9:25 on 10/13/25 – Markets Don’t Top On Bad News

Media Dump

Gorilla on YT –> GO SUBSCRIBE

BLS Brings Back Workers for CPI

T5D Performance

| S&P 500 | -2.71% |

| Equal Weight S&P 500 (RSP) | -3.63% |

| NASDAQ | -2.96% |

| DOW | -2.85% |

| Russell 2000 | -4.17% |

Talk of the Tape

Markets were cruising higher until trade tensions between the U.S. and China reignited on Friday as Trump responded to the Chinese increasing export controls on rare earth metals.

Week Ahead

Monday

- n/a

Tuesday

- J.P. Morgan (JPM)

- Citi (C)

Wednesday

- Fed Beige Book

Thursday

- U.S. Retail Sales

- CPI

- PPI

- Taiwan Semi (TSM)

Friday

- Housing Starts

- Building Permits

Intro

It is 9:25 for the week of October 13th, 2025. We have plenty to cover today as markets take a downward turn to end the week. We’re going to provide some context there. Summarize what last week’s earnings told us about the economy. Precap of coming inflation reports as well as the start of earnings season.

We’re 5 minutes away to the open on Wall Street. So let’s begin with the ignition of US China trade tensions.

Friday’s Sell Off

Around midday on Friday, markets took a downside term as Trump put out on social media. The Chinese had turned “hostile”. This is in response to the Chinese tightening expert controls on rare earth minerals that are integral to a number of industries, including traditional defense technologies, EVs, solar panels… pretty much anything that requires a magnet. Supposedly this matter was handled during the Geneva Talks last May, but here they are rearing the ugly head once again.

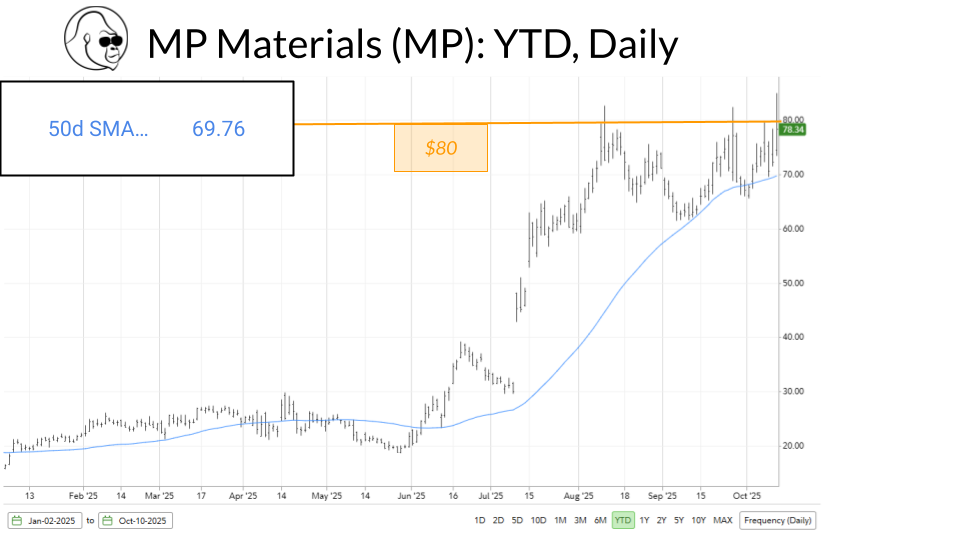

For the most part, everything stock fell on the news. However, it is worth pointing out there were a few winners. Most notably was a company by the name of MP Materials, ticker symbol MP.

I’m going to throw the chart up for you.

If I understand correctly. This is the only rare earth mineral, miner, and refiner in the United States. While I wouldn’t chase it here, assuming MP makes a wall time. You can play it by being a sustained move above $80 and then applying a technical indicator such as the 5 day or 13 day exponential moving averages as your stop. You know that I like to use the 5 day exponential moving average, but its your money, do the trade the way that you feel the most comfortable.

Broadly speaking, I’m actually relieved to see some uncertainty and fear reintroduced into the market. Markets don’t top on bad news, the same way that they don’t bottom on good news. Think about it. In October 2022, we bottomed on a CPI print north of 8%. In my opinion, price action these past few weeks was getting frothy. And while you can make an argument the froth was somewhat contained, it’s moments like these where a little air comes out of the market that actually elongate bull markets by ensuring they don’t overheat.

Don’t get me wrong, it sucks and can be scary going through these single day two to 3% declines; but understand they are a feature of the stock market and not a bug.

September CPI Precap

So, let’s turn our attention to inflation for a moment.

The return of this sort of news flow will certainly bring about the return of the tariff hawks. In my opinion, there’s really no reason to believe that this tariff scare won’t be resolved to the upside, the same as it was coming out of April. However, expect those who have staked their career and annual performance on these tariffs biting to double down now that the news flow has gone in their direction.

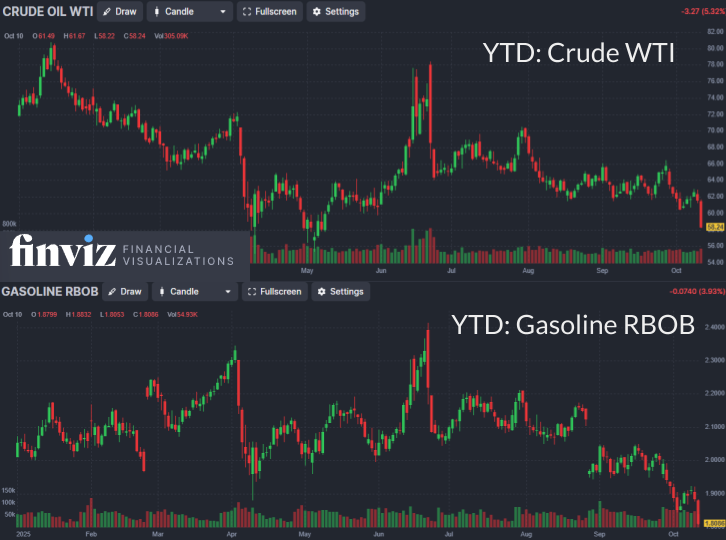

According to a Reuters report, it appears as though even without a resolution to the shutdown, the BLS will bring back furloughed workers to produce the CPI report. While Friday’s event shouldn’t impact CPI for September, I believe any surge from tariffs will be offset by the absolute capitulation and energy prices.

Oil is revisiting the April lows where many believed it was pricing in a global recession due to tariffs, and gasoline – through the eyes of the RBOB Index – made a new cycle low. These important inputs have been depressed the entirety of September. So, when I look at this, I believe there’s reason that CPI is going to have a downside surprise.

K-Shaped Confirmed

Before moving on to the start of earnings season, I want to spend a minute or so on Delta and McCormick and what it says about the economy.

Delta absolutely crushed it, but oddly enough, the back of the plane was soft and the front of the plane was extremely strong. In other words, people that were flying first class and business class – we’re talking about the affluent travelers, the business travelers – was robust and isn’t pulling back. If anything, they’re going as if nothing’s changed; whereas the casual flyer in the back of the plane appears to have pulled back.

If we take this at face value, it supports the notion that the US economy is k-shaped, as the different socioeconomic groups are recovering at drastically different rates since the COVID bottom. However, it is worth noting with back to school, those who typically book in the back of the plane simply don’t have the freedom with their kids back in school.

That said, McCormick also adds to the notion of a k-shaped economy. Their miss had nothing to do with volume. It had to do with price. In other words, the spice company sold plenty of spice more than we expected, but didn’t feel comfortable raising their prices, even though their costs continued to increase due to tariffs and labor costs. While I applaud the company for making the decision to keep prices low, it implies McCormick doesn’t believe their consumer base would accept the price increase.

I don’t know if this is a savvy political game to avoid White House scrutiny, or an estimate from management that the customers they serve, which tend to be on one side of the K, can’t afford to pay more right now.

It’s impossible to know, but the state of the consumer is always worth monitoring.

Upcoming Earnings: Money Centers and Semiconductors

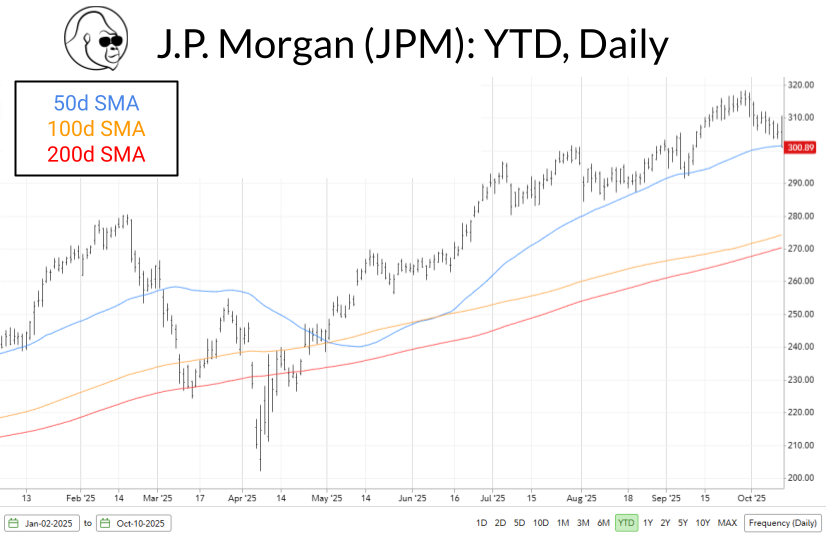

With that out of the way, let’s talk a little bit about earnings. We’re going to start earnings season on Tuesday and Wednesday with the money center banks. All eyes should be on best in breed: JP Morgan. I’ll also have my eyes on Citi, playing that there. I like the turnaround story. However, per the group as a whole, these money center banks do need to show up as far as earnings are concerned.

Here’s a chart of JP Morgan. I’m going to use this as a proxy for the group because it’s the most important for the entire group. It recently found support at the 50 day simple moving average, but is oftly close to rolling over. Most of the names in this group look similar.

Price action aside, the commentary is going to be more important. These money centers have intimate relationships with the shakers and movers across the economy. Good commentary from then bodes well for the rest of earning season.

Finally, we’re going to take a look at TSM, the world’s largest semiconductor foundry. Friday took it on the chin, shedding more than 6% on the tariff slide. However, it has been a very lucrative stock to be in if you’ve had the stomach.

While you could make the argument that TSM, at least for the time being, doesn’t have any cyclical risk due to the demand for AI semiconductors, there is no argument that it is isolated from tariff risk. While the recent tariff uproar appears to be contained between the US and China, China’s proximity and relationship to the country could result in the Chinese finding a way to apply pressure to that pain point.

To be clear, I mean through economic or diplomatic means, not through violence or the threat thereof. I imagine if you are in Taiwan, you feel as though that is a constant threat anyway.

Either way, I expect the report to be solid. We know the demand is real. That said, the sector clearly has beta to these trade headlines. So, until you personally get comfortable with that situation, we see a little bit of stabilization in the news flow – for myself personally – it makes sense to sit this one out regardless of what the commentary is. And that being said, I’m still long, but I’m just not doing anything around the quarter.

S&P 500 Supports

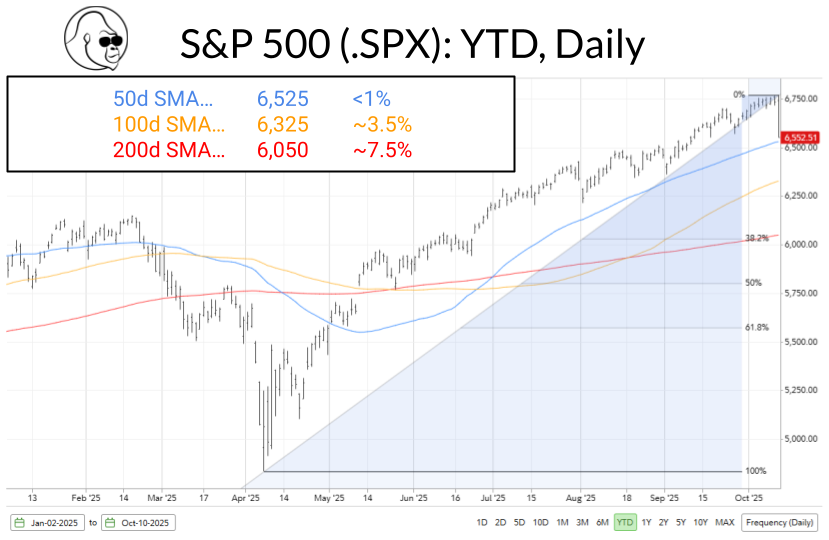

We’ll wrap up with a little bonus. I’m going to go over S&P 500 support levels.

Interruption from Future Me

Hello, this is Future Me interjecting before I go over those S&P 500 supports. The brief this week was recorded on Saturday prior to Sunday’s tweets where Trump downplayed or revised his stance on the hostile end quote relationship with the Chinese.

I expect when futures open in a couple of hours, we’re going to see some firmness, some resilience, some, some bounce, which may make what I go over a little less relevant. However, I’ve decided to keep that section in because these supports that I list are. Still the supports and there’s a moment where I go over how I would view a correction from a psychological perspective that I think is still valuable.

So I’m gonna go let past me, finish the job and finish the brief. I appreciate you allowing this interruption. Alright. Take it away past me.

When the VIX rises 30% in a day, you often have a stock market as opposed to a market of stocks. Put another way, when the VIX is “vixing”, the stock market tends to act as a unit as opposed to individuals.

The most obvious support is a 50 day simple moving average, which is in blue. On Friday, the 50 day closed at 6525. I’d applied a range, say between 6500 and 6550. Next, we have the 100 day simple moving average around 6325, 3.5% lower from here. If these levels are breached, then we may need to wait for support of the 200 day simple moving average around 6,000, which is near a 32.8% Fibonacci Retracement level from the April lows. This is about 7.5% lower from Friday’s close.

In my opinion, I would anticipate more negative catalysts will be required to blow through all of these supports, especially in a rapid succession. But, in the grand scheme of things, if the S&P falls 11% and revisits 6,000 after rallying 40% from the April bottom, would that really imply that the AI bull market is over?

I’ll leave you to ponder that question.

Outro + Crypto Preview

And with that, I’d like to thank you so much for tuning in this week. But before, I wish you all good luck. I want to share that I had a very insightful conversation with a crypto warrior from Alvaro’s Discord. He goes by the name of Bastion. Sometime this week it’ll be posted on my YouTube.

Yeah, that’s right. I’m on YouTube now at the Gorilla with Glasses. You can find a link to that below for those who have already headed over and subscribed: thank you. I appreciate it dearly; creating these videos is a labor of love. Your support does help keep me going, and if you’re watching on YouTube, do me a favor and consider doing the same.

Good luck on the markets out there. I’ll see you all next week and maybe sooner with a conversation on crypto.

Goodbye.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.