Happy Thanksgiving! Hope you all enjoyed the holiday with great food and even greater company. With the half day of business on 11th Street before December, I want to share a few opportunities emerging — in part due to the TPU-GPU/GOOG-NVDA drama — and provide a little insight into the mechanics at play.

For a more in-depth discussion, check out EP23 of Charts and Checks.

Rotation is the lifeblood of a bull market — Aristotle

We often view rotation through the lens of sectors, factors, or themes:

- Sell financials to buy staples.

- Sell momentum to buy quality.

- And, most recently, sell AI to buy anything else (ABC — anything but chips).

I’m a believer that rotation is a sign of a healthy, non-complacent market. I view it as the process of taking profits and reallocating them to other opportunities with a better risk-reward. Despite the red you may see on your screen as they occur, rotation is a sign that investors are exercising diligence, not giving up on the asset class.

The most recent rotation, which has given birth to the ABC trade, has created a handful of opportunities ex-tech. However, today I want to pull your attention to a different phenomenon: intra-sector rotation. It is responsible for a delicious Black Friday deal. Get your shopping list ready.

A Different Kind of Rotation

Intra-sector rotation occurs when capital within a certain sector, factor, or theme moves within the same sector, factor, or theme. From here on out, let’s call a “sector, factor, or theme” an area. The theory is that money in a certain area stays in a certain area.

Here’s how I understand it: If you run a fund or a portfolio, you are responsible for deciding how to allocate capital across sectors, factors, and themes. If a new opportunity emerges in a certain area and nothing else changes, the easiest way to fund a shift toward that opportunity is to sell something from that same area.

For example, let’s say you run a commodities fund or are managing the part of your portfolio allocated to commodities. You see that gold and silver are going on an absolute tear. You want more exposure there. Where should you fund it? You don’t feel any differently about the other areas in your portfolio, but you notice oil has underperformed. Sell oil; buy gold; from a 10,000ft view, the portfolio looks about the same; problem solved.

Intra-Semiconductors Rotation: GPU v TPU

It is what we’re seeing right now between NVDA and AVGO, which is benefiting the likes of GOOG and META.

The market appears to have fallen in love with the TPU (Tensor Processing Unit) story. Concisely, a TPU is a GPU (Graphics Processing Unit) that has been optimized for AI workloads. As a result, a TPU doesn’t have the same versatility as a GPU — which is also suitable for a number of other activities: graphic design, gaming, crypto mining, etc. — but a TPU’s optimized architecture creates the following advantages with respect to inference:

- Energy efficiency: favorable performance-per-watt

- Scalability: design allows for the creation of “pods” containing thousands of interconnected chips capable of communicating amongst each other

- Flexibility and freedom: you are no longer locked into Nvidia’s architecture

These advantages increase the probability GOOG and META do not spend as much on Nvidia chips or broad capex as previously stated. A real competitor to GPUs, for the first time since this spending spree started, means there may finally be some leverage for the hyperscalers in negotiating prices with NVDA.

Put yourself in the shoes of a fund manager. Suddenly, you need exposure to TPUs. But where do you pull it from? The most obvious place is the location where they may take market share: GPUs.

With this perspective, I think you might agree with my assertion that this price action is normal behavior and isn’t an indication that the GPU story is dead. Nvidia just guided $65–66B for next quarter. The idea that, overnight, TPUs toppled GPUs is fanciful, to put it diplomatically. As such, I view the following decline in Nvidia as the Black Friday sale. It is trading at 25–26x 1-year forward earnings and is expected to grow EPS by 56%. That is a bargain.

I can already hear the bears saying… How can you still believe NVDA’s estimates given the advent of TPUs?

Easy. We’re still so early that the demand for Nvidia GPUs is such that any shortfall attributable to TPUs will be quickly absorbed by buyers — particularly sovereign buyers. Over the next few years, I foresee TPUs helping semiconductor suppliers meet demand, meaning more orders get made and fulfilled across the semiconductor food chain, not less.

Intra-Consumer Staples Rotation: WMT and COST

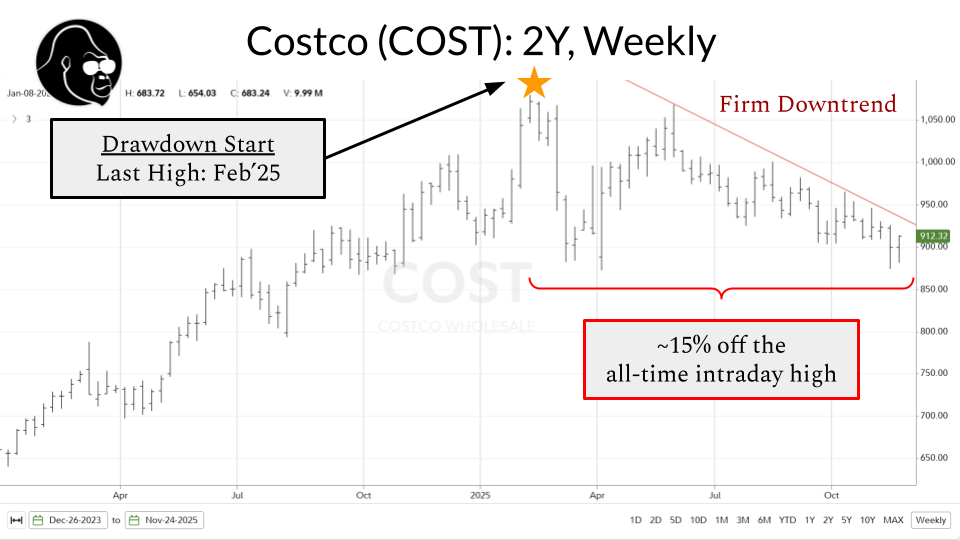

Once the unquestioned best-in-breed staples name, Costco (COST) has been in a steady six-month drawdown.

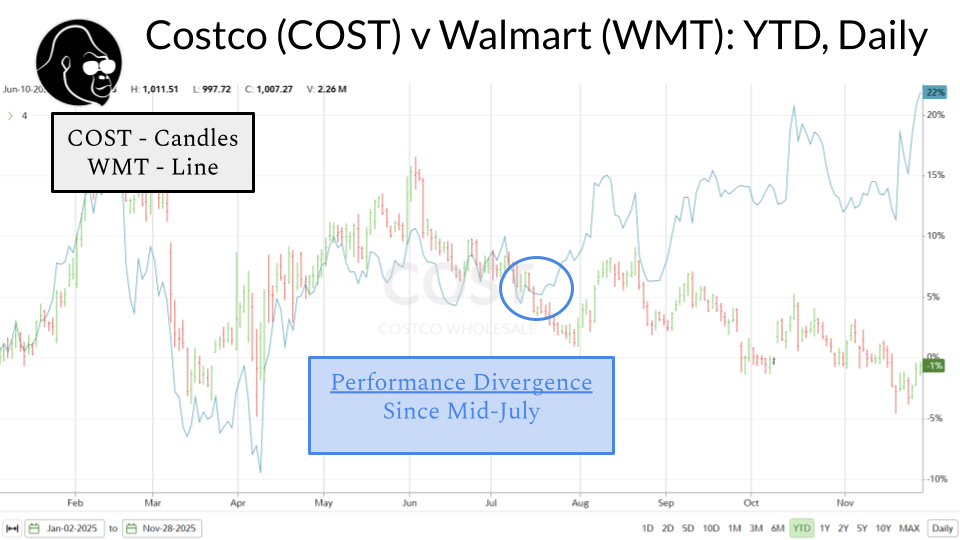

Walmart (WMT), on the other hand, appears to have finally convinced the Street to give the company credit for all the work it has done in creating a true competitor to Amazon through its mobile app and online platform. The Walmart app is legit. Without getting lost in the weeds, I think they’ve accomplished what Amazon wanted to do when they acquired Whole Foods: a true hybrid shopping experience.

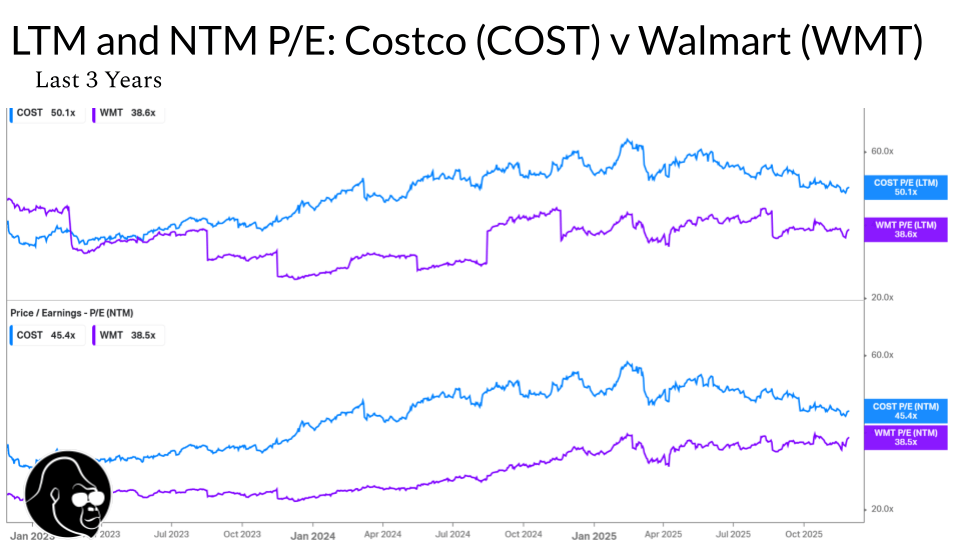

Costco has been slow to adapt. Their app leaves much to be desired, and they don’t seem to be in much of a rush to invest in the technology required to catch up. Although I am still of the opinion it is too early to assert Costco will be left behind, I am comfortable asserting the market is re-rating Walmart as the consumer-staple BIB (best-in-breed) at the expense of Costco.

Infamously, Costco sustained a mid-50s multiple on trailing and forward earnings. I don’t see why WMT can’t get there. If WMT did, given WMT EPS for 2027 is projected at $2.97, the stock would trade at $148.50 implying a 35% return from today’s price of ~$110.

The technical chart looks amazing as well. I think if you break $110, momentum takes it higher. While WMT is less of a bargain and more of a “buy high, sell higher” approach, the intra-sector rotation in consumer staples is creating a nice momentum opportunity in Walmart. That said, if you believe — like I do — that WMT could be destined for 45–50x earnings… then WMT is, in fact, a bargain.

What To Do With Costco (COST)

I am long Costco (and Walmart); still like Costco. Right now, the stock is testing the 100W SMA. This is the last chance bulls have to step in before this slow 15% drawdown from the highs has a chance to snowball into something worse. So long as COST maintains this 100W SMA, I’m happy to hold on and will be looking for short-term indications as to when it may be appropriate to add to the name. That said, I see a lot of downtrend lines for bulls to recapture first before I get interested. I don’t feel any urgency here.

That said, given the divergence we’ve seen over the past quarter, I believe that if WMT breaks out, it’ll be funded — at least in part — by further sales in COST: intra-sector rotation. While I hold both, if I see the breakdown in COST accelerate as the breakout in WMT accelerates, I’ll sell some COST to pad the position in WMT.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.