Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

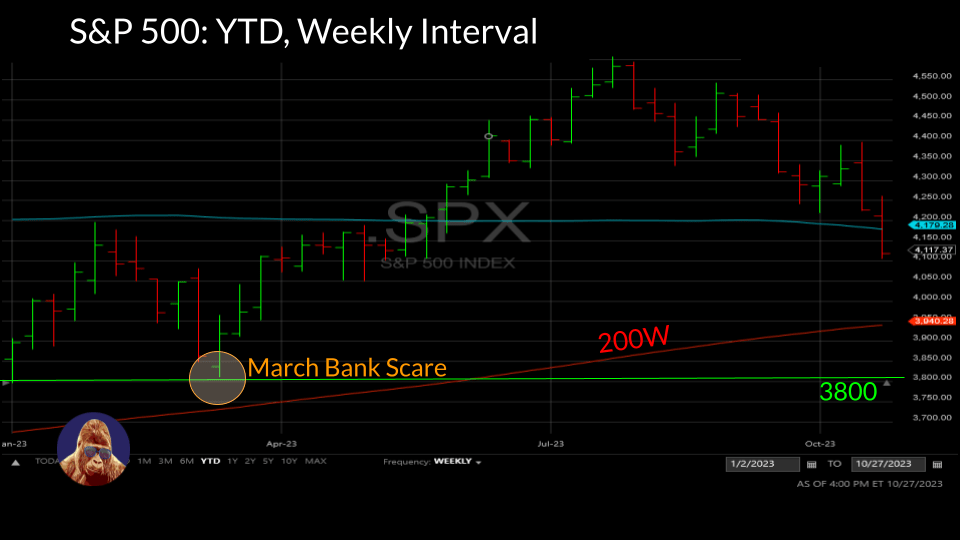

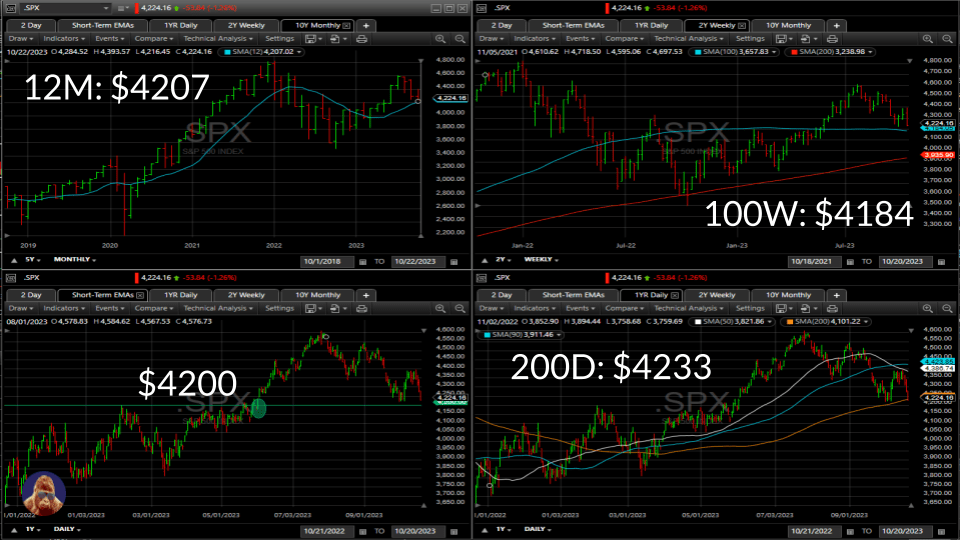

The Week Behind Fundamentally sound mega-cap earnings and downward pressure on the US10Y yield were insufficient to rescue stocks from a losing week. Each of the major indices lost over 2% during the week, with the S&P 500 surrendering the 4200 level in the process. Highlights Update on 4200 Although the US10Y yield backed off…

-

The Week Behind The US10Y yield touched 5% as robust economic data overpowered the Fed’s neutral posture. Yield pressure had the most impact on the NASDAQ, resulting in a ~3% weekly decline. The S&P 500 didn’t fare much better, dropping ~2.4%. While the Dow held up better, it also succumbed to the sell-off, shedding ~1.6%.…

-

The Week Behind While September’s CPI went the way of the hawks, events unfolding in the Middle East between Israel and Hamas proved the dominant market force. This conflict triggered a flight to safety, causing yields to retreat, gold to advance, and select ‘safe-haven’ stocks to outperform. The Dow and S&P 500 closed the week…

-

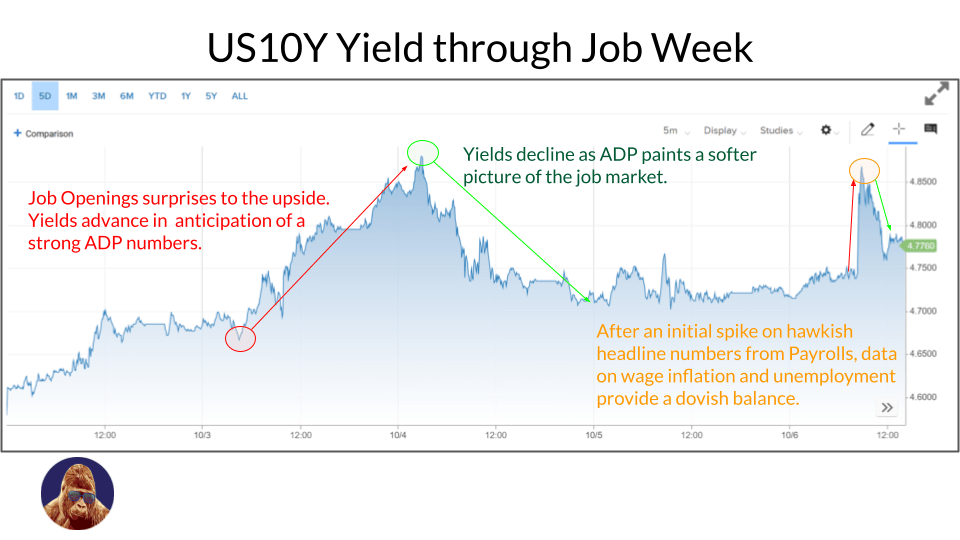

The Week Behind Labor data from ADP and Payrolls proved soft enough to temporarily halt the relentless advance of Treasury yields. For the second consecutive week, stock performance left much to be desired, but it felt as though the bear’s stranglehold on the market was loosening. The Dow ended the week 0.60% lower, whereas the…

-

The Week Behind In the latter part of the week, WTI and the US10Y eased from their peaks, allowing stocks to bounce off oversold conditions. Although this week’s performance wasn’t impressive, it feels like the three-week sell-off has lost momentum. The Dow declined by 1.3%, the S&P 500 fell by 0.74%, and the NASDAQ managed…

-

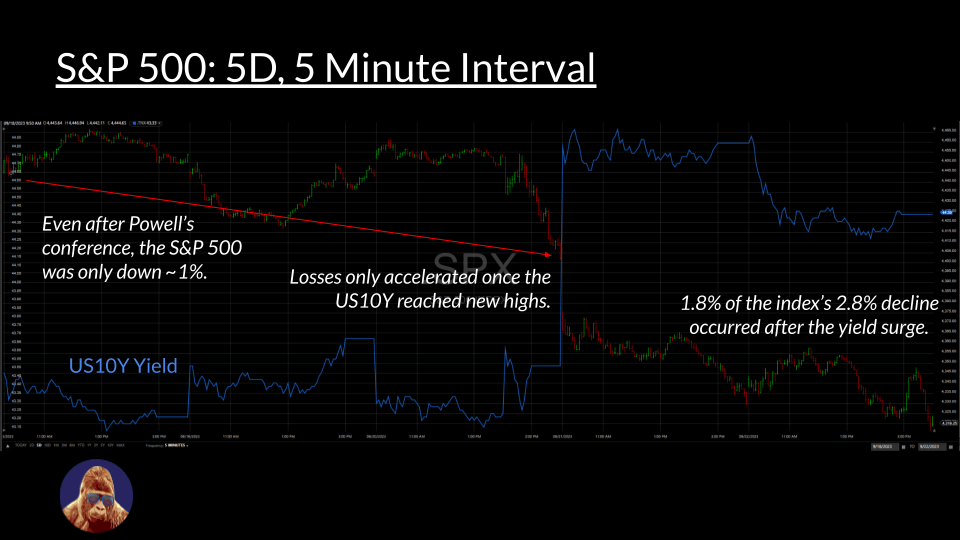

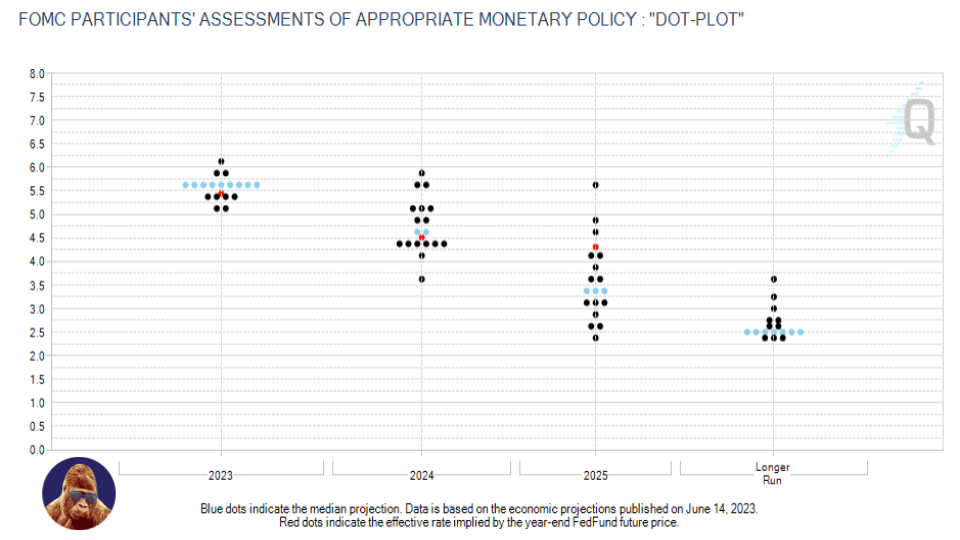

The Week Behind A day after the FOMC showcased a resolutely hawkish Fed, long bond yields gapped to new cycle highs causing stocks to capitulate lower. In a losing week for the indices, the NASDAQ declined ~3.6%; the S&P 500 lost ~2.8%; and the Dow dropped 2%. Highlights It Is How This Game Is Played…

-

The Week Behind Although it was a busy week, net-net, major events aligned with consensus. As a result, the major indices ended the week roughly where they started. Oracle and Adobe both, as predicted, declined despite solid quarters. Arm Holdings’ successful IPO built on capital market enthusiasm. Inflation prints did not disrupt the Fed-inflation narrative.…

-

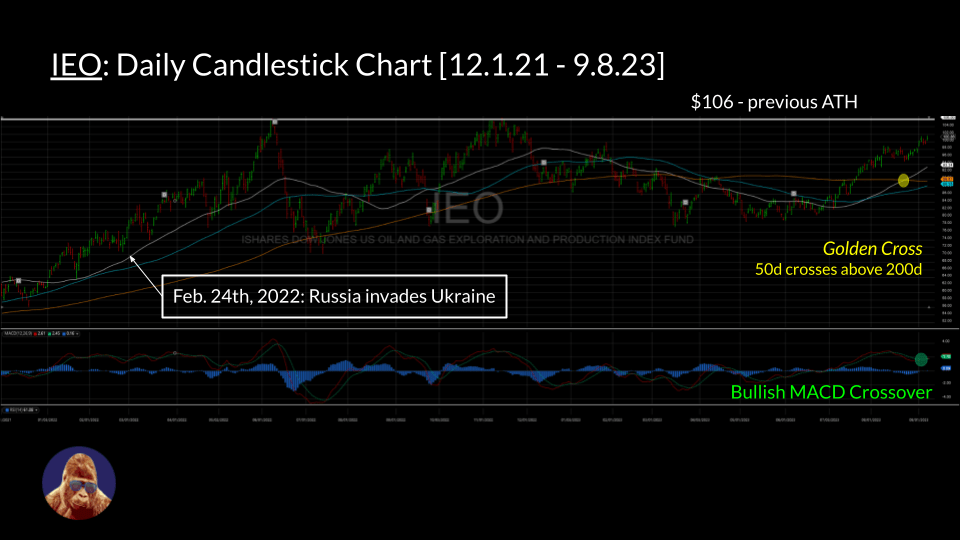

The Week Behind Despite offsetting inflation readings, the key market mover was the CCP’s ban on iPhones for government employees. The news caused a 6% decline in Apple (AAPL) shares. As a result, the major indices ended the week in negative territory, with the NASDAQ, S&P 500, and Dow closing approximately 2%, 1.3%, and 0.75%…

-

The Week Behind Although benign macro data allowed the major indices to record impressive weekly performances, the market still feels fragile as downward pressure from the US10Y yield persistently reminds investors that the Fed’s battle with inflation remains the dominant concern. The NASDAQ, S&P 500, and Dow closed the week approximately 3.25%, 2.50%, and 1.50%…

-

The Week Behind Despite another blowout quarter from Nvidia and Federal Reserve Chair Jerome Powell striking a neutral tone at Jackson Hole, the markets ended the week on a messy note. On the week, the S&P 500 and NASDAQ managed to eke out gains of 0.82% and 2.26% respectively, while the Dow experienced a slight…