Employment is No Longer Enough

Over the last half century, the U.S. has gone from a robust combination of public and private support for retirees via Social Security and pensions to a landscape where the public arm may go insolvent by 2033 and the private arm has been replaced by self-directed accounts (401k/IRA/403b).

Concisely, the burden of financial security — especially in retirement — has shifted from the government and private corporations to the individual. As a result, a career as an employee alone is no longer enough to achieve financial security. You need to do more. You need to invest. You need to become an owner.

Diverging Economic Realities

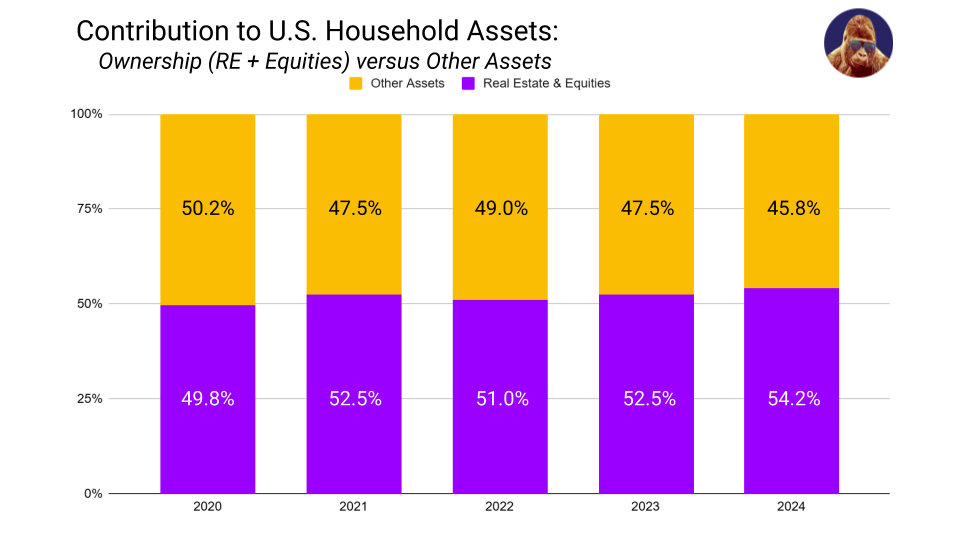

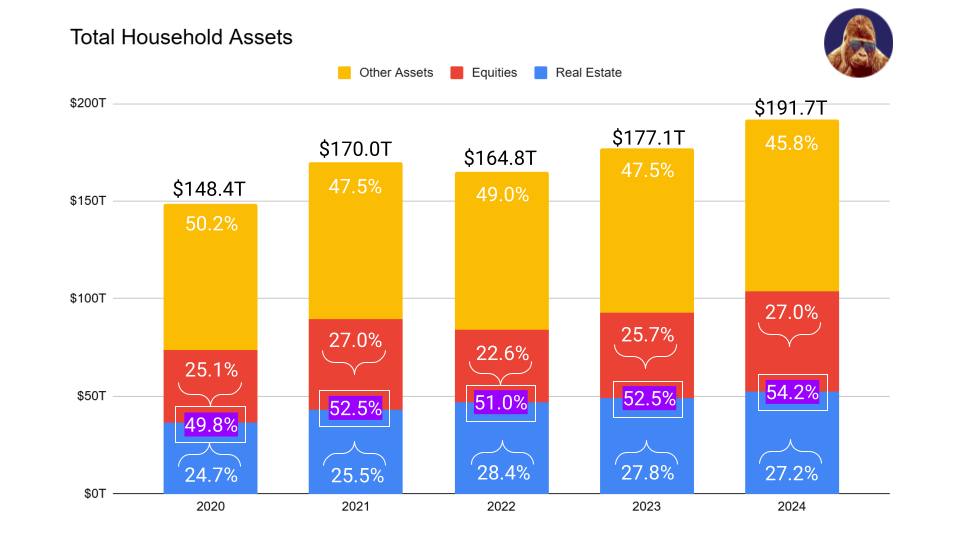

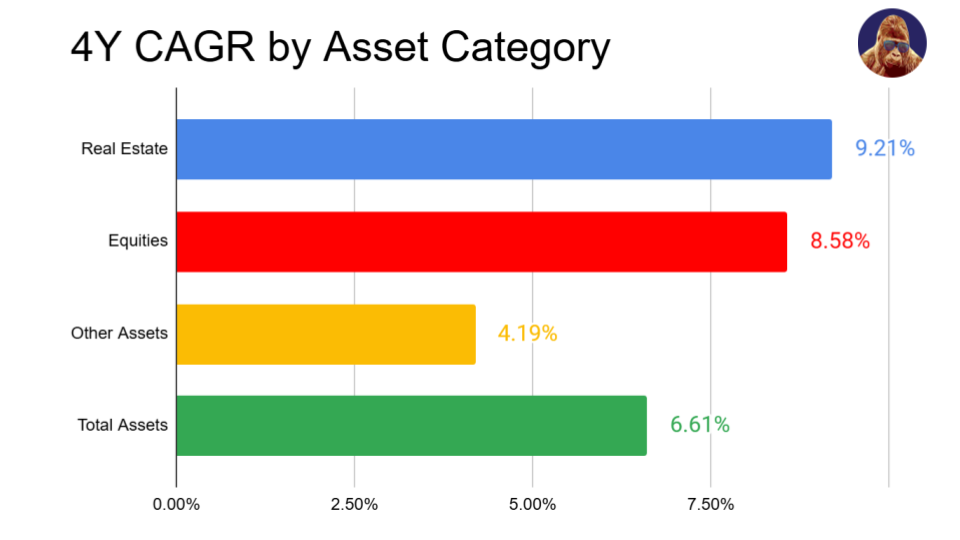

From the pandemic-year 2020 through year-end 2024, the contribution of real estate and equities to total U.S. household assets climbed from 49.8% to 54.2%. Put another way, the contribution from other assets shrank from 50.2% to 45.8%.

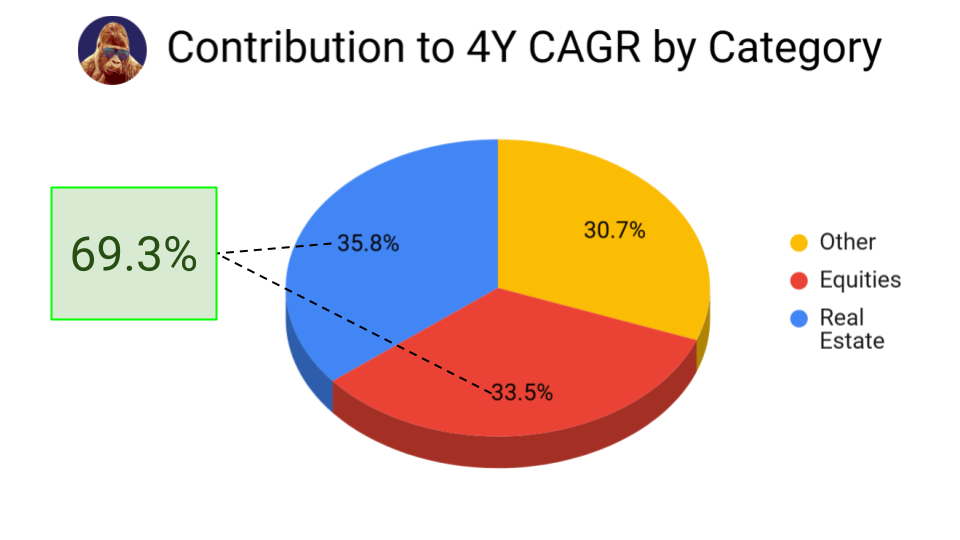

With respect to CAGR — compound annual growth rate — real estate and equities contributed ~70% to total annualized growth for U.S. household assets over the last 4 years. Furthermore, both real estate and equities have each grown more than twice as quickly as other assets.

While an equities and/or real estate market crash (or cooling) could lead to some trend reversion, this fact remains: owners have participated in a meaningful amount of passive asset appreciation that those only participating as employees have completely missed out on.

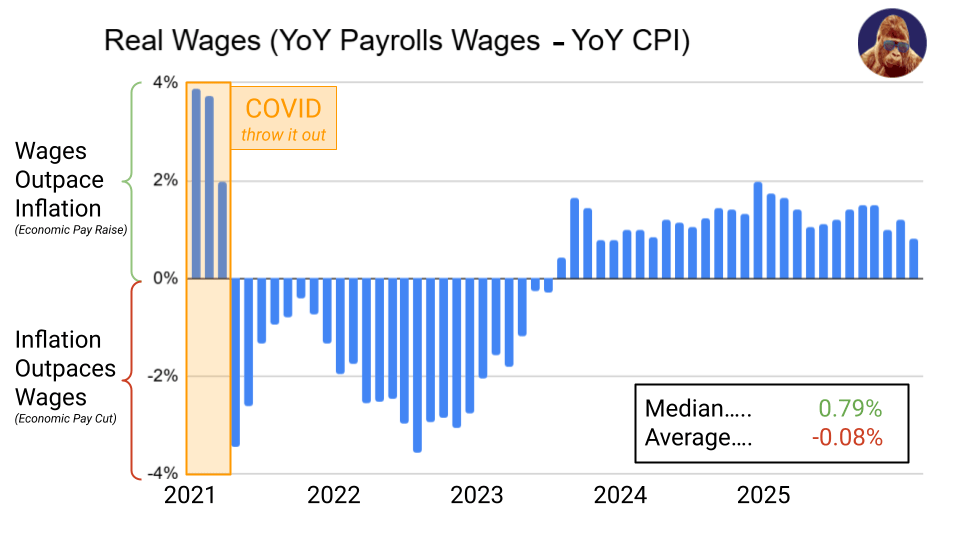

Combine this with the fact that wages have barely kept up (and by some measures have not) with inflation, and it becomes clear that employee-Americans live in a completely different economic reality than owner-Americans. As a result, I believe that wages alone no longer deliver financial security. Asset ownership is the way. It is no longer optional; it’s required.

The Ownership Class

As far as I am concerned, an owner is defined as one who has equity in an asset.

By this definition, you don’t need to own stocks in a brokerage to join their ranks. Here are a few examples of those in the ownership class without a brokerage account. You may be in and not know:

Paying down a mortgage? If so, you are building equity — a fancy word for ownership — in that property, which is an asset. You now benefit as the value of the property increases.

Application Approved.

Part of an employee stock option program? If so, you own equity in your employer’s company, making you a part owner of that asset. As the company grows, so does the value of your equity in the program.

Application Approved.

Buy physical gold or silver? Maybe you have bitcoin or ethereum in a cold wallet? You have been rewarded handsomely for doing nothing more over the last half decade.

Application Approved.

Contribute to a 401k, 403b, or IRA? You own stocks: the appreciation and the dividends. This doesn’t belong to your employer. You leave. They leave with you.

Application Approved.

Owners passively benefit as their assets grow over time. You don’t need to do anything more. That’s the beauty of it. If you don’t have assets, then you are missing out. And, as a bonus, ownership isn’t tied to your employer. The passive benefits of ownership naturally complement the active income you earn as an employee, and your equity doesn’t vanish if your job does. Instead, it provides a financial cushion when you need it most.

The Perfect Hedge

While on the topic of potential job loss, AI appears to be having a contractionary effect on the workforce. While new technologies have historically created more jobs than they displaced, the near-to-mid term contraction shouldn’t be casually dismissed. Owning shares of the companies driving AI disruption is excellent insurance against AI-displacement.

At worst, AI eliminates your position, but the capital appreciation in those shares buys you time to plan your next move. At best, you have ownership in a passive wealth vehicle that complements your overall financial position. A more perfect hedge doesn’t exist.

Ownership + Time = Security

Every dollar put toward ownership is a dollar that works for you. The sooner you join the ownership class, the sooner you stop depending entirely on a paycheck that can be taken from you and start building wealth that’s yours to keep.

Like Rome, financial security isn’t built in a day. In a world of instant gratification, it is easy to forget that every trophy requires a training ground.

Some people — through a combination of luck, bravery, and intelligence — have experienced rapid success by speculating in financial markets. Whatever “overnight successes” exist are likely not the same people building diversified portfolios, meaning the results between these two groups aren’t comparable. In my opinion, the former’s success isn’t any less legitimate — in fact, I believe their success is equally deserving of celebration — but it should be understood that the latter’s success is more sustainable and replicable.

Finally, it shouldn’t be forgotten that the true power of the stock market lies in compounding returns:

Compounding is the process where an asset’s earnings, from either capital gains or interest, are reinvested to generate additional earnings over time. This growth, calculated using exponential functions, occurs because the investment generates earnings from both its initial principal and the accumulated earnings from preceding periods.

Compounding — the secret to exponential growth — requires time. By its nature, wealth creation in the stock market isn’t an overnight ordeal. It is a matter of time, not a matter of timing.

Gorilla w/ a Tin Foil Hat

Not convinced? Maybe a conspiratorial appeal will reach you:

The biggest companies in the world don’t want you to own anything. They want to sell you everything as a service. This goes beyond the shift from physical goods to digital media.

- Don’t own music, rent it through Spotify, Apple, or Amazon.

- Don’t own movies, rent them through Netflix, Disney, or Amazon.

- Don’t own a video game, rent a library curated by Microsoft through Game Pass.

- Don’t own stocks, just rent them on the cheap with options or on margin through Robinhood.

- Don’t own a home, rent from a subsidiary of Blackstone.

- Don’t own a car, rent a ride when you need one with Uber, Lyft, or Waymo.

Everywhere you turn, companies want to sell you something without giving you ownership. Corporations – some of which have influence and resources greater than sovereign nations – clinging to ownership only underscores its value. Investors see it too. Many of the companies I listed above have performed extremely well, generating wealth for their stockholders.

To me, the case for joining the ownership class via stocks is simple: if owning the asset — the home, the car, the music, the movie — is out of reach, then the only alternative is to own the owners.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.