Happy New All-Time Highs!

But… can they be trusted?

Quick Disclaimer: this week’s jobs data has the influence to alter the market conditions that have powered this run from the April low. If the data suggests the economy — and by extension, earnings — are at risk, these all-time highs won’t prove durable. But if the labor data doesn’t upset the current narrative, then what I lay out below becomes the conversation.

The Averages Must Confirm Each Other

Dow Theory holds that a new high in the Dow Industrials (DJI) must be confirmed by a new high in the Dow Transports (DJT) to be considered durable. The principle dates back to the early 1900s. The economy is different now, but the logic still applies.

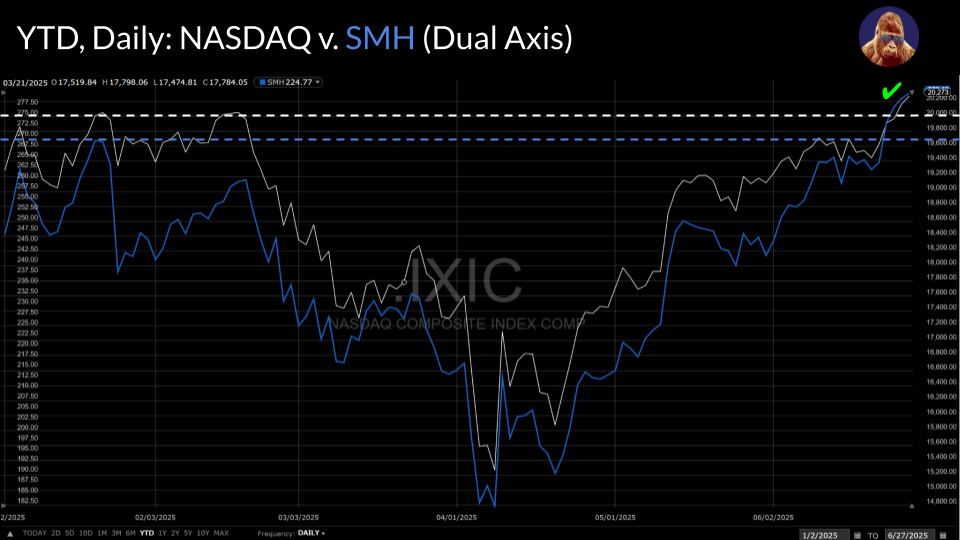

NASDAQ Confirmation

Personally, I view semiconductors, as tracked by the SMH, as the new Transports. Given the NASDAQ’s ~20% exposure to semis, I believe it is fair to use the SMH as a confirming average. In this case, the highs confirm each other. That’s a strong signal.

Within the SMH, several leaders have made not only new 52W highs, but fresh all-time highs (ATH): Nvidia (NVDA), Broadcom (AVGO), and Taiwan Semiconductor (TSM). The SMH is rich with opportunities for stock-pickers. Even the semiconductor equipment makers (AMAT, ASML) are showing signs of life after having endured a nearly 11-month downtrend dating back to last July. There is momentum here, and there are high-quality companies within that have yet to move.

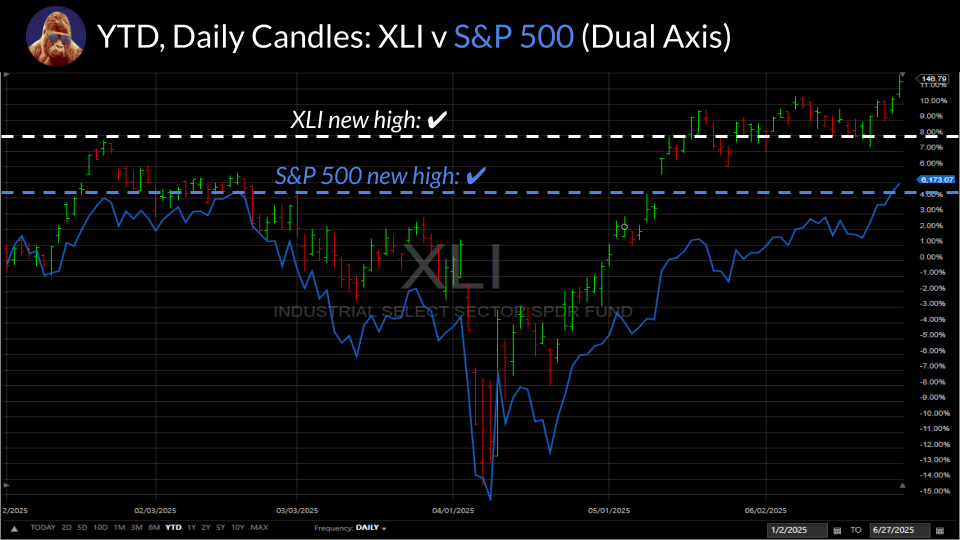

S&P 500 Confirmation

The S&P 500 is a bit more nuanced. I like to use the equal-weight version, the RSP, for confirmation. Clearing the ATH, about 4% away, would be a masterpiece. That said, convincingly clearing February’s level — ~$184, ~1% away — would be an undeniable indication of strong breadth, which we all look for to feel good about new highs.

That said, you can also look to certain S&P 500 sector ETFs to confirm a new high. Getting confirmation from cyclical sectors — like say the industrials and financials — is considered a fairly strong endorsement because the market wouldn’t bid up these sectors if there were legitimate concerns surrounding the economy.

We Already Have Confirmation from Industrials (XLI).

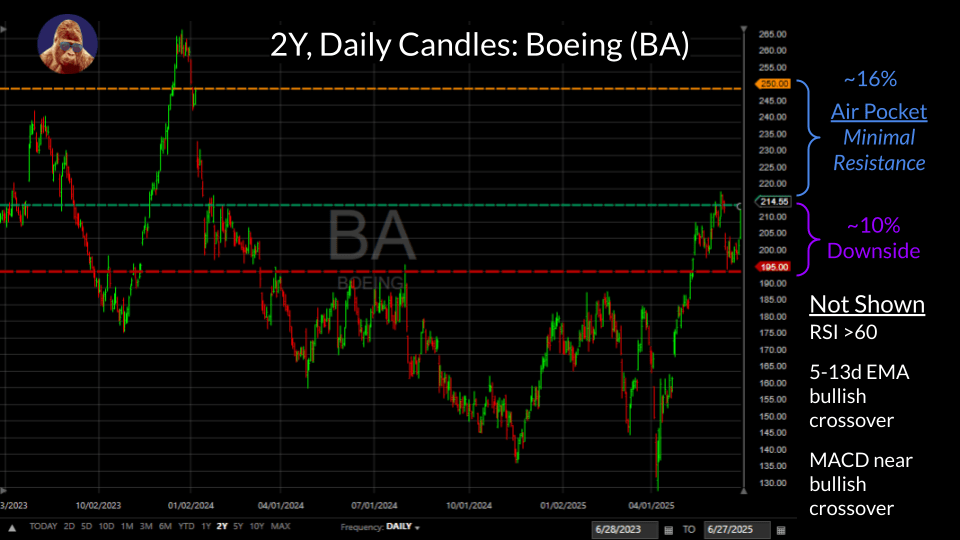

New highs in the index confirmed by a new high in a cyclical sector. Seems a strong signal. I am newly long Jacobs (J) and Boeing (BA). The former is still in the accumulation phase; the latter is in the participation (momentum) phase.

J is a great catch-up candidate. They’re Eli Lilly’s primary partner for creating new manufacturing capacity for their GLP-1 business. Furthermore, they’re involved with a number of infrastructure projects, the most important of which concern water treatment and purification. In my opinion, if it can start living above $130, it’s only a matter of time before it retests the all-time high.

I’m already in the name. You may want to wait for a convincing break above the purple downtrend or a firm close over $130. As for trade levels: I’ll stop losses on a bearish 5-13d EMA crossover or look to take profit ~$144.

While there is some headline risk associated with BA — the Air India Boeing 787-8 Dreamliner crash — the momentum is there. No news or good news could push the stock higher. I am already in the name. But, you can wait for a move above $220 for greater certainty. To the upside, I’ll be looking to offload shares between $250, which would fill the air pocket, and $275, the 5Y high (not shown). To the downside, I would view a material break of support at $195 as an indication the trade is broken.

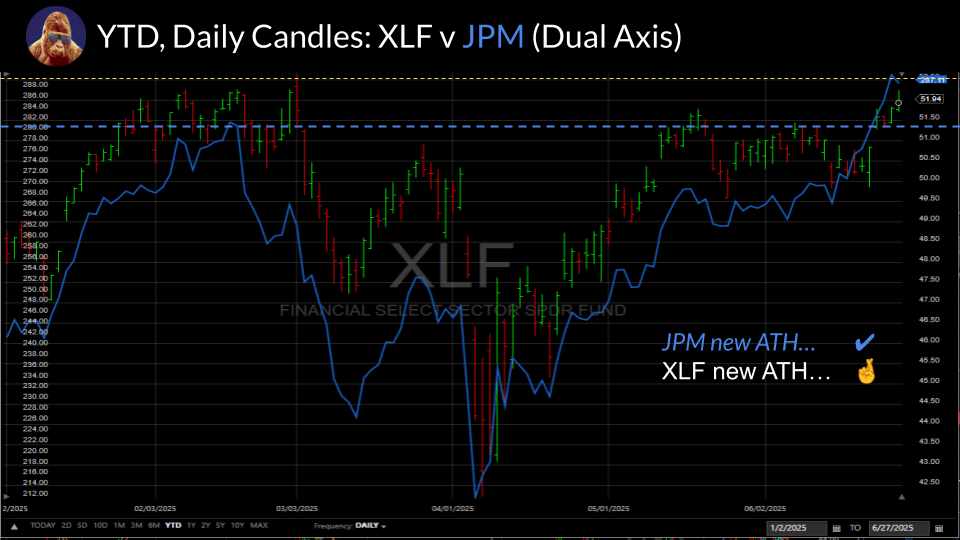

Financials (XLF) Appear to Have a Date with The New ATH Club.

JPM, a 10% component of the XLF, just minted a new ATH. The outright performance of JPM could seduce buyers looking for a second-best play in the sector. Think about how many piled into AVGO after “missing” NVDA. The inflows to AVGO benefitted the SMH and all the semis in it. No reason the same can’t happen with the XLF through JPM, to the benefit of WFC, BAC, and C that all are poised for their own breakouts.

As for the financials, I am long JPM and BAC. However, these are legacy positions. I’m happy to see JPM leading the entire cohort higher. It makes sense. JPM stands head and shoulders above the rest of its cohort. I expect the XLF and its constituents — specifically BAC, WFC, and C — will follow JPM’s example and make new ATHs, lending more credibility to last Friday’s record closes.

If I were to trade this sector, BAC would be where I would play it.

The stock is about to challenge the prior ATH set in Q1 2022. This base has been forming for nearly three years. Did someone say coiled spring? No, just my imagination.

In my opinion, you can wait for the breakout to actually happen and still catch a great trade. While I don’t do much trading options – prefer to simply own the common – this setup does create a nice opportunity to buy OTM calls north of $50 with about a month to expire. If the breakout materializes, you can either roll those calls up to lock in profits or simply cash out. At the same time, you’ve clearly defined the amount of risk you’re willing to endure upfront: the premium you paid.

If you’re still here and liked what you read, could you do me a favor? Consider subscribing to my website by signing up below for insights delivered directly to your inbox. If that doesn’t suit your fancy, consider dropping me a follow on LinkedIn, or sharing my work. Thank you for reading.