This morning’s move in gold — more on that shortly — forced me to take some chips off the table. With a little more cash in the portfolio, I decided to look for new opportunities in my bullpen, made up of a watch list as well as a few names that I had “sold the double” in… three stuck out.

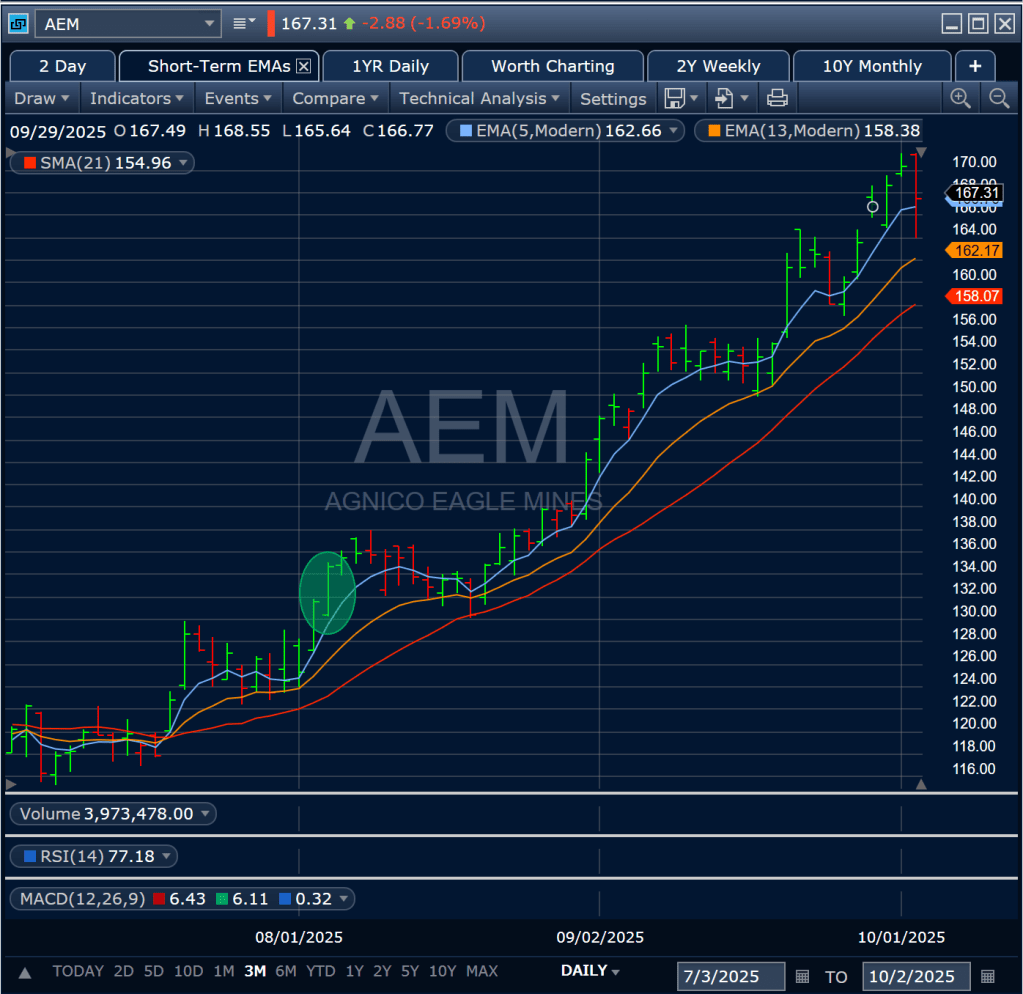

AEM: Ringing the Register… Sort Of.

In early August — the green circle — we entered the position on a breakout candle. The thesis: a breakout in GLD would send this stock higher. After GLD broke out, I decided to use a close below the 5d EMA — on a closing, weekly basis — as my stop-loss.

While it is too early to know if that will happen this week, I am concerned that today’s candle could be an engulfing bear candle. If so, it could be the start of a consolidation period or reversal. However, if there is no downside follow-through tomorrow, then this was a false signal.

To be clear, this isn’t a fundamental call on gold. I like the fundamental story there. I hope — and believe — gold and the derivative plays will do just fine moving forward. That said, this allocation isn’t based on fundamentals; it is based on technicals. And, the technicals are giving me cause to exercise the sell discipline. As such, I liquidated half of the position: 23% in 2 months isn’t anything to be upset about.

New Business

Now that you know where the money is coming from, here are the ideas that I am considering.

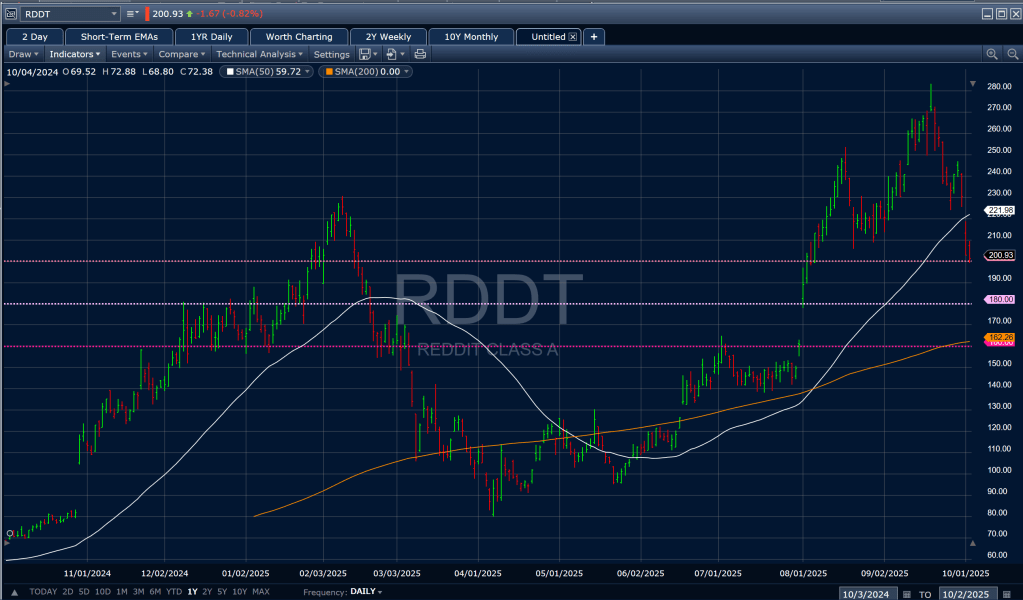

Reddit (RDDT)

Reddit is $80 or 28.5% off of its ATH on no news… the stock definitely has a high valuation, but doesn’t report until 10/27. There is sometime to trade this one without having to play games with the quarter.

Ideas

- Go long with a successful recapture of the 50d SMA (white).

- Put-Spread between $200 and either $180 or $160. These levels are emphasized using the pink dotted lines. I see pretty big gaps without much technical support.

- Buy a successful retest of the 200d SMA down at $160.

Rio Tinto (RIO)

Rio Tinto (RIO) is an Australia-based iron miner that primarily sells into China. Perhaps with the Chinese economy showing some signs of bottoming, investors are looking for derivative plays. It is also worth noting that as iron-ore miner, commodity prices tend to be inversely related to the USD. Therefore, this is also a rate-cut/weaker-USD play. Technically, the stock has been basing for an entire year. After multiple failed attempts to recapture $65, RIO-bulls have finally managed.

Idea

- Go long today paired with a downside stop loss for a close below $65.

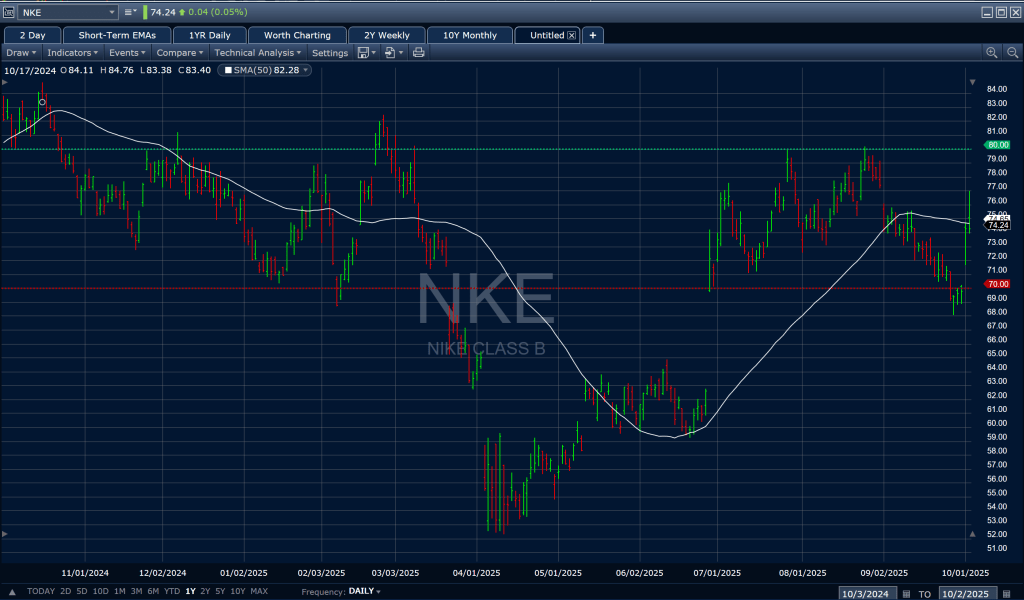

Nike (NKE)

This chart almost rolled over below $70 (red)… but a surprisingly positive quarter saved it. Not shown, but we do have a bullish-crossover of the 5-13d EMA, which bodes well in the short-term. If this can regain the 50d SMA (white), there is no reason NKE can’t make another run at $80 (green).

Idea

- Go long with a daily closed above the 50d SMA and play for a retest/breakout at $80.

- Call options: 1-3 months of time, strike price of $80. If NKE gets through the overhead resistance at $80, the breakout will be enough to cover your premium.

- Fade the positive quarter via puts or a put spread.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.