Good morning! It is 9:25 for the week of September 22nd, 2025, the stock talk pod publication that gets you ready for the open on Wall Street. It has been a very busy couple of weeks filled with personal obligations that deserved my undivided attention — weddings, bachelor parties, and the like. If I had put something together, it likely wouldn’t have been good for me to feel comfortable signing off on it and would’ve taken me away from those personal matters. I appreciate everyone’s patience and understanding. I expect to resume the audio/video format in mid-October.

This week, I am going to focus entirely on making the case for S&P 7000 by year-end. On Friday, I released a piece highlighting the importance of asset ownership to financial security. I felt this kind of analysis would complement it by showing that it still isn’t too late—or a worse time than others—to start investing if you have zero exposure.

S&P 7000

A Technician’s Take

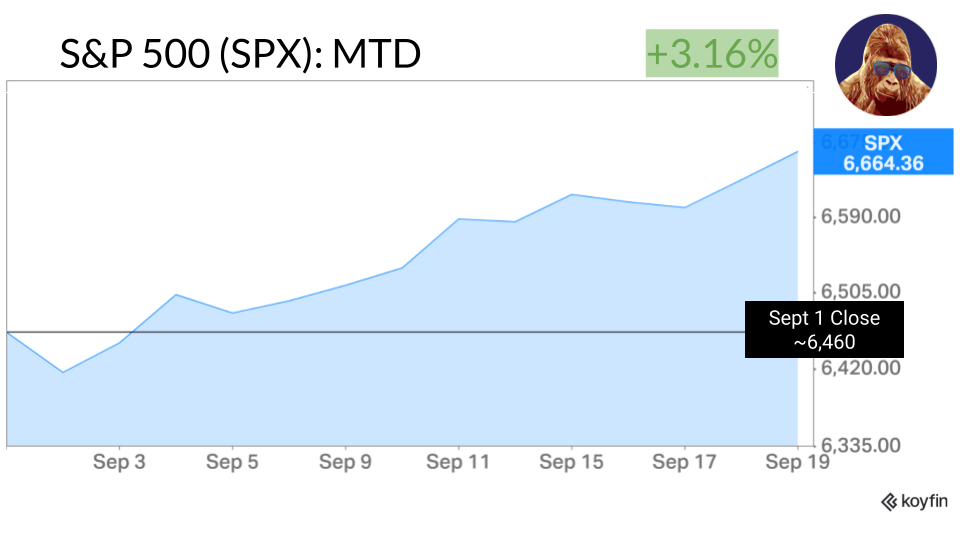

On the most recent edition of Charts and Checks, I asked my co-host Alvaro a yes-or-no question: Do you see S&P 7000 by year-end? His inner technician informed his answer: if we get through 6700, the door is open. For reference, the S&P 500 closed Friday at ~6,665. 7000 is only ~5% away.

An Industry Perspective

My understanding of the business of finance informed mine: Yes.

September is running out of time to live up to its seasonally bearish reputation. Professional managers who don’t have enough long exposure to this market will soon be forced to buy back in at higher prices. The career risk is too great. If you go into your quarterly (or annual) meeting in three months having missed out on a stock market where everything has worked, you will be let go.

On Thursday and Friday, a number of software and technology names—not even the speculative junk that showed the same behavior—were up between 5–10%. I see this as capitulation on the short side. The chase for performance may be beginning.

While I cannot say for certain whether we’ll close the year above that 7000 marker, I strongly believe the incremental demand for stocks caused by the “chase for performance trade” will be enough to drive another 5% before 2026.

The Data’s Input

While these qualitative takes are fun to discuss, there needs to be some quantitative data to back them up to make investment decisions. Thankfully, there is.

Much has been made of the “September Effect.” Since so much time has been spent on how bad Septembers have been, it’s only fair to investigate what stocks look like after a good September.

Since 1950, following a positive September, the median performance a year later has been +11%.

There have been 45 years (out of 74 from 1950–2023) in which September’s S&P 500 total return was positive. The median September return in those cases was about +2.1%, and the median forward 12-month return was about +10.9%. In 34 out of 45 instances (~75.6% of cases), the S&P 500’s total return over the following 12 months was positive (in the other ~24% it was negative).

Yes, there are some meaningful outliers to the downside, but the data is the data. Let’s assume the S&P 500 doesn’t blow the 3% cushion and end the month negative, applying that 11% gain to Friday’s close implies a 12 month price target of ~7400.

Furthermore, as per J.P. Morgan’s trading desk, “when the Fed lowers its benchmark lending rate [Fed Funds] while the S&P 500 is within 1% of its all-time high, the index soars on average by nearly 15% over the next year.” This almost makes too much sense. The market isn’t stupid. We aren’t at all-time highs for no reason. If the Fed were really too late, they would’ve cut 50 bps. In short, you have a scenario where the Fed is cutting into a non-recessionary backdrop. This is the manna-from-heaven scenario for stocks. Applying their 15% to Friday’s close, you land at ~7665.

Looking at the implied S&P 500 12-month price targets based on these statistics, 7000 by year-end 2025 passes the data-driven sanity-check.

Caveat Emptor

The S&P 500 is trading at 21–22x forward; the Nasdaq 100 at 26–27x. If there is a margin of error for stocks, it is GLP-1 thin. Despite the statistics suggesting a higher stock market twelve months from now, that doesn’t mean the path will be linear. However, two crucial facts remain: the Fed isn’t your enemy, and earnings are holding up. Barring a shade-of-gray swan event, that is a very difficult environment to sell into.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.