I hope you had a great Christmas and are ready to wrap up 2025. It’s a quiet week for news, but the “insane” move in gold and silver has likely caught your attention.

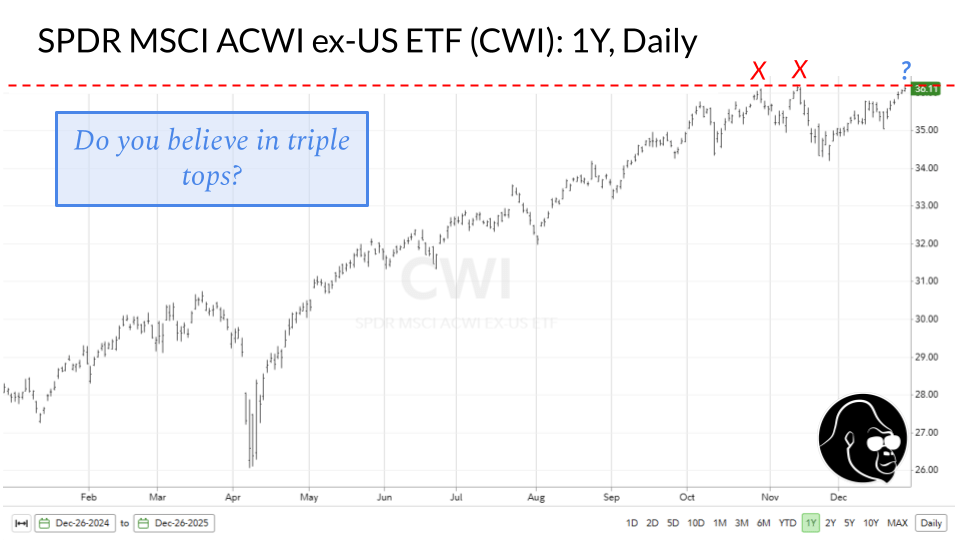

The macro variables fueling this precious metals rally are the same ones likely to push international stocks higher. I’ve held the CWI (ACWI Ex-US ETF) for a year and increased my exposure last week. Check out the charts at the bottom of today’s pregame. If the trend catches your eye, do some homework and stay tuned. I’m sure to bring it up in an upcoming video or article.

Monday

Nothing Scheduled

Tuesday

December FOMC Meeting Minutes |1400

- Coming out of the most recent Fed Meeting, it appears as though many on the committee are turning dovish. Furthermore, with a new Fed Chair imminent and Powell as a lame duck, this may be considered irrelevant.

Wednesday

Initial Jobless Claims | 215k est. & 214k prior | 830

Thursday

New Year’s Day – Markets Are Closed

Friday

Nothing Scheduled

Key

- Macro Economic Events

- Corporate Earnings

- High Importance

Ex-US: Time to Shine

As the name suggests, the ACWI Ex-US represents global equities minus the United States. After basing for 17 years, this index has finally broken through. I attribute this sustained breakout to USD weakness. Unless a strong Democratic performance in the mid-terms triggers a rethink of global central bank USD allocations, I don’t see a path for a USD mean-reversion. Provided the USD doesn’t interfere, I view a 20% rally as a modest start for a breakout that has been building for nearly two decades: the bigger the base, the bigger the breakout.

On shorter time frames, the index is knocking on the door for more upside. If you like the trade in gold, you have to like the setup in CWI. Both benefit from the same fundamental tailwinds, but international equities are far less extended and crowded than metals.

We’ll leave it there. Enjoy the week. Good luck out there!