in-line outcome reinforces the notion that the economy is slowing without collapsing. The reliability of this survey has fallen under scrutiny due to lackluster participation. While it is typically an important metric, this report will likely be the least significant of the week.

ECB Forum: Further reducing JOLTs’ importance is its competition with the ECB Forum on Monetary Policy featuring Powell and other central bank leaders. In 2022, this forum made it clear that central banks worldwide planned on defeating inflation by tightening financial conditions in unison. This time, the event could serve as a “full-circle moment.” Other central banks have already cut rates. Perhaps this will be when the world’s central bank leaders declare their intent to embark on a global normalization cycle to preserve the global economy.

Overly poetic? Perhaps. I’m just rooting for a happy ending.

ADP Employment: Before the market opens Wednesday, the ADP survey will be released. Wage data will be the focus. There’s no consensus on those metrics. For reference, last month’s report cited a 5% increase for “job stayers” and a 7.8% increase for “job changers.” Continued decreases in those gains would support a Fed cut.

July 4th: Thursday, markets are closed in honor of July 4th. If you’re looking for a glizzy, might I recommend Costco? Not that you didn’t know, but $1.50 nets you a ¼ pound hot dog and a 20oz soda (with a refill). It can’t be beaten. Full disclosure: I not only own the stock (COST), but I am a customer. This may or may not affect my view.

Payrolls: The government’s job report for June always carries a lot of weight. The main numbers are job creation, unemployment rate, and hourly wages. Job creation is forecasted at 195k, down from 272k. Unemployment is expected to remain at 4.0%. Hourly wages MoM are expected to come in at 0.3%; the consensus for YoY is 4.0%.

Recently, the market has focused primarily on the latter two. In my estimation, unemployment is the main factor allowing the Fed to keep rates at these restrictive levels without real hesitation. If that moves up incrementally, so as not to worry the market about recession, it’ll make the path to “victory cuts” much simpler.

Gorilla Tactics: Bitcoin (BTC)

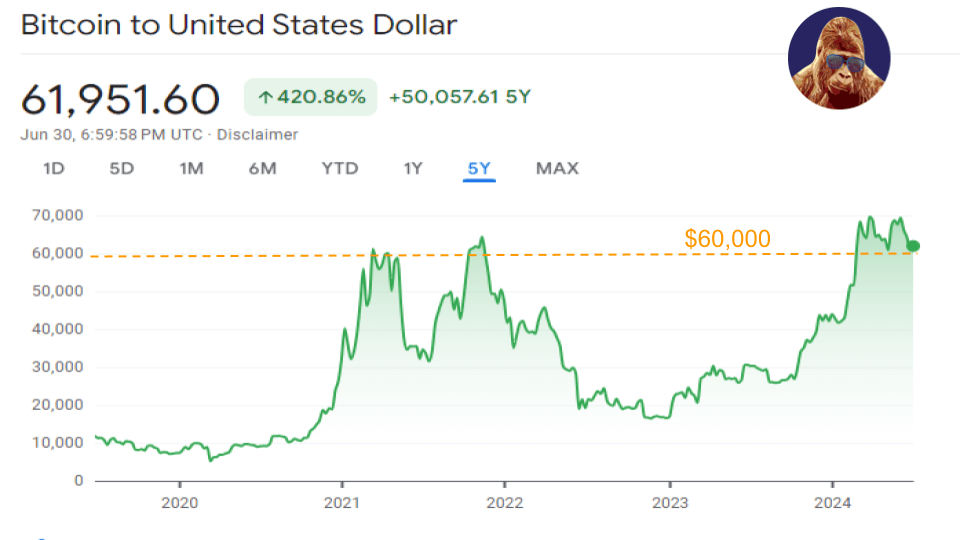

Bitcoin has interested me for a while. I have traded in and out of it plenty. Although not every trade was profitable, I have come out with more than I put in. The reason I want to talk about it now is that cryptocurrency has matured meaningfully over the past half decade, establishing itself as a bona fide asset class.

Bitcoin is the purest way to get exposure. Here’s a rundown of why I have finally decided to become an investor in cryptocurrency through Bitcoin. To put it in one sentence: 2024 BTC wouldn’t recognize 2021 BTC.

In 2021, cryptocurrency was a fringe movement that at times behaved like a cult. This not only isolated it from a large swath of retail investors but also invited skepticism and cynicism from governments, institutions, and money centers worldwide. Even the most reasonable investment cases lacked rigor, often hinging on lofty use-case arguments for further adoption.

In 2024, cryptocurrency has converted those powerful enemies into powerful allies, emerging as an asset class. Both U.S. presidential candidates are pro-cryptocurrency. Institutions and money centers have integrated it into their business models via BTC ETFs. The once cultish advocates with shaky investment theses have become more approachable and coherent.

Supply and demand ultimately determine price. In 2021, BTC could never support the demand necessary to justify the price, making it a better trade than investment. In 2024, it couldn’t be more different. BTC’s adoption by financial institutions promises a stream of steady demand with plenty of levers remaining unpulled.

I have more to say about this. Sometime this week, I will publish a more comprehensive piece. In the interim, I recommend you ask yourself this: Has there ever been an easier time to convince yourself to start a responsibly sized position? I don’t think so.

From a technical perspective, BTC is retesting $60k, an important level in 2021. Successfully holding would reinforce the notion that this asset class is making a new price base under the support of a larger, more mature stakeholder base. Fundamentally, thanks to all the friends BTC has made over the last 12-18 months, there is a clear runway for increased adoption, especially through financial professionals and institutions.

Personally, I have taken some cash out of the money-market (gasp) to start a 0.50% position. The plan is to buy more every other month or so. My limit is 5% exposure. I’ll trim it if that threshold is surpassed.

Leave a Reply