9:25 on 8/18/25 – Punching Above Your Weight

Charts and Links

T5D Performance

| S&P 500 | 0.85% |

| Equal Weight S&P 500 (RSP) | 1.39% |

| NASDAQ | 0.72% |

| DOW | 1.73% |

| Russell 2000 | 2.69% |

Talk of the Tape

The worst PPI print in 3 years provided the first indisputable sign that tariff inflation may be building in the pipeline. This materially complicated the case for a cut in September and generated a risk-off rotation.

Week Ahead

Monday

- Palo Alto (PANW)

Tuesday

- Home Depot (HD)

- Toll Brothers (TOL)

Wednesday

- FOMC Minutes

- Target (TGT)

- TJX (TJX)

Thursday

- S&P PMIs

- Walmart (WMT)

Friday

- Jackson Hole

S&P Flash PMIs for August

- Consensus for Services PMI is 53.3, slightly lower than the prior month’s 55.7.

- Consensus for Manufacturing PMI is 49.9, flat relative to the prior month’s 49.8.

TLDR; See Closing Thoughts At The Bottom

Full Transcript

Good morning, it is 9:25 for August 18th, 2025. This is a stock talk pod that gets you ready for the upcoming week on Wall Street right in time for the open. And this is not a show about the Browns preseason unfortunately, because man, it’d be a really fun topic right now. That aside, in this edition of the brief, we’re gonna be talking about the fallout from the worst PPI inflation reading in three years, what to expect on Friday at Jackson Hole, and previewing corporate earnings that punch well above their market cap weight.

Hottest PPI in 3 Years and Implications

Let’s begin with the hottest PPI inflation read since June, 2022. First off, it certainly complicates the easy case for a Fed cut. As a leading indicator of consumer inflation, this toasty PPI print is the first piece of conspicuous, no-brainer, in-your-face, evidence that there is in fact tariff inflation making its way into the economic pipeline.

The question is now: Will it show up in consumer inflation? Will companies eat the cost or will it be passed down. Despite this, let’s just call it concerning counter-consensus data point. The S&P 500 closed the day in the green courtesy of really what can be classified as nothing other than a graceful rotation to defensive tech or the tech staples.

I’m talking about the mag seven. Names like Spotify and Netflix, as well as some “higher for longer” beneficiaries, like the money center banks that make a little bit more money on the net interest income when they’re able to take their customer’s deposits from their checking account and invest them in short-term treasuries. I’m talking about Bank of America, JP Morgan, Citi Bank, you, you get the idea.

This graceful rotation as opposed to a complete washout, in my opinion, is best explained by two potential outlooks. The first is that the market sees tariffs as a one-time price increase that will not be the start of some sort of uncontrollable trend higher. If you could get comfortable with the idea that tariffs are gonna be one time, that allows you to take the position that companies will be able to adjust after a period of what would likely be demand destruction, as consumers need to reallocate their budgets accordingly.

The second – and I think this is more likely – that due to the abnormalities beneath the surface of this PPI print- there was a lot of weird service stuff; it wasn’t entirely due to tariff sensitive areas- and this PPI series has a history of pulling the occasional head-fake that the market is taking this PPI as one data point and one data point only, and not the start of a trend.

Rate Cut v Rate Hold Days

We’ll get to test this if/when we have another counter-consensus data point. Until then, you need to be prepared for “rate cut” days and “rate nothing” days. I’m just making these terms up, but a rate cut day would feature small mid-cap- your Russell 2000, your Russell, uh, Russell growth, your S&P 600- for example, the homebuilders like Lennar, DR

Horton, the regional banks – like Huntington – or some industrials leading while technology is lagging a bit. And the major indices would probably just be kind of choppy, but you’d see the Russell 2000 outperform and you would see the equal weight S&P outperform.

The opposite will occur on rate nothing days, where you’ll see a lot more stocks in the red, like say 65, 70% of things on your screen will be red, but the remainder will be those tech stocks that make up such a heavy weight in the index that you’ll see S&P 500, the Nasdaq and the Dow outperform. Whereas you’ll see the equal weight S&P and the small caps underperform. So, just be prepared for that. These kind of rotations are healthy. It shows you that the market is trying to identify winners and losers instead of just declaring everything a loser.

Jackson Hole and Eco Data

Of the three macro items highlighted, we got Jackson Hole, and that’s really all that matters.

I know we’re gonna get the Wednesday FOMC minutes, but anything that comes out of that is gonna be viewed as stale given the revelations of payrolls and PPI that have meaningfully changed the macroeconomic conversation.

On Thursday, we’re getting flash services and manufacturing PMIs for August, so it’ll be our first look at services and manufacturing activity for August. It could trigger a rate cut day if it’s soft. I’m not sure if I necessarily agree with the logic there, but either way, no matter which way we get a response. I feel as though the market will trade back to neutral ahead of Powell’s speech the next day.

And speaking of, I see one of three likely scenarios coming out of Jackson Hole and I’m kind of covering on my bases.

So we’ll call this, we’ll call this quite the intellectual hedge.

The first and the most likely: I feel he’ll set us up for a hawkish cut. Now let, let me explain that because a cut is obviously dovish. How? How could one cut in a hawkish manner? Well, here’s how the Fed will lower interest rates 25 bps; and then signal that there’s gonna be a less accommodative approach to future rate cuts. In other words, it’d be one and done. The reason this could be troubling is that it could draw comparison to the 1970s Fed approach of “stop and go” policy, which did not end well.

And the second scenario is that he’s just going take it off the table. He could go up there and say, listen, I was right to be as patient as I could to wait for the impacts of, or any potential impacts of inflation. PPI saw it. And that to me, as a leading indicator of inflation, tells me that I need to keep waiting. And, you know, hey, maybe if we don’t see it, then we can talk about cutting again. But, until I am certain that there is no huge inflation, flare, waiting in the pipeline, I’m not cutting anything.

And then third and finally – I consider this to be the second most likely, the taking it off the table thing just doesn’t seem realistic to me; and if it did, it would cause quite the downside – he could also use Jackson Hole, as other Fed presidents and even Powell has in the past, prior to 2023, to talk about broader range topics.

He could maybe make it a speech to his successor. He’s obviously not going to be asked to serve again. He could talk about the importance of Fed independence.

He can maybe talk about the changing role of interest rates in an economy that is less sensitive to interest rates now than in past; or maybe how he views inflation dynamics in a world that for the first time in 30 years is becoming less global.

You get the idea, but to summarize, I feel as though consensus for Jackson Hole is he sets up for a hawkish cut as difficult to needle as that would be to the thread.

Consumer Earnings

With that, let’s go ahead and talk a little bit about earnings. This is definitely a week where there’s not a lot of big names as far as index weight goes, but we’re talking about sectors that punch above their weight.

For example, we’re going to get Walmart, Target, and TJX. This can provide really good detail on consumer behaviors.

With respect to expectations, it’s highest for Walmart and TJX just because the stocks have done so well. There’s a symbolic power to consumer names doing well. It’s really hard to make a case that the consumer isn’t doing great. If Walmart is at a 52 week high, it’s hard to say the consumer is at a 52 week low.

Now, on the other hand, we have a company like Target where the situation couldn’t be more different. Ever since we’ve come out of COVID, they have done a terrible job executing; the stock shows it.

So, I actually view this as an interesting call option on consumer sentiment. Well, let’s imagine that right now we get the report from Target that shows there’s a real turnaround, real resurgence in their business. There is absolutely no way that could happen if we’re witnessing consumer decay. Now that said, I wouldn’t count on it.

It’s certainly more important we see a robust report from Walmart, and if it’s down a little bit, it’s down a little bit. But as long as the numbers and commentary are good out of Walmart, I think that’s the most important of the trifecta. We can feel pretty good that we are in fact in a hiring and firing stasis, but consumers have yet to react to it in a way that impacts their spending.

And think about it, if you had a neighbor that got laid off or fired. You might think about your own job security and start acting preemptively even if you don’t have any real reason to worry.

Homebuilder Earnings

With that, let’s move on to the housing space. We’re getting Home Depot and Toll Brothers. These are clear rate cut place to me.

The reaction these stocks have to their quarters is gonna be worth more than anything. If these homebuilders put up, so-so reports – and this earning season, if you’ve done that, you’ve been crushed – but let’s just say they stay afloat or even rally, that would be an indication from this segment of the market that those people in those stocks believe a rate cut’s coming in September.

Just think about it: you get a bad quarter or a shaky guide from Home Depot or Toll Brothers that rely on housing activity, and the stock rallies anyway, despite what we’ve seen in other circumstances. That would be the market not believing the guidance saying, “Oh, well this guidance doesn’t account for a rate cut that could spur a lot of that activity.”

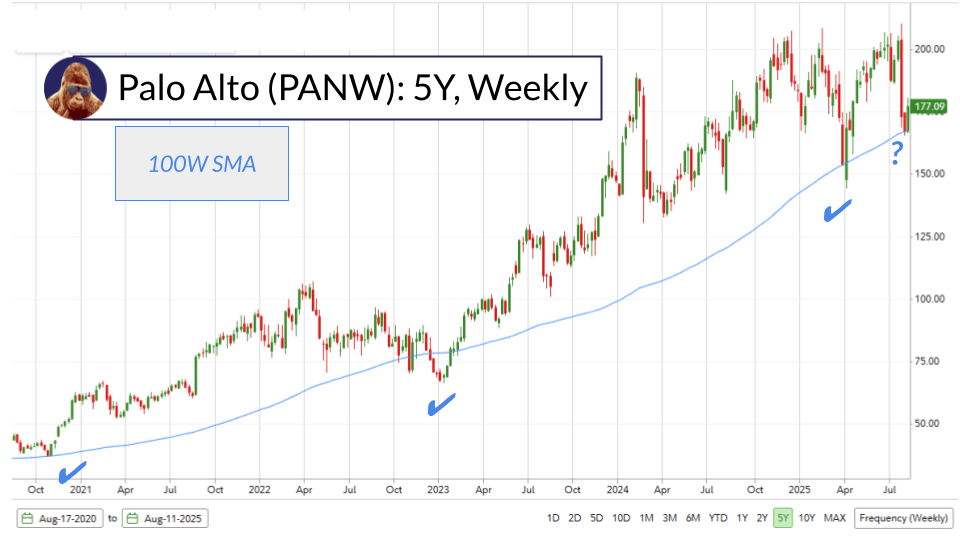

Palo Alto (PANW) Preview

We’re going finish up here with Palo Alto. It’s been defending the a 100W SMA well. This is the one chart I’m going to show you guys. It’s been a reliable level of support. If you bought in this area, you didn’t have to wait long to be rewarded. As such, I’ve been putting some of my regret minimization cash pile to work here, and I feel pretty good about the setup going into it.

I should also mention about CyberArk, as well. There’s a cash and stock deal for Palo Alto to buy them. So I’ll get $45 cash and I think two and change shares of Palo Alto for each CyberArk share I own. I like the idea of putting some money into that merger. I think it’s gonna get approved and I think it’s going to benefit Palo Alto.

Courtesy of Fortinet, which actually caused part of the pretty big decline you see in Palo Alto, the expectations are much lower than they were. This might be the first time in a while Palo Alto’s going to a quarter after getting slammed, like 15, 20%. I understand that some people looking at Palo Alto -and it was the market response- are concerned that they’re going to have a Fortinet-esque quarter.

I don’t think you have to worry about that with Palo Alto because they already had that quarter. It was the second quarter in February of 2024. And they were in the midst of transitioning their business model to look more like CrowdStrike – more hybrid, more cloud – which you can tell from the stock since that decline has worked out really well.

This is going to be maybe not the most controversial thing I’ll say, but maybe the most interesting or bold: I think the market for cybersecurity might be larger than that of AI because the economic environment doesn’t matter. No company… especially the huge ones that Palo Alto serves can afford to cut cybersecurity. You just can’t. We live in a country where if there’s a breach, you need to report it and make it public within a week or two if you think it’s material now. There’s no bar for that; the company just has to make a decision. And, when you live in that world, you need to be transparent about what’s going on. As a result, you need someone to help walk you through that part of the process and/or hopefully stop you from ever having to go through it.

To precap this print: I’m expecting a business as usual kind of report, and, with the expectations as low as they are, I think that invites an upward surprise. Knock on wood with me.

Closing Thoughts

So let’s just recap it all.

- We have big consumer names and housing names that impact sentiment more than the S&P 500 earnings: these are all worth monitoring.

- We have the potential for Palo Alto to stop the bleeding in the cybersecurity space that has been caught up in the “sell-software buy-hardware” trade. People are lumping cybersecurity together that that’s wrong.

- We have a live meeting on Friday at Jackson Hole.

For traders looking to play, or investors looking to put money to work, this is how I would look at the week:

Understand that anything you do Monday through Thursday might be really hard to justify or make you look like a genius.

Friday is setting up to be a binary event. Take for that what you will.

For me personally, it means that I’m gonna wait for the market’s reaction. In 2022, Jackson Hole was the event that eventually led to the bottom in October. If he just goes full hawk – we’re not cutting – this could be the start of a more serious pullback, which again, would be healthy.

Good luck on the markets out there this week. I’ve given you everything I think you need. Thank you for stopping in, and I hope to see you bright and early next Monday morning. Goodbye.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.