FlashNotes

-

Yesterday, the S&P 500 and Dow Jones Industrials closed at new all-time highs. 🍾🍾🍾🍾🍾 The Next Hurdle In my view, it’s the search for confirmation: looking for signs that this new high is sustainable and not just a false positive. Dow Theory would have us watch for similar action in another index or average before…

-

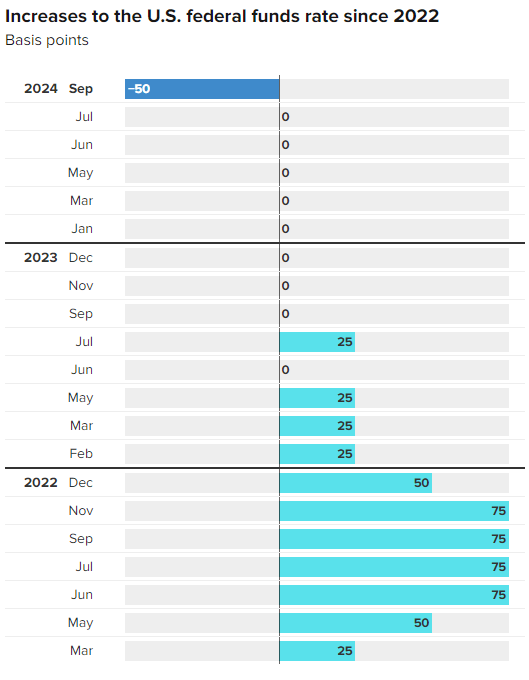

A Proactive Approach The Fed is often – and rightly – criticized for being too late. Relying on backward-looking data will do that to you. This iteration of the Fed, however, appears to be taking a more proactive stance. During the Q&A, Powell remarked, “The U.S. economy is in a good place. Our decision today…

-

Remember the yen-splosion in early August? Of course, you do. Just over a month later, the Japanese Yen is now stronger than it was back then. Given the context— the Fed’s first rate cut scheduled for next week, weakening the USD, and the BoJ raising Japanese rates, strengthening the Yen— the steady rise in the…

-

The market responded to this morning’s largely in-line CPI with a sell-off. It seems the market is unhappy with the reduced likelihood of a 50 bps cut, which dropped to 17% after starting the month as a slight 51% favorite. Personally, I find the 25 vs. 50 debate myopic. Focus on the idea the Fed is…

-

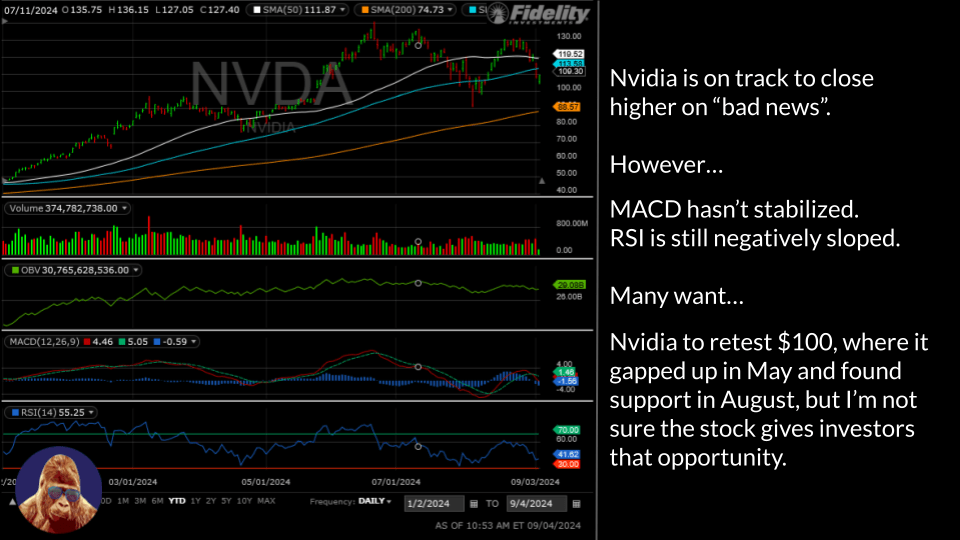

Nvidia opened lower as the DOJ issued subpoenas. The market seems to have forgotten that this is standard procedure for the DOJ. Mr. DOJ doesn’t just casually call Mr. Nvidia to ask for information. In my view, if Nvidia manages to close in the green after a red open, it would check the “stock rising…

-

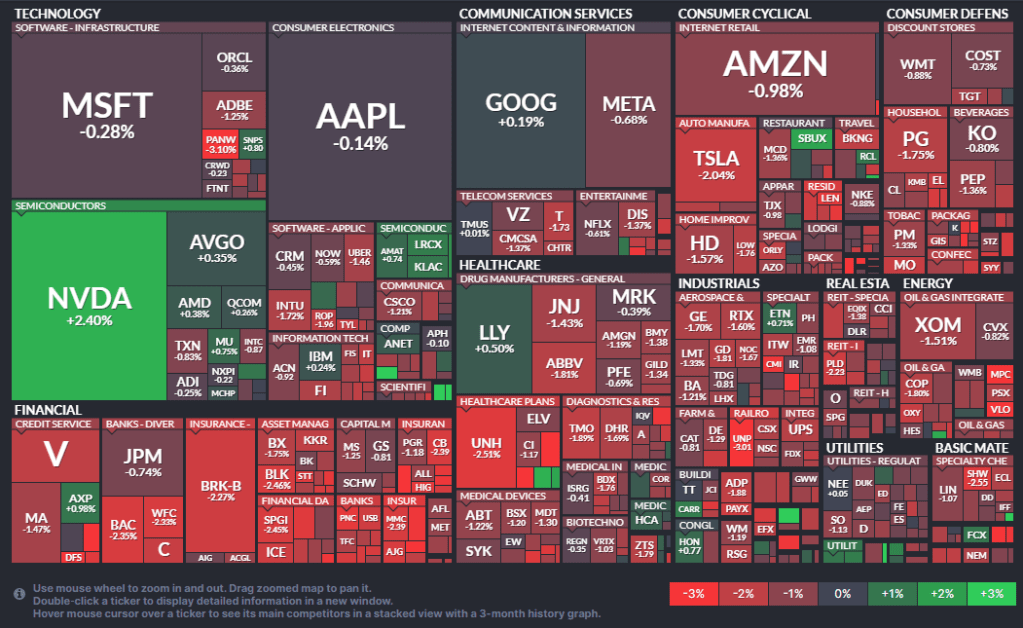

The options market was pricing in a 10% move on Nvidia’s (NVDA) earnings. It is early, but with NVDA down just 2-3%, this relatively muted reaction suggests the results were largely as expected. The rest of the market is either slightly higher or sideways. Looks like rotations: money leaving Nvidia for other opportunities in an…

-

Powell delivered a Jackson Hole classic. You can find a transcript here, but here are some key quotes that stood out to me: On Inflation “My confidence has grown that inflation is on a sustainable path back to 2 percent.” The risks associated with inflation are no longer the primary focus. On Employment “It seems…

-

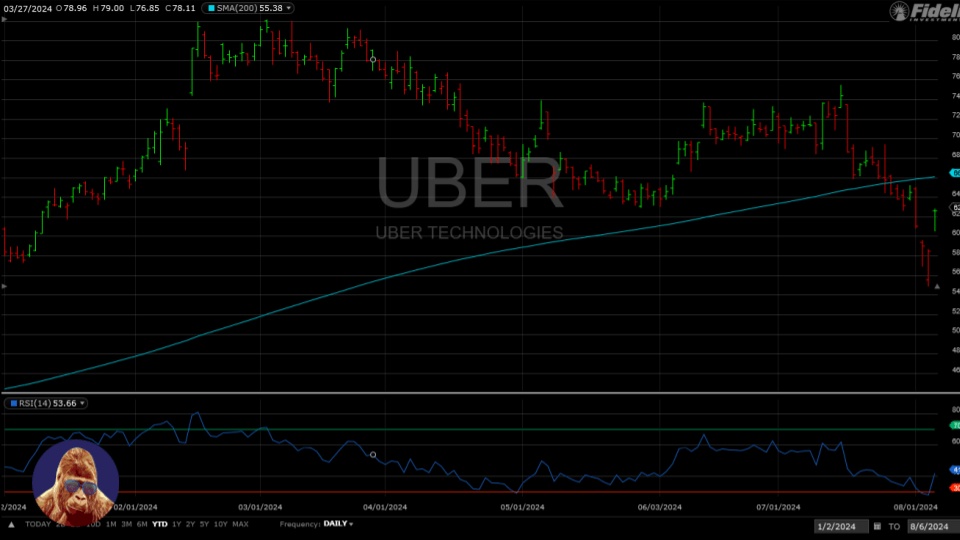

The economy is crumbling! So… how did Uber (UBER) report a beat on both the top and bottom lines? A 23% increase in mobility unit gross bookings and a 3Q estimate in line with consensus… 🤔🤔🤔🤔🤔 One company doesn’t define the economy… but if the U.S. were truly heading towards an imminent recession, Uber couldn’t…

-

This morning’s weak BLS payrolls survey reinforced the notion that the Fed may already be too late in cutting rates. Is it possible to act in a timely manner when relying on lagging data? Once this economic cycle is behind us, especially with the advent of real-time/alternative indicators developed during the COVID-era, the Fed will…

-

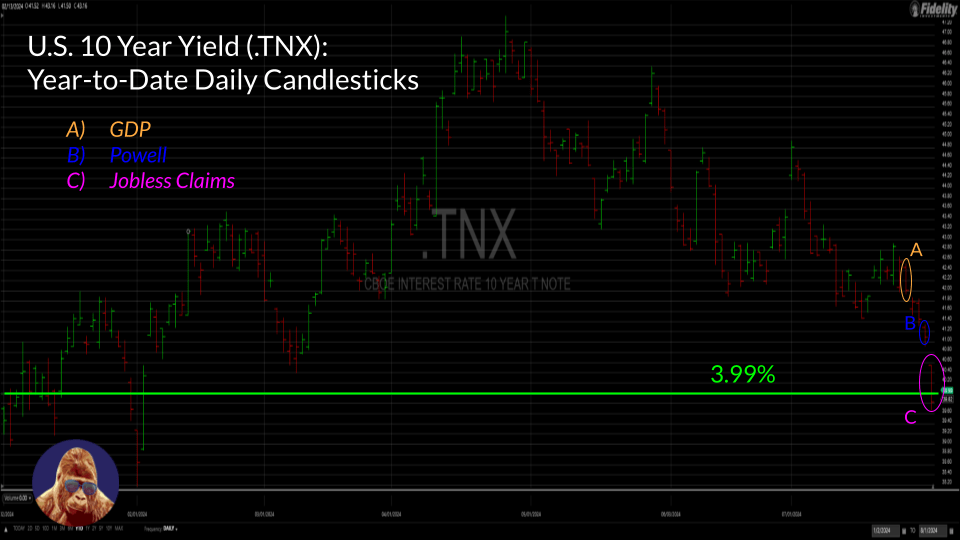

The U.S. 10-year yield is on track to close with a 3-handle for the first time since February. Throughout 2024, the US10Y has served as a proxy for growth expectations. Its decline suggests that the bond market is forecasting weaker economic growth ahead. What’s behind this damper forecast? Three factors come to mind: 1) Today,…