9:25 on 11/10/25 – Waiting Out The Valuation Ceiling

Media Dump

Gorilla on YT –> GO SUBSCRIBE

CEO Sam Altman Snafu (Via X.com, 1.40 length)

CFO Sarah Friar WSJ Business Summit (2.09 duration)

CNBC Interview with Brad Gerstner Clarifying Both Issues

Chart Deck

T5D Performance

| S&P 500 | -2.04% | |

| Equal Weight S&P 500 (RSP) | -0.22% | |

| NASDAQ | -3.93% | |

| DOW | -1.17% | |

| Russell 2000 | -1.27% |

Talk of the Tape

Without a resolution to the government shutdown, concerns surrounding the consumer – and, thus concerns surrounding valuations – continued to mount. As a result, equities had a risk-off week with only a handful of select names and sectors avoiding the deluge.

Week Ahead

Monday

- Rigetti (RGTI)

- Coreweave (CRWV)

Tuesday

- Veteran’s Day: Bond Market Closed

Wednesday

- Circle (CRCL)

- Cisco (CSCO)

Thursday

- *CPI

- Applied Materials (AMAT)

Friday

- *PPI

- *Retail Sales

* Subject to delay due to the government shutdown.

Script

I am trying a new editing suite. Unfortunately, there transcription software isn’t as accurate as the other. In lieu of a full transcript, below is a script made from the outline I reference during recording.

Intro

Good morning everyone; it is 925 for the week of November 10th, 2025. I am your host, Don Foiani. First and foremost, Tuesday is Veteran’s Day. I want to take a moment to thank our service men and women.

This week, I am going to spend some time talking about the return of valuation concerns, put some upcoming quarters on your radar, and then close with some names with the most to gain from a reopening of the government.

5 minutes to the open on Wall Street, we’ll begin with what the return of the valuation ceiling means for stocks.

Valuation Ceiling

How It Appeared

It started with Palantir. They reported the best quarter since Nvidia’s AI moment, but the stock fell 7-9% anyway. In my opinion, this event was the market, in real-time, discovering a valuation too rich to justify.

Then, there was some weirdness with the CEO and CFO of OpenAI. The implications of their behavior exaggerated concerns about some of the dynamics that exist in the AI-cohort, which I’ll touch on shortly.

Finally, the government shutdown became the longest in history. It reminded investors how long we’ve gone without a complete view on the economy without the BLS and marked a full month without 1.4 government employees getting a paycheck, which creates legit earnings concerns for certain companies.

You step back, S&P is trading between 22-24x FWD… which means the narrative needs to be bulletproof and between those three items… it wasn’t. In my opinion, it was this trifecta of headwinds hitting around the same time that was finally enough for investors to reassess.

What It Means

This Isn’t A Bubble: We’re witnessing the leadership of the theme accused of creating a bubble get slammed. Nvidia shed 10% this week without any stock-specific news. If we were in a bubble, you’d see names in the leadership go up 10% on a no-news week, not down.

The Bull Market is Alive and Well: there has been a clear rotation of money flowing into defensive areas with limited consumer exposure and to areas with lower valuation. These areas provide some protection from consumer headwinds attached to the shutdown and overall valuation concerns. The only names with high valuations that have held up are those whose high valuation is attached to consistency as opposed to the growth – AAPL, COST, WMT – all trading above 30x FWD. I made 50% trading options on ISRG – a medical devices company – this week.

The point is that there are still companies working – and ways to make money – despite the weakness in the leadership group. Investors aren’t giving up on stocks. If that were the case, money would be outright leaving the stock market and the only way to make money would be to buy puts or go short.

How The Ceiling Breaks

We need a catalyst. While I suspect an end to the government shutdown will meaningfully diminish the hyperfixation on valuations, I am not sure it would be enough to completely break the ceiling.

As I alluded to earlier, the shutdown isn’t the only damp towel cooling the market right now. Concerns surrounding valuations and the PR hiccups at OpenAI won’t be resolved by the government reopening.

For those that aren’t up to speed, let me quickly outline those worries:

- Circular Financing: All these deals where those in the AI ecosystem make financial commitments with each other is analogous to the 2000s bubble. While I view this as a false comparison, there are clear surface-level similarities.

- Lack of Transparency: OpenAI is the most important piece on the board but isn’t completely visible.

By partnering with everyone, they’ve made themselves too integral to fail. That isn’t an issue on its own. In fact, it is really smart business. It becomes an issue when the c-suite starts acting funny, and there is no way to check on how the company is doing.

Specifically, there was an odd altercation between the CEO, Sam Altman, who got really defensive to legitimate questions from Brad Gernisers. Then, during a WSJ summit,the CFO, Sarah Friar, appeared to imply OpenAI was looking for a government backstop to data centers loans.

There isn’t enough time to go through each in detail. I’ll leave links to each on my website if you’re curious to see it for yourself, but here is my take: while it is probably nothing, you probably shouldn’t ignore it.

Due to the lack of transparency surrounding OpenAI’s financials, this erratic behavior leads to, in my opinion, fair speculation that something might be wrong at OpenAI and the stress is getting to the c-suite. This matters because if that is the case, then every analyst who has increased numbers in public companies that have deals with OpenAI need to revisit those estimates.

This doesn’t mean anything is wrong in the long-term in the theme, but it creates a scenario where earnings estimates have gotten ahead of themselves, which creates the setup for a bona-fide correction.

Bring it full circle: while I expect the government reopening to be a meaningful tailwind, it won’t address this particular pain point. I’m not sure if anything but time and continued execution will.

Earnings

Speaking of execution, a number of names integral and adjacent to the AI story deliver their report card on corporate execution for the quarter.

Appetite for Risk

Monday, we get quantum champion, Regitti (RGTI, and data center kingpin, Coreweave (CRWV). Tuesday, we get what’s good from another data center hitmaker, Nebius (NBIS). Both of which have huge deals with Microsoft. Tuesday, Oklo – a pre-revenue nuclear energy play – sounds off. The creator of stablecoin USDC, Circle prints on Wednesday.

All of these names are similar in that they are in the leadership theme, trade at high multiples, and are somewhat speculative in nature.

While the context of their reports matter, I’m more interested in how the market trades them. It’ll give us an update on investor appetite for risk and how strong the valuation ceiling remains assuming we wake up Monday under the impression an end to the government shutdown is imminent.

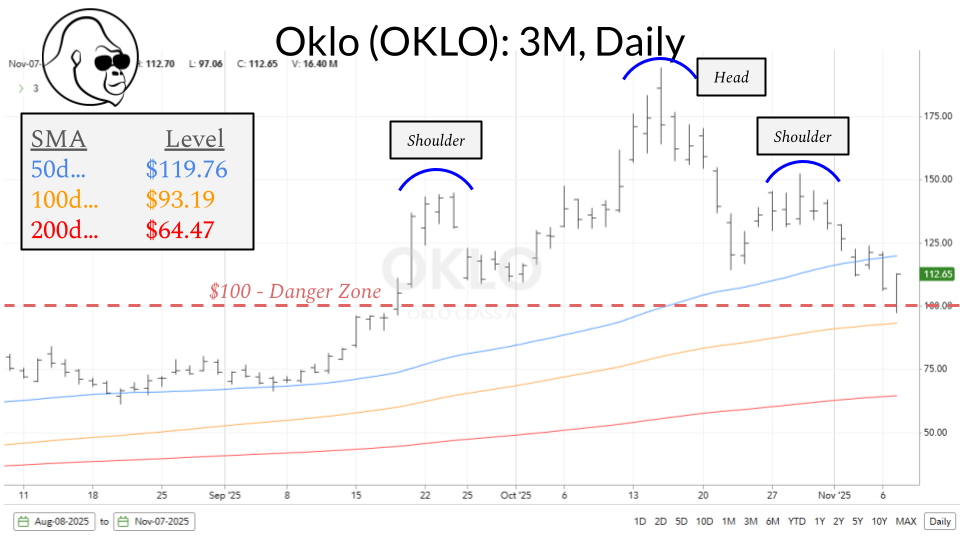

Before moving on, I think it is worth pointing out the head-and-shoulders pattern underway in OKLO. If it doesn’t hold $100, next level of support is the 100d SMA at 91.7. Honestly, this creates a nice bearish-put spread opportunity between current market price and that ascending 100d SMA. If I end up doing it, I’ll write a little post about it so those unfamiliar with that option strategy can see it in real time.

Applied Materials (AMAT)

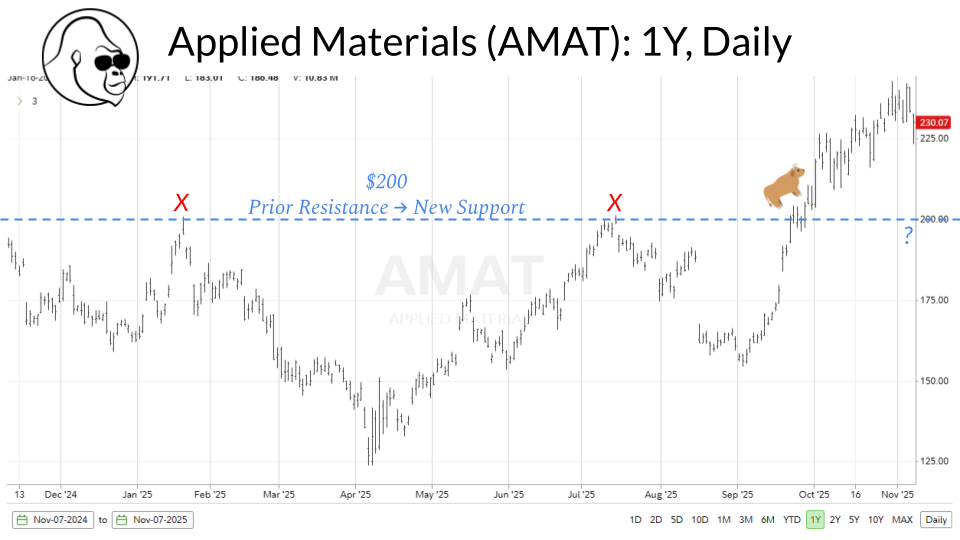

Applied Materials is a vendor of semiconductor manufacturing equipment. In the past, their business with Intel has been a headwind, but now that INTC appears part of a legit turnaround… maybe this headwind subsides or, even better, becomes a tailwind. I am not long here either, but the levels to watch are resistance at the ATH, about $13 above Friday’s close, and support at $200 where it made a prior high in July.

Cisco (CSCO)

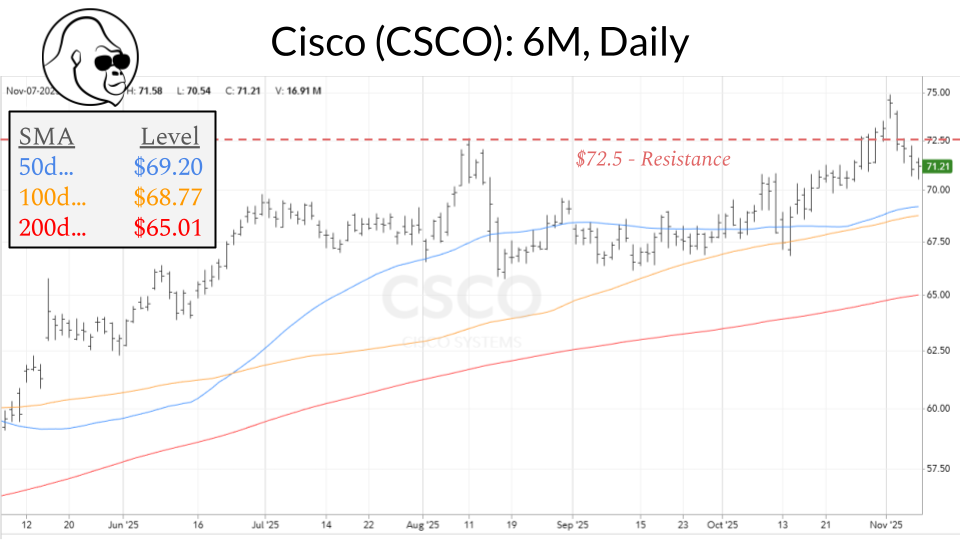

Cisco actually minted a new 52W high last week, but couldn’t hold it into the weekend. I am long this name because I believe – similar to IBM – it is a legacy tech name that has properly reinvented and repositioned itself to take advantage of AI-opportunities. IBM’s primary angle is software and consulting; Cisco’s is networking infrastructure, scaling, and security.

CSCO’s chart is fine, still above major moving averages with positive slopes. That said, it trades around 17.4x FWD earnings but 27.9x trailing, which implies a pretty meaningful pick up in earnings over the next 12 months is expected… so, CSCO needs to show progress there.

Government Reopening Plays

Speaking of progress, in the later half of the week, election victories for the Democrats created a notion that a resolution was more likely now that there were clear negative electoral consequences for the stand-off.

It is also worth noting that the market didn’t give up the Friday pop. I view this as an implicit endorsement of the idea that Friday’s offer from Democrats is going to be the start of successful negotiations as opposed to an open-and-closed offer-rejection.

Between these two new developments, I feel it is a good time to start looking for a way to play the reopening if the prospect interests you. I’ll be honest, I think the entire market gets a little relief rally on the backs of this catalyst. Therefore, you don’t really need to put on new positions to benefit. But, I find this stuff interesting and see opportunities; so, here we are:

First, let’s talk consumer names: 1.4 million government workers have gone without pay for well over a month now. That isn’t good for the local companies that serve those employees: less leisure spending and more conscientious shopping/grocery trips. Furthermore, due to air traffic control staffing shortages, there is less travel. Less tourism and business travel means less business for the companies that ordinarily serve those travelers.

SHAK & TOAST

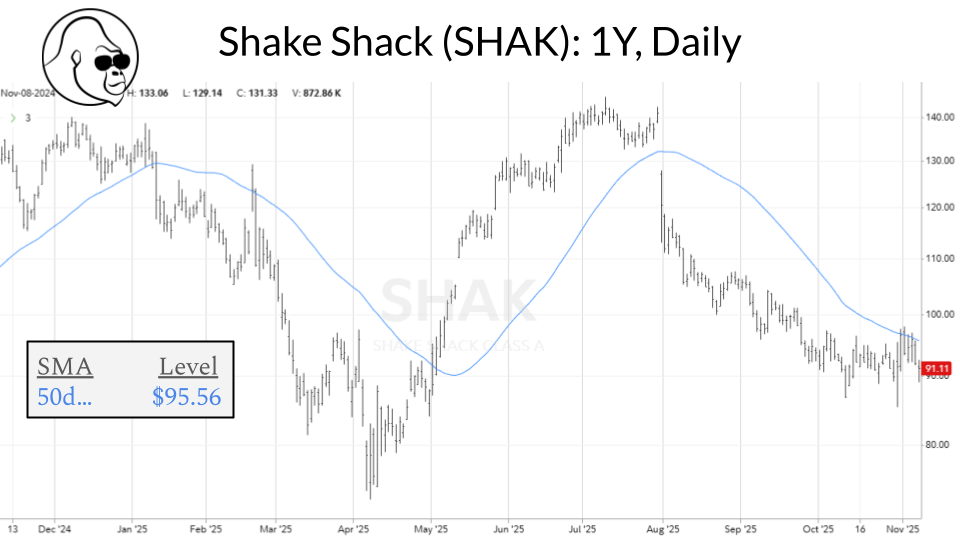

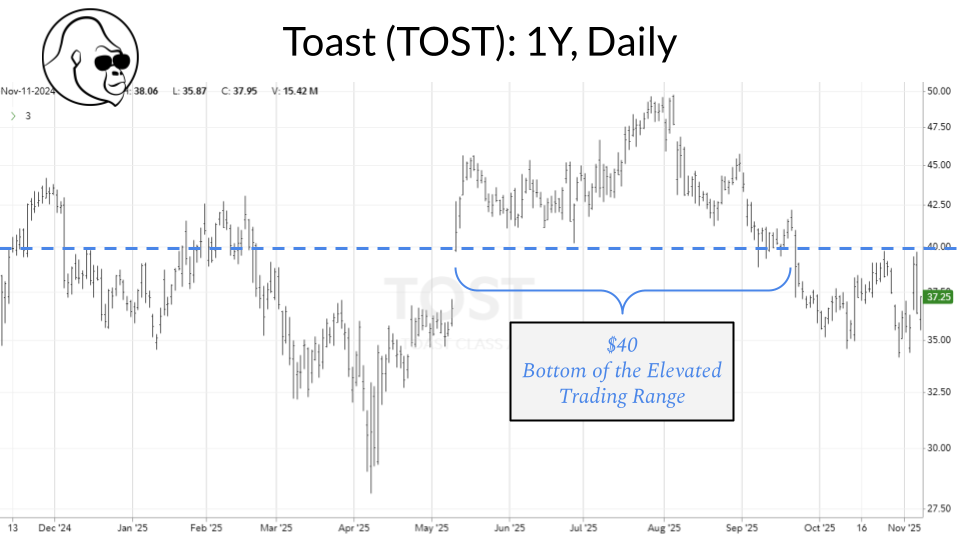

Of all of the names, I like Shake Shack (SHAK) and Toast (TOST). Both charts leave a lot to be desired. As for buy signals, SHAK above the 50d SMA would give me comfort that a durable base is forming. TOST above $40 would signal buyers have reclaimed the name. I am in both of these names. If you are interested, do your homework and size it appropriately. These are emerging growth companies. Volatility is a feature not a bug.

Airlines: Specifically American (AAL)

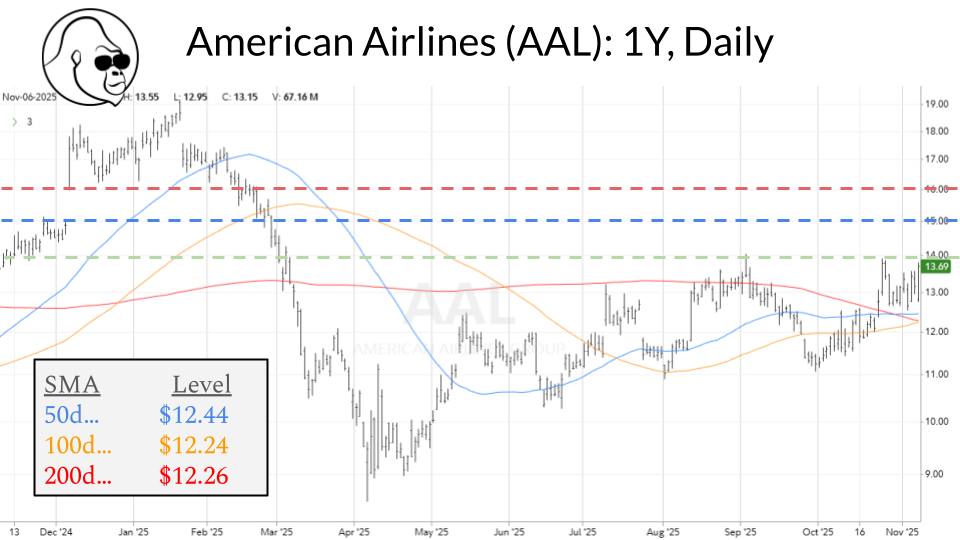

Second is the airlines. Air traffic control shortage limits the number of potential flights which translates to less revenue for airlines. After a little thought, I bought American Airlines (AAL) last week because I like the chart the most.

The thesis is that once the government reopens, AAl gets above $14, permitting a revisit to resistance at $15 and $16. That is where I would look to take profits.

I will say that if you don’t like this particular airline but like the idea, DAL is the BIB (best-in-breed), Southwest (LUV) should be the biggest movers given their concentration on domestic routes, and there is nothing wrong with simply buying the JETS ETF which has 40% exposure spread between AAL, LUV, DAL, and UAL.

Last word on this: this is a trade. I view the space as a trading vehicle. I won’t be getting married to any of these stocks. We’re going on a date. I hope it is a good one, but either way the date will end.

Outro

Thank you so much for stopping by. Appreciate you spending a little extra time with me this morning. Hope you learned something and left with a new name or two for your watchlist. Good luck on the markets out there. I’ll be here next week, hope to see you again. Goodbye.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.