Woke up Monday morning feeling a little sick and didn’t feel up to recording. But, I had to make good on my promise to provide a little something on the companies I mentioned in 9.25 on 8.11.24 that weren’t pressing enough to make the cut.

As promised, let’s take a look at the setups for Cava (CAVA), Brinker International (EAT), and Applied Materials.

This Market Is Worried About Discretionary Spending

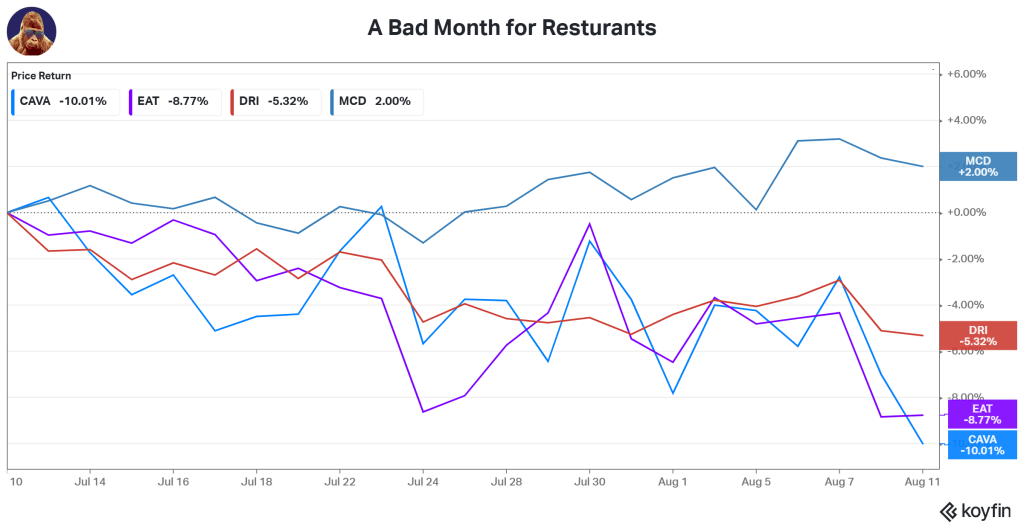

We’ll start with CAVA and EAT because of the shared narrative: concerned about discretionary spending. This last month, money has fled the restaurant space. Here’s a look at some of my favorites in the space that have been absolutely crushed during this capital flight:

I left out Chipotle (CMG) and Shake Shack (SHAK), which are each down ~25% over this period on earnings… Albeit for different reasons: CMG went into the quarter at a depressed level and disappointed further; SHAK went into the quarter at a new all-time high and just did not do enough to validate the optimism embedded in the price. And… we don’t talk about SweetGreen.

Back to business. Check out how these rank:

- McDonalds

- Darden – Olive Garden, LongHorn Steakhouse, Yard House, etc…

- Brinker – Chili’s and Maggiano’s

- Cava

Okay, let’s look at the list another way:

- MickyD’s extending the $5 Meal Deal limited-time offer

- Olive Garden’s “Buy One Take One”; LongHorn’s “2 for $25” & $8.99 Steakhouse Lunch Plates

- Chili’s “3 for Me” combo starting at $10.99

- Cava… average price per bowl ~$16 (for not as much food as any of the above).

Is anyone else getting hungry? Just me? I’ll continue then.

The market is rewarding companies that offer compelling prices on a lot of food.

How pragmatic is the market? Dining out is one of the first places a budget-strapped household can cut costs. Why leave capital in these stocks? The consumer doesn’t need to fall off a cliff to become budget-conscious enough to start doing a little more home cooking. This risk-reward isn’t appetizing.

Since you’ve read – or scrolled – this far, you’ve finished your veggies; you can have some charts for dessert.

Cava (CAVA)

Not interested in this one.

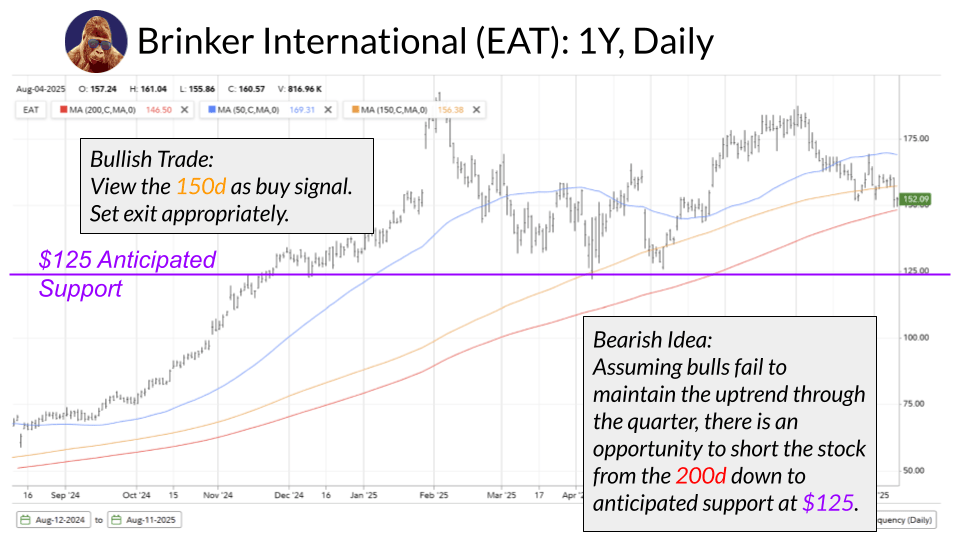

Brinker International (EAT)

Interested in this one, to both the upside and downside.

Chip-Shoring

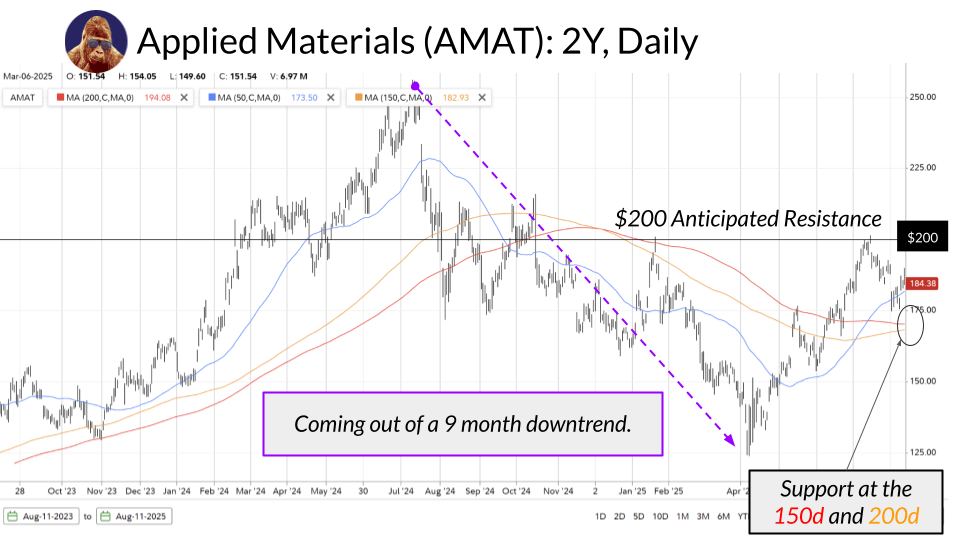

We’ll finish up this food-forward note with some chips. By now, most are familiar with Nvidia, AMD, Broadcom, and Taiwan Semiconductor. Applied Materials (AMAT) is one of the few companies – alongside the likes of Lam Research, ASML, KLA, etc… – that makes the machines used to manufacture semiconductors.

While we can’t seem to land on a name for this trend – creating supply chains for meaningful industries within a nation’s border (re-shoring) or within the borders of an allied nation (friend-shoring) instead of relying on rivals and/or adversaries – it is happening for the semiconductor industry and benefits these specialty vendors.

Take Taiwan Semiconductor’s (TSM) foundry project in Arizona. As TSM plans their fab footprint, they’ll be making calls to a number of these manufacturers to get all the equipment necessary – some of which the size of school buses – to bring these fabs to life. These orders translate into revenue that wouldn’t be made if not for the reshoring macro trend.

Applied Materials (AMAT)

Although I have enough semiconductor exposure, I am tempted here. If the stock can make the 8.5% march to $200, then it could attract some buyers.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.