Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

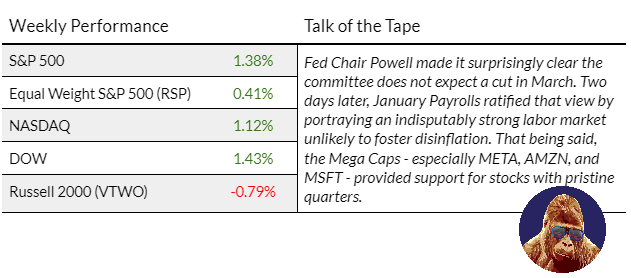

Weekly Performance S&P 500 1.38% Equal Weight S&P 500 (RSP) 0.41% NASDAQ 1.12% DOW 1.42% Russell 2000 (VTWO) -0.79% Talk of the Tape Fed Chair Powell made it surprisingly clear the committee does not expect a cut in March. Two days later, January Payrolls ratified that view by portraying an indisputably strong labor market unlikely…

-

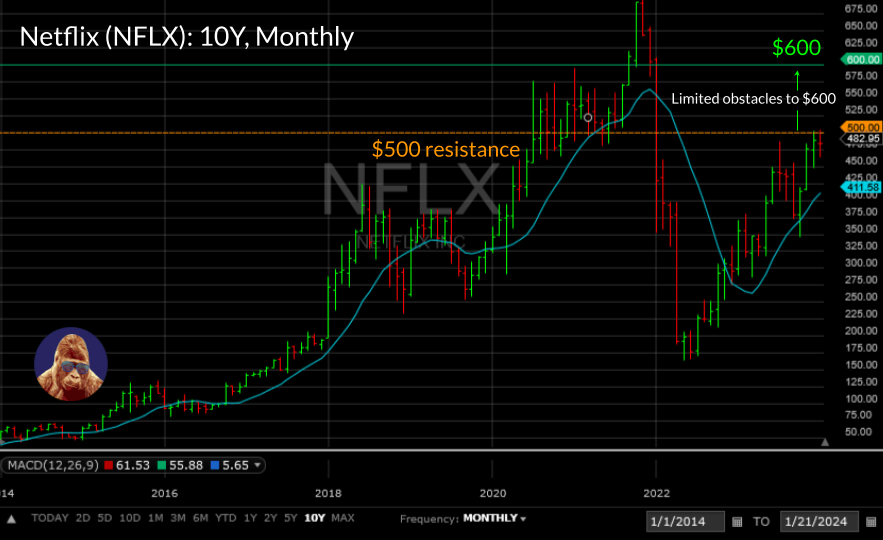

Weekly Performance S&P 500 1.03% Equal Weight S&P 500 (RSP) 1.08% NASDAQ 0.94% DOW 0.65% Russell 2000 (VTWO) 1.75% Talk of the Tape While Netflix’s quarter personified prime-time, Tesla’s car crash reduced the Magnificent Seven to the Super Six. Meanwhile, the goldilocks scenario for stocks persisted as GDP showcased a strong economy, and PCE highlighted…

-

Weekly Performance S&P 500 1.17% Equal Weight S&P 500 (RSP) -0.56% NASDAQ 2.26% DOW 0.72% Russell 2000 (VTWO) -0.34% Talk of the Tape While regional banks did their part, hotter economic data challenged the “broadening out” thesis. At this point, the pullback in the equal-weight S&P and Russell 2000 can be viewed as “routine”. However,…

-

Weekly Performance S&P 500 1.84% Equal Weight S&P 500 (RSP) 0.25% NASDAQ 3.09% DOW 0.34% Russell 2000 (VTWO) -0.01% Talk of the Tape A resilient response to CPI showed stocks can handle inflationary data so long as the “trend is our friend”. The following day, PPI, a leading indicator for inflation, was cool, supporting that…

-

Weekly Performance S&P 500 -1.52% Equal Weight S&P 500 (RSP) -0.83% NASDAQ -3.25% DOW -0.59% Russell 2000 (VTWO) -3.75% Talk of the Tape Although rate expectations were largely unaffected, Friday’s Payrolls dampened enthusiasm for stocks. Otherwise, the rotation out of the Magnificent Seven into other sectors with better risk-reward prospects continued. The Week Ahead Monday…

-

The Week Behind In the wake of an apparent Fed pivot, the rotation from the Magnificent Seven to other sectors accelerated. Outperformance belonged to the equal-weight S&P 500 (RSP) and small-caps (Russell 2000), gaining 3.75% and 5.5%, respectively. That being said, the major indices had strong weeks as well, each rising between 2.5%-3%, extending their…

-

The Week Behind It seems that the market opted for a holding pattern leading up to the final CPI and FOMC meeting of the year. Despite dovish economic readings, major indices recorded only slight gains. However, these small gains felt like a bigger win as they propelled all the majors to achieve new 52-week highs.…

-

The Week Behind PCE was soft; Powell was dovish; it was a good week for stocks even if the S&P and NASDAQ experienced flat weeks. My optimism stems from the Dow’s 2.5% gain this week. The Dow’s outperformance, following a period of underperformance, indicates the market’s breadth is expanding, which is a positive indicator for…

-

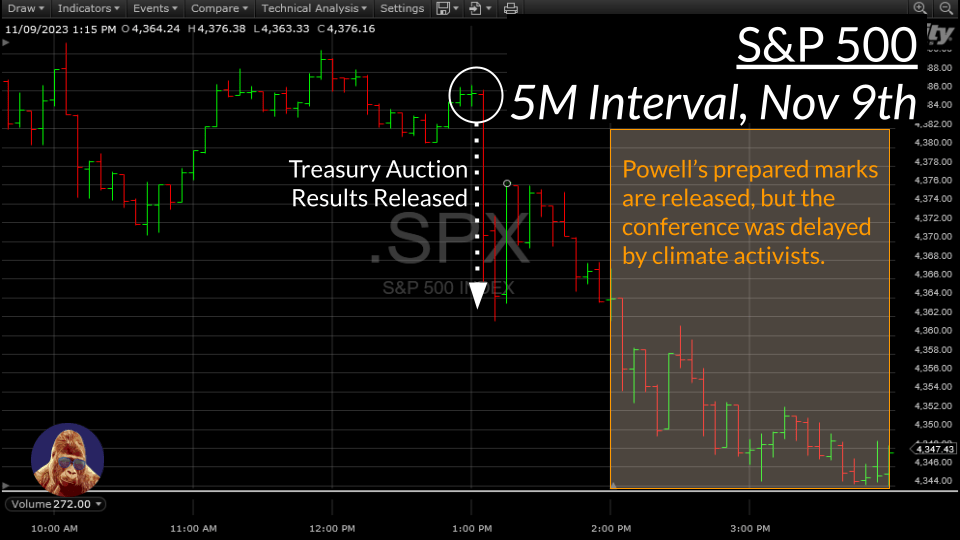

The Week Behind It was shaping up to be an uneventful week until Thursday threw a curveball. A lackluster 30-year U.S. Treasury (US30Y) auction, coupled with Powell’s IMF remarks, pushed interest rates higher and stocks lower. However, the following day brought a ray of hope in the form of Taiwan Semiconductor, the world’s leading semiconductor…

-

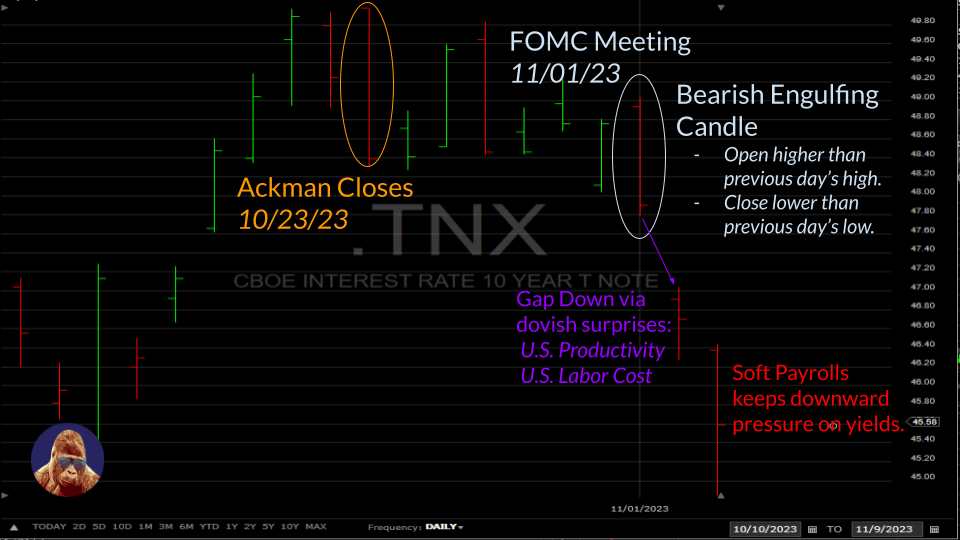

The Week Behind The market managed to avoid all the potential pitfalls that provided bears and hawks the edge over the past two weeks. Treasury announcements alleviated concerns about mounting government debt, economic data showed signs of softness, ADP and Payrolls hinted at labor market slack, and bellwether earnings maintained investor confidence. Consequently, as the…