Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

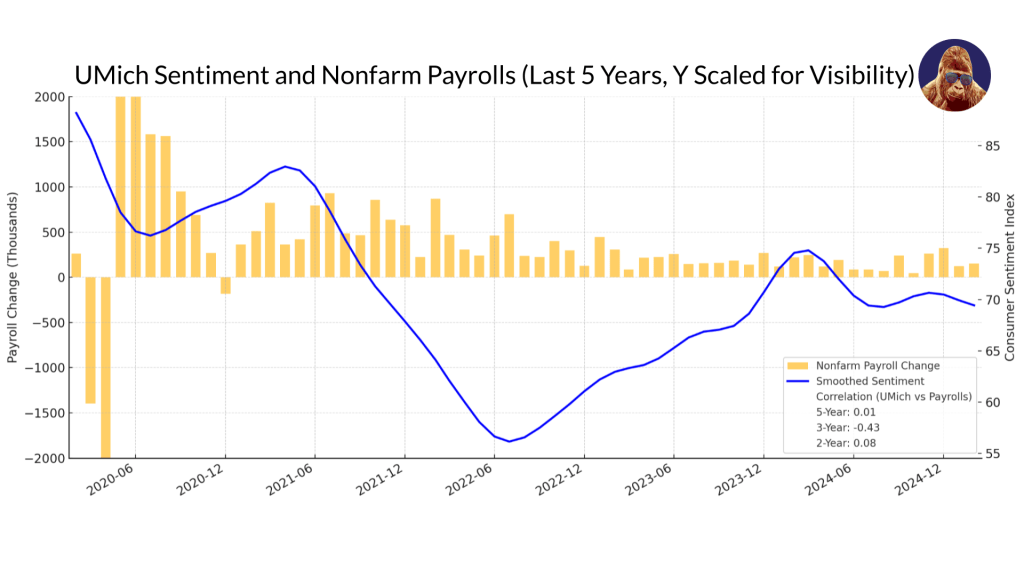

“Personally, I think those forecasting the vibe-cession turn into a recession underestimate two things: the American consumer’s propensity to spend, and corporate America’s hesitation to cut headcount prematurely after the COVID experience.” Soft data is already in recession, but is the hard data about to follow? This week, between tariffs and Payrolls, we’ll find out.…

-

“The worst-case scenario isn’t that tariffs go into effect—but that no clarity ever arrives.” We’ve entered a moment where uncertainty itself is the most powerful macro force. With an April 2 deadline looming, tariff clarity—not the outcome—may prove to be the real catalyst. A loaded macro slate and two under-the-radar earnings reports could also offer…

-

“An adversarial White House caused this correction. We need that to change before it’ll be ‘safe to buy’ again. But the bottom will come before we get that rhetoric.” 🔮Markets are always trying to price-in tomorrow today. 📉 Down 10%, what does the S&P 500 need to bottom? 📥Read the latest 9:25 to find out.

-

“Last week told us everything we need to know: the macro is in control of the market.” Broadcom (AVGO) delivered a masterclass quarter, yet the stock barely held its gains until Powell stepped in to stabilize sentiment. Meanwhile, the S&P 500 remains at a critical technical level, and with CPI and PPI on deck, the…

-

What looked to be a nice day—fueled by Nvidia’s earnings hat trick (beats on revenue, earnings, and guidance)—was unexpectedly upended by developments in D.C. Yet, this market refuses to break, finding resilience through rotation. With tariff deadlines, key job market data, and a slate of earnings on deck, expect another week of volatility on Wall…

-

You feel that in the air? If you pay attention to stocks, you certainly do. It’s the unmistakable buzz surrounding Nvidia’s quarterly release. Adding to the tension, we’ve got PCE— the Fed’s preferred inflation measure—hitting the tape at precisely the time inflation’s path has become uncertain. The 9:25 is back from a prior engagement just…

-

While we’re still in the thick of earnings season, there is now enough data to start drawing some conclusions on key questions that have been overhanging the market. In this edition of The 9:25, I share those conclusions, set the stage for a fresh round of eco-data, and highlight the corporate earnings stories unfolding this…

-

DeepSeek rocked the boat. Mega-caps calmed the waters. Tariffs entered the chat. What a week. Thankfully, this week will be… nevermind. With major inflation data and earnings on deck, there’s no slowing down. Check out this edition of The 9:25 for everything you need to know, including previews of market-moving labor reports, mega-cap earnings, and…

-

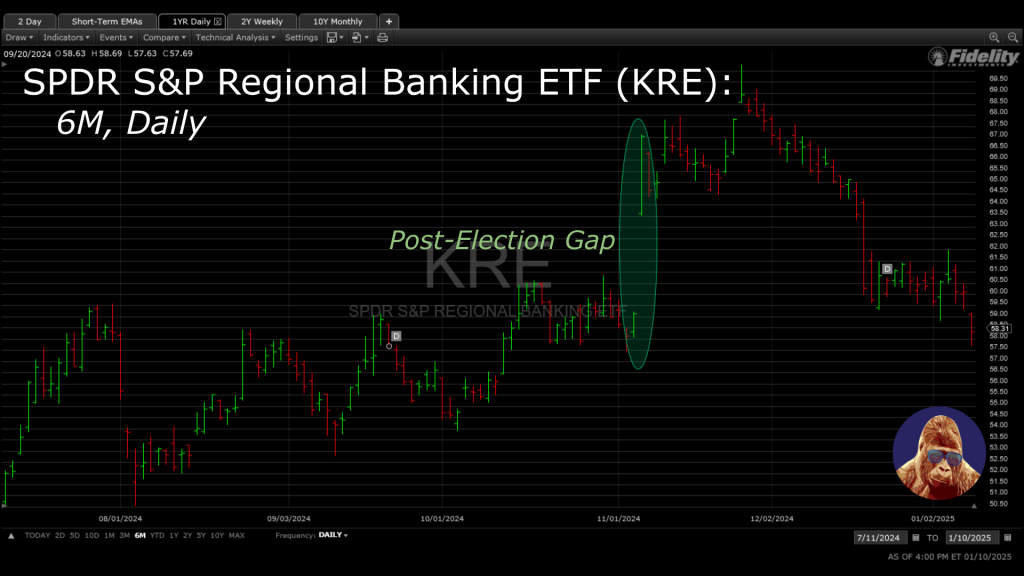

While the USD and US10Y didn’t break, stocks welcomed last week’s breather. Donald Trump was inaugurated as President over the weekend, forcing us to revisit the “buy the election, sell the inauguration” trade. This edition of The 9:25 plays a game of “For Real or Fugazi?” on these topics. With earnings officially in full swing,…