The Trump Administration has Declared War on Wind.

Here’s the headline from the Department of the Interior’s website.

One’s Tragedy is Another’s Triumph

While only a fraction of the expected 6 GW is online, the minimum 90-day halt — at a minimum — delays a vital source of new energy for a U.S. grid in desperate need of diverse inputs.

| Project | Expected Capacity | Status Pre-Halt |

| Coastal Virginia (Dominion/D) | 2.6 GW | Under construction; expected late 2026. |

| Empire Wind 1 (Equinor/EQNR) | 0.8 GW | ~40% complete; expected 2027. |

| Sunrise Wind (Ørsted/DNNGY) | 0.9 GW | Under construction; expected 2027. |

| Vineyard Wind 1 (Avangrid/AGR & Iberdrola/IBDRY) | 0.8 GW | Partially operational; 50% sending power as of Oct 2025. |

| Revolution Wind (Ørsted/DNNGY) | 0.7 GW | ~80% complete; expected early 2026. |

| Total | ~5.8 GW |

My personal feelings aside, the companies involved — most notably, Dominion Energy — took a hit on these headlines. As a believer of intra-sector rotation, I couldn’t help but notice a few names rallying as these names were sinking…

Total Eclipse of the Sun

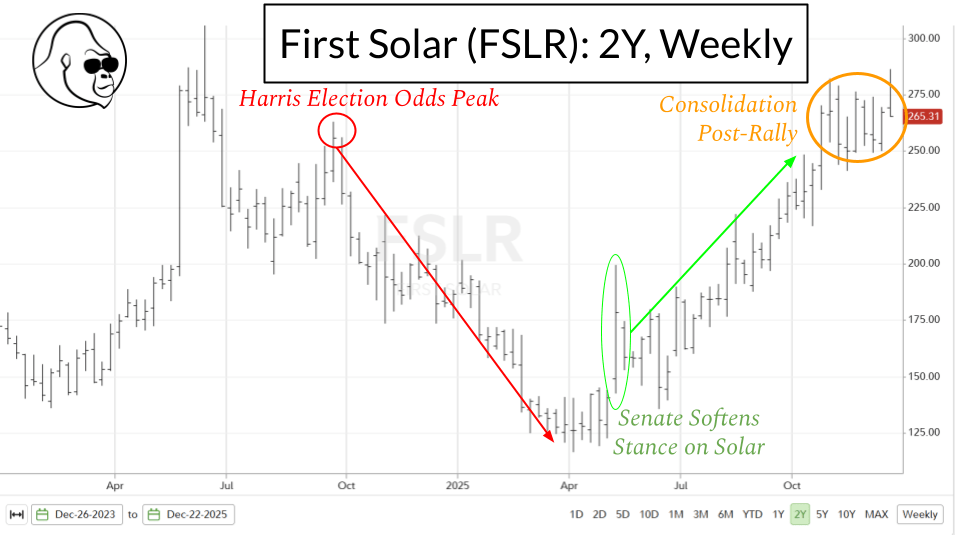

Solar, specifically utility-scale, appears to be the winner. While I’m not sure if this is as simple as a zero-sum exchange, utility-grade solar is clearly viewed as a beneficiary. This is a classic headwinds-to-tailwinds story that is best illustrated by a chart of the sector’s best-in-breed, Ohio’s own First Solar (FSLR)

When Harris lost in November, FSLR — and the rest of solar — was left for dead. The thesis was that Trump viewed solar, wind, and hydro as an inefficient sham/scam shoved down the country’s throat by Democrats that were more concerned with virtue-signaling than problem-solving.

Not my opinion. Simply a recollection of the rhetoric used.

Making matters worse, FSLR had optimized their supply chain to take advantage of geographic advantages without entering China. Basically, engaged in friend-shoring, setting up manufacturing capabilities in countries that were considered allies with the U.S. Unfortunately, that approach bit them as Trump rolled out a U.S. or nothing tariff policy.

From the top associated with the peak in Harris’ chances of electoral victory in September 2024, the stock was cut in half and finally bottomed with pretty much everything else in April 2025 during the tariff tantrum.

An Explosion of Energy

And… that is where the narrative started to shift. The first clear sign came in June as Senate Republicans negotiated an easier policy stance on solar in the Big Beautiful Bill. In its final version, it allowed for legacy tax credits to extend to existing utility-grade solar projects and those that begin construction by July 4, 2026. This was a massive overhang on solar: an imminent revocation of these tax credits — upon which the industry planned its expansion — without any period to adjust severely damaged the outlook for the group.

Now, with 6 gigawatts of renewable energy in jeopardy and a July 4th deadline, there is a rush to secure solar energy to fill that potential void. Alphabet (Google) reinforced this notion by announcing a $4.75 billion acquisition of Intersect Power (a major First Solar customer) on the same day as the DOI’s declaration of war, proving Big Tech is hedging its energy bets by diversifying into solar to power the AI revolution.

Is FSLR still a Buy?

One one hand, you can point to a confluence of narrative, valuation, and technical analysis saying buy.

- Narrative has shifted from “Trump hates solar” to “Solar is a relatively safe bet with a deadline to get it done”.

- FSLR is currently trading 13x NTM P/E; this is well below the 5Y and 10Y median of 17x and 19.2x, respectively.

- You saw the chart earlier: clear uptrend.

Between the expected growth rate, the discount to its historical valuation, and the potential for new projects to meet the tax-credit deadline and/or supplement the loss of wind energy, FSLR appears undervalued trading at 13x NTM P/E. The buy-thesis is that the valuation has room to recover.

On the other hand, there aren’t clear catalysts to force that valuation recovery.

There aren’t many bears left to convert to bulls and with 2026 EPS growth projected at 60%, I don’t see meaningful upside from strategist calls or analysts revisions. In fact, you can argue — and, I’ll disagree — that optimism has reached a point where this is actually a downside risk.

Barring an unforeseen development — such as another hyperscaler investing in solar as they have in nuclear — I believe FSLR is more likely to consolidate and pull back, as it is doing today (down 6-7%), than immediately rush to retest all-time highs north of $300.

Today, FSLR is easier to pitch as a trade than as a long-term entry point.

I am long FSLR. I rode it through the majority of that 50% drawdown, and in the $140–$170 range, I gritted my teeth and bought more. I did so because I believed in the management and refused to buy into the narrative that the administration viewed solar as a fraud. Today, I am not adding. I am not selling, either. Instead, I am writing calls at the $320 strike.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.