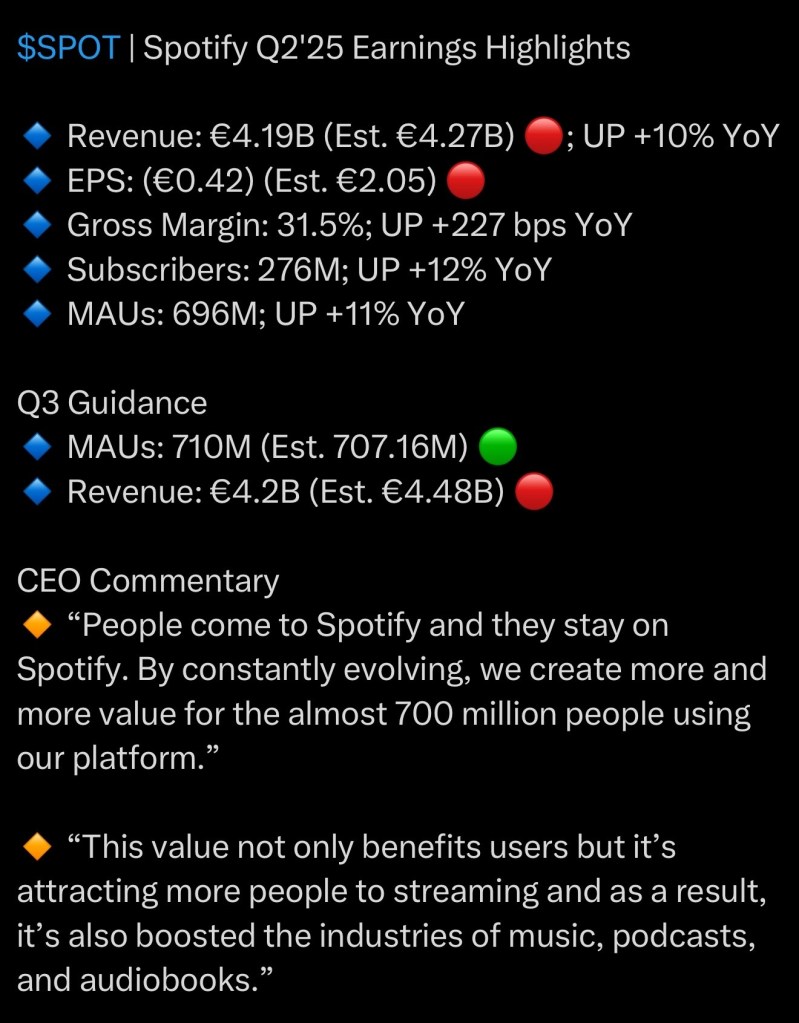

I said I’d buy more Spotify if they put up a Netflix-esque quarter and sold off anyway…

Got the sell-off, but not exactly the quarter. As a result, the stock is looking down ~7.5% in the pre-market. Eh, growth stock. Feature not a bug. These things happen.

The silver lining? MAUs

Monthly active users (MAUs) came in strong and beat expectations. If that number had disappointed, then we’d have a real issue because it would suggest a broader problem with the platform. But, thankfully, that is not the case. People are still showing up and sticking around. Managements new objective is to do a better job converting those users into paying subscribers.

Restaurant Analogy

It’s like a restaurant missing on revenue/earnings but beating on foot traffic. The concept’s clearly working; people are coming in the door. We just need to improve the menu/pricing to boost what each visit is worth.

Now What?

For me, buy the dip. I view MAUs as a leading indicator for revenue. The business is working. All that is required is some fine tuning. That said, Spotify went in, even after a 10% decline, at a premium valuation. This was not a premium quarter. The stock will need to lose a a little of that premium, which means the price needs to come in. Assuming the -7.5% reaction holds, Spotify will be down ~18% in a month (almost a bear market). I don’t think there needs to be much more downside, but I am giving this the 3-day rule: I’ll revisit this at Friday’s close. If the stock has managed to stop bleeding or – better yet – recovered some ground, then I’ll dollar cost average into the name.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.