We are all familiar with the Magnificent Seven (Mag 7).

These Mega-Cap stocks quickly emerged as the best positioned to benefit from the AI boom ignited by ChatGPT. Throughout the cohort’s hegemony, individual performance has been uneven. Apple, Alphabet, and Tesla were left for dead earlier this year at a time when Microsoft, Meta, and Nvidia seemed invincible. Today, Alphabet is king, while Microsoft and Meta face scrutiny.

This could be confirmation bias given my recent writing, but it looks like intra-sector rotation at a thematic level — the theme being AI. Let’s take Alphabet as an example:

You see the news surrounding TPUs and realize you don’t own enough Alphabet (GOOG). You’re fully invested. So, to buy more GOOG, you need to sell something else. Where can you source the capital without changing your portfolio allocation? The easiest sale comes from a portfolio winner in the same theme… Nvidia fits the bill.

You sell Nvidia to buy Alphabet: intra-Mag7 rotation.

While capital is finite, deployment strategies are limitless. But, the exercise of swapping names gets tiring. So, I asked myself:

What if I sidestepped this dance by owning all of them equally?

To answer my query, I created an equal-weight Mag 7 portfolio (dividends reinvested, no rebalancing) and measured it against the individual names and the S&P 500 starting November 2023, marking the moment ChatGPT captured the public’s imagination, and perhaps changed the trajectory of the economy, [seemingly] overnight.

You can find a full table with more metrics below.

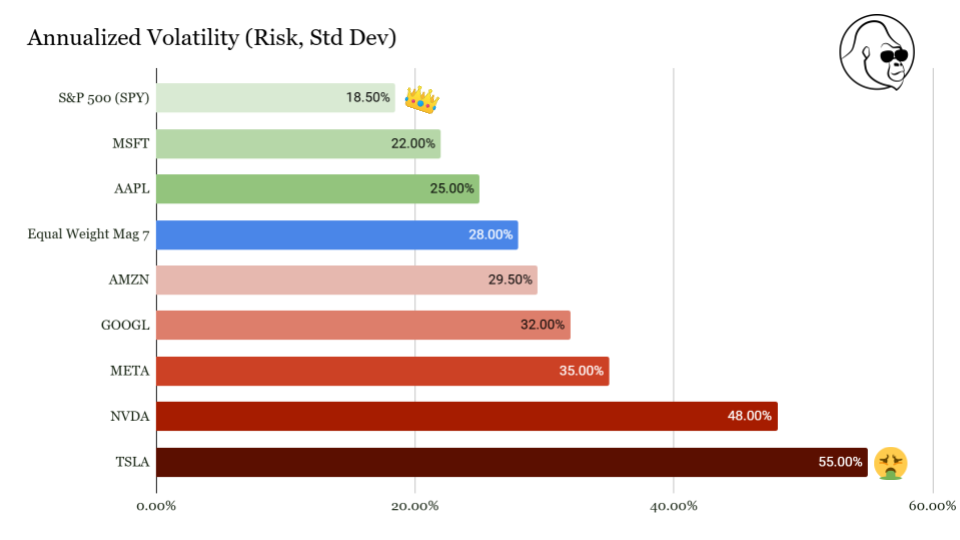

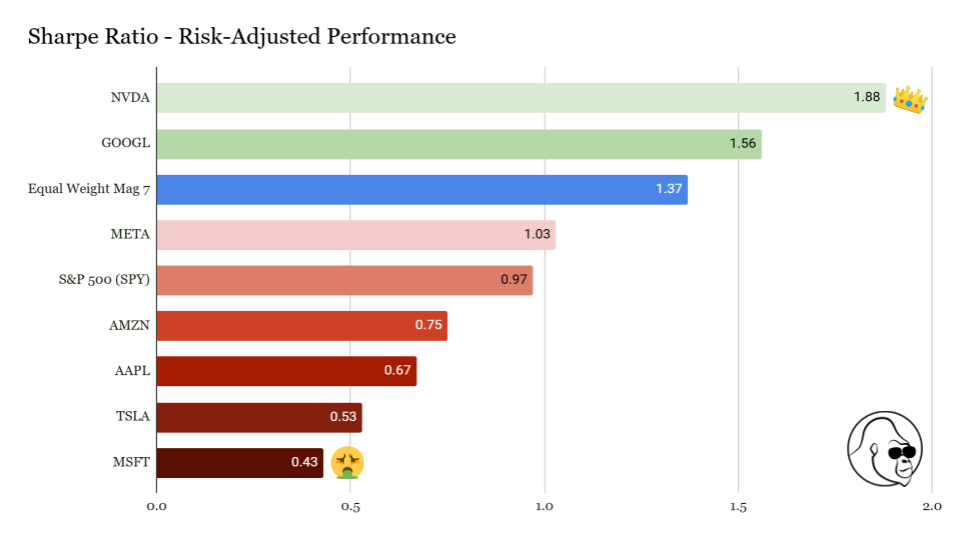

The numbers speak for themselves. In raw return, the equal-weight portfolio beat the S&P 500 and five of the seven constituents. There was more risk associated with those returns, as indicated by standard deviation and drawdown, but the excess return justified the risk as per the Sharpe Ratio. Only Nvidia and Alphabet – what a turnaround there this year – delivered a superior Sharpe over the 2-year period.

While past performance is not indicative of future results, it offers an important lesson about the past and the conversations we’re having in the present:

You were better served owning the group rather than trying to time the constituents as they went in and out of favor.

This analysis isn’t meant to be a prescription for your portfolio. It is meant to be a prescription for your peace of mind. The media wants you glued to the screen, stressing over Nvidia’s counter to Alphabet’s TPU-jab. But, the data suggests that the stress of picking winners was largely unnecessary… and perhaps costly. I don’t believe this TPU development will change that; in fact, I see the TPUs are creating a supply environment where more orders get made and fulfilled then less.

We often talk about ‘risk-adjusted returns’ in finance, but we rarely talk about ‘stress-adjusted returns’. This holiday season, take the win, reclaim your time, and allocate it to the people who actually matter. Don’t allocate it to something no one will remember – including yourself – a year from now.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.