9:25 on 9/02/25 – Spooky Season

Charts and Links

Eco-Data Estimates:

Correction: JOLTs is Wednesday, ADP and Initial Claims are Thursday, Payrolls is Friday.

- JOLTs (July): Consensus – 7.4 million; Prior – 7.4 million.

- ADP Employment (August): Consensus – 75k; Prior – 104k.

- Initial Claims: Consensus – 231k; Prior – 229k.

- Payrolls (August):

- Job Creation: Consensus – 75k; Prior – 72k.

- Unemployment: Consensus – 4.3%; Prior – 4.2%.

- YoY Wages: Consensus – 3.7%; Prior – 3.9%.

- MoM Wages: Consensus – 0.3%; Prior – 0.3%.

Payrolls Panorama: What Data Looks Like In A Recession versus Today

Palo Alto: Not All Software Is The Same

T5D Performance

| S&P 500 | 0.03% |

| Equal Weight S&P 500 (RSP) | -0.26% |

| NASDAQ | -0.13% |

| DOW | 0.05% |

| Russell 2000 | 0.47% |

Talk of the Tape

Despite a blockbuster doubleheader of Nvidia earnings and PCE, markets ended the week similarly to how they started. No landmines disrupted consensus. Markets accurately priced-in what the hyperscalers’ quarters told us about Nvidia, and analysts nailed PCE estimates using inputs from PPI, CPI, and retail sales.

Week Ahead

Monday

- Labor Day Holiday

Tuesday

- Zscaler (ZS)

Wednesday

- JOLTs

- Salesforce (CRM)

- Dollar Tree (DLTR)

Thursday

- ADP Employment

- Initial Claims

- Broadcom (AVGO)

Friday

- Payrolls

Summary & Intro

Good morning. It is 9:25 for the week of September 2nd, 2025, the stock talk pod that gets you ready for the open on Wall Street. This week, I’ll get you ready for big jobs data, explain the brilliance of Nvidia’s guidance, showcase a clear signal of recession concern in the market, and precap the corporate quarters worth monitoring. Unfortunately, I will not have time to cover my sports bets for this upcoming NFL season, but I’m not that hard to find. If you’re curious, send me a text.

Unsurprised: Recap Last Week

Let’s start by quickly recapping last week. Despite what was truly a blockbuster main card featuring Nvidia’s quarter and PCE, no one was surprised by either. Nvidia put up a banger, PCE hugged the estimates. We knew Nvidia would do what Nvidia would do because the hyperscalers’ CapEx told us. PCE was informed by the related inputs such as CPI, PPI and retail sales. Things are as we knew them to be, explaining a relatively flat week for stocks.

Labor Data Overview

And, while that’s all well and good, this week is less likely to go smoothly. We’re at the beginning of the spookiest month for stocks, being September, and have a high stakes job weeks to welcome it in. Tuesday through Friday, the market will get a new piece of labor data to price in and adjust to. JOLTs, which has job openings, ADP employment, initial claims, and payrolls, in that order. You can find estimates for each in the associated materials below.

Although I am personally most interested in ADP, it is no secret that payrolls carries the most weight. At this point, given DOGE’s impact on the public sector, I am simply more interested in the dynamics of the private sector. In my mind, it’ll be up to decisions made in the private sector with respect to CapEx and workforce that ultimately decide where the economy is going next, because we know that the current administration has no interest in expanding government jobs, despite increasing the deficit through the big beautiful bill.

Payrolls Preview

That said, Payrolls is more likely to have the final say on price action, so let’s precap it.

I believe the consensus view, which would result in the least volatility, is for the data to confirm the hiring firing stasis. It would permit the Fed to cut in September without looking too late and leaves the door open for more than a single rate cut 9 (of 25bps).

Personally, I will be cheering for a rebound in this job’s data, which would suggest the hesitation, the hiring-firing stasis was only temporary. However, if we do get that result, I anticipate the market will react irrationally, selling off on the news, viewing it as an anti-rate cut development. But once the algos and weak-hands finish selling that, it would create perhaps the easiest dip in the world to buy.

The only outright bad scenario would be for this data to worsen, payrolls goes negative. It would suggest the Fed is already too late and won’t be able to salvage the economy from the damage already unfolding. In other words, the die is already cast. It’s too late.

In the interest of intellectual honesty, there is some nuance with respect to what payrolls should look like when accounting for the fact that the US is at decades low in immigration. I don’t want to spend too much time on this, but it is worth elaborating a touch further:

Let’s just say we have two equal economies and neither are in a recession. Suddenly, one of these economies stops allowing immigration. Through the lens of payroll’s headline job creation, we would expect the economy with immigration to look better than the one without, because the economy with immigration would have a higher supply of labor, and if you have a higher supply of labor, you have more people in your economy, meaning there’s more demand in that economy.

That doesn’t guarantee that the economy who halted immigration goes into a recession; what it does mean is that the expectations for “normal” job growth and “normal” job creation need to be adjusted for an economy that no longer features immigration.

All that said, we get a truly sour payroll print. Forget the nuance. The market will sell first and ask questions later. I’m going to attach some charts I didn’t release when I put out what I called a panorama on what payrolls looks like during an NBER recession. And, that will also include a snapshot of what the payroll’s data looks like right now. There’s not enough time to talk about it this morning. I’ll leave you to decide an appropriate level concern. You can find the link below as well.

Nvidia Recap

That is enough macro, let’s pivot to Nvidia and then we’ll wrap up with some upcoming earnings previews.

Going into Nvidia’s quarter, I was interested in three money metrics, margins, data center, and guidance. As for margins: the GAAP gross margins – which means the official number – printed 73.3%, rebounding from about 60. This is huge. The law of large numbers is going to prohibit Nvidia from posting a triple digit revenue growth number year over year, quarter over quarter, moving forward. So, in order to keep the bears off of Nvidia’s valuation, Nvidia needs to keep showing us that they can basically mint money at a 70 to 80% gross margin clip.

But that said, the revenue was still certainly impressive. Overall, was a beat 46.74 billion versus 46.06 expected. Data Center fell a touch short 41.1 versus 43.34. That said, guidance, which is really what matters, beat 54 billion versus 53.1 billion. Now, the interesting caveat to all of this is that these metrics excluded China sales. No H20s were sold in the quarter and management’s guidance for the current quarter we’re in assumes no H20 sales and that’s despite now having a license to sell it. So unless you believe that Nvidia will never make another sale in China again, you have to assume that data center segment wouldn’t have missed and that the overall beat on revenue and guidance would have been even bigger than it was.

As such, I view the quarter as an absolute banger. News of Alibaba producing a competitive AI chip did dog the stock to end the week, but this feels like a cheap imitation of the DeepSeek scare, and the limited market response verifies that view for me so far.

Savvy Behind NVDA’s ex-China Guidance

Now, before moving on to new business, I want to make good on my promise and point out just how savvy Nvidia’s management was by issuing guidance without China. In my mind, it boils down to three things.

- First, this allows management the perfect opportunity to issue a conservative guidance and be applauded for it, which creates a nice setup for an upside surprise next quarter without having to do anything necessarily heroic.

- Second, it forces Wall Street analysts to make their own China assumptions.

- Third, somewhat by extension of the second, by forgoing a China projection, it doesn’t create any leverage for DC to push Nvidia for a quick deal. No target for China means less pressure on Jensen to compromise any more than he views as economically pragmatic.

Zscaler (ZS) and Salesforce (CRM)

From an earnings recap to this week’s precap, on the docket we have two software companies, a read on the consumer and one of Semiconductor’s big three reporting.

We’re going to start with Zscaler and Salesforce. They will represent the software cohort this week. Zscaler is a cybersecurity company, whereas Salesforce is a customer relationship management company, which I actually, I’m sure you’ve probably heard of both of these.

Fair warning to understand this part of the conversation, you may need to read a piece I recently wrote relating to Palo Alto’s quarter where I talk about differentiating between winners and losers in the software space that’ll also be linked below.

So from where I am sitting, Zscaler is the kind of software company in the winners column. I’m of the opinion that the proliferation of AI means more cyber attacks, which means more demand for cybersecurity. Zscaler has a hybrid per-seat, per-usage model. In other words, their business model is already skating where the puck is going.

Salesforce position isn’t quite as fortunate. Currently, the perception is that a reduction in workforce associated with AI will meaningfully impact their fundamentals due to the predominant per-seat business model that they currently use. In other words, despite being a technology company, Salesforce isn’t a secular growth story. It’s levered to the economy. It needs a boom in hiring and business formation to be worth allocating to. Even if you were to remove the threatening implications of AI on the workforce, the state of the economy, which is clearly slowing and perhaps nearing recessionary levels from an historic standpoint, is a clear headwind for Salesforce.

Full disclosure, I’m long four names of cybersecurity. So, I’m just going to watch ZS from the sidelines, but it is finding support. If this reacts like CrowdStrike, and this is where you want your cybersecurity exposure, seems like a decent place to start a longer-term position. But, I am of the opinion that if you’re going to invest in something, you should choose best-in-breed, and that’s CrowdStrike.

As for Salesforce, while the bar, as implied by the stock’s price performance, is low enough for a meaningful upside surprise, I think that if the market has been wrong to punish Salesforce as it’s been punished, chances are you can miss the first leg up and still do very well in the name because there will be a lot, a lot of reversion to the mean that Salesforce needs to do. That said, if the market ends up being proven right to have punished it the way it is, it just feels like an excuse to sell even more of it. I would stay away and just let the quarter decide what you do with it if anything. And I am not long Salesforce.

Dollar Tree (DLTR)

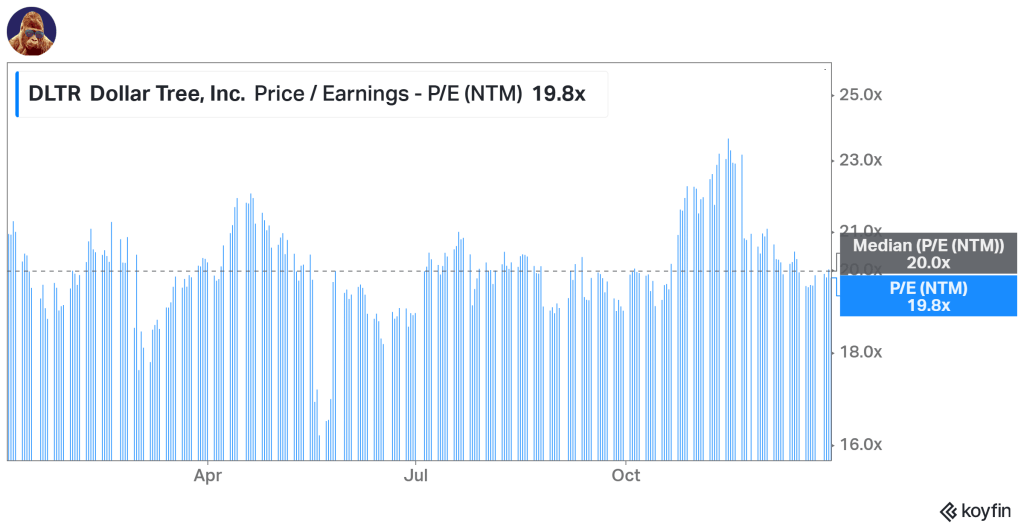

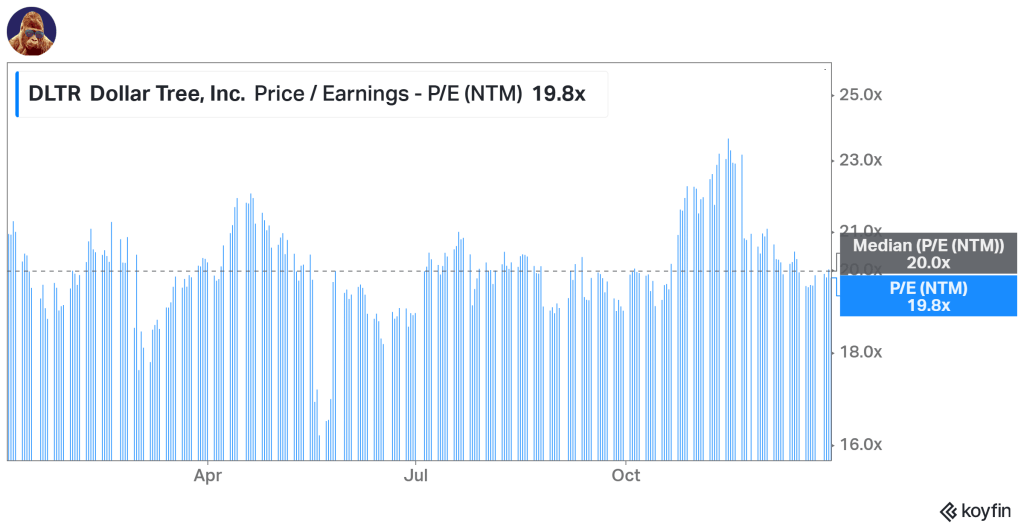

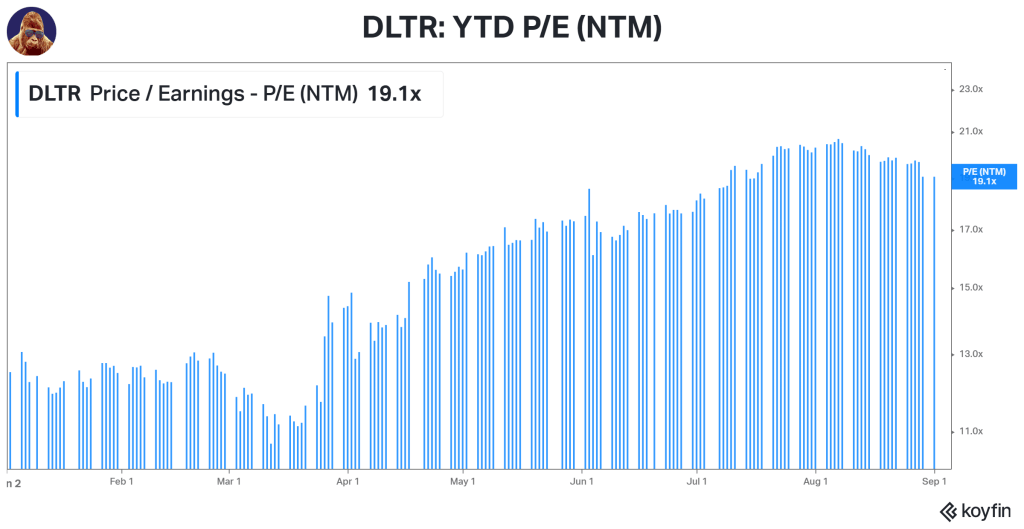

Next, we will touch on the Dollar Tree. Traditionally speaking, the better dollar stores are doing, the worse the economy is. The logic being dollar stores do better when consumers trade down to save money because they can’t afford – or don’t feel like they can afford – to go shop where they would normally want. I’m not going to spend a lot of time here going through the economics of dollar stores, but the movement in DLTR’s forward PE or next 12 months (NTM) PE is worth taking a look at.

In 2022, when recession fears associated with one of the most aggressive tightening cycles in history were particularly acute, the median forward PE was 20 times.

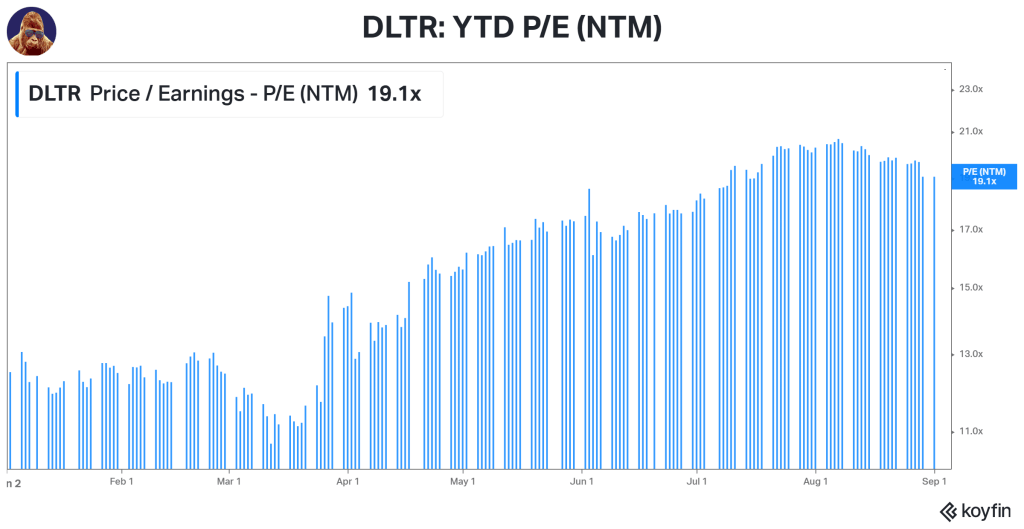

In 2024, when recession probabilities decreased as the year went on, that metric compressed from 20.4 to 12.8, landing the median at 15.4.

The takeaway is that when investors are worried about a recession, they pile into Dollar Tree. When the investors aren’t, they jump ship.

Right now, it trades at 19.1x forward, but did manage to achieve a plus 20 multiple. In the most recent episode of Charts and Checks, I mentioned there are market signals suggesting pockets of economic weakness. Dollar Tree trading at an elevated valuation is plainly one of them.

I do apologize for not providing something actionable here, especially because I made you listen to one of my rants, but guidance and price action from Dollar Tree are more important than any trade. Furthermore, I’m not sure that Dollar Tree will perform as it has in past recessions due to what tariffs mean for the business’s ability to maintain a low price point and or protect margin because they import many of their goods from overseas. It’s not a business I would want to own, so it’s just not a business I’m ever looking to invest in. Of course, you could trade it, but again, I think that right now the interest in Dollar Tree is based on muscle memory and not on a thorough thought process of what a recession associated with tariffs and inflation would look like for that company.

Broadcom (AVGO)

And we will finish up with Broadcom. For reference, I am long Nvidia, TSMC, Broadcom, and I have a very small position left in Micron that I’m in the process of liquidating. It was a trade position. I’m just following the technicals and my discipline.

Broadcom is probably the number two AI GPU vendor to Nvidia. Most notably, they’re partnered with Google to make what I understand is called a TPU, a Tensor Processing Unit. From my limited understanding, this is a custom AI chip made specifically for Google and Alphabet… or well, they’re the same company. Given what we know about Google’s CapEx and what we saw out of Nvidia’s guidance, there is a lot of reason to be optimistic. Furthermore, thanks to the acquisition of VMware completed in late 2023, Broadcom has a substantial software business to complement the hardware business. Speaking of, the hardware business does include some ex-AI end markets, which thanks to Marvell’s recent report, we have some confidence in the process of bottoming.

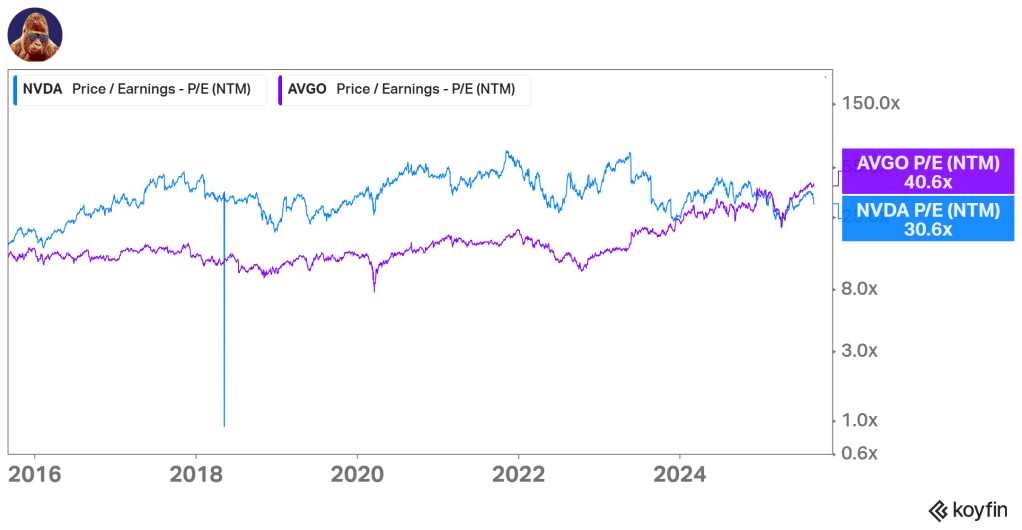

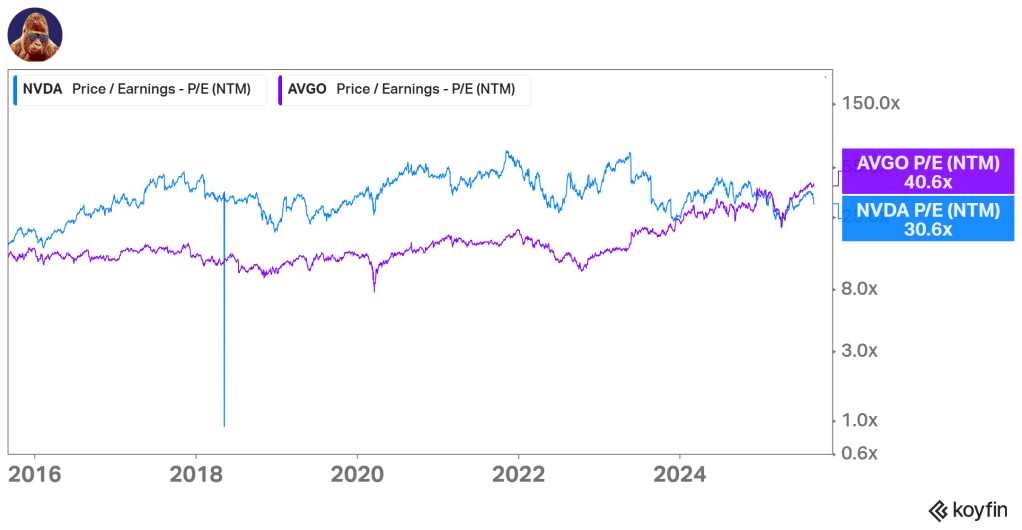

Clearly, I’ve laid out a very solid bull case for Broadcom. I’m expecting a big quarter, but so is the market. It’s trading at 40 times forward. That is 10 turns higher than Nvidia.

That said, ever since the tariff tantrum, the market has awarded Broadcom a higher forward multiple than Nvidia, which is a notable departure from the last 10 years of history. In my opinion, this is indicative of the market assigning a higher degree of tariff risk, or maybe China risk, to Nvidia more so than Broadcom; but, that’s simply my theory. From a technical perspective, the stock took a steep hit, one of the steepest hits I think actually, after Alibaba claimed to be producing a competitive AI chip and is probably going to test that 50-day SMA.

If this is a business usual quarter and we see a sell off, I would anticipate support coming in between $250 and $265. If we get there, I’ll be tempted to add some, but if that level fails, wait to see what happens at the 150d SMA.

Outro

That is all the time we have today. Thank you so much for stopping by. Hope to see you next week. Good luck on the markets out there.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.