Happy Tuesday!

Due to travel and Father’s Day, there wasn’t much time to write. However, with retail sales fresh in our minds and the FOMC tomorrow, I figured I’d add my 6 cents on 3 matters (2 cents per matter) that would’ve made the 9:25.

1) Israel-Iran Conflict

For a moment, let’s remove the human element and talk strictly from a financial markets perspective.

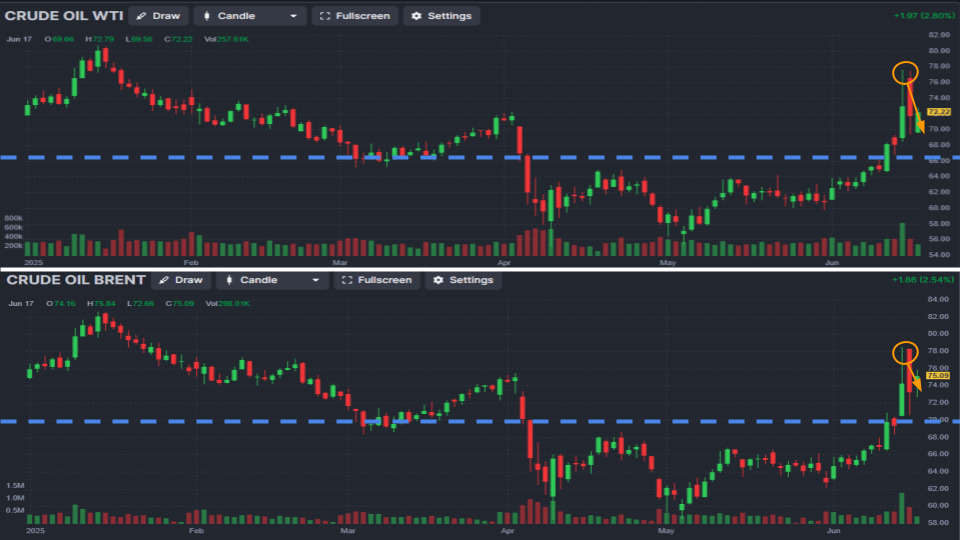

From a technical perspective, WTI and Brent broke out as the conflict hit the media. With each side signaling a desire to deescalate, WTI and Brent are ~6% below the recent highs. Although oil is gaining today, it appears as though the market is at least considering these communiques as being made in good faith. Technically speaking, oil is prime to continue higher, but, for the time being, this is clearly an event-driven market.

I don’t know enough about Middle Eastern geopolitics to have an informed opinion. As such, I defer to the brain trust of the futures market – composed of trillions of dollars – to help shape my view.

2) Fed Meeting

CME says they’ll do nothing. At ~4% on the US2Y, within 25–50bps of Fed Funds, the bond market agrees. Who am I to disagree?

The job market and inflation give the Fed the luxury of patience. This Fed doesn’t want to surprise markets. A cut now would likely be interpreted as a signal they “know something we don’t.” So, I don’t expect a rate move tomorrow, but the new dot plot does increase the potential for volatility attached to the event.

Personally, I don’t see the point in waiting. Tariff risks may not be as contained as stock prices imply, but labor market concerns are real and disinflation has continued (even with front-running by businesses and households).

3) Retail Sales

No arguing that tariff distortions are here.

The last 5 months have been marked by by persistent tariff and job market uncertainty. In that period, MoM retail sales have averaged -0.08%. Not great, but far better than most expected given the backdrop.

“Back running” is a term I’ve heard to explain this morning’s weak retail sales print: consumers pulling back after stockpiling in anticipation of tariffs. In my opinion, the resilience suggests the market views this downside surprise as the pull to front-running’s push. As such, retail sales was natural, predictable, and one-time in nature. For every push, there is a pull. Nothing to worry about.

That said, I wouldn’t expect the same stock price resilience if we get another weak print like this one.