Hey everyone. There are some stocks setting up nice. Figured, I’d take some time to point them out.

Prologis (PLD)

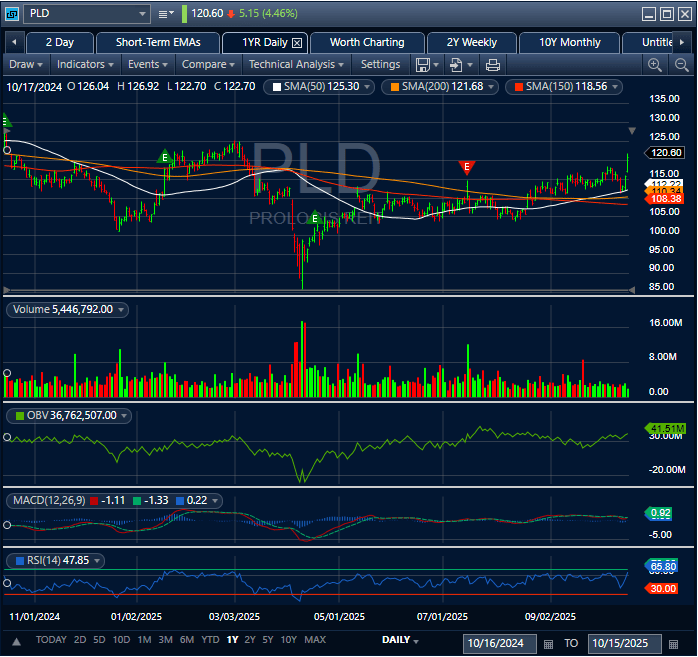

A REIT? I know. Crazy. Five days ago, I spotted a textbook breakout brewing:

- Support at the 50d SMA

- Report an impressive quarter

- Manage a close above the post-tariff tantrum range.

… 5 days later …

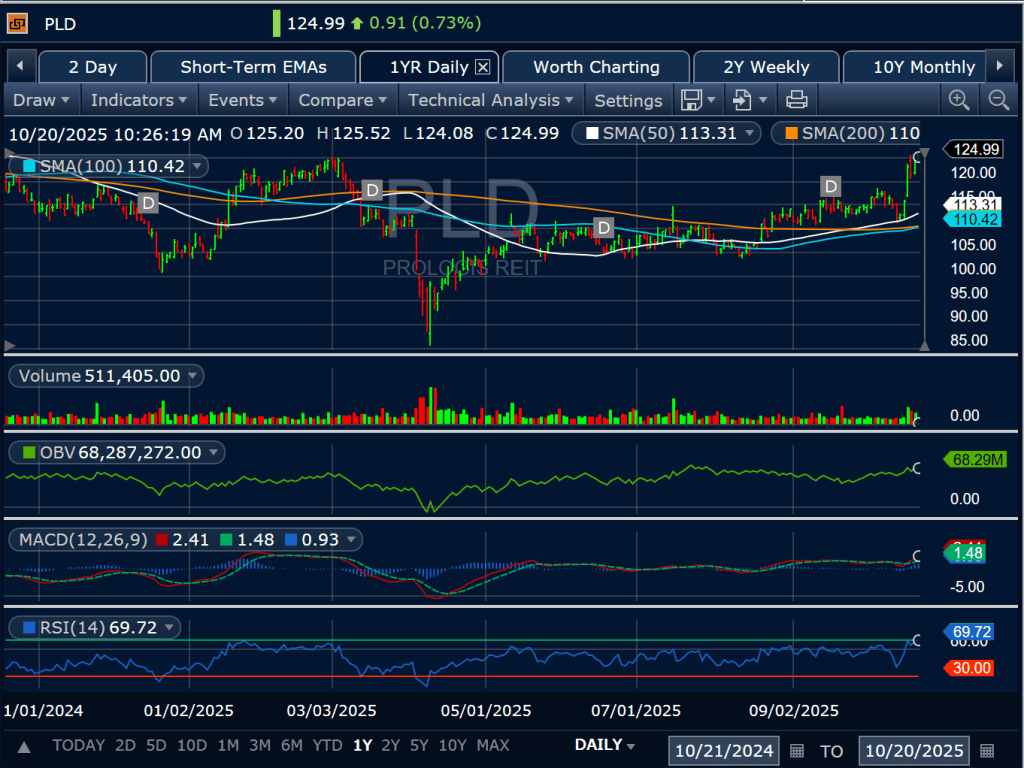

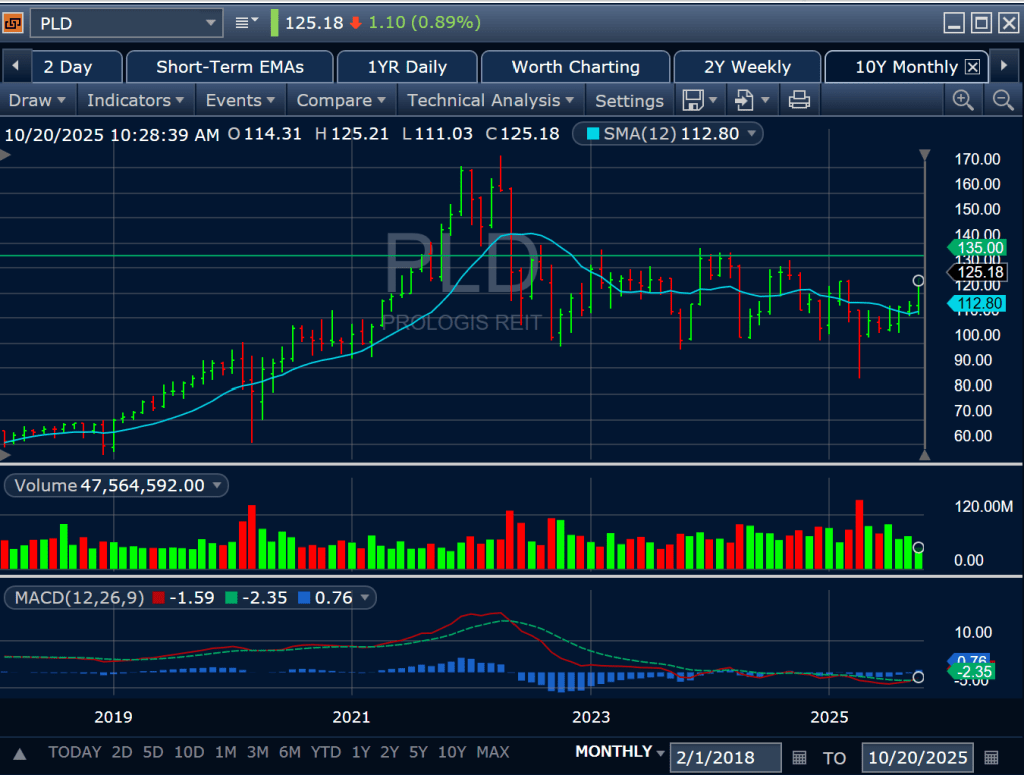

We find PLD at the top of it’s 2024 range.

Next stop? Let’s zoom out. I say $135 before real overhead resistance. Pays 3.26% dividend while you wait.

United Health (UNH)

Simply put, UNH is trading in – what appears to be the last – downside gap. I only got interested when it retook the 150d SMA (red line). Bears have a chance to reject the stock here, but, so far, no luck. The longer UNH consolidates above the 150d SMA, the better.

Above $380, UNH invites institutions to substantially rebuild their positions as well as momentum traders to get in. However, for those interested, you need be aware that October 28th – next Tuesday – is their earnings.

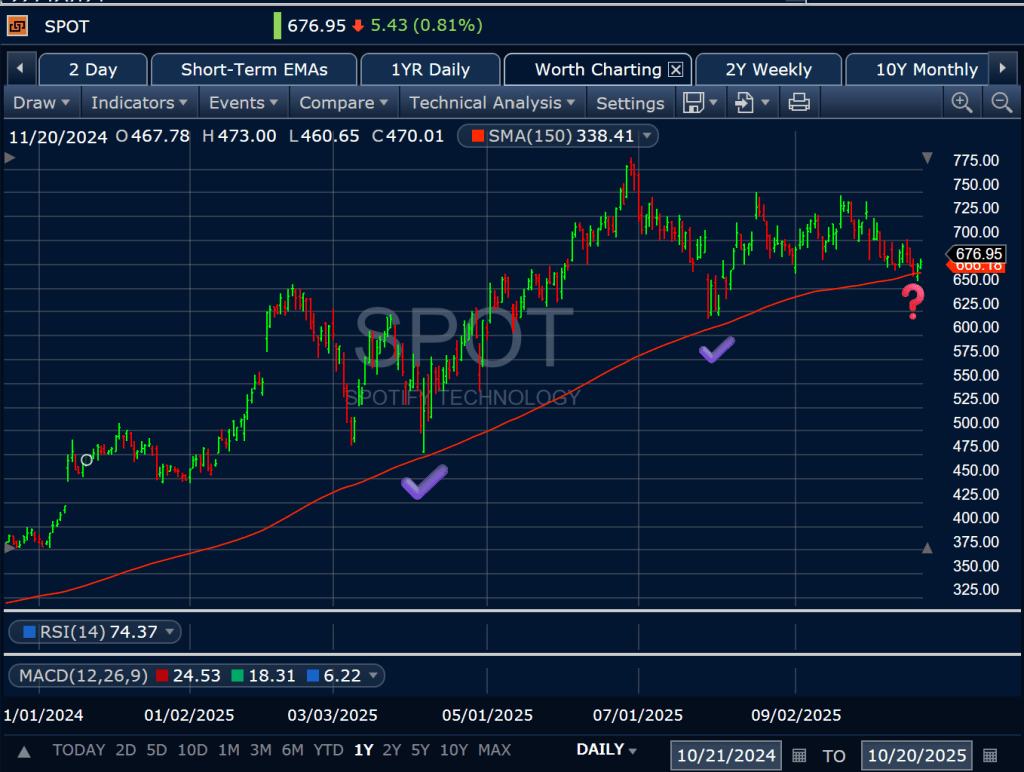

Spotify (SPOT)

The name is testing the 150d for the third time this year. If this year’s history repeats itself a third time, then you should be interested in getting involved here.

To be clear, I am fundamentally bullish on this story. Similar to Netflix, it is the winner in it’s category: audio streaming. Over the last three months, the market has lumped these names together… just look at the price action QTD.

Netflix reports tomorrow night (October 21st). I expect SPOT will trade in sympathy at least until SPOT reports om November 4th. My current position on SPOT is breakeven. As such, I’ll wait for the NFLX quarter before making the decision to allocate more.

Amazon (AMZN)

Apparently, there was an AWS outage this morning. Stock is shrugging it off, up 1% as we approach the halfway marker in today’s trade. More importantly, the stock is finding support at the 150d SMA, where it has twice since coming out of the April lows.

Full disclosure, I am adding a little to my position today. I believe the financials are outperforming the stock price. It should only be a matter of time before this stocks wakes up. A lot is riding on Q3.

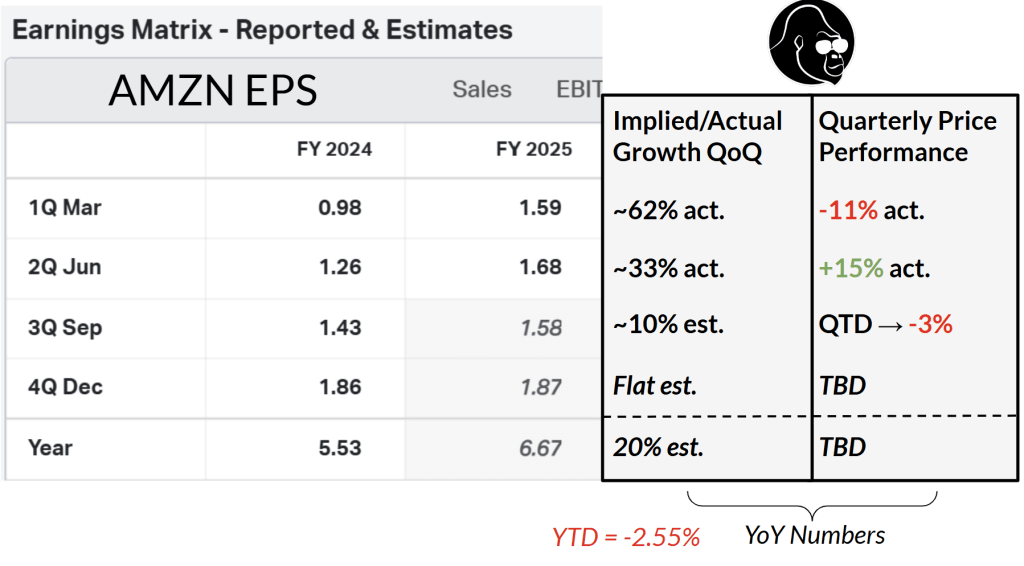

While the comparable quarterly EPS is decreasing (62% → 33% → 10% → 0%), YTD the stock is down despite their track for a YoY EPS performance of 20%.

However, you could take this matrix and explain the underperformance in two ways:

1) Expectations for comparable QoQ % gains are decreasing through year-end… hard to get excited given everything else everywhere else.

2) The stock did so much in 2022 and in 2023 that the stock is simply going to financially outperform the stock performance because the stock still needs to digest and consolidate.

My take? Flat comparable Q4 growth means there is a lever for upside.

How? Report a robust Q3, forcing analysts to revise Q4 higher.

Do that and AMZN becomes the perfect “chase for performance” play: lagging blue chip, heavy S&P 500 weights, underappreciate fundamentals. What else could you want?

That said, Q3 needs to impress for this thesis to play out. Of course, AMZN could still be a chase for performance play without it. If we’re taking the S&P 500 to 7000 by way of the “chase for performance”, then AMZN will benefit due to its weight in the S&P 500. Regardless, after taking time to review current earnings expectations, I have come to realize more is riding on this quarter than I previously thought.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.