Morning everyone! After the bell, my favorite stock and largest position, CrowdStrike (CRWD), will deliver their quarterly earnings report.

The post-earnings price action will be worth more the results.

Personally, I think we have been spoiled by earnings this quarter:

- Palantir (PLTR) with the best numbers in software… perhaps, ever.

- Nvidia (NVDA) with the best numbers of anyone, ever… perhaps in the history of stock.

Both got sold.

The market’s appetite for risk — for the best companies… not necessary stocks, but companies — hasn’t been the same since the negative price action following Palantir. Nvidia, unfortunately, didn’t manage to reignite interest either. Makes sense. If you can’t make money getting ahead of those quarters, where can you?

What does CrowdStrike (CRWD) mean for you?

I love the question.

Let’s assume Best-in-Breed (BIB) CRWD delivers BIB results and, crucially, is bought instead of sold. This outcome could break the cautious posture that has cramped the market since the Palantir (PLTR) event.

The process already appears to be underway. Recently, the market seems to be done aggressively rotating from “momentum” to “quality” (or whatever you want to call it). The market’s character feels less aligned with firm risk-off and more aligned with risk-in-certain-spots.

Concisely, positive price action following CRWD’s report could change my perceived yellow light on risk appetite to a green light. If a high-multiple name delivers high-multiple results and gets rewarded for it, that could materially change the market’s posture, which, in my opinion, has already started to shift from “risk-off” to “risk-maybe.”

Why CRWD may get different treatment…

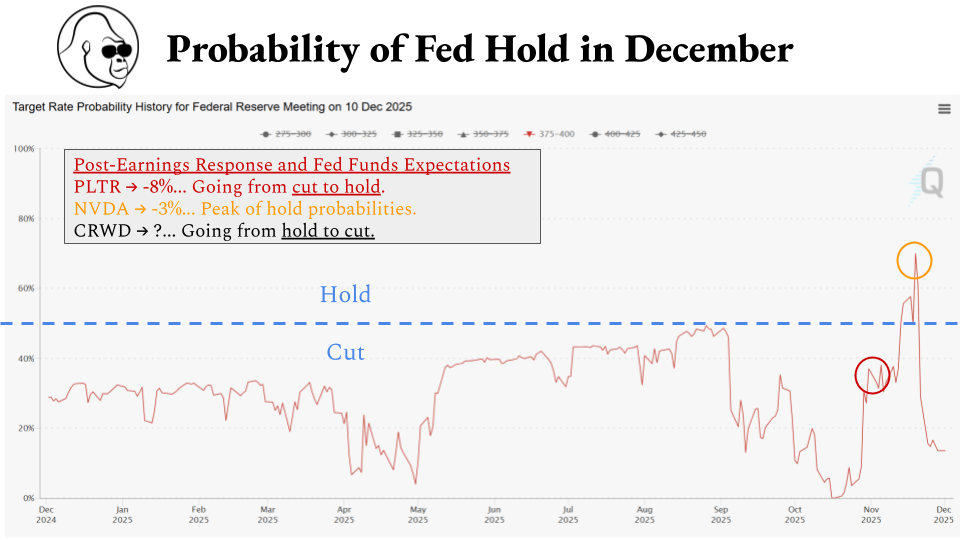

My answer may annoy you… in fact, it annoys me… but look at the position of Fed-Funds Futures. When NVDA and PLTR reported, the market was forecasting a hawkish Fed.

- Palantir reported when our expectations where shifting from dovish to hawkish and was battered 8%.

- Nvidia reported at — what now appears to have been — peak hawkishness and was only battered 3%.

- CrowdStrike is about to report right as our expectation have shifted from hawkish to dovish.

Concisely, the market’s stance on Fed policy has reversed since PLTR. Perhaps, the market is now more willing to buy into these stories again… as long as the stories remain as good as we believed them to be earlier in the year. It’s annoying because I don’t think this should matter for these companies over any time period, but from a tactical perspective, it cannot be denied that risk appetite and Fed dovishness are, at times, directly correlated.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.