Headline: Inflation Accelerated in June

Analysis: We don’t buy inflation will remain as tame as this data indicates.

- Furniture, toys, apparel drove the number. This is tariffs. It will get worse.

- US10Y yield is rising to reflect expectations of higher inflation driven by tariffs.

Maybe… But, What Other News Broke?

Nvidia just got the okay to re-enter the Chinese market.

That is growth positive. In my opinion, this would be a material reason to sell treasuries and reallocate those funds into growth investments that will yield more than 4.5% per year over the next 10 years (in the case of the US10Y Treasury). Pretty good timing too. Most of last week, the leaders were getting sold in a rotation into laggards.

Skeptics could — fairly — argue this isn’t a material development. Prior to today’s news, it was reasonable to assume that Chinese AI would be built on transshipped Nvidia chips. My rebuttal: transshipped revenues weren’t in analysts’ projections or in the market’s conscience.

Rising for the Right Reason

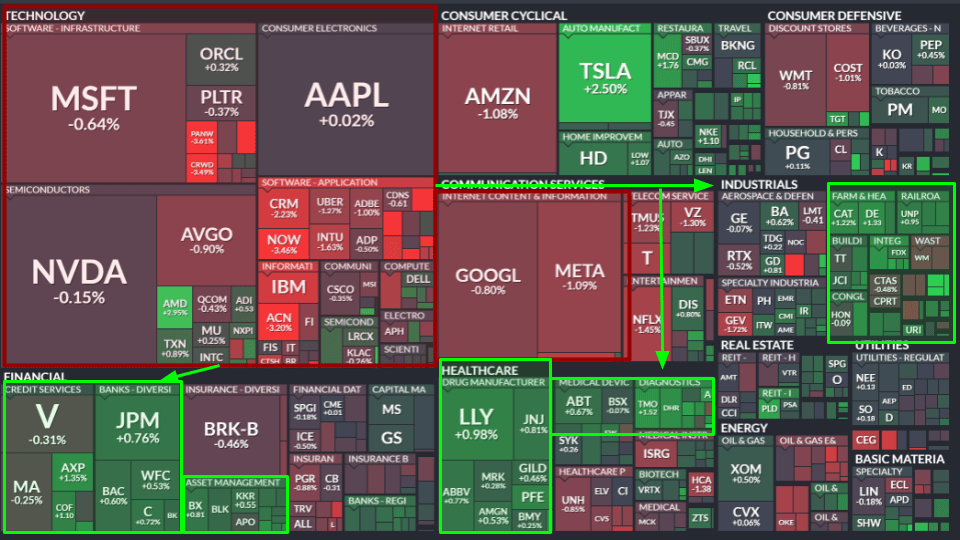

In the most recent edition of The 9:25, I highlighted the potential for CPI to trigger a sell-off if yields rose for the wrong reason — inflation fears. That didn’t happen. The market isn’t cheering, but it’s not crumbling either. Tech strength is masking a flat-to-down tape across most sectors, which leads me to my final point.

In my view, the biggest surprise this morning wasn’t that tariffs are starting to seep into CPI data. We’ve been waiting on that since April. The biggest surprise is Nvidia securing a clear path to re-engage directly with the Chinese market. We are witnessing a growth-driven yield spike — catalyzed by Nvidia — driving money into growth names (best exposed to AI). We are not witnessing an inflation-driven yield spike causing a mass exodus from equities.

Not Just a Today Thing

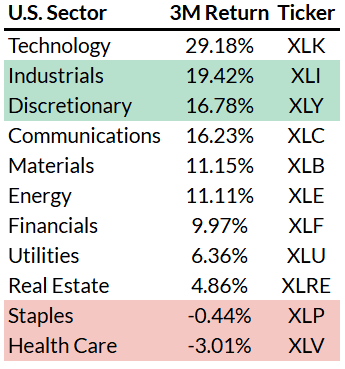

This isn’t just a today thing. It’s been brewing since the April bottom.

The market wouldn’t bid industrials and consumer discretionary into near bull markets in only three months’ time if recession were on the radar. Furthermore, the only two sectors in the negative — consumer staples and healthcare — benefit most when recession fears are most acute. In other words, if you were to paint a non-recessionary picture, this would be it: leadership from cyclical areas and laggardship (patent pending) from defensive ones.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.