Weekly Performance

| S&P 500 | -% |

| Equal Weight S&P 500 (RSP) | -0.23% |

| NASDAQ | 0.46% |

| DOW | -0.84% |

| Russell 2000 | -% |

Talk of the Tape

In a relatively quiet week on low volume, markets looked through tariff headlines, tallying a flat week at the index level. That said, beneath the surface, there was a notable rotation from winners to losers ahead of Q3 earnings.

The Week Ahead

Monday

- n/a

Tuesday

- CPI

- J.P. Morgan (JPM)

- Citi (C)

- Wells Fargo (WFC)

- Black Rock (BLK)

Wednesday

- PPI

- Fed Beige Book

- Bank of America (BAC)

- Goldman Sachs (GS)

- Morgan Stanley (MS)

Thursday

- Retail Sales

- Taiwan Semiconductor (TSM)

- Netflix (NFLX)

- Cintas (CTAS)

Friday

- n/a

Macro Movers

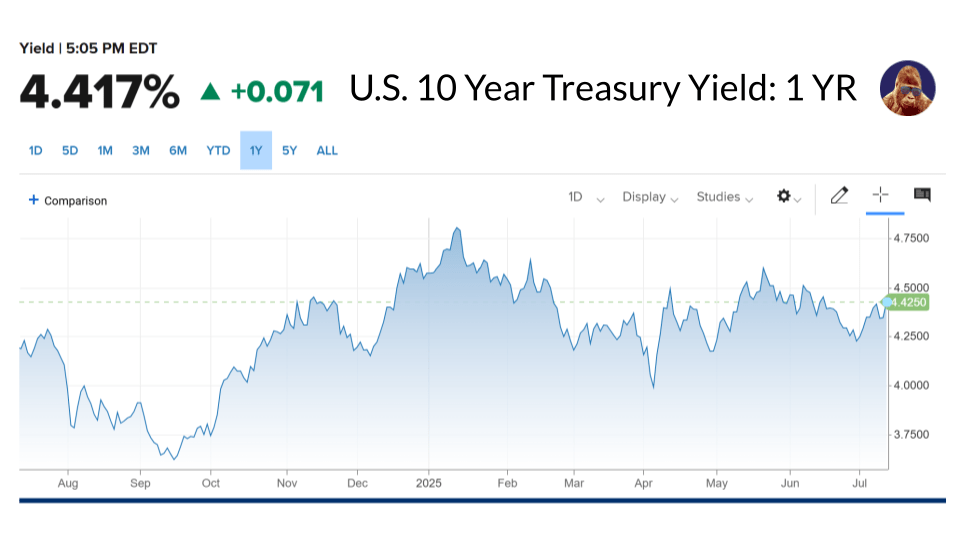

Yield Watch

While the major indices didn’t do much this week, there may be something brewing in the US10Y. It looks like the yield is making another attempt to push through 4.5%.

The reason? Up for debate. It could be fallout from the $5T debt ceiling, a bond market condemnation of the tariff letters, a rotation from bonds to stocks as recession odds stay low, or even just the hot weather. Likely, it’s a mix of all of the above… except maybe the last one.

Is it a problem? Only if the market decides the move is for the wrong reasons. The NASDAQ, in theory the most rate-sensitive of the major indices, just notched another all-time high despite the long-end’s rise. If Tuesday’s CPI is an upside surprise and yields rise, then we should expect the narrative to be that stocks are declining because yields are rising for the wrong reason.

Concisely, this is something to watch, but not something to worry about… Yet.

Consumer Price Index (CPI, June)

- Core CPI is forecasted to print 3.0% YoY; prior month was 2.8%.

- Core CPI is forecasted to print 0.3% MoM; prior month was 0.1%.

Producer Price Index (PPI, June)

- Consensus for MoM Core PPI is 0.2%, a tenth higher than prior.

Fed Beige Book

- This report compiles anecdotal information on the current economic conditions – inflation, growth, employment, etc… – across the 12 Fed Districts. While it doesn’t often move markets, the snapshot of the economy occasionally draws headlines.

U.S. Retail Sales (June)

- Headline is projected to come in at 0.2%; a notable improvement from the prior -0.9%.

- Ex-autos is projected to come in at 0.3%; recovering from last month’s -0.3%.

Micro Movers

Greenlight for Stupid

Investors just experienced one of the fastest bear markets in history, followed by one of the swiftest recoveries. It’s hard not to feel invincible right now:

- Stocks are at new highs.

- IPOs are on a heater, with more on the way.

- Unloved names are catching bids thanks to rotation.

- The negative effects of tariff policy haven’t surfaced; and if they do, they’ll be discounted as temporary.

- Goldman’s most shorted index has rallied back to a 3-year high.

There is froth here. We have the greenlight on stupid.

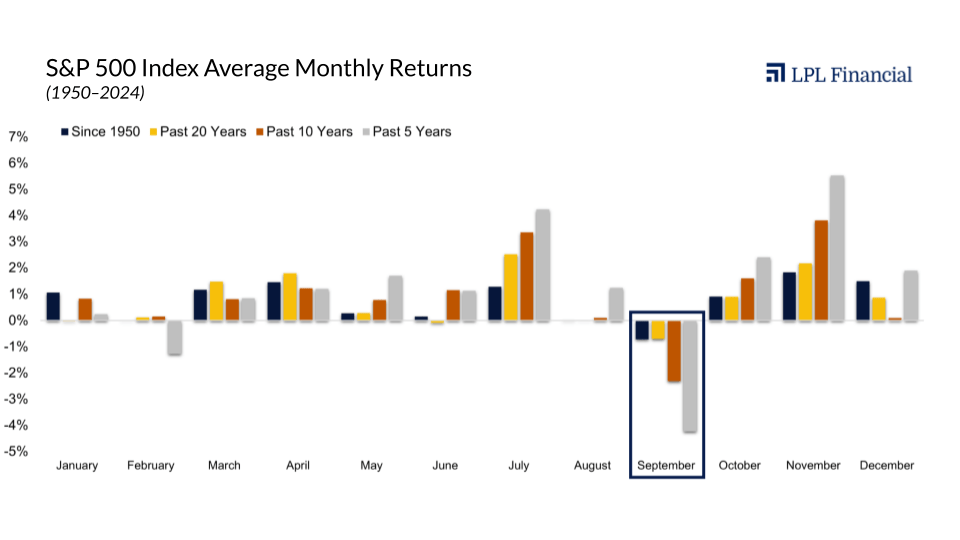

Even the calendar agrees. July and November are historically two of the strongest months for stocks. But seasonality turns against you as we head into Q3. Based on this chart, you could say that September, especially over the last five years, belongs to the bears.

My take on the stock market stupidity? There’s plenty of money to be made — and lost — when the market gets a little dumb. I’m not here to tell you not to play. I’m here to remind you that the prerequisite for participation is an exit plan. For the upside and the downside.

Take emotion out of it. Have a plan. Stick to it. Discipline trumps conviction every time.

Q3 Earnings Kickoff

While we’ll still have to wait ~14 Sundays for the NFL’s return, Q3 earnings kicks off will keep us plenty busy.

I won’t attempt to cover every name, but here’s a rundown of the ones mentioned in the week-ahead schedule:

Money Centers: JPM, WFC, BAC, C, BLK

Leadership from this sector has added credibility to the S&P 500’s recovery. While Financials (XLF) pulled back 1.8% last week, the sector is still up ~20% off the April lows. Broadly speaking, we want this cohort to guide higher. Banks do better when their clients — households and corporates — are doing well. Robust guidance here would suggest the economy is holding up despite trade uncertainty.

Despite the recent pullback, most of the sector’s charts still show bullish setups. Earnings will decide whether bulls can follow through, or if the sector’s run has been too much too fast.

Investment Banks: GS, MS

Are IPO’s back? The success of Circle (CRCL) and Coreweave (CRVW), alongside a more accommodating SEC, has prompted several private companies — particularly in the crypto/tokenization space — to begin IPO filings.

GS and MS are trading at all-time highs, meaning the market already knows the story and the expectations are elevated. To sustain these levels, GS and MS will need their results to match (or exceed) the enthusiasm.

Taiwan Semiconductor (TSM)

Quietly, alongside Nvidia and Broadcom, TSM has rebounded off April lows to make new all-time highs. The stock was hit harder than others because TSM carries both cyclical- and tariff-related risks. Now, with recession fears fading and AI-related demand booming, the market is realizing something unique about TSM:

Nvidia is one of TSM’s biggest customers. Sovereigns and mega-caps are writing massive checks to Nvidia. A portion of that spending inevitably reaches TSM’s topline.

Yes, geopolitical risk around a potential Taiwan invasion is real, and it shows in the valuation. TSM trades at a 7x discount to the sector: 24x FWD versus the sector’s 31x FWD. That isn’t to say that TSM’s valuation will expand to the average, but it does imply the valuation has room to grow. Furthermore, I believe their moat is underappreciated: the scale, precision, and talent required to replicate what TSM has built would take years, billions of dollars, and coordinated global policy. The moat is too deep to casually cross.

If I weren’t already long, I would wait for the quarter and see if the market gives me an opportunity.

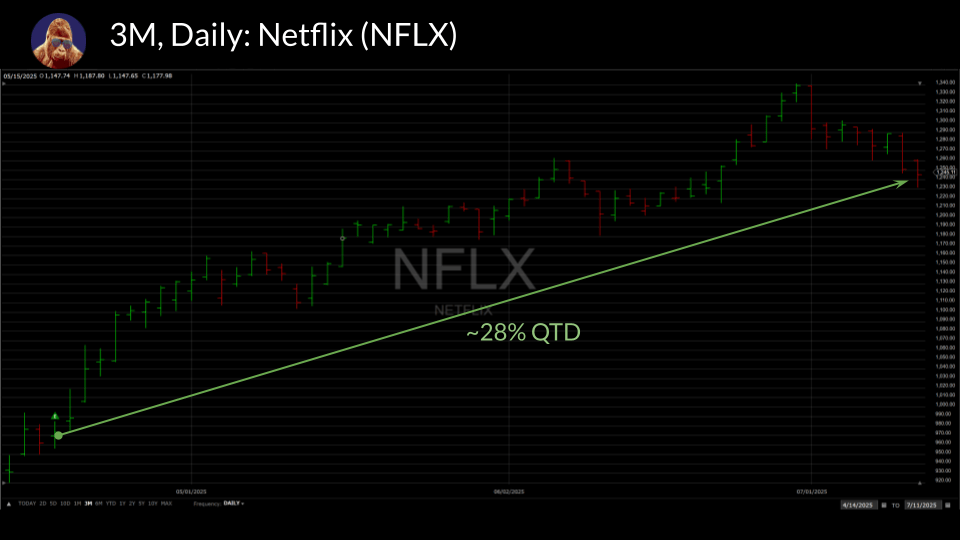

Netflix (NFLX)

Some analysts have started throwing cold water (downgrades) on the streaming champion ahead of earnings. Last quarter, NFLX surged on impressive growth numbers that underscored its unique ability to play both offense and defense in an extremely uncertain environment.

If this quarter is business-as-usual and the stock sells off anyway, I’ll look to add to my core position.

Cintas (CTAS)

Cintas supplies uniforms and facility services to small and mid-sized businesses across the U.S. Like banks. CTAS thrives when its clients — which are an integral part of the U.S.’s growth engine — are confident. A strong set of numbers from CTAS would undercut the case for a weakening economy in a very meaningful way.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.