FlashNotes

-

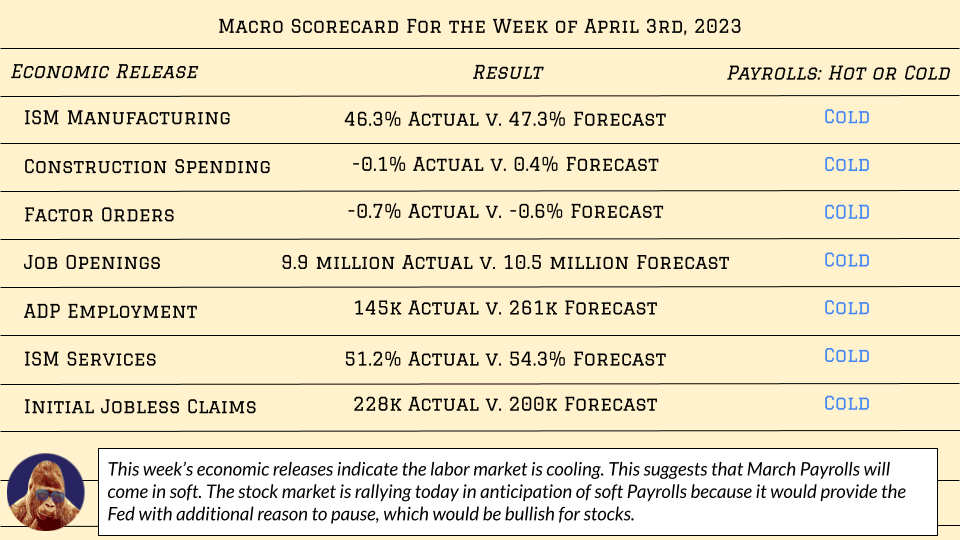

The market has decided that March Payrolls will showcase a cooling labor market, providing the Fed with additional reason to pause, which would be bullish for stocks. All of this week’s economic reports have painted a picture of a cooling labor market: It appears that the bank scare has had a real impact on the…

-

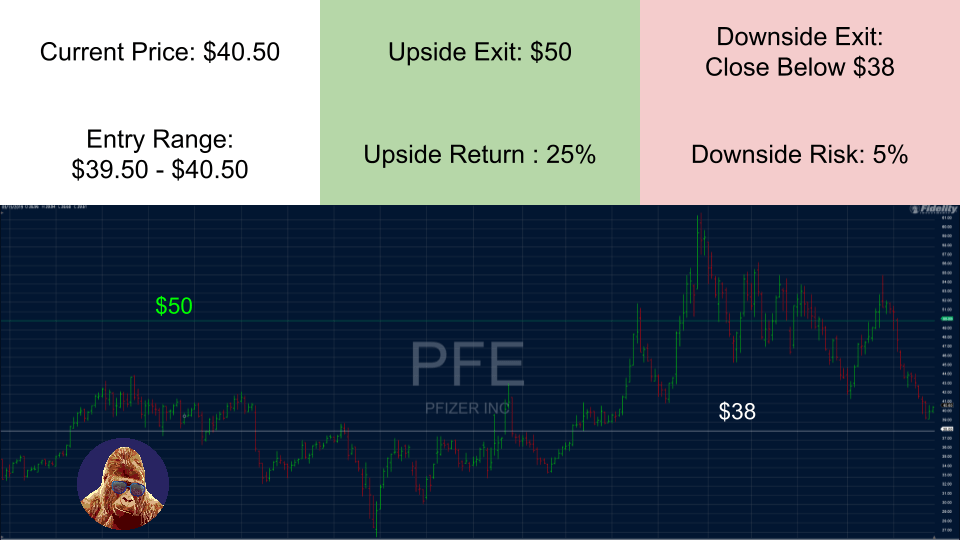

The majority of my writing focuses on contextualizing complex market moves to assist in making investment decisions. While I occasionally discuss the sectors that I believe benefit from those market moves, I rarely mention individual stocks. However, recent volatility has caused unjust dislocations in certain companies’ stocks, creating attractive risk-reward scenarios only when defined entry…

-

Confused by today’s rally in equities? No worries. I attribute this relief rally to three factors: 1) A group of financial institutions – Morgan Stanley, Bank of America, Wells Fargo, J.P. Morgan – are in talks to deposit ~$20B in First Republic Bank (FRC). 2) After touching a new 52-week low at around $65.50, Crude…

-

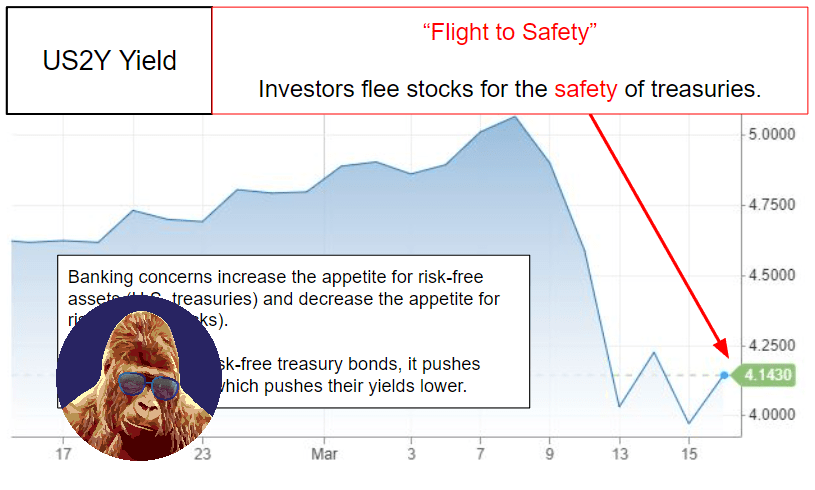

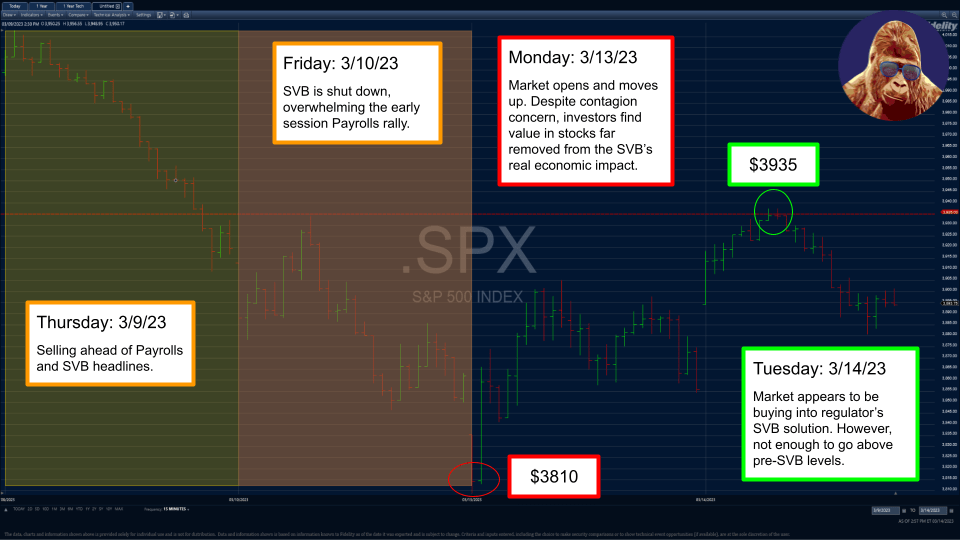

As markets grapple with the implications of Silicon Valley Bank (SVB), it is difficult to keep the emotion out of investing. Emotion – fear and hope alike – have no place in any investment strategy. Until regulators reach a more permanent resolution, we should expect increased volatility. To remove emotion from the equation, I defer…

-

Initial Thoughts Chat GPT has created significant excitement surrounding AI, causing associated stocks to skyrocket. Initially, I dismissed this as a typical buzzword bubble. However, earnings from Nvidia (NVDA) and Broadcom (AVGO) have led me to question my skepticism. Ambitious Statements From Conservative Management Jensen Huang, CEO of NVDA, remarked that AI is at an…

-

A Shift In Emphasis Despite a vast number of companies reporting before and after each session, economic data dominated this week’s tape (2/13 – 2/17/23). The market is shifting its emphasis from the micro – company-specific developments – to the macro – economy-wide developments. While this shift occurs quarterly, it is worth noting because in…

-

Last week, I wrote a piece explaining how tech layoffs may imply slower growth for the mega-caps in 2023. If you haven’t, then I recommend skimming it; the implications came to fruition for MSFT, AMZN, AAPL, and GOOG. As each announced, the post-market reaction was mixed but became decisively negative once forward guidance revealed slower…

-

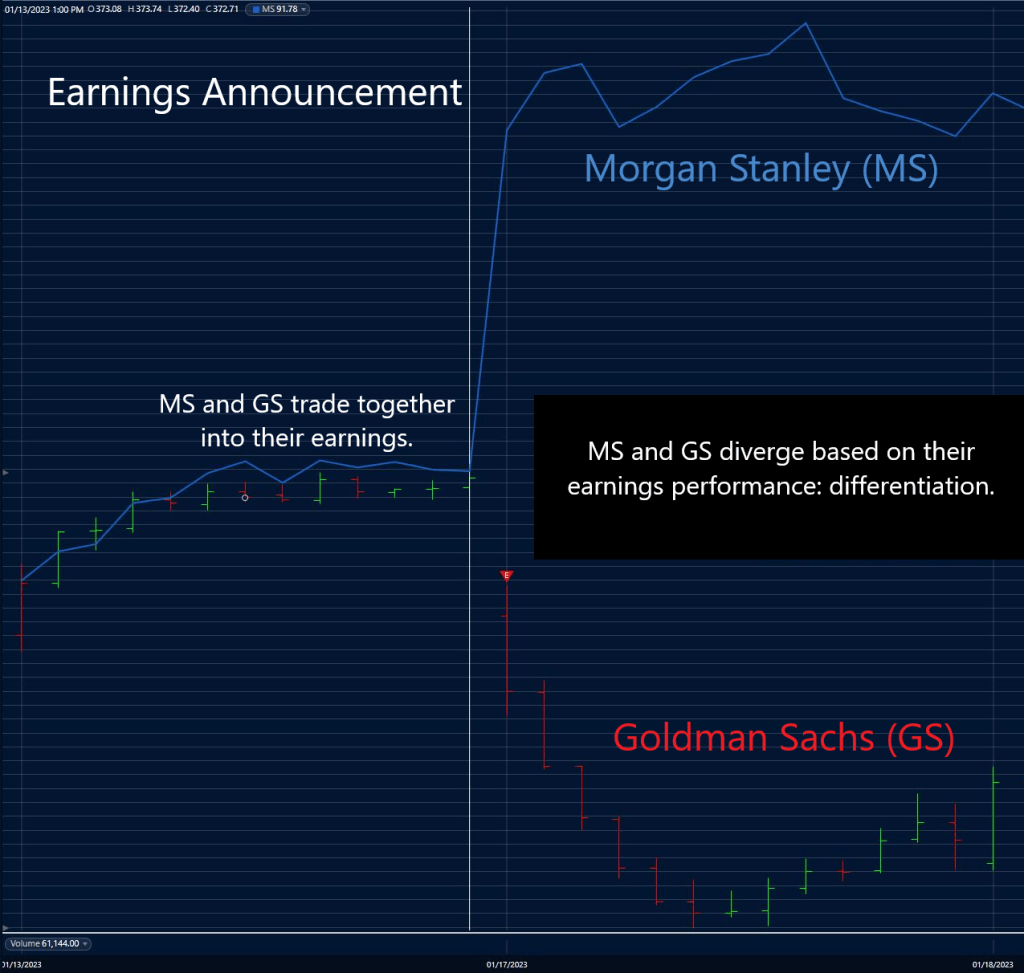

In bear markets, stocks have a tendency to behave like commodities, trading up and down together based on the macro. Bull markets are different; they feature differentiation. Throughout 2022, there was no differentiation. Economic sectors were judged by their weakest link. On two separate occasions in 2022, negative headlines regarding Snapchat (SNAP) brought down the…