Charts & Checks EP3 – MSFT, HOOD, COIN

Week Behind

Weekly Performance

| S&P 500 | 0.99% |

| Equal Weight S&P 500 (RSP) | 1.65% |

| NASDAQ | 0.35% |

| DOW | 0.93% |

| Russell 2000 | 0.29% |

Talk of the Tape

The majors rose gradually, but that masked a week marked by sharp earnings moves and notable short squeezes. Equal-weight outperformed the S&P 500, indicating gains were driven by rotation and breadth expansion as opposed to AI-led concentration.

Week Ahead

Monday

- n/a

Tuesday

- JOLTs

- Spotify (SPOT)

Wednesday

- ADP Employment

- GDP

- FOMC

- Meta (META)

- Microsoft (MSFT)

- Robinhood (HOOD)

Thursday

- PCE

- Amazon (AMZN)

- Apple (AAPL)

- Reddit (RDDT)

- Coinbase (COIN)

Friday

- Payrolls

Macro Movers

Fed Week, Earning’s Market

As you can tell by the calendar, this is a massive week for macro data. Investors will get an update on the state of the labor market, inflation, and the Fed. That said, with the Fed on hold and analysts able to provide solid estimates for PCE based on June CPI and PPI, the only potential surprise lies with Payrolls.

Specifically, markets are concerned with unemployment and job creation. Even the Fed isn’t concerned about labor market driven inflation, which makes sense. If we’re worried the dynamics of hiring and firing may be inflecting to the downside, then it doesn’t make sense to also be concerned about companies overpaying for labor as they did coming out the pandemic.

Seasonally speaking, it would be poetic for a weak Payrolls print to kick off the kind of Q3 downtrend that markets have historically experienced. If we get a gap down on August 1st tied to a disappointing pre-market Payrolls release, July 31st could end up marking a temporary top.

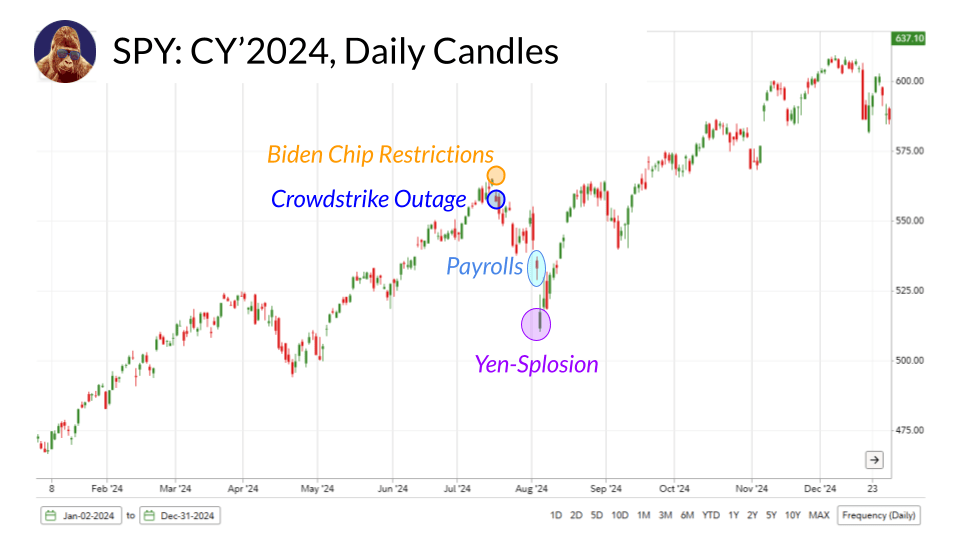

That setup wouldn’t be too different from last year, when July marked the temporary top following…

- The Biden administration’s consideration of tighter Chinese chip restrictions—a move that triggered earnings concerns and fueled a rotation out of tech.

- Crowdstrike outage, which intensified earnings fears and the rotation out of tech.

- Payrolls report that triggered the Sahm Rule.

- The unwind of the yen-carry trade, which I like to call the yen-splosion.

All of that to say: the market has a way of taking the escalator up and the elevator down. It’s impossible to predict exactly what will cause the next elevator drop. As those dominoes fell in Q3 last year, it was chaos. No one was prepared for the rapid sequence of gut punches that upset consensus.

That said, absent a gut punch from Payrolls, this tape belongs to earnings, which, thus far, I interpret as reinforcing the thesis of resumed economic resilience enhanced by AI-related activity. We’ll talk more about that after running through expectations for macro matters.

Micro Movers

Early Earnings Proved Informative

Last week, Alphabet’s (GOOG) quarter surprised to the upside and left tea leaves for the remaining mega-caps.

Metrics on Google Cloud, YouTube, and Waymo were downright solid, but the real surprise was search: expected up 2%, this metric doubled expectations, printing +4%.

My pessimism surrounding GOOG was based on the idea that the money printer – made by their search monopoly – would be eroded prior to a company-specific breakthrough in AI. Well, this result and their most recent AI reveal through Veo 3 effectively nullified my bearish thesis.

The stock rallied into the quarter, which means the market correctly sniffed this out. In my opinion, this quarter green-lights the stock – trading at only ~20x FWD – to catch up to the AI-5 of the Mag-7 (more on that in a moment).

Mega-Cap Pre-Cap

Meta (META) – YouTube ad revenue and search crushed it, which means we ought to expect one hell of a performance from Meta’s advertising platform, which has separated itself through integration of AI tools to better create, manage, and track campaigns.

Amazon (AMZN) and Microsoft (MSFT) – Google Cloud was strong, indicating the overall environment for AWS and Azure is favorable, which bodes well for these companies’ important growth drivers.

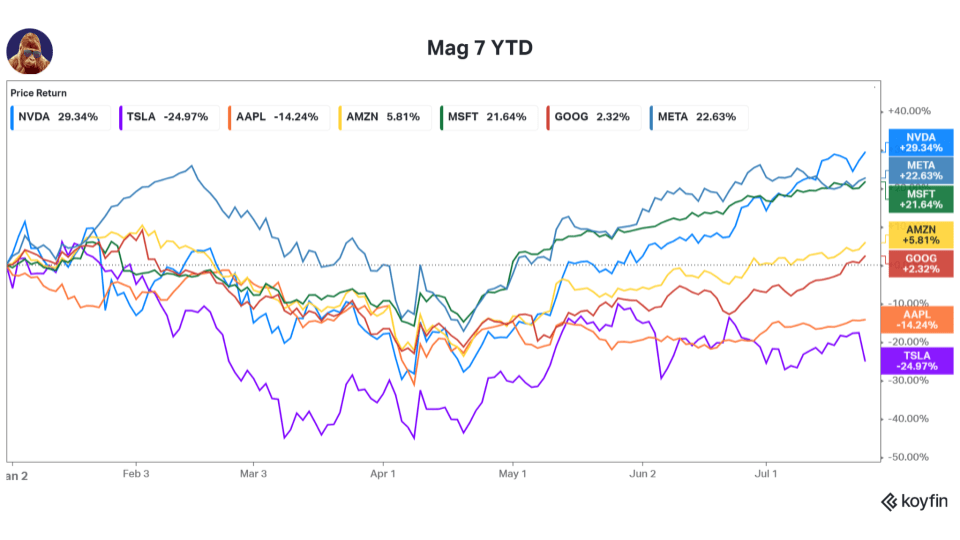

Apple (AAPL) – They need an AI strategy. The Mag-7 appears to be distilling down into the AI-5. As you can see from the chart below, the YTD winners – NVDA, META, MSFT, AMZN, and GOOG – are those with clear AI strategies and the means to fund them without debt; whereas the losers – TSLA, AAPL – lack one or both.

Apple certainly has the means to pay – but not the platform to pay into. If they announce a strategic initiative to buy an AI model, such as Perplexity, the stock could come back into favor quickly. That said, it would be extremely un-Apple, which puts value on complete control over the Apple experience. While I see an acquisition as their only remaining option, it’s likely not viewed as a palatable one by those at desks in Cupertino.

Before moving on to the other names I’m highlighting this week, it would be neglectful to omit GOOG’s additional $10B in capex, which benefits none other than you-know-who: Nvidia, which reports near the end of earnings season.

Reddit (RDDT)

This stock hasn’t performed as well as I expected coming out of the tariff tantrum. After some thought, I think the issue is similar to what plagued Alphabet: the market isn’t sure what increasing use of GPTs for traditional search inquiries and Gemini summaries means for Reddit’s engagement.

I hate to admit it – partially because I’m long the stock – but I find these concerns valid. That said, my reason for investing in Reddit remains unchanged: I believe they own a unique asset – an enormous, richly layered database of human interaction spanning an almost endless range of topics. I can’t think of a better source of training data for AI models.

With the benefit of GOOG’s quarter, which showed traditional search has held up better than expected, I anticipate RDDT will report a quarter that calms engagement concerns and recenters the narrative on my original thesis: Reddit’s ability to monetize its data by partnering with companies training AI models.

Spotify (SPOT)

Spotify remains the clear audio streaming winner. Investing in clear industry leaders – especially those with recurring revenue models – is a sound strategy.

I attribute recent weakness in the stock to positioning. Some investors entered the name as a safety trade, attracted by Spotify’s recession-resistant subscription base. As macro uncertainty fades, those buyers are rotating elsewhere.

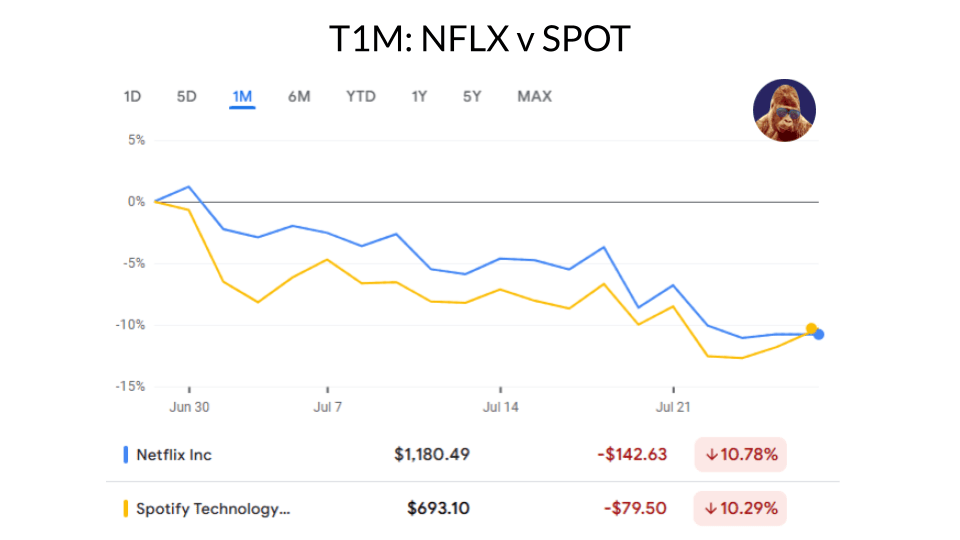

We saw this same dynamic with Netflix. Despite strong execution, NFLX is down ~10% since reporting last month. Valuation simply got ahead of itself. That said, SPOT followed NFLX, sliding ~10% in sympathy. Perhaps, the valuation has reset enough to limit further downside.

Heading into earnings, I expect Spotify to deliver another solid quarter. It’s the industry leader, after all. The real question is whether the quality of the quarter can meet or exceed the expectations embedded in its valuation. Either way, assuming a business-as-usual quarter, I expect to continue allocating to this name.

Microsoft (MSFT), Robinhood (HOOD), Coinbase (COIN)

Before signing off, if you want a pre-cap of HOOD, MSFT, and COIN, check out episode three of Charts and Checks. I think you’ll find our coverage of COIN particularly informative. I learned a lot prepping for it and am now considering a small position if a poorly received quarter provides an opportunity.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.