T5D Performance

| S&P 500 | -0.78% |

| Equal Weight S&P 500 (RSP) | -0.02% |

| NASDAQ | -1.22% |

| DOW | -0.57% |

| Russell 2000 | -1.51% |

Talk of the Tape

Although stocks ended the week marginally lower, neither initial claims nor PCE rocked the boat, as the majors continued their bull-market behavior: steadily moving higher, minting new all-time highs, and seeing dips get bought.

Week Ahead

Monday

- n/a

Tuesday

- Paychex (PAYX)

Wednesday

- ADP Employment

Thursday

- Initial Claims

Friday

- Payrolls

No Real Bear Case

Throughout the year, this market has done a great job climbing whatever wall of worry it encounters:

- Are tariffs going to reignite inflation and lead to mass layoffs, resulting in a recession? Hasn’t happened yet.

- Is immigration policy, DOGE, and AI going to lead to an increase in unemployment that generally results in a recession? Hasn’t happened yet either.

- Will hyperscalers slow AI capex? Zuckerberg just admitted he’d rather overspend by $100 billion than risk getting left behind. Oracle has tapped the debt market to keep up, as the company has now reported -$6 billion in free cash flow over the past four quarters.

Right now, none of these bear cases seem particularly compelling. It isn’t easy to identify legitimate negative cases beyond these. Sure, you can mention valuation, but valuation alone isn’t a bear case. At most, it can be used to argue that the market is priced-for-perfection thus vulnerable to bad news.

So here we are: the only bear case is that there isn’t one, which means whatever bad news shakes markets next has the potential to surprise us and be met with an overreaction.

To be clear, I am not backing down from S&P 7000 by year-end, but there are three months left. We could see a 5–10% move in the S&P 500 in October and recover by December 31.

Job’s Week

The first week of a new month brings new job data.

ADP Employment

Expectations are for private-sector job creation to print 40k, down from the prior 54k. While this number is important with respect to labor market implications, I will be looking at the Pay Insight section for insights on wages and inflation. In my opinion, the only barrier to a Fed cutting cycle is services inflation flaring up. As such, wage inflation remaining a nonfactor is more important to the market’s current consensus than the headline number.

Initial Claims

Thankfully, the last two weeks of initial claims appear to ratify the view that the 264k reported on September 6 was an anomaly due to an uptick in Texas. Consensus for this week is 228k. For comparison, last week’s came in at 218k.

September Payrolls

The key metrics for this report are headline job creation, unemployment, and wages. As far as the market is concerned, unemployment will be the metric used to ultimately update consensus on the labor market and the path of Fed policy.

- Headline job creation is expected to print 45k, better than the prior month’s 22k.

- Unemployment is expected to remain unchanged at 4.3%.

- Month-over-month average hourly earnings is expected to again print 0.3%.

- Year-over-year average hourly earnings is expected to tick 0.1% lower to 3.6%.

Net-net, bulls want to see the hiring-firing stasis continue, as such wouldn’t disrupt the current market narrative. However, in my opinion, stronger labor data is better for earnings, which is better for equity investors over the long term.

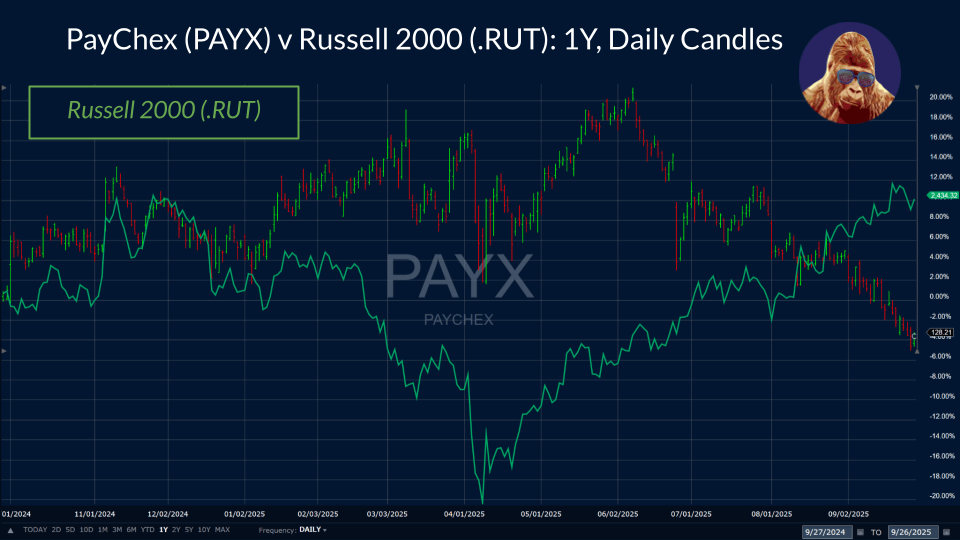

Welcome to the Party, Russell 2000

For the first time since 2021, the Russell 2000 (R2K) has finally managed a new all-time high on a closing basis. Coincidentally, Paychex, which handles payrolls and benefits for a wide swath of small- and medium-sized businesses across the U.S., reports this week. I expect PAYX — which does well when its customers, companies like those in the R2K, are doing well — to deliver a quarter that verifies the price action in the Russell 2000.

That said, the expectations implied by the price action in PAYX are not aligned with the optimism of the R2K. The divergence in the performance of the R2K and PAYX seems counterintuitive. Perhaps there is an opportunity for a long (bullish) trade on PAYX? I won’t be playing it, but I found it interesting enough to point out.

It is also notable that the R2K joining the ATH club is another form of Dow Theory confirmation. In my opinion, the price action here can be used to make a case that while there is indeed concentration in the S&P 500, it doesn’t mean the rest of the market is completely devoid of performance. If you zoom out beyond the 100–200 names that everyone knows in the S&P 500, the market is showcasing differentiation. Put another way, I view the current state of play as a market of stocks, as opposed to a monolithic stock market… which is an industry way of saying: stock pickers market.

Opportunities in this Market

As I alluded to earlier, everything that is easy and obvious — the 100–200 well-known names in the S&P 500 — is working. As such, you don’t need me to review them. No edge there.

Instead, I’ll make the case for a specific cohort of the market that isn’t loved by the masses and is hated by many… including myself at different points. Okay, hate is a strong word, but I once said there is no compelling reason to invest in this group. That said, I am about to lay out a trading case, not an investment case.

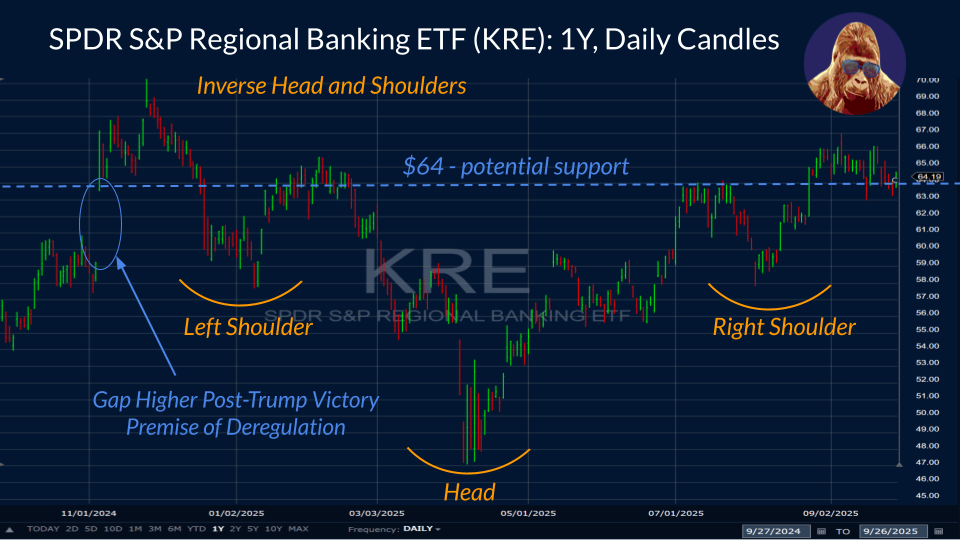

Technically speaking, the KRE has completed an inverse head-and-shoulders pattern and is ripe for a breakout. Currently, $64 — the level where it gapped up to after Trump’s electoral victory last November — appears to be becoming support. Assuming no change to the current narrative, it may only be a matter of time before the index seeks to join the ATH club with a move above $70. I think we see it for two reasons:

First, we got the Big Beautiful Bill, representing the deregulatory pieces of the bull thesis for the regionals. When we popped back in November, passing deregulation wasn’t necessarily a given. Now that we have it, bears can’t make the case Congress will block this path.

We also have a softer US10Y yield, which correlates better with mortgages than Fed Funds (the rate the Fed controls). A large part of the earnings thesis surrounds the notion that regional banks have more exposure to the mortgage business than the money centers, making the KRE a stronger play on refinancing than the XLF.

My pick is HBAN. Full disclosure: I am long. Perhaps it is nothing more than hometown bias: shout out to my friends in the 216 and 440. But another name I like in the space is Fifth Third (FITB). The 1Y charts look nearly identical to the KRE.

As for the trade: I am playing for a breakout to new all-time highs above $18.45. If we see that breakout, I’ll implement the 5d EMA as my stop-loss. For now, my downside stop is $16.75: the level the stock has broken out from twice in the last 3 months. In my opinion, losing that threshold suggests the story, at least in the short-term, has changed.

One final word on my position in HBAN: this is a trade. I am not in love with the fundamental story. I am suspicious that tech-enabled upstarts may siphon off some of the financial tailwinds attached to a refinancing boom, but market memory is strong, and the regionals should benefit as that narrative unfolds.

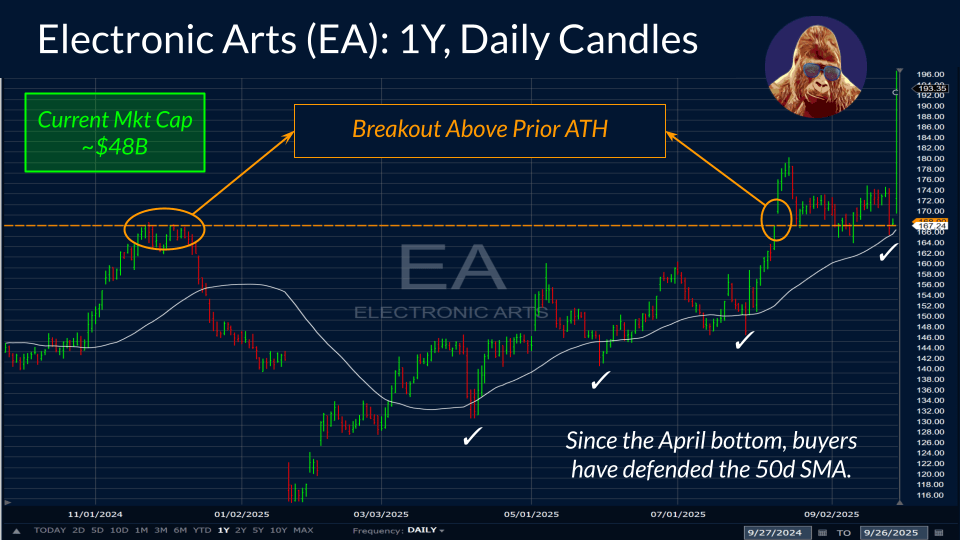

Trade Alert: Electronic Arts (EA)

I try to have a lesser-known stock top of mind to share with people when they ask me for a new idea. For the past week, it has been EA. In short, I believe the promising setup in the chart was investors attempting to get ahead of Battlefield 6’s potential to meaningfully improve the company’s future outlook.

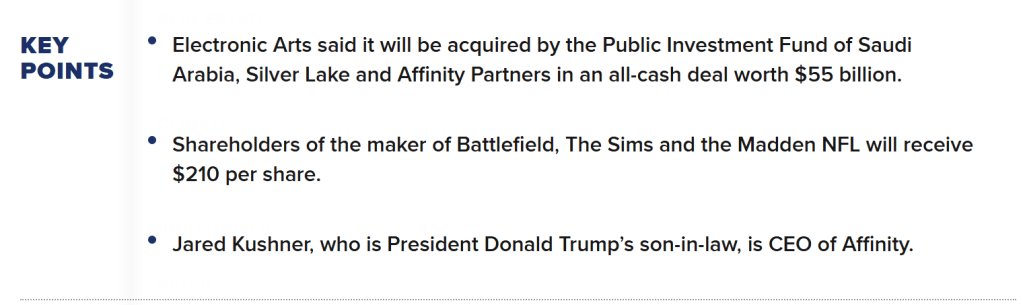

During a live edition of Charts and Checks recorded in the waning hours of Friday’s session, the WSJ reported that a consortium of investors was going to announce the largest leveraged buyout (LBO) in history to bring EA private for $50B sometime next week. The stock jumped to a valuation of around $48B, up 15%, on the news.

For those who were listening, you know that I rang the register, locking in the 11% gain after holding for only three days. Prior to the announcement, my position was based on a technical opportunity that aligned with a fundamental story. Now, it is an M&A opportunity with only about 4% more upside to the $50B take-private offer.

UPDATE

The go-private price has been reported at $210. The 5% pop from Friday’s close aligns with the $50 billion price target reported by the WSJ.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.