Producer Price Index (PPI) came in 🌶️ Habanero Hot 🔥

Year over year:

- Headline: 3.3% actual vs. 2.3% prior

- Core: 2.8% actual vs. 2.5% prior

Month over month:

- Headline: 0.9% actual vs. 0.2% estimate

- Core: 0.6% actual vs. 0.3% estimate

Who Care? What Does It Mean?

PPI measures inflation at the wholesale level. It is what wholesalers are paying. It is considered a leading indicator for consumer inflation. This print implies that once vendors sell through their tariff front-running inventory, they will have two options for handling goods purchased at higher prices:

A) Raise prices for consumers, which will eventually show up in CPI and PCE inflation.

B) Absorb the costs, which will compress margins, negatively affecting earnings.

C) There is no C.

Despite a fairly compelling bear case, equity futures aren’t off as much as I thought they might be. Maybe this turns into a bona fide sell-off; but if it doesn’t, here’s what the bulls can hang their hats on:

- One data point doesn’t make a trend.

- Yes, this is a hot print, but it doesn’t mean a trend is forming; it could be an aberration.

- The stock market is not the economy.

- And a majority of S&P 500 earnings and market cap is tied to an acyclical story: AI.

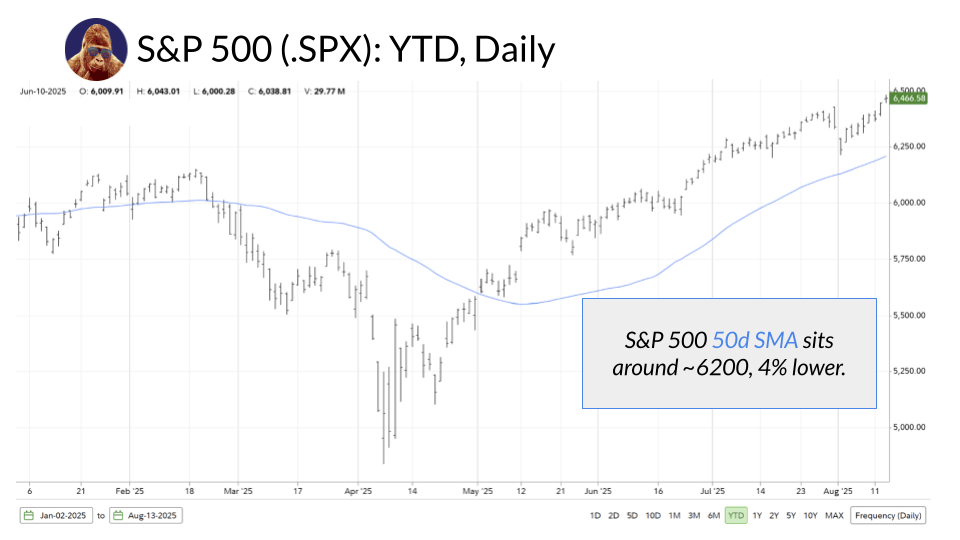

If this gets messy, I see this permitting a retest of the 50-day SMA, which sits around 6,200 — about 4% below yesterday’s levels.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.