9:25 on 11/03/25 – Quarter-Baked Jobs Week

Media Dump

Gorilla on YT –> GO SUBSCRIBE

Chart Deck

T5D Performance

| S&P 500 | -0.13% | |

| Equal Weight S&P 500 (RSP) | -2.25% | |

| NASDAQ | 0.88% | |

| DOW | 0.19% | |

| Russell 2000 | -2.12% |

Talk of the Tape

Although Powell and the Fed threw cold water on the rate-cut fire, the incredible results from mega-cap earnings won the week. As a result, breadth narrowed as money rotated from rate-cut winners to areas with less cyclicality.

Week Ahead

Monday

- Palantir (PLTR)

Tuesday

- Uber (UBER)

- Spotify (SPOT)

- AMD (AMD)

Wednesday

- ADP Employment

- Robinhood (HOOD)

- IonQ (IONQ)

Thursday

- Vistra (VST)

- D Wave (QBTS)

Friday

- Constellation Energy (CEG)

Intro

Good morning everyone. It’s 925 for the week of November 3rd, 2025. I am your host, Don Foiani, I hope that all of you had a fantastic Halloween weekend. Last week, between the mega-cap earnings, the October FOMC, and all of the additional stock-specific headlines, there was really too much going on. I don’t have time to rehash it all this morning, so if you’re curious for my opinion on the MegaCaps, go check out episode 18 of Charts and Checks. My opinion hasn’t changed in the five days since it was recorded.

In this edition, I’m going to talk about how the October FOMC and the mega-cap earnings have positioned the market going into year end, cover some popular names reporting this week and preview the one piece of labor data that we’re guaranteed to receive on time.

Five minutes to the open on Wall Street, will start with how I see the combination of the October FOMC and the mega cap earnings shaping markets into year end.

October FOMC Recap

So to sum it up briefly, The FOMC meeting was more hawkish than what the market was positioned for. Going into that meeting, the consensus was that the Fed would continue to go down this path of cutting 25 bps in December – and maybe one or two more even in early 2026 – even in the event that this BLS data wasn’t going to be available.

This consensus view was quickly disrupted as Powell came up to the podium and said, “a further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it. Policy is not a preset course…”

Powell, if I remember correctly, later made an analogy about when you’re driving through fog, you tend to slow your course as opposed to speed up or maintain it. The fog in this case is being created by the incomplete view that the Fed has on the economy due to the government shutdown making BLS data unavailable.

In my opinion, Powell didn’t really rule out a rate cut or say anything revelatory. He simply reasserted that the Fed is data dependent. And in a world where… I can’t believe I’m saying this… that data is scarce, it would be unwise to simply assume that policy is on a set course. That said, it doesn’t change the fact that his words were a departure from what was being priced in. So, the markets moved as investors were forced to reposition.

Return of Defensive Tech

After the conference, I suspected that his hawkish display would be enough to snuff out whatever spark a better than expected CPI print left for the momentum names to regain their footing, at least in the short term.

Then, the mega caps reported and reminded us again why they were anointed in the first place: their growth is not attached to the economy or the labor market or anything they execute alongside or despite what’s going on around them.

I know the price reactions varied from mega-cap to mega-cap, but I don’t think any argument can be made that any of the reports were anything less than impressive. As such, investors now face the following scenario:

Fed cuts are less likely and the vision on the economy is still impaired.

Given that set of circumstances, where is the most compelling place to allocate incremental capital?

I would suggest it is in the names that definitely don’t need a rate cut, won’t surprise you with an inflation-related miss, and are not tethered to the labor market. It’s the tech staples, defensive tech: Netflix, Apple, Amazon, Google, Meta, Microsoft… the obvious names. Some of these names received a bullish embrace post-earning… just look at Google, look at Amazon. But others did not. especially Meta. You could argue Microsoft: down-to-flat…

From a longer term perspective, it is time to start looking at those in the latter camp – the camp that maybe got smashed or dismissed – and be ready to step in once the bleeding stops. Meta is now the cheapest of the Mag-7, again trading at 21 or 22 times forward. I can’t remember a time where it wasn’t a good idea looking back a year to invest at Meta at that valuation.

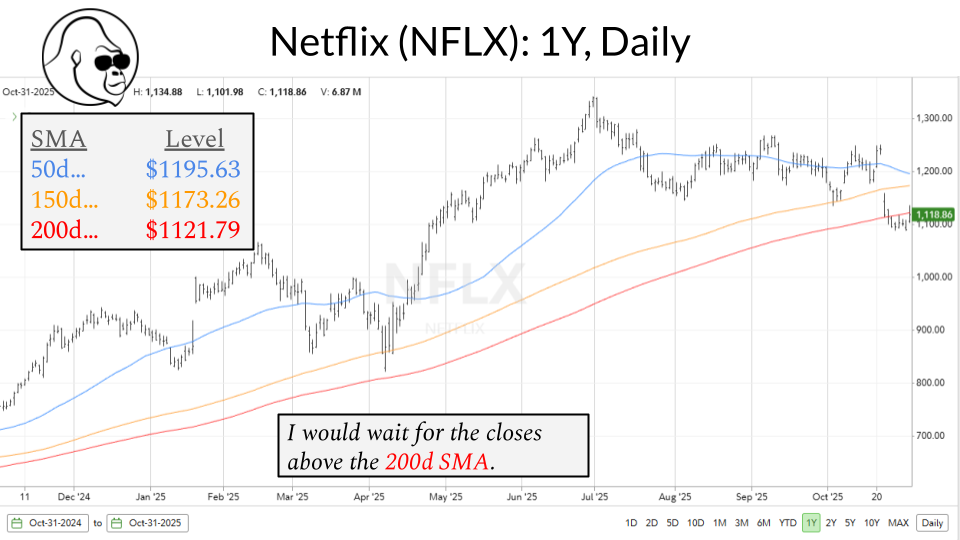

Personally, I’m actually most excited for the news we got from Netflix. The 10 for one stock split could meaningfully reignite interest in the name. As we can see here on the charts battling a couple of major moving averages, I would let people know when I get in, but if we can get past the 200 day – which is where it’s battling now – the next stop is 150d. If you get past that, the only resistance to revisiting the all-time high is 50 day.

Palantir, AMD, Robinhood

Since we’re talking stocks, let’s stay there with this week’s docket of reports. I’m going to start with a group of Palantir, AMD, and Robinhood. I put them together because these names have defended their upside performance incredibly well, and because I view both as attracting starkly different groups of capital. On one hand, you have the cult-degenerate money, and on the other hand, you have the emerging growth managers. It’s weird how sometimes these groups of investors and their capital sometimes swim in the same pond.

Palantir, of course, has a commercial and government business. While the government shutdown could create a potential landmine for that side of the business, I don’t think it’ll matter. Karp is an extremely talented and skilled CEO. And even if there is some sort of slowdown there, I expect the commercial business to steal the show. We just heard from the mega caps: year on year, Azure showing 39% growth, Google Cloud 34% growth, AWS – the biggest of all of them – +20% growth.

Business activity in the cloud and AI realm is material. I expect Palantir to benefit from all that activity in a big way, especially when you consider that Palantir’s commercial business has a much smaller base relative to the aforementioned mega caps.

Let’s move on to AMD. It’s not a name I frequent, but the news flow shows why the stock is where it is:

- You had that $1 billion AI supercomputer with the Department of Energy.

- A 6 gigawatt deal with OpenAI.

- News out of IBM that they can run their quantum computing error correction on AMD chips.

You get the idea. Some of these are clearly material developments as far as a P&L is concerned. I just have no idea as to what degree and if it’ll be enough to justify where the stock is. It’s been on an absolute tear.

Now, I’m going to move on to Robinhood. The stock matched Coinbase’s 6% post earnings rally on Friday. Coinbase’s report was highlighted by transactional revenue. The read through there is pretty obvious to Robinhood. While you can make the argument that the bar is higher for Robinhood than COIN – given where the prices are at time of reporting – I think you should expect a smooth quarter from Robinhood given what we heard out of Coinbase.

I am long the stock. I’m holding my house money position. I would consider re-upping into Robinhood if the market gave me a juicy enough opportunity.

Uber and Spotify

Now we’re going to pivot to a few of my favorite names that are reporting this week. These names are in the 100 billion to 200 billion dollar market cap category. I believe we can get to half a trillion or maybe even a trillion within the next five to 10 years. Uber and Spotify, I’m long both of these names.

I have a few positive notes on Uber to share:

Recently, some old news surrounding an autonomous driving partnership with NVIDIA resurfaced, and it appears as though a lot of people weren’t privy to that partnership prior.

Beyond that, despite recent efforts at Lyft, I still don’t really view them as a viable challenger to the rideshare business. I see this Nashville partnership with Waymo as savvy positioning by Alphabet. Alphabet needs leverage in future negotiations surrounding a similar partnership to do logistics with Uber.

If you’re Alphabet, you need to have some leverage: you need to be able to tell Uber, “Well, we have competitors that can do it at this price. I need you to lower your asking price.” So, I think it’s just savvy positioning. I don’t think that Lyft is going to be able to reinvent themselves or that it would be wise to expect more of these Lyft-Waymo partnerships, especially at the expense of Uber. Lyft simply doesn’t have the scope that Waymo needs across important markets.

The only other bear case I can think about is that maybe Uber Eats takes a hit given what we hear about the lower side of the K, referring to the K-shaped economy. But with Uber One, which is their subscription tier, I need to remind myself that there are a lot of people locked into that platform and use it in a way that I don’t and never did and probably never will.

I’m not doing anything ahead of the quarter with my Uber. As far as the technicals watch the $100 level, I have no idea who keeps selling it there, but once the bulls take it out (or whoever is selling shares there runs out of shares to sell), the rally resumes in a meaningful, quick, rapid way. It’s going to be a face ripper. For those looking to get in, assuming this is a business as usual quarter – or BAU is what I sometimes say – see what happens at the 50 day or the 100 day simple moving averages. Buyers have stepped in there consistently, especially coming out of the April tariff tantrum lows.

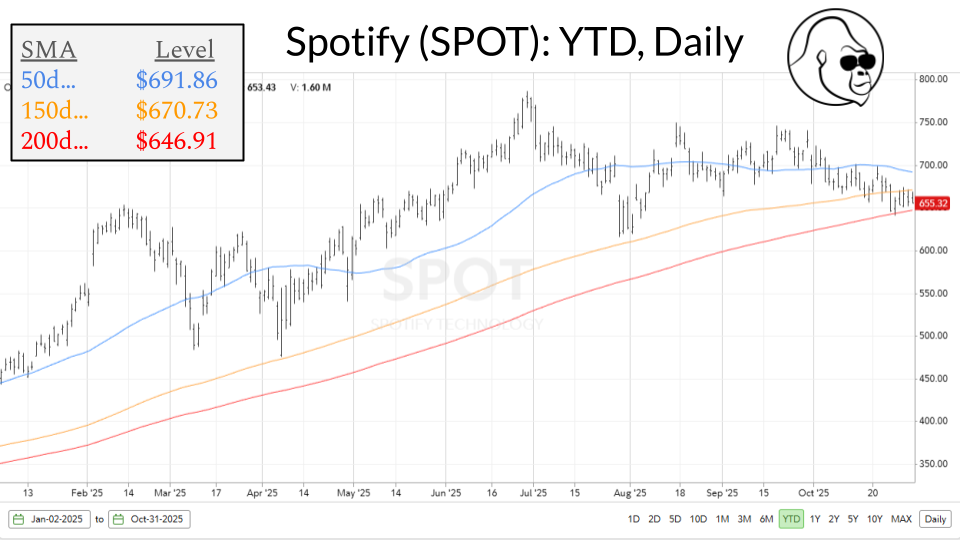

Now let’s take a minute to talk about Spotify (SPOT). While their last quarter wasn’t well received, I viewed the underlying metrics surrounding engagement and usage, specifically monthly average users, MAUs, as indicating that the fundamental story was still intact.

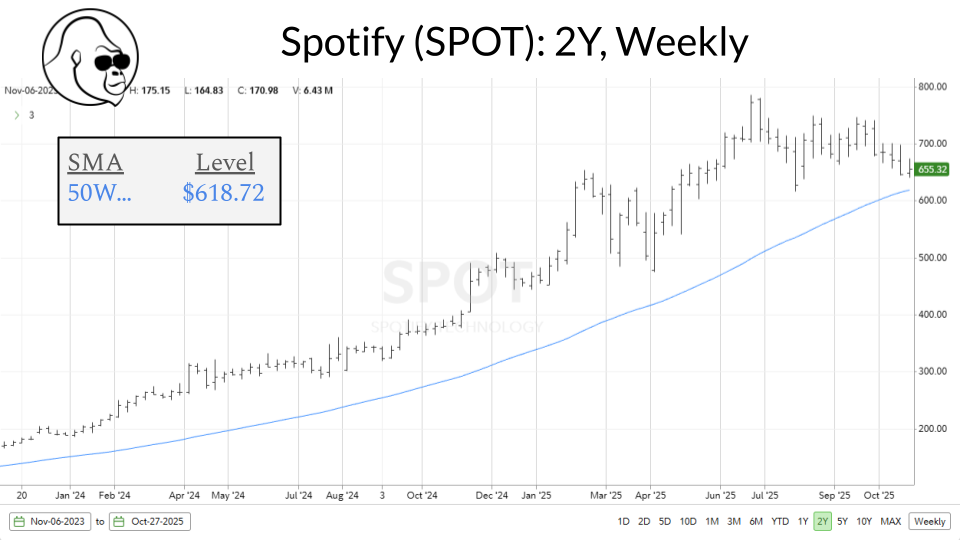

Right now it is sandwiched between the 150 day and the 200 day simple moving averages. If you change the time period, you can see it isn’t too far off the 50 week, which is another material moving average I like to take a look at.

Honestly, I like the company more than I like the stock right now. My position in the name is down between 3-5%, but I’ve been saving ammo waiting for the right opportunity to add. I would prefer to add on strength, coming out of a good quarter, a return to form. That said, if the quarter shows the market was right to be hesitant here, I will need to take a deeper look at how to proceed.

Quantum and Nuclear Reports

We’re going to wrap up the earnings preview with some general statements on the Quantum and Nuclear names reporting this week. Representing Quantum is IonQ reporting on Wednesday and D-Wave which will report on Thursday. Nuclear’s champions are Vistra on Thursday and Constellation on Friday. I am no longer in the Quantum names but do have personal exposure to Constellation Energy, ticker symbol CEG.

All of these names, if we’re being honest with each other, trade beyond their fundamentals. Sure, for these companies, the four specifically mentioned, the fundamentals and the financials do matter, but there’s no point in trying to handicap the quarter using them because the direction of the wind or the pH of the soil at the time of the report could impact how they move regardless of how phenomenal or how terrible the financials end up being.

In other words, or I guess the takeaway here, if you’re trading, be careful; and if you’re an investor, trust your interpretation of the quarter to gauge its quality more than the immediate reaction.

ADP Employment Preview

We will wrap up with a preview of ADP and some commentary on – to borrow the Fed chair’s verbiage – the data fog.

The prior month’s reading on ADP was -32,000 (-32k). I wasn’t able to find a consensus estimate for this Wednesday’s print yet. I’m recording this a little bit earlier, but I have seen some whispers around +20-25k.

The important thing to know going into this print is that the consensus is that the labor market is in a hiring firing stasis, which means there’s not a lot of hiring going on and there’s not a lot of firing going on. This isn’t great for the economy. It’s weaker than it has been in the past, but it’s also not necessarily a dire situation to be in. Fed cuts are still making their way through the system, which in theory should help these jobs numbers sometime in the future.

General knowledge is that Fed cuts take anywhere from 8 to 12 months to sink into the economy. I think that the economy is less sensitive to rate cuts. So, if there is any meaningful impact of these rate cuts, I think they’re more likely to surface as far as 18 months into the future. We could be waiting a long time. But, this view – my view – is not consensus.

Consensus is a shorter lag; therefore, if we do get a weaker print, I anticipate there will be a willingness in the market to write it off as a one-off because we’re expecting these cuts that we’ve seen at the past two meetings to buoy the labor market in the intermediate term. As such, if there is a market-wide sell-off, attached to some sort of miss in this ADP data, I suspect it would get bought up fairly quickly. Like, if not by the end of the day, then definitely by the end of the week.

Quarter-Baked Jobs Week

Stepping back a little bit as far as job week goes.

Typically we get JOLTs, Initial Claims, and Payrolls to go along with ADP. This jobs week obviously we’re only guaranteed to get ADP, thus the quarter-baked title thought it was very clever.

The lack of data due to the government shutdown, in my opinion, is frankly embarrassing for the country. However – this is certainly going to be a half glass full take – I applaud the Fed for looking at alternative measures of inflation and the labor market in the absence of the BLS statistics. By now, we all know that the BLS data, especially when it’s survey-based, has clear limitations. The quality has only worsened since coming out of the pandemic. We can see that the survey response rates have gone down since then and just aren’t coming back. That said, I find it equally embarrassing that there is so much inertia attached to this BLS data in an age of real-time reporting, increased interconnectivity, and of course AI, that the Federal Reserve of the United States, which is arguably the most important financial institution in the world, hasn’t actively petitioned for better data inputs for their data dependent process.

I wish we weren’t testing this in real time with grocery prices from Adobe, and I’m serious about that… But, if there is any silver lining here, it could be that the Fed is forced to develop their own measures while the BLS is reportedly investigating ways to improve their process whenever the government decides to reopen itself.

I think that’s plenty for one morning brief. Thank you so much for stopping by and listening to my little rant there. Good luck on the markets out there. I’ll be here next week. I hope to see you again too. Goodbye.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.