9:25 on 10/06/25 – Fed Take-Over

Media Dump

JD and Chinese Stocks: Charts and Checks

T5D Performance

| S&P 500 | 0.72% |

| Equal Weight S&P 500 (RSP) | 0.99% |

| NASDAQ | 0.70% |

| DOW | 1.02% |

| Russell 2000 | 1.35% |

Talk of the Tape

Despite the government shutdown shutting the market out of the September jobs report, stocks marched on to make new all-time highs again.

Week Ahead

Monday

- n/a

Tuesday

- McCormick (MKC)

Wednesday

- FOMC Minutes

Thursday

- Initial Claims

- Delta (DAL)

- Pepsi (PEP)

Friday

- n/a

Intro

Good morning everybody. Good to be back in my normal setup. There’s plenty to discuss as we get back to business. This week we’re going to talk about the Fed takeover, comment on the market’s patience for a resolution to the government shutdown, dismiss the notion of a market wide bubble, and then finish up by walking everyone through a number of individual names on my radar.

It’s 9:25 for the week of – my brother’s 25th birthday. Happy birthday, Michael – October 6th, 2025.

Fed Media Spree

Let’s begin with the Fed media spree. Tuesday. We’re going to hear from five speakers Wednesday, five speakers, and get the FOMC minutes. Thursday we’re going to hear from five speakers and there’s going to be six obligations; so, someone’s going to be speaking twice, and Friday we’ll have one speaker.

Headlines from these events have the potential to move markets, but the only one we really need to worry about is 8:30 on Thursday: Powell is going to take the microphone. This is the highest probability of having an outsized move given the lack of anything else going on.

Patience for the Gov’t Shutdown

Otherwise, if the government manages to reopen, we will get initial claims on Thursday.

If not, it will be the second consecutive week without, which is a nice segue to my thoughts on the market’s apparent patience for this government shutdown. I believe that so long as this doesn’t extend into the next batch of inflation reports. The market is going to be pretty cool with this. While there is no substitute for payrolls, which we missed out on last week, there are private data supplements that give us hints. None of them have rocked the boat: including ADP, despite what some people may have said.

The same isn’t true of inflation. CPI is scheduled for the 15th of the month, so perhaps if no progress on reopening the government is being made towards the end of this week, we could see the markets start sliding in anticipation of going into a period of time where the Fed is blind to inflation.

So, if anything, with respect to the macro, I think we need to be concerned most about headlines concerning a continuation or an ending of the government shutdown.

Dismissing The Bubble

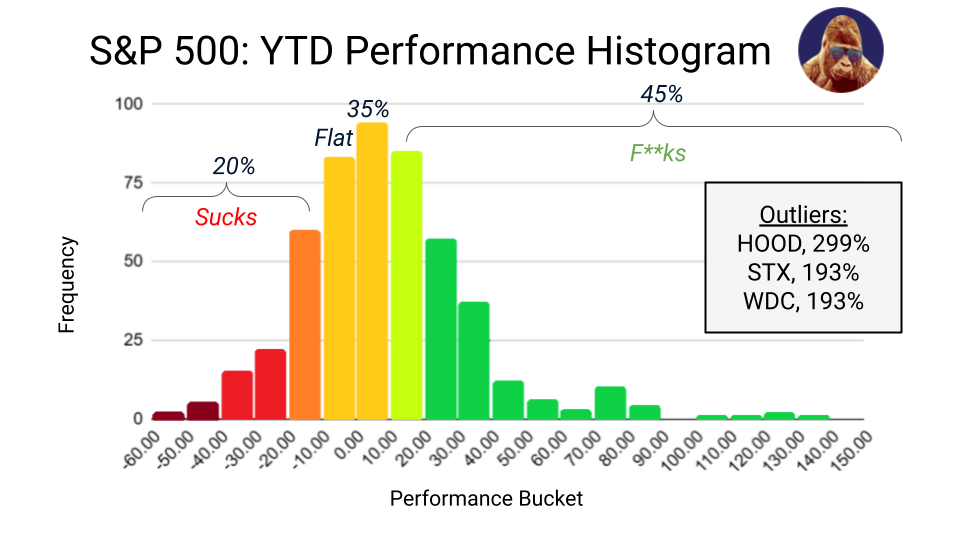

Now with macro concerns out of the way, let’s talk about “the bubble”. Did you know that 28% of the constituents in the S&P 500 are 20% below their 52 week high, meaning about 140 names in the S&P 500 are in a bear market.

If we zoom in just a touch, looking at year to day performance, which may be a little more instructive, we’ll find that 20% of the index absolutely sucks: down between 10 and 60%. 35% of the index is flat: they’re either down 10 or up 10 or somewhere in between. And 45% of the index absolutely f**ks: up 10% or more.

So yes, there are a lot of names working in the S&P 500, but there are also a lot of names sucking. If this were a market wide bubble, everyone would be making money in stocks. With 20% of the index absolutely sucking, there are clearly people that aren’t. If we want to take the conversation of bubbles outside of the major indices, I’m willing to adjudicate on a case by case basis.

Quantum computing and robotics do deserve scrutiny. These companies are 5 to 10 year stories with triple digit price to sales, despite making less in revenue than most professional athletes. Don’t get it twisted though. I think there is a lot of money to be made in those spaces. My take is you can date them if you like, but don’t introduce them to your parents.

Have fun. Have fun, but be careful.

Earnings Preview

With that out of the way, we’re going pivot to the company’s reporting this week, McCormick Pepsi, and Delta. Again, light slate. But let me ask, what do all of these companies have in common? They provide insight into different aspects of the consumer.

When times are tough, consumers tend to eat more at home, or at least that is the tale that Wall Street has told, which generally provides a tailwind for the spice maker McCormick. As for Pepsi, it’s less about strength in the soft drink segment and more about strength in its collection of inexpensive snacks.

Delta is on the other end of the consumer spectrum. If their quarter suggests they aren’t having trouble filling up the front of the cabin, ie) first class or business class, then it implies that business travel and or the more affluent consumer with their American Express cards remains robust.

K-Shaped Economy

It should be noted that it is becoming common knowledge that we live in a K-shaped economy post-COVID, which means that different sectors and population segments are recovering at drastically different rates.

So, it is possible that we see both. We see McCormick and Pepsi do well, and Delta do well. That said, in my perfect world – don’t take this the wrong way, McCormick shareholders – you have a poor quarter, suggesting the bottom quartile of the economic ladder is doing, or at least feeling, better than the current economic narrative suggests; and, we also see continued demand for Delta flights… mainly because tourism is a fantastic tailwind for economic activity elsewhere and punches above its weight, especially in a US economy that is heavily leveraged to services and experiences.

Trading Opportunities

Finally, we’re going to wrap up here with a handful of potential trading opportunities.

Unless noted, I am not in these names. Furthermore, this is just my own technical analysis. This is not fundamental advice nor solicitation for anyone listening to enter any of these trades on your own. This is always the case, but with market excitement among the trading community at current levels, I felt this was a necessary, and friendly reminder.

Nuclear Trades

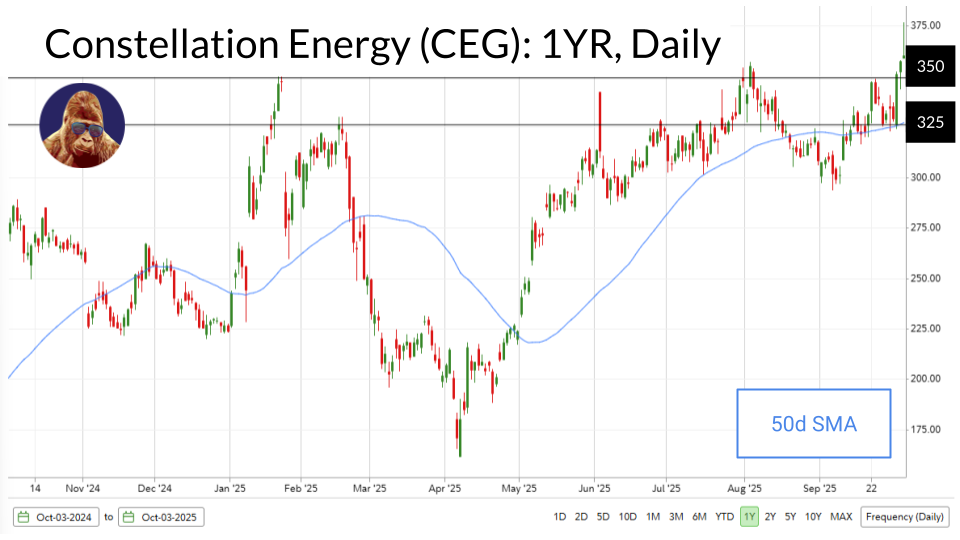

So let’s talk about a few nuclear options. We all know that nuclear is going to feed the AI energy demands sometime in the future. CEG, Constellation Energy, one of my favorites.

We’ll pull up a chart just close at an all time high on Friday after announcing a $340 million deal for a hydro project in Maryland.

While it was unable to keep most of its gain, hard stop around 375, it didn’t fall all the way back to revisit the level of the prior day. If you’re interested in this one watch 350, we want to see that level, which was resistance back in late January and early August to start acting as support.

So long as that level isn’t convincingly broken, there is more room for this breakout to keep moving to the upside. That said, if you’re patient and want to be in this name, I would look for support at 325, which happens to align with the 50d SMA.

However, I view Vistra (VST) as more compelling. It swims in the same pond as CEG, but hasn’t moved quite yet.

Again, we like to see resistance becoming support. $200 was the mid-January high, and we have the added bonus of this also being near the 50d simple moving average. I see easier ways to risk manage with clear checkpoints to the upside, I would prefer a trade in VST to CEG, but I am in neither currently.

China Play

Next, let’s talk a little bit about a China play that I find particularly interesting. We went over this on Friday’s live edition of Charts and Checks. I will link the portion where we talk about it in the link dump below. But I think it is important that I quickly go over the technicals here.

Let me pull this up. So we have a 10Y monthly with a 12M simple moving average from 2021 to mid-2024. This was in a powerful three year downtrend. You had MACD go negative on this monthly timeframe in 2021, and it finally went positive in June or July of 2024. In my mind, $30 is the level to watch.

I’m not in this name either, but if we see a monthly close above that 12M simple moving average, and the MACD – which hasn’t gone negative since it inflected positively in June – stay that way. I could see myself getting in this name and putting a different risk management on it.

New Position: SAIL

Finally, we’re going to finish up with SAIL. We’re going to start by saying that I am in this name. I may be a perma-bull for cybersecurity. So, when I see a decent setup in the space, I take a look.

I started this position on a Thursday or Friday. I like to see action above the $22.50 level. MACD went positive and my favorite short term indicators, the 5d and 13 day exponential moving averages, remain in a bullish formation with the 5d cleanly above the 13. For those that are curious as a re-IPO, after being taken private a few years back by Thoma Bravo; the market cap now is about 13 billion.

So, this isn’t really a fresh IPO. If you’re curious, again, they specialize in identity management. This matters less to me than what the chart is doing. We have a pretty big base, I think so long as it can maintain that 22.5 level. This has an opportunity to revisit the all-time high, somewhere around 25 or 26, especially if this becomes a chase for performance candidate. Cybersecurity as a whole, the sector after going through a shadow bear market in some cases, is off the bottom. So, I do really like the opportunity that’s emerging here.

Outro

That is all I have for you this week. I think I gave you plenty of opportunities to look for.

I wish you all the very best of luck this week and hope to see you all step by next time. Thank you.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.