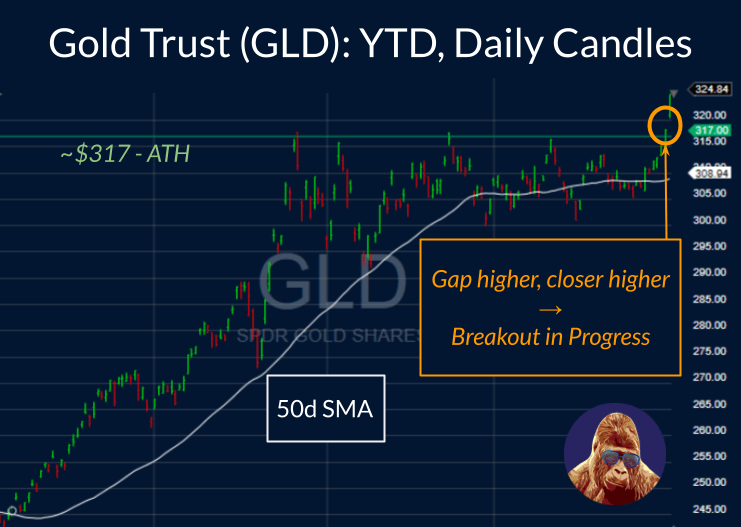

Gold (GLD) Gapped Up To A New All-Time High

… and wants to close higher.

August 5th, I identified two gold mining stocks as break outs in progress. If you’re interested in how I identified the opportunity and how to play that kind of move when it happens, give it a look. For those that are already privy to the trade, here’s how you play it now.

(Apparent) Catalyst: Deficit Concerns

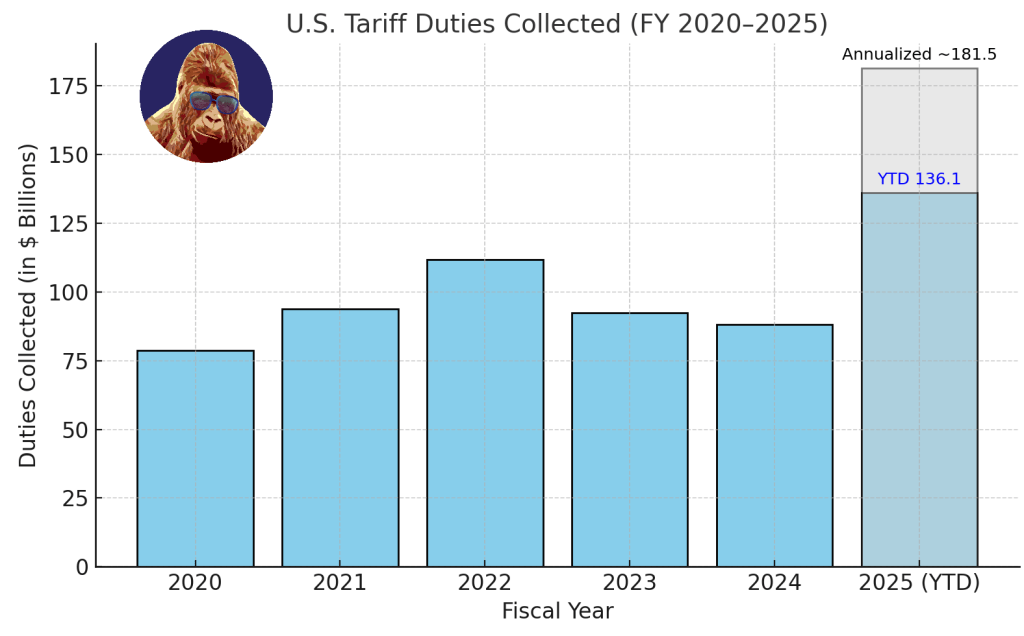

Over the weekend, an appeals court ruled most of the Trump-tariffs – importantly the the reciprocal tariffs – are illegal. While much has been discussed surrounding the implications of these tariffs, less coverage has explored revenues collected. Here’s a table of tariff collect for the full-years 2020-2024 as reported by the U.S. Customs and Border Protection (CBP):

- FY 2020: $78.8 billion

- FY 2021: $93.8 billion

- FY 2022: $111.8 billion

- FY 2023: $92.3 billion

- FY 2024: $88.07 billion

- YTD 2025: $136.1 billion

$136.1B in 7 months, already more than any of the prior years. Annualize that, and you arrive at $181.5 billion. While this is a drop in a bucket relative to the national debt of ~$37.7 trillion (with a T), this extra revenue was beginning to become considered a means to reigning in the much-talked-about, unsustainable path of the U.S. debt.

Market Reaction

This court’s ruling creates a world where the U.S. returns (repays) those duties to whomever paid them, thus yields move higher to reflect a worsening deficit outlook with the U.S. 30Y tapping 5%. That said, you could also interpret this move as a pro-growth/inflation move. An unceremonious end of the Trump tariff-regime should imply a cleaner growth outlook.

If you have made this far into the article, thank you! Ideally, it means you’ve learned what you need to know to understand the powers at play. Now, you’re reward:

What Now?

I have a nice trading position in AEM. So, now what?

“As for the upside, I plan on selling 25% of the position if gold breakouts as anticipated…”

Me, Last Month

At least for me, ring the register on 25% of the position. What is the point of a plan if you don’t stick to it? You shouldn’t get in the business of backing out of deals that you make with yourself.

What Next?

“… [use] a bearish violation of the 5d EMA as a stop for the remaining 75%.”

Me, Last Month

Shockingly, I am going to make good on this part of the plan too by rolling up my stop to that 5d EMA, reviewed on a weekly basis.

However, there is another, fresh way to look at this trade.

What If You Want In?

AEM

The Trade

Buy today and set a stop-loss for $140 or $144.

$144 wouldn’t kill the trade, but is a material level where AEM experienced follow through. Breaching $140 would suggest a material change in the market’s thoughts on the gold-trade.

To the upside, we’re in new all-time territory. It is completely up to you.

There is no historic level of resistance to point to, and the stock is above all moving averages. From a supply-demand perspective, demand is in control; there isn’t much supply (none historically) of AEM at $147 because the stock has never been there for someone to regret buying it.

KGC

In my opinion, this is the better option for a new trade. Relative to AEM, it trades with a higher beta to gold and has a more compelling technical setup. I am not long KGC and probably won’t do it. I already have a horse in the race.

With respect to the upside, the same rationale as AEM applies. All-time high means no long-time-bag-holders waiting with limit order wanting to get out. No supply to meet demand → price goes higher.

Long-Term Catalyst: De-Dollar-ization

There is a much more powerful, longer-term story powering gold, which is why I believe that these trades (and the commodity itself) still have room to run.

Newly rich countries (India, being the primary example) and established ones no longer want to be as reliant on U.S.-denominated assets as they have over the past 20-30 years. Why? Well, it goes back longer than the last two administrations, but let’s focus on recent history.

Tariffs have brought about a reboot of the Cold War Classic, M.A.D – mutually assured destruction – with less real nukes but very really economic ones. You don’t want your economy to be reliant on a country that seems less interested in maintaining a stable relationship and more likely to act in ways politely (and accurately) describe as mercurial and antagonist.

That said, a logical argument can be made that this trend was set into motion due to how the Biden-Administration handled Russia when they first invaded the Ukraine. The decision to freeze Russia’s U.S.-denominated assets forced many nations to analyze how their country would fare under a similar scenario. Many didn’t like the prognosis and looked to Putin as an example of how to survive.

The answer: a massive stockpile of gold and oil, assets free of political bias.

Not every country has access to oil within their borders nor does every country have the logistical means of creating a crypto reserve, leaving gold as the only place for governments to hedge. See the demand story unfolding? Gold is finite… and if you can convince yourself of this demand story, then the result is clear.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.