At the risk of mission creep, it is worth talking a little about Friday’s action in gold and silver. While I am not entirely convinced of what I am about to say, we do need to open to the following idea:

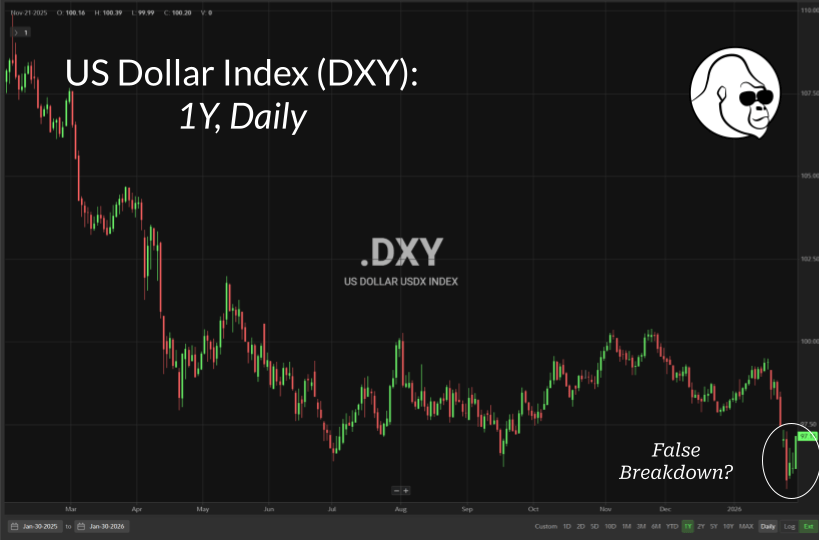

The selection of Warsh as Fed Chair may be a durable bottom in the U.S. Dollar.

For a moment, ignore the fact it was Trump — who has been irresponsibly vocal about his desire for lower rates — that nominated Warsh. If you remove this context, you’ll find Warsh isn’t a dove by default. Notably, he has been a harsh critic of quantitative easing — the central bank purchasing of long-dated securities (such as government bonds) on the open market to artificially lower their rate — as a policy that inflates asset prices and exacerbates inequality… a debate for another time.

While many will correctly line up the timing of a hawkish PPI with the rally in the USD, I would argue that if the market viewed Warsh as a Trump sycophant, then that rally would have faded on the idea that Warsh would continue cutting regardless of the potential for inflation to reassert itself. I would view a sustained rally as an implicit endorsement that Warsh will act in a way that doesn’t further jeopardize the Fed’s independence.

However, it is impossible to ignore his dovish tilt since entering the conversation for Fed Chair. And if new Fed-specific headlines erode that implicit endorsement — resulting in a swift continuation of the precious metals rally and the DXY index continuing the process of making new lows — then this interpretation will be disproven.

I do what I can to provide responsible, out-of-consensus viewpoints to inform decision-making. If this one ends up becoming consensus, it will mean we’ve witnessed a top in the metals trade as durable as the bottom is in the USD. It doesn’t mean money flees the metals, but it does mean that new flows won’t be seduced as easily.

In fairness, false breakdowns rectify quickly; if the DXY can’t get above 97.5 within the next 5-10 sessions, then technical conviction meaningfully decreases.

Monday

Disney (DIS) | BTO

Typically, I listen to this call to get an idea of consumer appetite for discretionary spending. Their parks segment says a lot about the character of family households: an important niche within the broader consumer basket. However, this quarter will also be interesting due to the continued weakness in Netflix. The drama there likely means that investors will view the results from Disney+ through a rosier lens. Perhaps Disney will become a beneficiary of some of the market cap that Netflix has “donated” over the past six months.

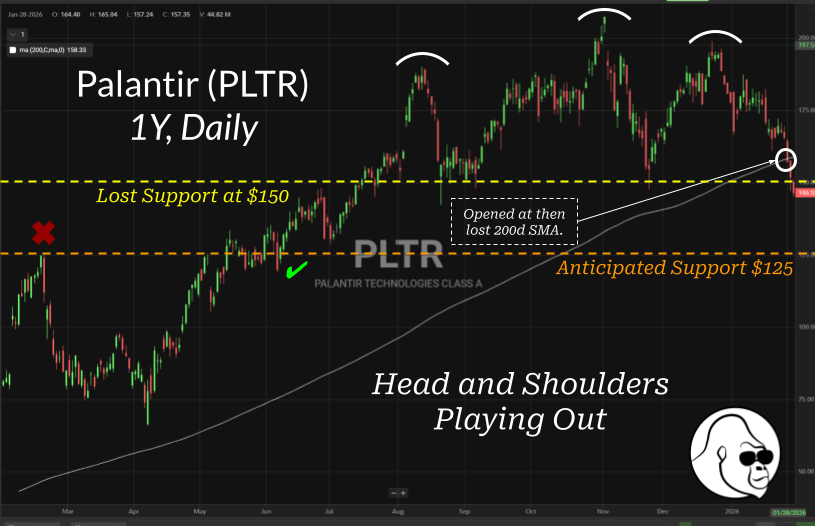

Palantir (PLTR) | ATC

Amazing house, terrible neighborhood. I am not sure if the quarter — which I assume will be amazing — can do anything but set a floor until sentiment on software normalizes.

The stock appears to be following through on a bearish head-and-shoulders pattern. I view $125 as an important level of support; if we get there, you’ll find me in the bid book. That said, given that it has no OpenAI exposure, there is a chance that positive numbers will be met with a positive response, vis-à-vis Meta.

Tuesday

Job Openings (Dec’25) | Est. & prior both 7.1 million | 1000

Eaton (ETN) | BTO

Concisely, Eaton is one of the few players actually integral to upgrading energy infrastructure. GEV and CAT are the other obvious ones. Worth pointing out because these names are definitely buyable on dips.

AMD (AMD) | ATC

INTC results were received poorly because supply constraints suffocated the guidance. If AMD’s guide isn’t ailed by those same constraints, perhaps we will see a better post-earnings reaction. But one thing is certain: all inputs to the AI factory will face shortages, and CPUs are no exception. Given the chart, the report will determine whether a double top kills the stock in the short term or if we see a new blow-off top. I’ll be sitting this one out.

Wednesday

ADP Employment (Jan) | 45k est. & 41k prior | 0815

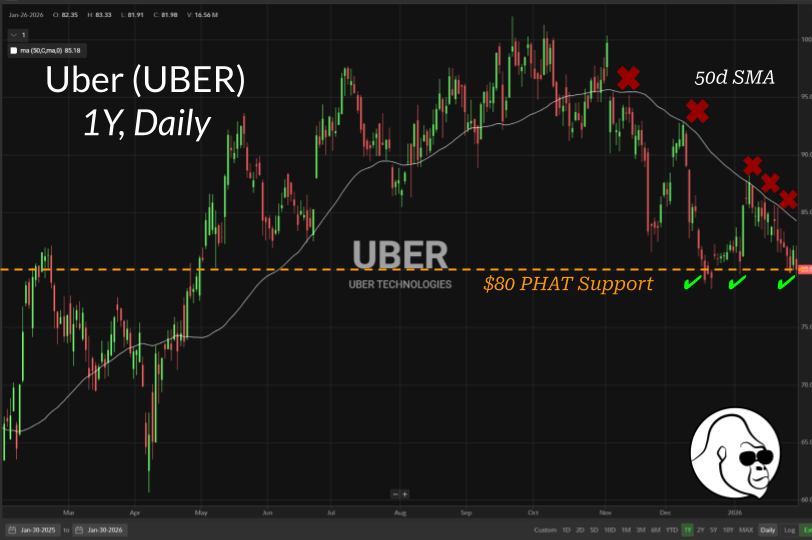

Uber (UBER) | BTO

The stock is currently trapped under the 50-day SMA and supported by the key psychological level of 80, which nearly aligns with the 100-week SMA and has been an important level in the past. This quarter feels binary. Bears will talk about Waymo emerging faster than expected, while bulls will highlight Uber’s position and savvy as the market share leader.

I am still long, but for the first time in a while, I am nervous about the reaction. That said, I don’t worry about the quality of the quarter itself. Earnings from airlines and other sectors reveal continued strength in specific consumer pockets that Uber also serves.

Eli Lilly (LLY) & Novo Nordisk (NVO) | BTO

I was stopped out of NVO, but not LLY. The concern is that NVO will not be able to compete in a GLP-1 price war with Lilly. A recent memo showed that NVO still finds it necessary to spend significantly more on advertising than Lilly — leading to higher relative costs — at the same time “TrumpRx” is specifically targeting these drugs with price caps, threatening lower overall revenues. Getting stopped out might make me look foolish in hindsight, but given recent post-quarter reactions, it has taken a Herculean effort to earn a positive next-day response unless you are manufacturing memory for GPUs.

Alphabet (GOOG) | ATC

From worst to first, Alphabet has come a long way in a year. Obviously, the stock is richly valued, but it should be: there is no OpenAI risk, a dual tailwind of cost-cutting, the potential for new revenue from TPUs, no immediate regulatory concerns, and YouTube is outgrowing every other streaming service on the planet. Furthermore, a handful of “other bets” — such as Waymo — are finally paying off. As the current leader of the Mag 7, its price movement is vital to market sentiment. This report should be on everyone’s radar.

Thursday

Initial Jobless Claims | 212k est. & 209k prior | 0830

Amazon (AMZN) | ATC

I have been a major Amazon investor, which, at times, has been an exercise in frustration. Although Amazon emerged as a prominent player in OpenAI’s most recent funding round, the primary focus will be on AWS performance and its evolution in integrating AI via its in-house chip, Trainium.

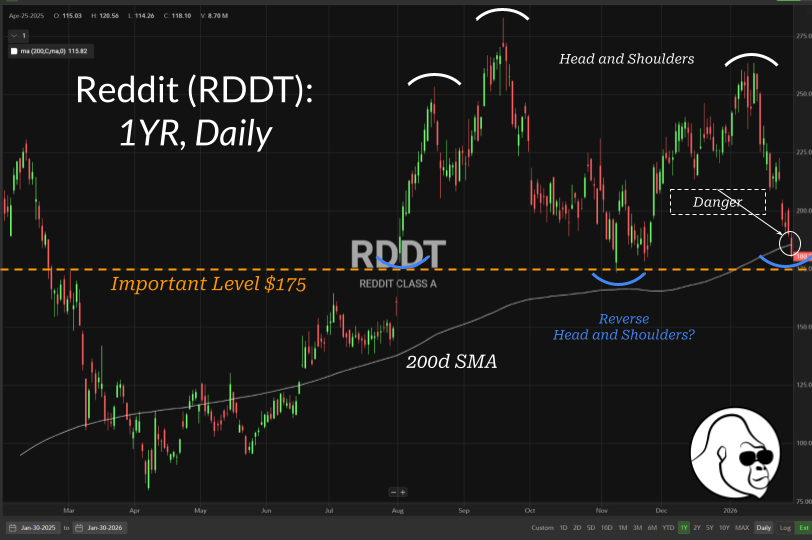

Reddit (RDDT) | ATC

Similar to PLTR, RDDT is breaking down. The latest bear case emerged following revelations that YouTube is now the most-cited source for AI answers.

I only have “house-money” positions left in the name, all with a low cost basis. I may exit these completely and revisit once the dust settles. While Reddit is a social network where user and engagement metrics matter, its valuation multiple is tied to its role as a unique pool of data for AI training monetization. If that narrative is jeopardized, this stock could go significantly lower.

That said, this turns around and it’ll look like a reverse head and shoulders.

Friday

U.S. Employment Report | 0830

Job Creation: 55k est. & 50k prior

Unemployment : Est. & prior both 4.4%

MoM Hourly Wages: Est. & prior both 0.3%

YoY Hourly Wages: 3.6% est. & 3.8% prior

Key

Macro Economic Events

Corporate Earnings

High Importance