9:25 on 10/20/25 – Private Credit Peekaboo

Media Dump

Gorilla on YT –> GO SUBSCRIBE

T5D Performance

| S&P 500 | -0.38% |

| Equal Weight S&P 500 (RSP) | -0.73% |

| NASDAQ | -0.16% |

| DOW | -0.60% |

| Russell 2000 | -2.88% |

Talk of the Tape

Markets paused as investors navigated potential cracks in private credit and U.S.-China trade tensions.

Week Ahead

Monday

- Regional Bank Earnings

Tuesday

- Netflix (NFLX)

Wednesday

- GE Vernova (GEV)

- Tesla (TSLA)

Thursday

- Newmont (NEM)

Friday

- CPI

Intro

Good morning everyone. It’s 9:25 for the week of October 20th, 2025. In this episode, I’ll give my 2 cents on the private credit Peekaboo, bring you up to speed on this week’s earnings reports with a handful of charts and wrap up with my prediction for September CPI coming out on Friday.

Private Credit Peekaboo

It is five minutes to the open on Wall Street, and we are going to start with my insight on the private credit realm, which has really been the first scary event of the third quarter that wasn’t on my Halloween Bingo card.

The specifics of this situation in private credit have already been covered by qualified sources, and I think are less important to investors listening this morning. I’m going to narrow my comments to how I view this situation affecting the stock market:

Based on reporting through Sunday afternoon, I believe this is going to be an isolated incident. To be clear, we aren’t out of the woods yet. News flow could get worse throughout the week, and could manifest itself in a 5-10% decline in the S&P 500.

However, the lack of regulatory oversight in the private credit world has never been a secret. As a result of this risk being known, I believe it mitigates the probability of this evolves into some sort of black swan systemic event vis-a-vis Silicon Valley Bank or SVB.

Opportunities in Financials

That said, if we do see an overreaction and get a 5-10% correction, you may want to pick up shares in names that are likely to be unjustifiably sold in a financials-led sell off.

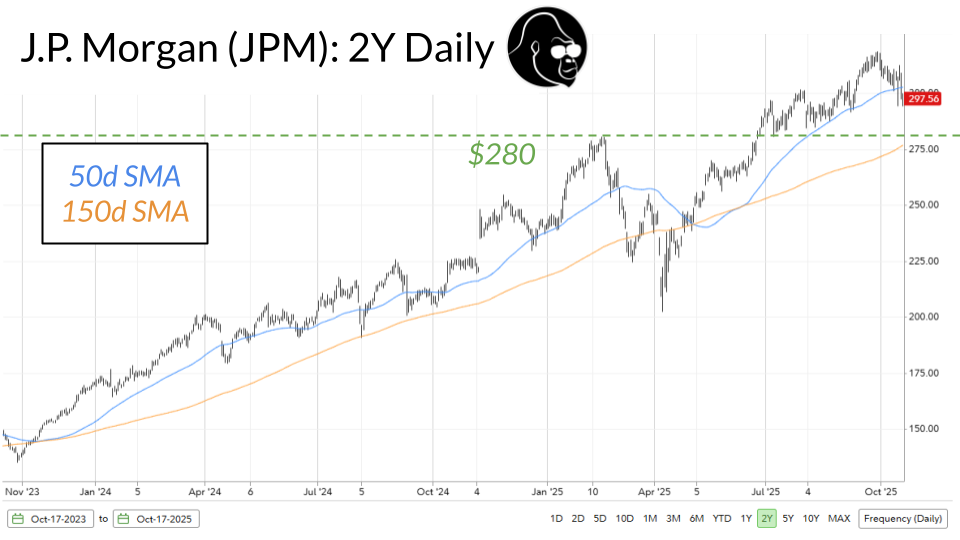

I would be focusing on JP Morgan, ticker symbol JPM, and American Express, ticker symbol AXP. For JPM, I’d be looking at the $280 level. That was prior resistance in February and will likely be the 150d SMA in the next couple of weeks. As far as JP Morgan is concerned, we want to see resistance in February become support today in October, and we also want to see the 150d SMA hold up as a strong support for the bulls.

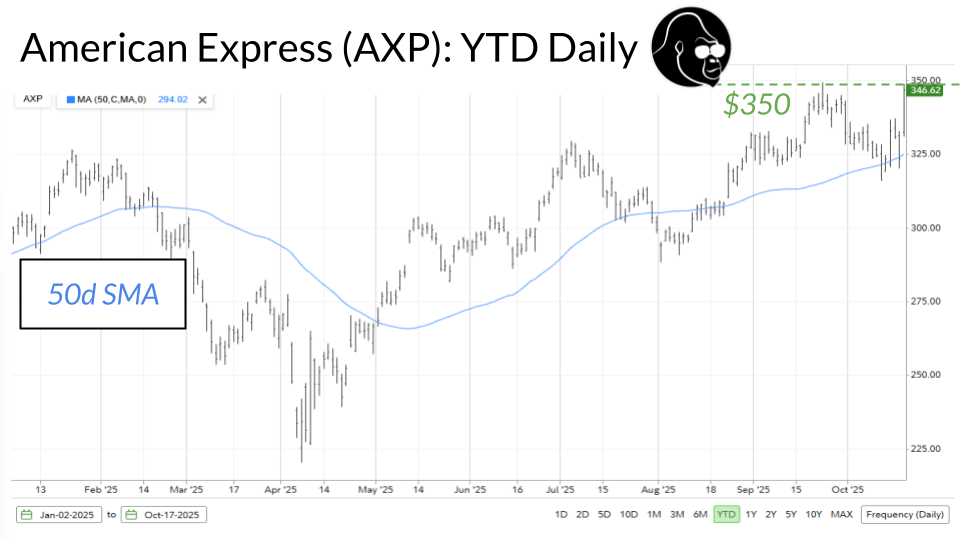

As for American Express, this one seems a little bit more bulletproof. When this scare started coming out on Thursday, American Express found support at the 50d SMA Friday morning, delivered a banger of a quarter and ended up 6-7% on the day.

I feel like it’s gonna challenge the ATH at 350. And honestly, maybe that’s the way to view American Express: as a breakout play instead of something that you’re just going to catch. But again, this was in a world where the S&P is down 5-10%. In that world, I don’t see American Express coincidentally or simultaneously breaking out to a new ATH.

Private Credit Ground Zero – Regional Banks

With my commentary on the private credit situation out of the way, it makes the most sense to pivot into earnings because this morning and after the close, we’re going to get a lot of the regional banks reporting, and we’re hoping for reassuring commentary. That would come in the form of no increases to the amount of reserves being held for bad debt.

If I understand the reporting correctly, Zion kicked off this private credit peekaboo when they disclosed a $50 million charge off on loans involving alleged fraud. So when Zion reports after the close today, on Monday, we need them to help stabilize the situation.

Gold Trade

With that firmly out of the way, I want to pivot the conversation to the gold miners.

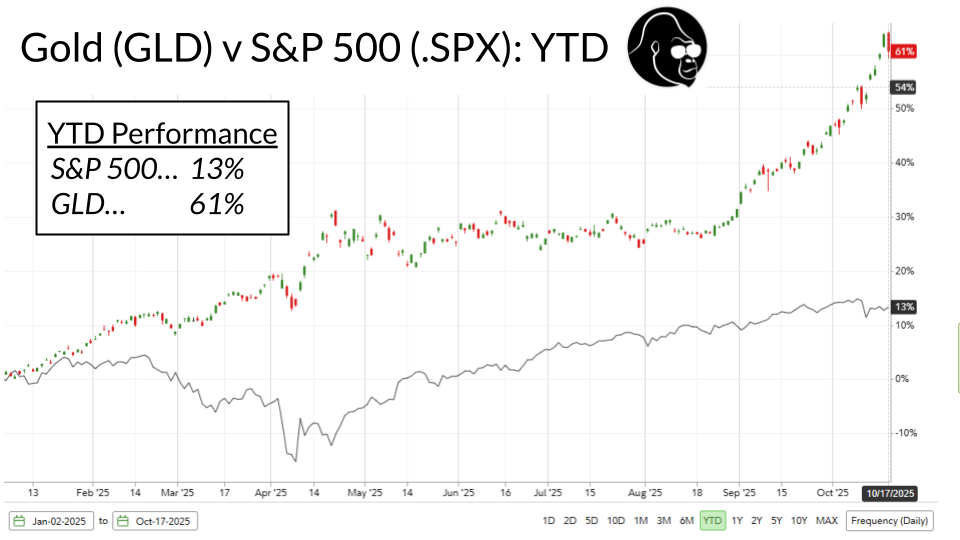

At this point, everybody knows gold has been on a historic tear: up 61%, well outpacing the SAP 500 year to date. The miners have followed suit. I’m still in Agnico Eagle, ticker symbol AEM. I like Kinross, KGC as well. I’ve heard others ask about Barrick, ticker symbol B, and even some on Newmont, ticker symbol NEM, which happens to report on Thursday. All of these charts look very similar up into the right, these last few weeks. You could say it looks exponential in fashion.

That being said, Friday, all of these names, including gold itself, took a bit of a dip. The miners underperformed gold, which was only down 1%, they all slid five or 8%. There was no apparent catalyst. In my mind, it could just be profit taken going into the weekend. Some of these companies are getting ready to report this week or next, and with the potential for resolution to the government shutdown, it just kind of makes sense to take some chips off the table even if you got in any longer ago than a week.

That said, it is worth noting that the price action in gold is only one side of the story. With respect to the gold miners. One of the biggest input costs is actually oil, which is necessary to run machines used to extract gold. With oil revisiting 52 week lows last week, these gold miners should be gushers for free cash flow. Now, will that be enough to justify these moves? It’s really hard to say. That said, if you feel like you’ve missed out here and are seriously considering starting a position in this gold mining space, I would wait to see what happens with Newmont when they report on Thursday.

Let’s assume based on what we know – gold up, oil down – which is revenue up, cost down. The stock has a blockbuster quarter. If we see a sell-off, it would imply the sector is priced well beyond perfection and needs to cool off. Put another way. I feel as though, given the performance we’ve seen in the last quarter alone, the risk may be skewed to the downside right now.

Setup in TSLA, NFLX, and GEV

However, I can’t help but feel a little better about the setup in mega cap tech and AI infrastructure. I don’t have any edge on Tesla, but it has moved sideways over the last month. My only fear is that coming into this month, there was a big pull forward in EV demand with that tax credit expiring at the end of September. I know the company isn’t a car company. It doesn’t trade, and never has, at those multiples. But there is no denying that this stock performs best when the EV business is performing as well.

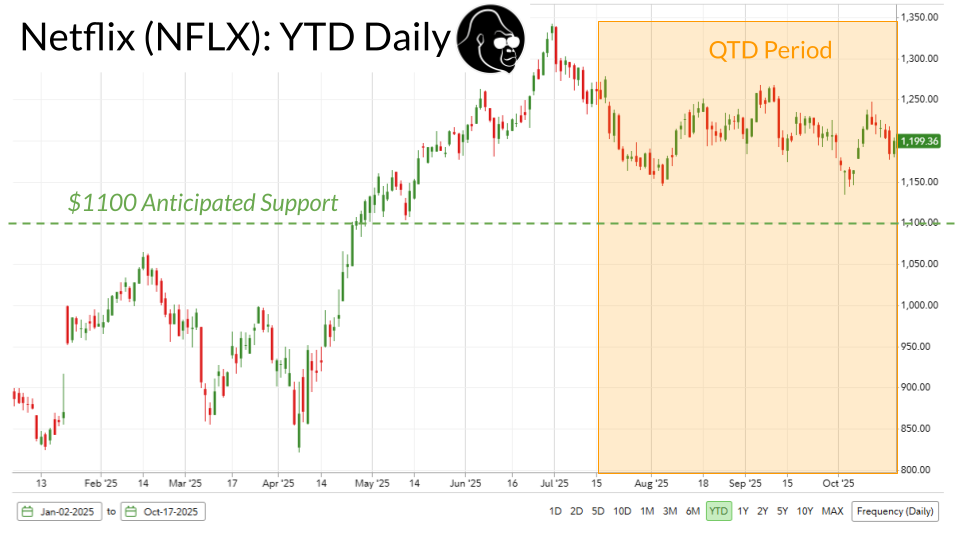

With respect to Netflix and GE Vernova, neither name has done much such reporting their last quarter. Netflix has actually down quarter to date. I don’t think there is any reason to believe momentum has changed since the prior quarter, which was nothing short of amazing despite what the stock has done since then. When I look at what happened in Netflix over the last three months, I chop it up to just saying it appears as though the stock got a little ahead of itself coming into the quarter, and I hope that another quarter of equal caliber reignites interest here.

GE Vernova is in a similar boat. For those not familiar, this company makes equipment necessary for modernizing the US electrical grid for AI. Again, I think the stock just got a little ahead of itself. I don’t think the momentum in the business has deteriorated.

So assuming these names report quarters of a similar caliber to their last, these names should respond well. However, if they don’t, then I think it makes sense to start looking for opportunities to buy more or start fresh positions if either interest you. For Netflix, I would be looking at the $1,100 level; GEV, i’d be looking at the 550 level.

September CPI

We’re gonna wrap up with a preview of September CPI, which will be released Friday morning.

Concensus estimate for core month over month is 0.3%, which matches the prior. The same can be said of year over year core, which is expected to come in at 3.1%, same as prior. Headline CPI, however, year over year is expected to come in two ticks higher than the 2.9% prior at 3.1%.

Obviously the closer to the 2% fed target the better.

There is some tension concerning operating without the full suite of BLS data… the, the market, and the Fed, I mean. As such, this CPI has the potential to be a real landmine. If we get a counter-consensus print, those concerns will be exacerbated. And, with the market trading and elevated multiples – implying a very optimistic outlook is being priced in – we are vulnerable to overreacting on bad news.

That said, I chose the word landmine carefully. This is not a ticking time bomb.

If it is a consensus print, then any tension should dissipate, and as I alluded to last week, given the extreme weakness and energy commodities through the month of September, I would bet on a consensus print more than I would bet on a counter-consensus print.

Outro

Thank you all so much for tuning in this week.

To tightly summarize, Monday – today – is a very important day for the private credit situation. Tuesday and Wednesday for the mega cap tech trade; and Thursday for the Gold Trade. Friday has the potential to be a landmine, but I anticipate the result will allow us to sidestep it.

Good luck on the markets out there, and I will see you next week. Goodbye.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.