Retired November 2025 – 9:25

Start the week with the “9:25” – you’ll get up to speed on what’s moving your money in the markets by the 9:30 open. Formerly, The Market Brief.

-

In this episode of Conversations from the Canopy, Don brings in Frank Ferritto, a man with a decade plus experience in wealth management, to talk about how tax loss harvesting can generate alpha for a portfolio. It is the first of December; the clock is ticking to identify which names – if any – make…

-

In this episode of Conversations from the Canopy, Bastion returns for an in-depth discussion on stable coins; Don gets Bastion’s take on Cathie Woods’ revised 2030 Bitcoin target; and each offer their insights into the massive declines in crypto.

-

In a matter of days, valuation has reasserted itself as a valuation for stocks. How did it happen? How do we break it? What can be done in the meantime? In the process of tackling those questions, Don also takes some time to outline how this ceiling undermines bubble-claims and actually supports the notion that…

-

What did Powell really say at the October FOMC? What does it mean for markets? Don takes on both of those questions in this week’s 9.25. Alongside the Fed recap, Don let’s you in on the tech-opportunity he is most excited for, gives you everything you need to know for the upcoming slate of earnings…

-

Welcome to the busiest week of the quarter… and maybe the rest of the year. This week I breakdown what September’s tame CPI print means for the the busiest week of S&P 500 earnings and the crucial October FOMC meeting. Specifically, he takes a look at what could reverse the rotation out of momentum and…

-

The lack of regulatory oversight in private credit was always a known risk, mitigating the probability it evolves into a systemic event. As we wrapped up last week, there was a scare in private credit. Don gives you his insight on what this means for the market, goes over the technical setups for another week…

-

This week, the 9:25 delves into the renewed tensions shaping US-China trade dynamics. I make my case for a downside surprise on inflation and follow-up on what companies like Delta and McCormick reveal about the economy. With earnings season kicking off, I get you ready for the key players like JP Morgan and TSM. Finally,…

-

As the government shutdown continues, I discuss how much patience the market has left for our elected officials and parry the current bubble argument. As for this week’s business, I prepare you for the Fed [Media] Take-Over, go over the slate of corporate earnings, and highlight a few names on my technical radar… including one…

-

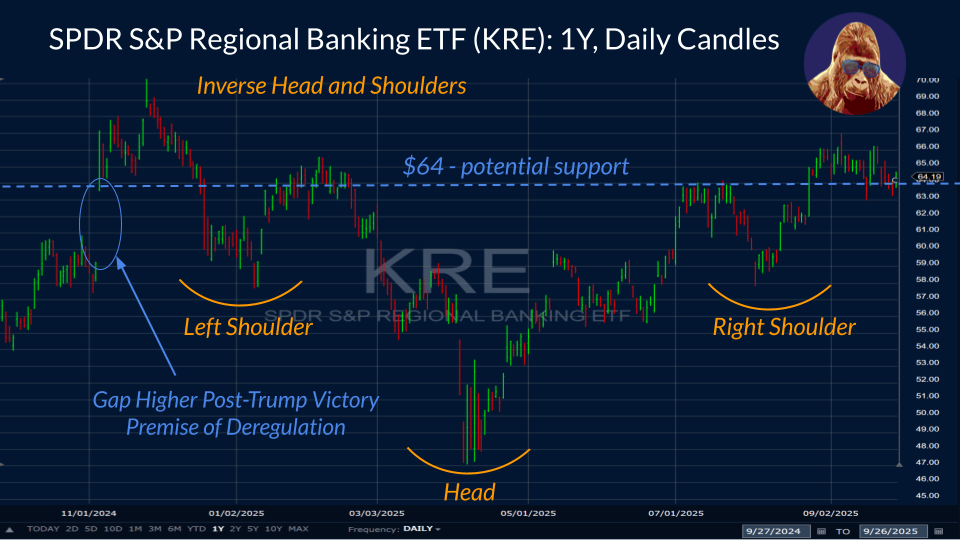

S&P 500 is trading around 22x, but the Fed is your friend. It is just as hard to buy this market as it is to sell it. However, that hasn’t stopped other parts of the market from waking up. Last week, for the first time since 2021, the Russell 2000 (R2K) — the small-cap index…

-

😎 Hope you all enjoyed a relaxing Labor Day Holiday because it is officially September, the spookiest month for stocks seasonally! 👻 Check out this edition of the 9:25 so you don’t get tricked by job’s week and to find some portfolio treats in the earning’s roundup.