investing

-

Subscribers eat first. We’re going to be talking about the fallout from the worst PPI inflation reading since June 2022, what to expect on Friday at Jackson Hole, preview corporate earnings that punch well above their market cap weight, and reveal another name that’s been the beneficiary of my regret minimization cash pile. Don’t miss…

-

My thoughts on what the worst PPI in 3 years means for stocks: More Concentration.

-

Did a 🌶️Habanero Hot 🔥 PPI just open the door for Q3 Volatility? Click around and find out why this matters and what level on the S&P 500 I’ll be watching over the coming weeks.

-

Didn’t feel up to recording yesterday, but I had to make good on my promise to set the table for Cava (CAVA), Brinker International (EAT), and Applied Materials. The stories and charts are waiting.

-

Payrolls made the Fed look offside but earnings bolstered the market for a feel-good, bounce back week following Friday’s sell-off. This week I get you prepared for fresh inflation data and quarterly reports from some of the hottest names in tech that you may not be as familiar with as you should be.

-

A forgotten gem in the AI-story. The story and the trade. Nothing more; nothing less in less than 60s.

-

Two stocks are minting new, golden all-time highs. I’m putting some money to work in one of them at today’s close in 20 minutes. For the trade, the names, and catalysts click the link.

-

This week on The 9:25, I talk about the sudden dislocation between financial markets and the Fed and what that means for Q3. I dive into Powell’s surprising hawkish posture, the ramification of a soft Payrolls report, and share my regret minimization playbook. Finally, we wrap up by previewing earnings from Palantir, Lilly, and Uber.…

-

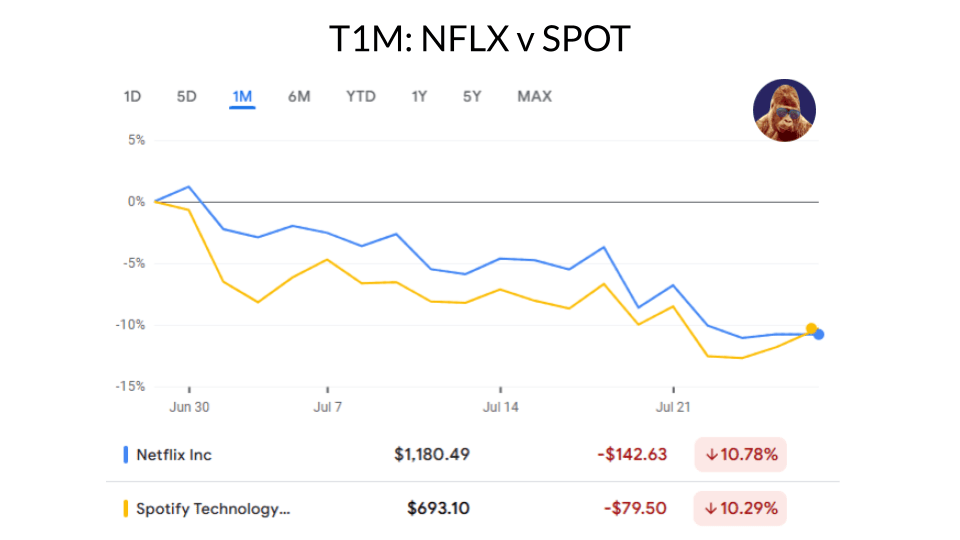

I said I’d buy more Spotify if they put up a Netflix-esque quarter and sold off anyway… Got the sell-off, but not exactly the quarter. So, what not? Click around and find out.