9:25 on 10/27/25 – Busiest Week of the Quarter

Media Dump

Gorilla on YT –> GO SUBSCRIBE

Best of the Bunch: Setup for AMZN Q3

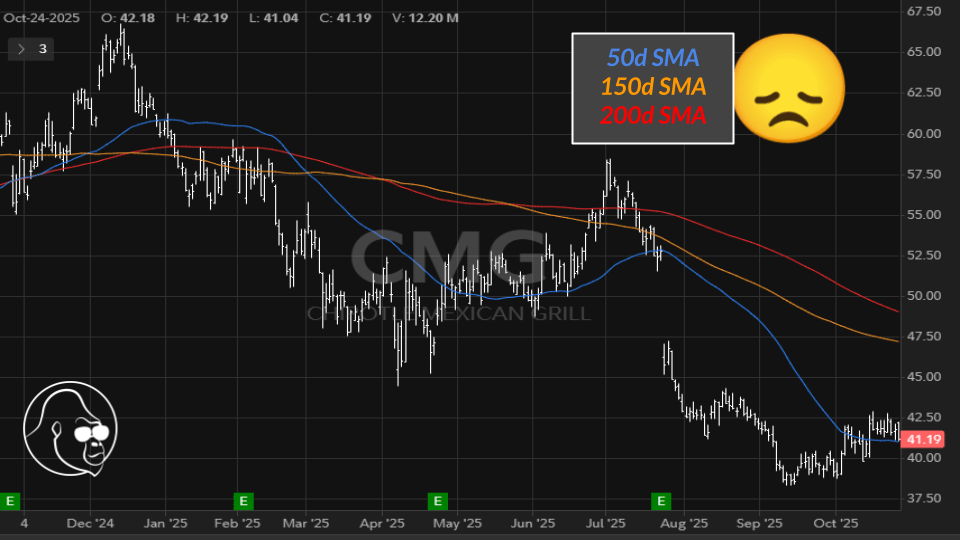

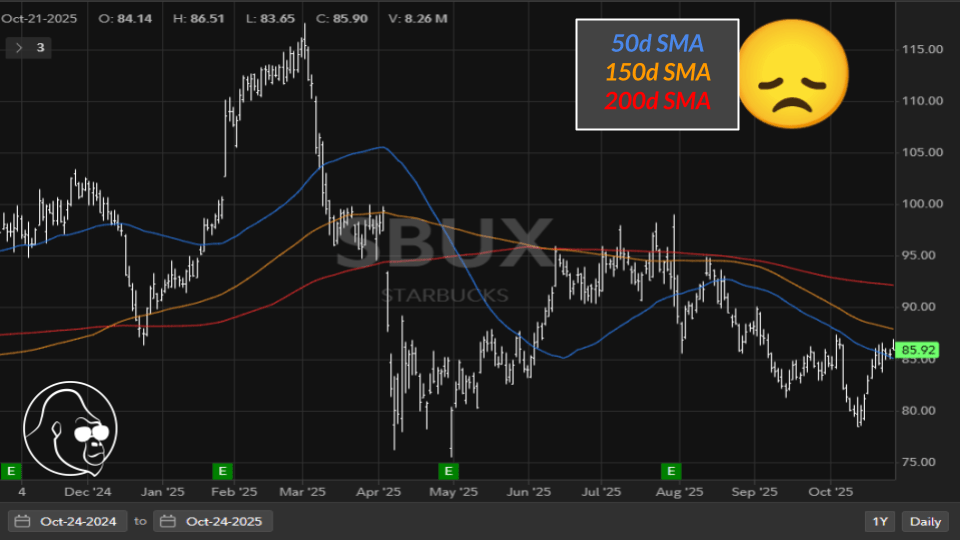

Chipotle & Starbucks

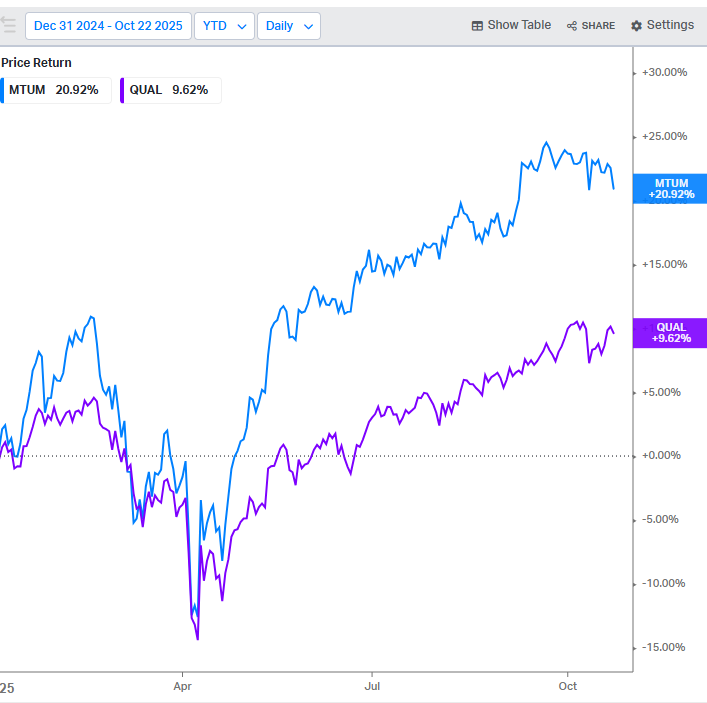

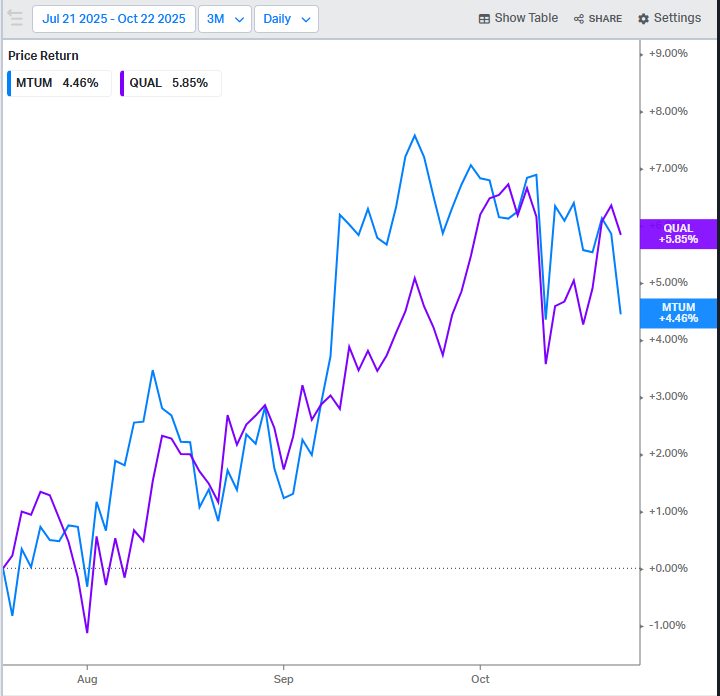

Momentum v Quality

T5D Performance

| S&P 500 | 1.27% | |

| Equal Weight S&P 500 (RSP) | 1.19% | |

| NASDAQ | 1.48% | |

| DOW | 1.71% | |

| Russell 2000 | 1.20% |

Talk of the Tape

The CPI print was favorable allowing stocks to party on with the big three major indices – S&P 500, Dow Jones, and Nasdaq – all making new all-time highs ahead of the busiest week for S&P 500 earnings and the October FOMC.

Week Ahead

Monday

- n/a

Tuesday

- United Healthcare (UNH)

Wednesday

- FOMC Meeting

- Chipotle (CMG)

- Starbucks (SBUX)

Thursday

- Meta (META)

- Microsoft (MSFT)

- Alphabet (GOOG)

Friday

- n/a

September CPI Implications

Good morning everyone. It is 9:25 for the week of October 27th, 2025. It is a massive week for markets. You have the busiest week of S&P 500 earnings combined with the October FOMC meeting. Five minutes of the open, we’re going to start with how September CPI has set the stage for everything to come this week.

In a sentence, CPI verified the scenario that markets have been pricing in for quite some time now: the Fed will cut 25 bips at their next meeting, which is on Wednesday of this week, and inflation remains tame, amidst tariff uncertainty; or rather, the Fed will be able to continue cutting because inflation has remained so tame.

For those who didn’t catch the release on Friday, here’s a quick summary of the result:

Headline, CPI year over year printed 3%. This is 1/10th lighter than expectations, but some would point out that this is actually 1/10th higher than the prior month. So, you can make an argument that, uh, the quote unquote, progress isn’t real. It’s just all relative to our expectations.

However, if you look at core CPI year over year, it also printed 3%, and that result is 1/10th, less than the estimate, and 1/10th less than the prior. So, we didn’t really have any progress on the headline CPI, but with respect to core – which is what really matters – we did see incremental progress.

Month over month core CPI printed a 0.2% gain, which was 1/10th lighter than 0.3%, which was expected and was also the result for the prior month.

October FOMC Precap

Fed Fund futures in response have penciled in a 25 bip cut for Wednesday. As of Saturday, the probability was at 98.3%. Honestly, I don’t expect there to be much drama with Wednesday’s meeting.

Of course, the commentary from Powell matters and has the chance to shake the snow globe, so to speak, but I wouldn’t place too many chips on that roulette square.

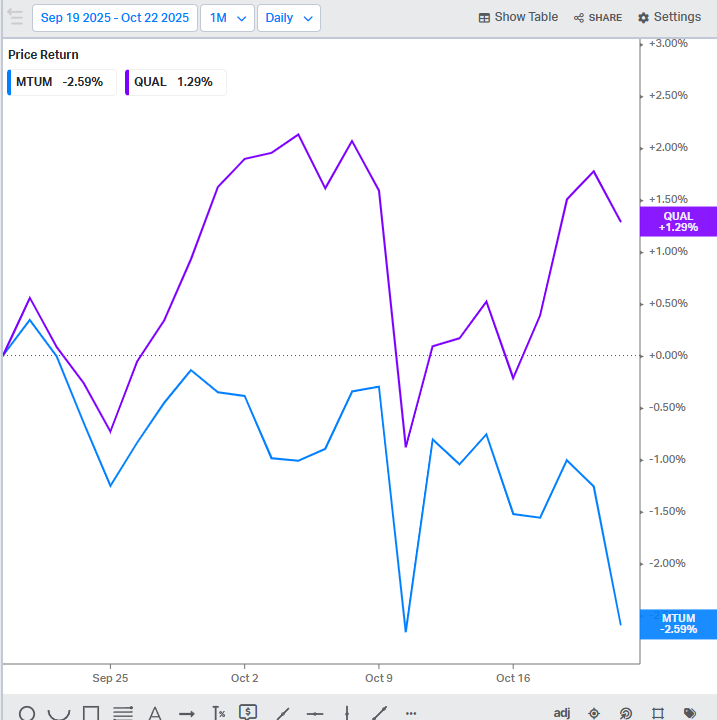

Momentum-Quality Rotation

As for the stock market, it isn’t a secret that momentum has been a winning factor during the year 2025. In other words, investors

have been sticking to and have been attracted to what has already worked. To illustrate this, take a look at the iShares momentum ETF In blue against the iShares quality ETF in purple.

Year to date, momentum is crushing it, but in the last three months, quality has actually outperformed with most of it coming in the last month. Now, given that there really wasn’t a change in the fundamental outlook, I chop up this rotation to some exhaustion on the upside for the momentum cohort. There is such a thing as too much or too fast, too quickly.

Investors have been quietly – well, not so quietly over the last week or two – been booking profits in these momentum names and are reallocating that money to quality where the opportunity appears a little bit better. As you all know, I like rotation. It keeps markets from overheating and from bubbles from getting too inflated.

That said, with this CPI print, reinforcing the fundamental backdrop and earlier big tech earnings showing us that cohort is going to have a robust quarter of earnings. This could be the cocktail of tailwinds required to reignite the momentum trade into year end.

Ex-Tech Earnings

If you agree with me that the stage is set for momentum to reassert itself, it will be up for earnings to light that match. Before we cover the mega caps, I do want to point out a few names that could be lost in the shuffle of this week’s busyness.

UNH reports on Tuesday. I’m long in the stock. If the quarter leaves investors with the notion that the government investigation is going well for UNH and isn’t interfering with their ability to operate their business, I imagine that that will be enough to satisfy the new cohort of investors who have put money to work in this name since the 13Fs revealed such an inflow of new investors. Keep your eyes on that $380 level. There’s a lot of overhead supply there. Retaking that level should attract momentum buyers and traders alike, so you get some closes above 380, it bodes very well technically for the stock.

Wednesday, we’re going to hear from Chipotle, CMG, and Starbucks, SBUX.

These stocks and those names in this retail niche have been absolute dog water since their reports last quarter. I still have Chipotle and Shake Shack. Shake Shack’s ticker is SHAK. I don’t have any insider information or real edge on what they’re going to say when they report on Wednesday.

We all know that we are in a k-shaped economy, but honestly, I would expect those who typically patronize Chipotle or Starbucks to be on the upside of that K. I point this out only to say that if the quarters give us a spark and start a small fire in that sector, there is so much potential upside that you can get in after the first leg higher and still make a lot of money.

As such, I’m not making any decisions to add or reduce Chipotle or Shake Shack until after I hear what is said on Wednesday and see how the market responds to it.

Mega Cap Earnings

Now let’s pivot to some intentionally too-brief precaps of the mega caps.

Wednesday we’re going to hear from Meta, Microsoft, and Alphabet.

Meta will be all about social media engagement and the ad business overall, especially as it pertains to the continued monetization of Reels. With TikTok here to stay, you could see a slight depreciation of whatever multiple investors are applying to Meta’s ad business now that this legit competitor in TikTok is no longer going to be permanently removed from the field of play in the United States.

For Microsoft, let’s not overcomplicate: the stock will go as Azure goes.

Maybe, there is a potential landmine concerning Open AI commentary given how they’ve continued to expand their reach ex-Microsoft. But, that isn’t a secret to anyone and hasn’t been for some time.

Going into Alphabet’s quarter, there is a lot priced in, if you take a look at the chart hanging at the all time highs. I’m not sure if the Anthropic deal with Google Cloud will be incorporated into the guidance, but if it is, then this quarter is sure to impress regardless of where the stock is.

The annual run rate for Google Cloud is $54 billion. This anthropic deal is supposedly worth “tens of billions of dollars” as per the official releases. Let’s just low ball it and say it’s 10 billion. If you apply that to their $54 billion run rate, that’s an 18% increase with one customer. The only potential bear case I see is that the stock is priced beyond perfection, meaning any small blemish or any small perceived blemish will be used as an excuse to take profits.

For example, let’s say traditional search only meets expectations. That might be enough for the stock to fall if it is priced for a result that would be impossible for the company to deliver.

With that, we’re gonna move on to Thursday where we’re going to hear from Apple and Amazon on Friday.

Apple closed at a new all time high without their own in-house AI solution. I think it’s fair to say at this point that the market has decided to give it the benefit of the doubt. Honestly, fair. Apple knows products and that customer is more sticky than Gorilla Glue.

That said, Apple isn’t at a new all time high just for funsies. It’s due to external channels showing that the iPhone 17 series is selling extremely well in both the US and Chinese markets. If customers in these crucial markets are upgrading en masse, it will materially increase their revenue growth, thus the incremental excitement for the stock and why it can trade at a new all time high. As long as the iPhone 17 numbers impress and meet expectations, Apple stock could move a little bit higher. It’s at a $3.9 trillion market cap. It feels like 4 trillion is a formality at this point.

We’ll wrap with Amazon. Keep it simple, similar to Microsoft, Amazon will go as AWS goes For more on this, check out the most recent edition of Charts and Checks, episode 17. Or you can take a look at the small clip that I carved out from it. Both will be in the link dump below. It provides great insight on the setup by making the argument that the AWS outage is bullish, comparing AWS to Azure and Google Cloud services, as well as going over the important valuation metrics and the technical charts.

Outro

Thank you so much for tuning in from my preview of what is likely to be the busiest week of the quarter. Like, subscribe, and in the comments, let me know what you’re going to be for Halloween. I’m going to be espresso to my fiance Serena Carpenter, with our dog as security. Protect his passion, as the saying goes, at least for him.

Good luck on the markets out there. I’ll see you next week.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.