“The market will move in a way that makes fools out of the most people” – Socrates

This morning, we got Payrolls for November…

While there was nuance and government layoffs finally showed up in the data (for October). I don’t think it changes the narrative: hiring-firing stasis; monetary policy – aka Fed Policy as it pertains to interest rates – remains unchanged.

All that said, we have money flowing back into tech and out of everything else. Of course, one day doesn’t make a trend… but just as everyone started talking about the cyclical trade, you get a trading session that makes all of those talking points look foolish.

Let’s say you agree with me that the narrative hasn’t changed with this morning’s data dump. So, what do I attribute the reversal of the ABC – anything but chips – trade to? Oil.

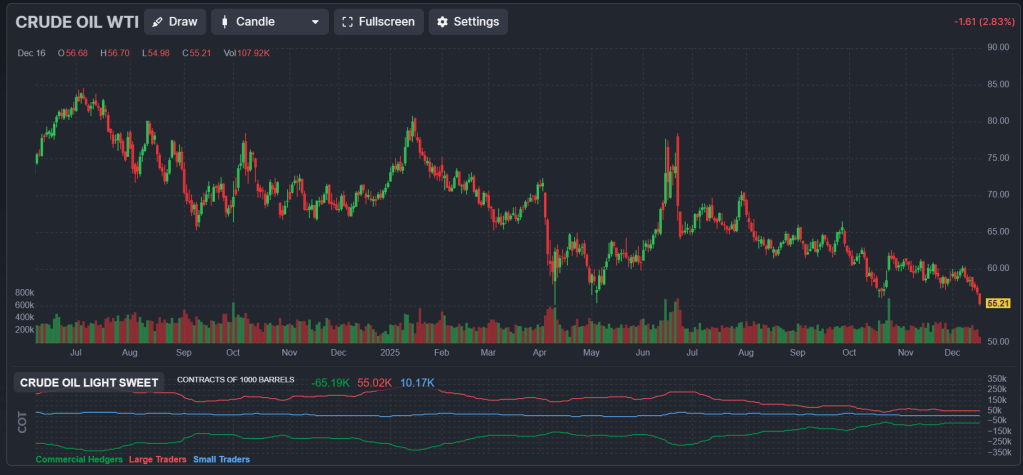

A new lower low in what has been an unrelenting downtrend since rebounding from April’s low.

Oil making cycle lows is not bullish for cyclicals. Typically, oil prices are associated with economic activity. You need oil to ship and fly goods around the world. Until that changes (both the reality and perception) – and maybe it does within my lifetime – weakness in oil to this degree implies expectations of less global economic activity. That said, it is worth noting that with respect to certain economic activity, it can be self-correcting:

Lower oil –> Lower gasoline –> More disposable income –> Tailwind to consumer spending

However, for now, the new low in oil is adding to uneasiness surrounding the economy and, by extension, the labor market, which I believe explains why the cyclical trade took a break today.

In my opinion…

… I think some relief in the AI-cohort, specifically Mag-7 names, is reassuring.

For a quarter (three months), momentum has been out of favor and quality has stepped-in. This rotation, which has materially improved market breadth, has kept the S&P 500 and Nasdaq afloat and allowed the RSP, Dow, and Russell 2000 to mint fresh all-time highs.

Eventually, I believe the investors come to the realization that the Mag-7 represents the utmost quality and take advantage of the recent declines:

- Nvidia is 15% off the $210 high.

- Microsoft is 11% off the $540 high.

- Amazon is 14% off the $260 high.

- Meta is 17% off the $795 high… notably this appears to have bottomed ~$590.

- Apple, Google, and Tesla are fine.

Perhaps, the Mag 7 begins reasserting itself today? Hard to make such an assertion with only one day’s trade, but certainly worth monitoring because it is the easiest path to S&P 7000 before the calendar turns.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.