Weekly Performance

| S&P 500 | -0.34% |

| Equal Weight S&P 500 (RSP) | -0.30% |

| NASDAQ | -0.22% |

| DOW | -0.32% |

| Russell 2000 | 0.17% |

Talk of the Tape

Although this FOMC was a “business as usual” meeting, tension surrounding the situation unfolding in Iran kept a bid under oil and a lid on equities. The result, a flat week for stocks.

The Week Ahead

Monday

- Flash PMIs

Tuesday

- Consumer Confidence

- Powell Speaks

- FedEx (FDX)

Wednesday

- Micron (MU)

- Paychex (PAYX)

- General Mills (GIS)

Thursday

- Initial Jobless Claims

- McCormick (MKC)

Friday

- PCE

Macro Movers

A Nothingburger

The decision to hold rates steady and the accompanying commentary from Powell did not reveal much change in how the Fed views the unfolding economic situation. Despite the typical intraday choppiness that occurred while he was speaking, equities didn’t do anything notable. It was a nothingburger. Exactly how I like my FOMC Meetings.

However, the changes in the SEPs did provide some incremental insights:

- 50bps of rate cuts for 2025 (unchanged)

- 25bps of rate cuts for 2026 (previously 50bps)

- PCE inflation, previously expected at 2.7%, moved up to 3.0%

- Real GDP, previously expected at 1.7%, came down to 1.4%

- Unemployment now expected to print 4.5% in 2025 and 2026, a touch worse than 4.4% and 4.3%, respectively

While much can be argued about what these changes mean, I think one conclusion is undeniable: The Fed’s only concern to its inflation mandate is tariffs. The new projections see an uptick in inflation over the same period as GDP — the economy — is expected to slow and unemployment — the labor market — is expected to soften. If you have more inflation, but a slowing economy and labor market, that really only leaves one factor responsible for the uptick: tariffs.

What’s the Holdup?

Personally, even accounting for tariff-related inflation concerns, I’m not sure what the holdup is on lowering rates. Whether Fed Funds sits at 4.5% or 3.75%, it won’t change how tariffs affect prices. A lower Fed Funds rate won’t worsen tariff-driven inflation, just as raising it wouldn’t neutralize it. There’s simply no connection between the two.

Absent tariffs, the Fed believes GDP will decline and unemployment will rise. In my view, that makes now an appropriate time to cut. If anything, lowering rates could create a disinflationary tailwind. Many wealthy individuals are content earning 4.25–4.5% risk-free on cash. This same cohort has played a significant role in propping up discretionary spending — especially in sectors like travel. Remove that steady +4% monthly cash inflow, and you might start to see them ease up on spending a la disinflation.

U.S. – Iran Fallout

I have nothing of value to add regarding the weekend’s events. From a market perspective, though, the only chart you need to watch is oil.

Oil futures opened up 4%. S&P 500 futures opened down ~0.50%. Bitcoin has flirted with losses between 1.5 – 3.5%. It’ll be interesting to see how the day progresses, particularly with respect to oil taking a shot at resistance ~$80.

Beyond That

There’s plenty of data coming. None more important than PCE, which we hope continues to show that inflation is behaving. Since we already have May CPI, I’d imagine analysts have the forecast mostly dialed in. As always, keep an eye on Thursday morning’s initial claims — it’s been hanging around the danger zone for three straight weeks.

S&P Flash PMI (June, preliminary)

- Services expected at 53.0 (vs. 53.7 prior)

- Manufacturing expected at 51.5 (vs. 52.0 prior)

Powell Speaks to the House Financial Services Committee

- Nothing to handicap here, but worth noting: the market feels especially headline-sensitive right now. Expect volatility if anything notable gets picked up from Powell’s remarks.

Consumer Confidence (June)

- Forecast: 99.1 (up from 98.0 prior)

Initial Jobless Claims

- Expected at 248k (vs. 245k prior)

Personal Consumption Expenditure Index (PCE)

- Headline YoY: 2.3% (vs. 2.1% prior)

- Headline MoM: 0.1% (unchanged)

- Core YoY: 2.6% (up from 2.5%)

- Core MoM: 0.1% (unchanged)

Micro Movers

Eyes on Oil

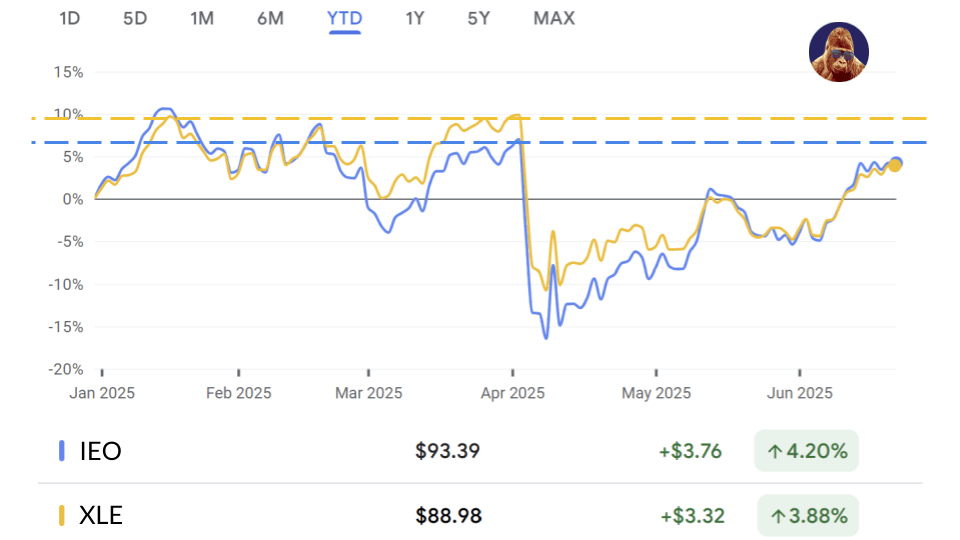

Over the past few weeks, oil prices have been something to watch, and it shows in the momentum data. As of Friday’s close, the median RSI across energy names was 60.9 — the highest of any S&P 500 (GICS) sector. For comparison, information technology came in second at 54.3.

This seems like a “buy high, sell higher”. While many have already piled into the trade, these stocks are under owned. Unlike the S&P 500, the IEO and XLE have yet to reclaim their pre-April level. If oil can manage to simply move sideways for the next few months, I like the chances these two ETFs break out. Concisely, if you’re looking to be opportunistic, the opportunity set in energy — the ETFs or individual names in those baskets — shouldn’t be overlooked.

Earnings Highlights

- FedEx (FDX) – As one of the world’s premier logistics bellwethers, FDX is uniquely positioned to comment on the ripple effects of tariffs. The stock looks poised for a breakout. But, if earnings disappoint, it’ll go from breakout to breakdown.

- Micron (MU) – This stock has doubled off its April lows and is up 30% in the last month alone. I’ve held the name for about a year, and for much of that time it was a portfolio loser. Not anymore. Their exposure to AI-driven demand is real, and I think they’ll deliver. That said, RSI is 84. The stock is due for a breather, increasing (short-term) stakes to deliver this quarter.

- Paychex (PAYX) – We’re hoping they say business is booming. It would suggest the small- and medium-sized businesses they serve are doing well too. Hard to have a recession when that cohort isn’t laying people off.

- General Mills (GIS) – We’re looking for a decent number here. Their name brands are constantly battling private labels on price. If GIS is performing well, it signals consumers don’t feel pressure to trade down.

- McCormick (MKC) – Honestly, we’d rather this one miss. A strong quarter from MKC could mean more people are cooking at home. Not necessarily bad in my book, personally. But, it might also suggest they’re dining out less, which can be an early warning sign of consumer strain.