finance

-

As the government shutdown continues, I discuss how much patience the market has left for our elected officials and parry the current bubble argument. As for this week’s business, I prepare you for the Fed [Media] Take-Over, go over the slate of corporate earnings, and highlight a few names on my technical radar… including one…

-

Good afternoon as we approach the close. I’ve been traveling these last few days, but I got a trade alert this morning. I was stopped out of half of a position I’m up 23% in over two months. So, I have a little money to redeploy. For the name of the winner that got trimmed,…

-

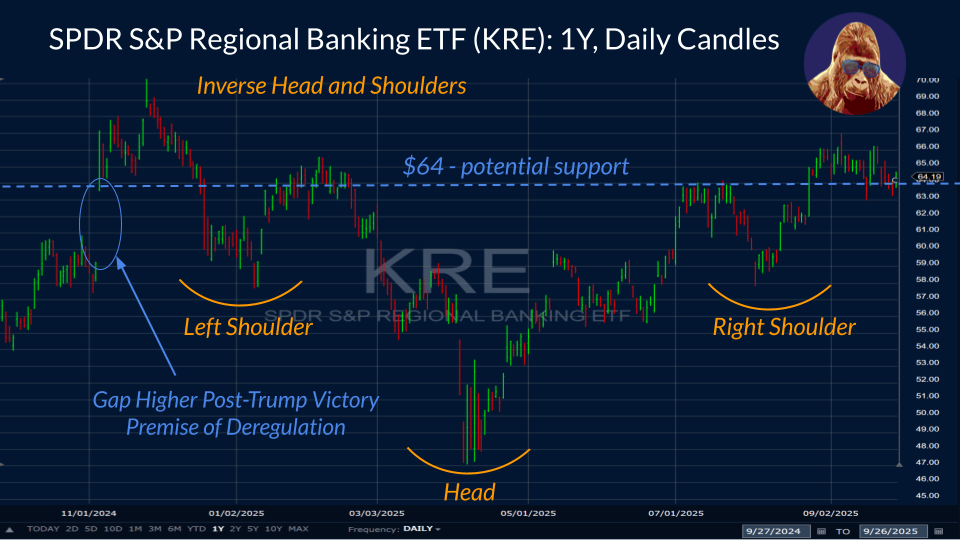

S&P 500 is trading around 22x, but the Fed is your friend. It is just as hard to buy this market as it is to sell it. However, that hasn’t stopped other parts of the market from waking up. Last week, for the first time since 2021, the Russell 2000 (R2K) — the small-cap index…

-

The 9:25 is back: leaner, sharper, and making one bold call: S&P 7000 by year-end. September has a reputation as the market’s worst month. But, what happens when it bucks the trend? Qualitative and quantitative points align in a powerful setup: 7000 is in play before 2026.

-

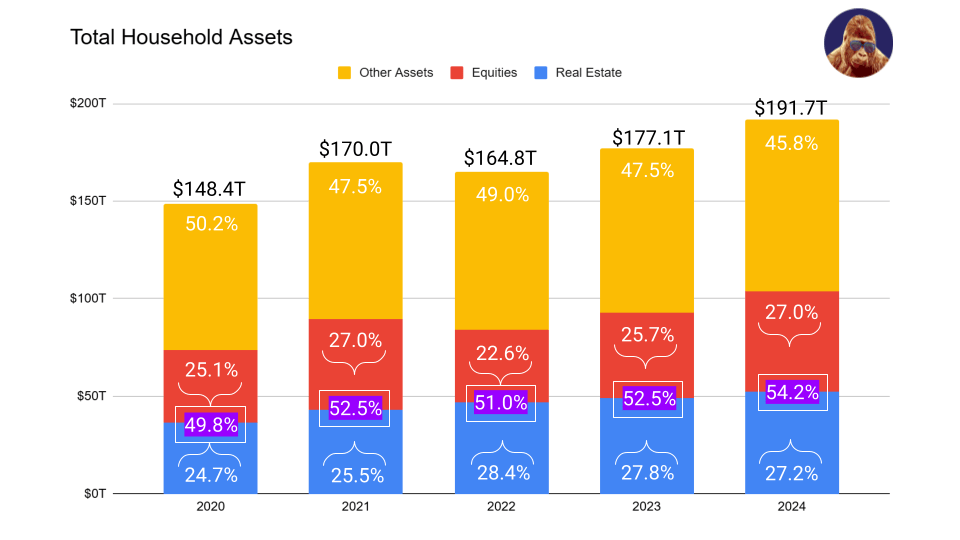

Wages alone are no longer enough to guarantee financial security. By highlighting the diverging realities of owner-Americans and employee-Americans, I argue that asset ownership — not a career of employment — is the key to achieving financial security in America. In my opinion, the barrier for many isn’t money but knowledge — and the fear…

-

Last month, I highlight some golden opportunities to leverage the price action in gold. This morning, it is paying off. Find out what’s caused the move, how to manage (hopefully) your 9-18% gain, and why it isn’t too late to get in on this.

-

😎 Hope you all enjoyed a relaxing Labor Day Holiday because it is officially September, the spookiest month for stocks seasonally! 👻 Check out this edition of the 9:25 so you don’t get tricked by job’s week and to find some portfolio treats in the earning’s roundup.

-

Surprise! A soft pivot from Powell at Jackson. I break down how this changes the state of play for stocks and set the table for the most important earnings report of the season: Nvidia (NVDA). Finally, we wrap up with a fun game of “buy, sell, or hold” featuring AMD, OXY, FTNT, WMT, UNH, LLY,…

-

Expectations for Jackson Hole did not meet reality in the best way possible. I heard a soft-pivot form Powell. For my immediate take on the Jackson Hole keynote, you know what to do.

-

The sell-off in software has the attention of many. Palo Alto may have just reminded the market of the obvious: not all software is the same. For my take on what Palo Alto’s quarter signals for the software trade—and a definitive list of winners 🏆 and losers ❌ — you know what to do… 🖱️